6.0 financial plan

- 1. 6.0 FINANCIAL PLAN 6.1 INTRODUCTION The financial plan is the final step in the preparation of a business plan. A financial plan incorporates all financial data derived from the operating budget i.e marketing, operations, and administrative budgets. The financial information from the operating budgets is then translated transformed into a financial budget. Based on this financial data, projections are then prepared via several pro forma statements, namely cash flow, income (profit and loss) statement and balance sheet. These pro forma statements are normally prepared for a minimum three-year planning period. The term pro forma statement, used in the context of planning, means a projected statement of something that the entrepreneur estimates in advance. The pro forma cash flow statement, pro forma income statement, and pro forma balance sheet, therefore are projected statements that forecast the financial condition of the business. These statements reflect estimated values based on planning assumptions rather than actual events. Ratios provide helpful information about a company's liquidity, profitability, debt, operating performance, cash flow and investment valuation. ChocoholiqsCrunchiezzz has prepared the following financial statements for a year projected period. ChocoholiqsCrunchiezzz requires (RM 243 040) to start the business. The cash, appearing on the cash flow statement remains positive throughoutthe projected period. In short, a good financial plan should be able to determine the following: ïŽ Total projectimplementation costs or size ofinvestment ïŽ Total amount of financing required and the proposed sources offinance ïŽ Capital structure of the new firm ïŽ Amount ofdepreciation on fixed assets ïŽ Amount ofloan and hire purchase repayments ïŽ Cash inflow and outflow for the planned period ïŽ Profit and loss atthe end ofthe planned period ïŽ Financial position at the end ofthe planned period ïŽ Financial viability ofthe proposed project

- 2. 6.2 SOURCES OF FINANCIAL

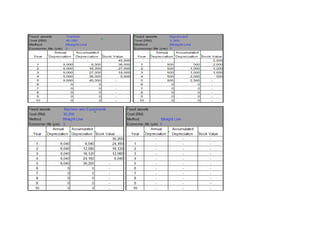

- 5. 6.4 LOAN & HIRE PURCHASE AMORTISATION SCHEDULE

- 6. 6.5 PRO FORMA CASH FLOW

- 9. 6.6 PROFORMA INCOME STATEMENT

- 10. 6.7 PROFORMA BALANCE SHEET Year 1 Year 2 Year 3 ASSETS Non-CurrentAssets(Book Value) Land& Building OfficeEquipments 22,400 16,800 11,200 Vehicle 36,000 27,000 18,000 Signboard 2,000 1,500 1,000 MachinesandEquipments 24,160 18,120 12,080 OtherAssets Deposit 84,560 63,420 42,280 CurrentAssets Stock of Raw Materials 10,600 6,000 4,890 Stock of Finished Goods 12,000 7,690 5,890 Accounts Receivable Cash Balance 10,589,432 22,270,333 35,193,070 10,612,032 22,284,023 35,203,850 TOTAL ASSETS 10,696,592 22,347,443 35,246,130 Owner'sEquity Capital 243,040 243,040 243,040 AccumulatedProfit 10,187,394 21,955,277 34,925,294 10,430,434 22,198,317 35,168,334 Long-TermLiabilities LoanBalance 221,488 166,116 110,744

- 11. Hire-PurchaseLoan 36,000 27,000 18,000 257,488 193,116 128,744 CurrentLiabilities AccountsPayable 400,955 835,313 1,309,755 TOTAL EQUITY & LIABILITIES 11,088,877 23,226,746 36,606,833