8. iran

- 1. IRAN

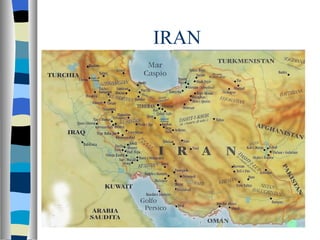

- 2. Iran Stato dellâAsia sud-occidentale, confinante per via di terra con lâ Armenia , lâ Azerbaigian , il Turkmenistan , a N (dove, peraltro, il limite ÃĻ fornito per un tratto anche dal Mar Caspio ), lâ Afghanistan e il Pakistan a E, la Turchia e lâ Iraq a O, mentre a S si affaccia sul Golfo Persico e sul Golfo di Oman tra loro collegati dallo Stretto di Hormuz .

- 3. Aspetto fisico Contrasto fra catene montuose cingono da ogni lato e lâinterno costituito da un altopiano smembrato in bacini separati di varia grandezza, senza deflusso al mare e per lo piÃđ steppici o desertici. Monti Zagros Pochi fiumi affluenti del Tigri

- 4. Clima Generalmente arido; umido sulle fasce costiere. Le temperature estive sono elevate, gli inverni freddissimi; marcate escursioni termiche , non solo annue ma anche diurne, estrema siccità in estate

- 5. Popolazione A) Sotto il profilo etnico, gli Iranici costituiscono la maggioranza: persiani in netta prevalenza, poi beluci, curdi (circa 5 milioni) e popolazioni seminomadi come i lur. B) Distribuzione della popolazione non omogenea: litorale caspico e le alte vallate del NO, regioni fertili e ben irrorate, sono piÃđ popolate; nelle desolate contrade centro-orientali, con qualche eccezione, la popolazione ÃĻ pressochÃĐ assente.

- 6. Popolazione A) Il 35% della popolazione ÃĻ considerata rurale e vive generalmente in villaggi, spesso chiusi e fortificati, situati al centro delle oasi o comunque là dove la presenza di acque superficiali consente la pratica irrigua e quindi le coltivazioni agricole. B) Permangono forme di nomadismo C) Forte tendenza allâinurbamento ïĄ aumento del numero delle città con piÃđ di 100.000 ab., salite da 9 nel 1956 a 38 trentâanni dopo.

- 7. Religione e lingua Lâislamismo sciita ÃĻ la religione dominante, professata dal 93% della popolazione; il resto segue prevalentemente lâislamismo sunnita (5,7%). La lingua appartiene al gruppo iranico dellâindoeuropeo ïĄ neopersiano (o fÄrsi ), Nella fase moderna il persiano utilizza lâalfabeto arabo con lâaggiunta di quattro lettere e ha inglobato nel suo lessico un gran numero di arabismi .

- 8. Condizioni economiche Petrolio Il settore agricolo che assorbe circa il 23% della forza lavoro e contribuisce alla formazione del PIL per il 20% â ha visto aumentare le proprie produzioni; tuttavia, la bilancia agricola si mantiene passiva e lâIran ÃĻ costretto a importare derrate alimentari e soprattutto cereali.

- 9. Condizioni economiche Si coltivano:cotone, barbabietola, canna da zucchero, tÃĻ e papavero da oppio, ortaggi e frutta. Eâ uno dei maggiori produttori di datteri e di pistacchi. Rilevante ÃĻ lâallevamento ovino

- 10. Condizioni economiche Poche industrie : scarsità di risorse tecnologiche e inadeguatezza delle infrastrutture; lavorazione degli idrocarburi, con impianti di raffinazione e petrolchimici.

- 11. Storia Impero dei Medi , gente iranica che tra lâ8° e il 6° sec. a.C. dominÃē nella zona settentrionale dellâaltopiano. Alla supremazia dei Medi dapprima si affiancÃē e poi (metà del 6° sec.) si sostituÃŽ quella dei Persiani veri e propri stanziati nella zona meridionale del paese.

- 12. Storia Con la famiglia reale degli Achemenidi e il suo capostipite Ciro il Vecchio, lâImpero persiano assunse una posizione di primo piano nella storia non solo dellâAsia ma di tutto il mondo antico. Con Ciro, fu abbattuto il regno dei Medi (550), poi il regno lidio (546), infine quello babilonese (539).

- 13. Storia 528 Ciro morÃŽ combattendo Cambise, figlio di Ciro, intraprese la conquista dellâEgitto (525), ma morÃŽ nel 522, mentre faceva ritorno in Persia. Dario I (522-485) compÃŽ lâopera di Ciro, e portÃē lâImpero persiano allâapogeo della potenza.

- 14. Storia Lâimmenso impero fu diviso in 20 satrapie , collegate da una mirabile rete stradale e governate da una salda ed elastica organizzazione burocratica , facente capo al sovrano. il potere centrale rispettava la libertà religiosa e assicurava la prosperità economica dei singoli popoli sottomessi fastosa vita di corte e per unâimponente attività edilizia (residenze di Susa, Ectabana, Persepoli)

- 15. Storia Scontro con i Greci insurrezione ionica: 498-94; Prima guerra persiana battaglia di Maratona (490 a.C.) . Serse, figlio di Dario, seconda guerra persiana (battaglie di Salamina, 480 a.C, di Platea e Micale , 479 a.C)

- 16. Storia Gli episodi principali di questa storia sono: contese per il regno tra i fratelli Artaserse II e Ciro il Giovane, terminate con la disfatta di questo a Cunassa (401) la pace di Antalcida del 386, che ribadiva il dominio persiano sulle colonie greche dâAsia Minore, le guerre del 4° sec., sotto Artaserse III (358-38), per domare le province ribelli.

- 17. Storia Conquista di Alessandro Magno e il crollo dellâantico Impero persiano (battaglia di Isso, 333; di Gaugamela 331; morte dellâultimo Achemenide, Dario III, 330) ïĄ Seleucidi Impero sasanide fino alla conquista araba dopo la morte di Maometto (632 d.C.) Poi Turchi âiranizzatiâ

- 18. Storia Nel 1925 un militare nazionalista noto come RidÄ KhÄn che, con lâaiuto soprattutto britannico, assunse il titolo di scià e fondÃē una dinastia (1925). Russi e Britannici, preoccupati della germanofilia del regime iraniano, occuparono il paese (1941) assicurando cosÃŽ alla causa alleata il controllo del petrolio e le vie di comunicazione del Medio Oriente Cessata lâoccupazione solo nel 1946, compÃŽ una scelta di campo filo-occidentale

- 19. Storia Dal 1977 lâopposizione al regime si acuÃŽ, rapidamente conquistata dai religiosi sciiti dellâayatollah KhomeinÄŦ, in esilio a Parigi dal 1963, e nel gennaio 1979 lo scià fu costretto a lasciare lâI., paralizzato da scioperi e manifestazioni, mentre lâesercito, si disgregava. KhomeinÄŦ , tornato in patria, assunse la direzione del paese .

- 20. Storia Il 1° aprile 1979 fu proclamata la Repubblica islamica dellâIran e una nuova Costituzione conferÃŽ a vita a KhomeinÄŦ il ruolo di guida religiosa del paese. Nel 1979, 50 funzionari dellâambasciata statunitense a Teheran furono presi in ostaggio e rilasciati solo nel 1981 in cambio della sospensione delle misure di congelamento dei depositi iraniani negli USA

- 21. Storia Situazione complessa: timori dellâOccidente per la possibilità che la rivoluzione islamica si estendesse Iraq, contando anche sullâappoggio occidentale, invase Iran: guerra che si concluse nel 1988

- 22. Storia Dal 2005 Ahmadinejad : invettive contro Israele, minacciata nella sua stessa esistenza, sostegno alle azioni degli áļĨHezbollÄh libanesi, grande enfasi posta sul programma nucleare, che hanno esposto il paese alla condanna della comunità internazionale, in particolare degli USA, ma hanno altresÃŽ permesso allâI. di guadagnare prestigio nella regione. Le elezioni del 2009 hanno confermato la presidenza di Ahmadinejad, pur contestata da forti manifestazioni di piazza denuncianti pesanti brogli .

- 23. Storia Attualità http://temi.repubblica.it/limes/tag/iran http://www.eurasia-rivista.org/lenigma-delliran/13413/

![Persiani [1 Es]](https://cdn.slidesharecdn.com/ss_thumbnails/persiani1-1228331637495510-9-thumbnail.jpg?width=560&fit=bounds)