9 28-10 nhf - cal hfa - chdap

- 1. Home Buyer Assistance Loans CHF Grant | CalHFA | CHDAP Down Payment & Closing Cost Assistance We will begin in a moment Class Scheduled to begin at 5:00pm Homeownership Educator Scott Schang Branch Manager Broadview Mortgage Corporation 1-866-667-6724

- 2. CHF Grant / CalHFA / CHDAP Getting the most value out of the class You may type questions in at any time during the presentation – Chat box on your screen Homeownership experts are standing by to answer your questions during the presentation This is an interactive learning environment. You will get the most value by having your specific questions answered There are no dumb questions! Write this number down in case of technical difficulty 1-866-667-6724

- 3. CHF Grant / CalHFA / CHDAP Chat on right side of your screen 

- 4. CHF Grant / CalHFA / CHDAP Topics we will cover NFH CHF Homebuyer Grant Program CalHFA financing programs qualifying guidelines CalHFA FHA Government Loan Program California Housing Downpayment Assistance Program (CHDAP) Taking the next step – Getting approved

- 5. CHF Grant / CalHFA / CHDAP NHF CHF Grant

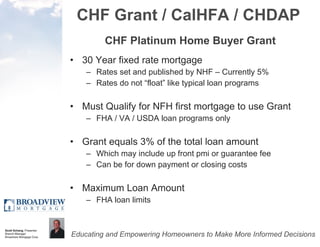

- 6. CHF Grant / CalHFA / CHDAP CHF Platinum Home Buyer Grant 30 Year fixed rate mortgage Rates set and published by NHF – Currently 5% Rates do not “float” like typical loan programs Must Qualify for NFH first mortgage to use Grant FHA / VA / USDA loan programs only Grant equals 3% of the total loan amount Which may include up front pmi or guarantee fee Can be for down payment or closing costs Maximum Loan Amount FHA loan limits

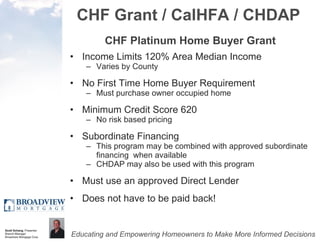

- 7. CHF Grant / CalHFA / CHDAP CHF Platinum Home Buyer Grant Income Limits 120% Area Median Income Varies by County No First Time Home Buyer Requirement Must purchase owner occupied home Minimum Credit Score 620 No risk based pricing Subordinate Financing This program may be combined with approved subordinate financing when available CHDAP may also be used with this program Must use an approved Direct Lender Does not have to be paid back!

- 8. CHF Grant / CalHFA / CHDAP CalHFA is BACK!

- 9. CHF Grant / CalHFA / CHDAP Qualifying Guidelines

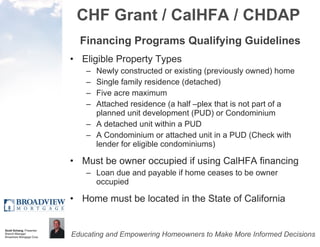

- 10. CHF Grant / CalHFA / CHDAP Financing Programs Qualifying Guidelines Eligible Property Types Newly constructed or existing (previously owned) home Single family residence (detached) Five acre maximum Attached residence (a half –plex that is not part of a planned unit development (PUD) or Condominium A detached unit within a PUD A Condominium or attached unit in a PUD (Check with lender for eligible condominiums) Must be owner occupied if using CalHFA financing Loan due and payable if home ceases to be owner occupied Home must be located in the State of California

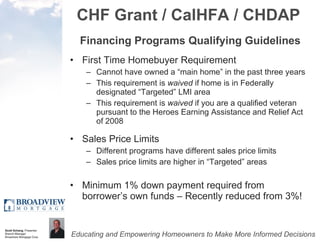

- 11. CHF Grant / CalHFA / CHDAP Financing Programs Qualifying Guidelines First Time Homebuyer Requirement Cannot have owned a “main home” in the past three years This requirement is waived if home is in Federally designated “Targeted” LMI area This requirement is waived if you are a qualified veteran pursuant to the Heroes Earning Assistance and Relief Act of 2008 Sales Price Limits Different programs have different sales price limits Sales price limits are higher in “Targeted” areas Minimum 1% down payment required from borrower’s own funds – Recently reduced from 3%!

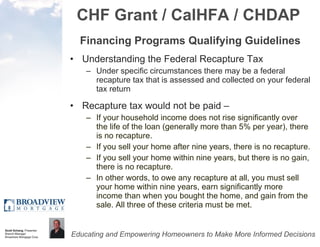

- 12. CHF Grant / CalHFA / CHDAP Financing Programs Qualifying Guidelines Understanding the Federal Recapture Tax Under specific circumstances there may be a federal recapture tax that is assessed and collected on your federal tax return Recapture tax would not be paid – If your household income does not rise significantly over the life of the loan (generally more than 5% per year), there is no recapture. If you sell your home after nine years, there is no recapture. If you sell your home within nine years, but there is no gain, there is no recapture. In other words, to owe any recapture at all, you must sell your home within nine years, earn significantly more income than when you bought the home, and gain from the sale. All three of these criteria must be met.

- 13. CHF Grant / CalHFA / CHDAP FHA Government

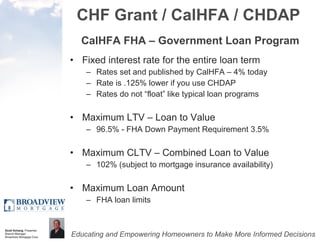

- 14. CHF Grant / CalHFA / CHDAP CalHFA FHA – Government Loan Program Fixed interest rate for the entire loan term Rates set and published by CalHFA – 4% today Rate is .125% lower if you use CHDAP Rates do not “float” like typical loan programs Maximum LTV – Loan to Value 96.5% - FHA Down Payment Requirement 3.5% Maximum CLTV – Combined Loan to Value 102% (subject to mortgage insurance availability) Maximum Loan Amount FHA loan limits

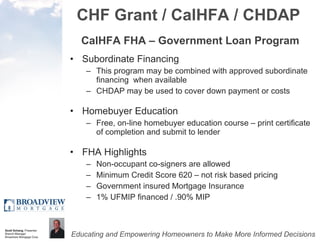

- 15. CHF Grant / CalHFA / CHDAP CalHFA FHA – Government Loan Program Subordinate Financing This program may be combined with approved subordinate financing when available CHDAP may be used to cover down payment or costs Homebuyer Education Free, on-line homebuyer education course – print certificate of completion and submit to lender FHA Highlights Non-occupant co-signers are allowed Minimum Credit Score 620 – not risk based pricing Government insured Mortgage Insurance 1% UFMIP financed / .90% MIP

- 16. CalHFA FHA / Cal30 / CHDAP CHDAP

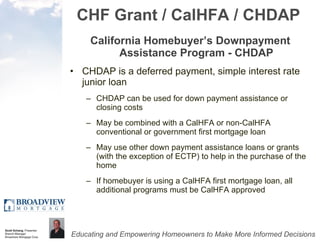

- 17. CHF Grant / CalHFA / CHDAP California Homebuyer’s Downpayment Assistance Program - CHDAP CHDAP is a deferred payment, simple interest rate junior loan CHDAP can be used for down payment assistance or closing costs May be combined with a CalHFA or non-CalHFA conventional or government first mortgage loan May use other down payment assistance loans or grants (with the exception of ECTP) to help in the purchase of the home If homebuyer is using a CalHFA first mortgage loan, all additional programs must be CalHFA approved

- 18. CHF Grant / CalHFA / CHDAP California Homebuyer’s Downpayment Assistance Program - CHDAP Maximum Loan Amount 3% of the sales price or appraised value, whichever is less Under no circumstances can the CLTV exceed 102% when utilizing any combination of CalHFA first mortgage loans and subordinate loan products or approved programs The maximum 102% CLTV also applies to CHDAP loans used with a non-CalHFA first mortgage

- 19. CHF Grant / CalHFA / CHDAP California Homebuyer’s Downpayment Assistance Program - CHDAP Fixed interest rate for the entire loan term Rates set and published by CalHFA – 3.25% Rates do not “float” like typical loan programs Term of CHDAP Loan Term matches the term of the first mortgage Payments on the junior loan are deferred for the life of the first loan Minimum Borrower Contribution Minimum 1% of the sales price required from borrower’s own funds – Recently Reduced!

- 20. CHF Grant / CalHFA / CHDAP California Homebuyer’s Downpayment Assistance Program - CHDAP Repayment of the principal and interest on the junior loan shall be due and payable at the earlier of the following events: Transfer of title Sale of the residence Payoff or refinance of the first loan Upon the formal filing and recording of a Notice of Default (unless rescinded) Program Restrictions May not be used with CalSTRS 80/17 per CalSTRS guidelines MAY be used with CalPERS FHA 1 st & DPA loans

- 21. CHF Grant / CalHFA / CHDAP Hiring your Real Estate Agent & Lender Team The decision to work with a Loan Officer and Real Estate Agent is a decision to hire someone for a professional service it is to be taken very seriously Hold your team accountable to high expectations of character, communication and expertise A quality home buying team will educate and inform you Always avoid pressure tactics and implied urgency Make sure your team specializes in the programs that you are interested in to purchase your home

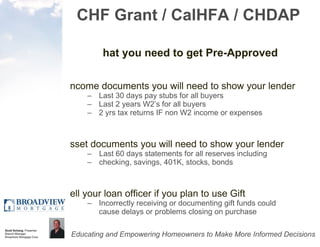

- 22. CHF Grant / CalHFA / CHDAP What you need to get Pre-Approved Income documents you will need to show your lender Last 30 days pay stubs for all buyers Last 2 years W2’s for all buyers 2 yrs tax returns IF non W2 income or expenses Asset documents you will need to show your lender Last 60 days statements for all reserves including checking, savings, 401K, stocks, bonds Tell your loan officer if you plan to use Gift Incorrectly receiving or documenting gift funds could cause delays or problems closing on purchase

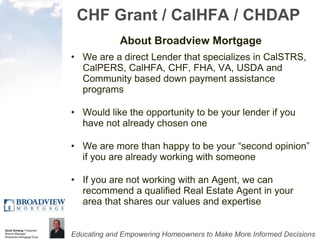

- 23. CHF Grant / CalHFA / CHDAP About Broadview Mortgage We are a direct Lender that specializes in CalSTRS, CalPERS, CalHFA, CHF, FHA, VA, USDA and Community based down payment assistance programs Would like the opportunity to be your lender if you have not already chosen one We are more than happy to be your “second opinion” if you are already working with someone If you are not working with an Agent, we can recommend a qualified Real Estate Agent in your area that shares our values and expertise

- 24. CHF Grant / CalHFA / CHDAP Wrap up and Take Aways Video & Power point will posted on site later this week We will stay online until all of your questions are answered Call 1-866-667-6724 to speak with specialist now If you enjoy these classes please tell your friends about – www.HomeownershipUniversity.com

- 25. Thank You for Attending If you enjoyed this class – Tell a friend  Please tell us how we’re doing Say Nice Things on “Praise” page Your feedback is greatly appreciated For more information 1-866-667-6724 Homeownership Educator Scott Schang Branch Manager Broadview Mortgage Corporation