A report on insulin delivery system

- 1. A REPORT ON INSULIN DELIVERY SYSTEM Syringes Latest syringes are smaller and have finer needles and special coatings that work to make injecting as easy and painless as possible. When insulin injections are done properly, most people discover they are relatively painless. Insulin Pen An insulin pen looks like a pen with a cartridge. Some pens use replaceable cartridges of insulin; other pen models are totally disposable. A fine, short needle, similar to the needle on an insulin syringe, is on the tip of the pen. Users turn a dial to select the desired dose of insulin and press a plunger on the end to deliver the insulin just under the skin. Insulin Pumps These high technology products are miniature, computerized pumps. They are about the size of a beeper, weigh about 3 ounces, and deliver insulin through a flexible plastic tube attached to the body. The pump mimics a healthy pancreas by offering insulin delivery in two ways. First, it provides a rhythmic, continuous drip of insulin, which is known as the basal dose, all day long. Second, the pump allows you to add an additional amount of insulin when you eat. This extra dose is called a bolus. You request your bolus with a simple push of button. You usually determine the size of the bolus by estimating the amount of carbohydrate youwillbeeating. Inhaled Insulin Inhaled System of Insulin delivery is the latest Product offering several advantages over the other conventional Systems Business Opportunity Overview Number of Diabetic Patients is on the increase & Insulin Market in India is placed around INR 250 Crores with about 30 % growth rate. The Inject able Insulin Market is comprised of products such as Insulin Syringes, insulin Pen , Insulin Pumps & Jet Injectors Then there are Inhaled Insulin products, Oral Insulin Markets, Nasal Insulin delivery technology, Transdermal Insulin Delivery, Rectal Insulin Delivery, Ultrasound Insulin delivery, Iontophoresis Insulin Delivery Technology, Electro oration Insulin Delivery Technology and so on The products are Highly Technology Oriented and there are very few players in the world Market. Indian Market is served by Imports & therefore priced high. There are attempts to start manufacturing these products in the country & therefore, the Insulin Delivery Systems market in India is considered to be very bright.

- 2. LIST OF PROSPECTIVE BUYERS FOR INSULIN DELIVERY SYSTEM IN INDIA INSULIN DELIVERY SYSTEM IN INDIA There are seven brands of human insulin available in India. These include both Indian and foreign brands. Insulin is available in vial form in different strengths ranging from 40 iu/ml to100 iu/ml. In November 2004, Biocon, a Bangalore based Indian company, launched a new generation of bio-insulin called Insugen. In August 2005, Eli Lilly India launched its insulin analog under the brand name of Humalog Mix 25-50. Indian companies like Wockhardt, Shantha Biotechnics and Intas Pharmaceutical manufacture erythropoietin. Several other Indian companies have licensing agreements with the multi-national companies (MNCs) to market recombinant erythropoietin. Janssen Cilag CRF a division of Johnson & Johnson was amongst the first companies to successfully launch a biotechnology drug in India under the brand name Eprex. Hindustan Antibiotics has tied up with a U.S. company Elanex Pharmaceutical to market their product under the brand name Hemax. Recombinant Brand Company Human Insulin Huminsulin Eli Lily and Company India Insugen Biocon NovoMix39 and NovoRapid Novo Nordisk Reconsulin Shreyas Life Sciences Wosulin Wockhardt Streptokinase Indikinase Bharat Biotech Shankinase Shantha Biotechnics STPase Cadila Pharmaceuticals Erythropoietin Ceriton Ranbaxy Epofit and Erykine Intas Pharma Eprex J& J Hemax Hindustan Antibiotics LG Espogen LG Chemicals Shanpoietin Shantha Biotechnics Vintor for Nephrology/Epofer for Emcure Haematinics Wepox Wockhardt Zyrop Zdyus Biogen Hepatitis B Vaccine Bevac Biological E Biovac B Wockhardt Engenix-B GlaxoSmithKline India Enivac HB Panacea Biotec

- 3. Gene Vac-B Serum Institute of India LGEuvax B Inj LG Chemicals Revac B Bharat Biotech Shanvac B Shantha Biotechnics Human Growth Hormone Humatrope Eli Lilly India LG Eutropin Inj LG Chemicals Norditropin, NordiLet Novo Nordisk Saizen Serum Institute of India G-CSF Emgrast Emcure Grastim Dr. Reddy’s Labs Neukine Intas Pharma Interferon alpha 2a LG Intermax alpha Inj LG Chemicals Interferon alpha 2b Intron A Fulford India (Schering Plough) Markferon Glenmark Labs Shanferon Shantha Biotechnics Zaveinex Zdyus Biogen Interferon beta 1a Avonex Nicholas Piramal- Biogen Blood Factor VIII FSH Gonal-F Serum Institute of India Ltd. LG Follimon Inj LG Chemicals Tissue Plasminogen Activator German Remedies Alpha Drotrecogin Xigris Eli Lily and Company (India)

- 4. Indian Disease Burden Estimations The growing population, change in disease patterns, and demand for new medicines to combat these diseases are leading to increased demand for bio drug, vaccines and diagnostics products. The below table provides the estimated cases of diseases in 100,000. Disease/Health Condition 2000-05 2015 Communicable Diseases, Maternal & Prenatal Conditions Tuberculosis 85 NA HIV/AIDS 51 190 Diarrheal Disease episodes/yr 760 880 Malaria and other vector borne 20.37 NA conditions Leprosy 3.67 Expected to be eliminated MR/1000 births 63 53.14 Otitis Media 3.57 4.18 Maternal Mortality/100000 births 440 NA Non-Communicable Conditions Cancers 8.07 9.99 Diabetes 310 460 Mental Health 650 800 Blindness 141.07 129.96 Cardiovascular Diseases 290 640 COPD and Asthma 290 640 Though non-injectable forms of insulin are more costly per dose than their injectable counterparts, demand is expected to soar in coming years, even in price-sensitive countries like India. “If Pfizer was the only company, then price would be an issue. But with so many competitors, pharma companies cannot out- price themselves,” says Mr. Mattoo. Though non-injectable forms of insulin are more costly per dose than their injectable counterparts, demand is expected to soar in coming years, even in price-sensitive countries like India. “If Pfizer was the only company, then price would be an issue. But with so many competitors, pharma companies cannot out- price themselves,” says Mr. Mattoo. Key Suppliers The major suppliers of biotechnology products include U.S., European and Indian companies. Some of the Indian companies manufacturing healthcare biotechnology products include Bharat Biotech International, Bharat

- 5. Immunological and Biological, Bharat Serum, Biocon, Dr Reddy’s, Haffkine Bio- Pharma, Indian Immunological, Krebs Biochemical, Panacea Biotec, Serum Institute of India, Shantha Biotechnics, Wockhardt, Ranbaxy Laboratories, Organon India, Kee Pharma, Emcure Pharmaceuticals, Glenmark Labs, Lupin Labs, Nicholas Piramal, Intas Pharma, Hindustan Antibiotics and Shreyas Life Sciences.Foreign companies in India include Eli Lilly, Novadisk, Johnson & Johnson, Fulford India, Wyeth Lederle, Glaxo SmithKline, Aventis Pharma, Pifzer and LG Chemical Distributors in India for insulin injection system 1. Shreya Life Sciences Pvt. Ltd. (www.shreya.co.in) In August, 2007 Generex entered into a Master Product Licensing & Distribution Agreement with Shreya Life Sciences, a leading Indian-based pharmaceutical company. Shreya is the fourth largest distributor of insulin in the Indian market and has interests in both pharmaceutical and biopharmaceutical products in key therapeutic segments including cardiology, neuropathy, and diabetes. India has a significant and growing number of people with diabetes. According to the Diabetes Atlas 2007, there are approximately 40.8 million diagnosed patients with diabetes in India. There are also an estimated 35.9 million people who have pre-diabetic conditions which, if not properly treated and managed, could lead to full-blown diabetes. Generex believes that early intervention with insulin therapy could delay the onset and progression of diabetes and its numerous complications. Generex Oral-lyn, as a convenient and pain-free alternative to insulin injections, could encourage prandial insulin therapy among those patients who presently avoid injections. "We are pleased to anticipate the commercialization of our flagship product in a major market like India and the attendant revenue," said Anna Gluskin, Generex's President & Chief Executive Officer. "We are optimistic about the establishment of a new treatment paradigm for diabetes and pre-diabetic conditions in India and other countries where we are now pursuing approvals. We look forward to working with Shreya to expand the market in India in order to capture a wider patient population." Generex Oral-lyn is presently in Phase III clinical trials at several sites around the world. About Generex Generex is engaged in the research, development, and commercialization of drug delivery systems and technologies. Generex has developed a proprietary platform technology for the delivery of drugs into the human body through the oral cavity (with no deposit in the lungs). The Company's proprietary liquid formulations allow drugs typically administered by injection to be absorbed into the body by the lining of the inner mouth using the Company's proprietary RapidMist(tm) device. The Company's flagship product, oral insulin (Generex Oral-lyn(tm)), which is available for sale in Ecuador for the treatment of patients with Type-1 and Type-2 diabetes and which was approved for sale in India in

- 6. October 2007, is in various stages of clinical development around the world. For more information, visit the Generex website at www.generex.com. Safe Harbor Statement: This release and oral statements made from time to time by Generex representatives concerning the same subject matter may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by introductory words such as "expects," "plans," "intends," "believes," "will," "estimates," "forecasts," "projects" or words of similar meaning, and by the fact that they do not relate strictly to historical or current facts. Forward-looking statements frequently are used in discussing potential product applications, potential collaborations, product development activities, clinical studies, regulatory submissions and approvals, and similar operating matters. Many factors may cause actual results to differ from forward-looking statements, including inaccurate assumptions and a broad variety of risks and uncertainties, some of which are known and others of which are not. Known risks and uncertainties include those identified from time to time in the reports filed by Generex with the Securities and Exchange Commission, which should be considered together with any forward-looking statement. No forward-looking statement is a guarantee of future results or events, and one should avoid placing undue reliance on such statements. Generex undertakes no obligation to update publicly any forward- looking statements, whether as a result of new information, future events or otherwise. Generex cannot be sure when or if it will be permitted by regulatory agencies to undertake additional clinical trials or to commence any particular phase of clinical trials. Because of this, statements regarding the expected timing of clinical trials cannot be regarded as actual predictions of when Generex will obtain regulatory approval for any "phase" of clinical trials. Generex claims the protection of the safe harbor for forward-looking statements that is contained in the Private Securities Litigation Reform Act. SHERYA LIFE SCIENCE PRIVATE LIMITED Company Profile Tablets, Capsules, Injections, Cream, Syrup, Solution, Ophthalmic Solution Relevant Chemicals, Pharmaceuticals And Medical Equipment Categories : Product Pharmaceutical Formulations Profile : Address : shreya house, 301/a, Pereira hill road,, andheri (e),, MUMBAI 400099 Telephone : Fax : 91-022-6939222

- 7. 3. MANTHAN.INC WE ARE PHARMACEUTICAL DISTRIBUTORS DEALING IN BRANDED FORMULATIONS AS WELL AS GENERIC MEDICINES. We ARE INTRSTED IN EXPORT OF Indian PHARMA PRODUCTS. We CAN PROFESSIONALLY WORK AS AN INDENTING PARTNER FROM India. We ARE AUTHORISED AGENT / SERVICE PROVIDER FOR MEDISENSE ABBOTT'S OPTIUM GLUCOMETER & STRIPS (U. S. A) AS WELL AS INSULIN RANGE OF INJECTIONS OF NOVO NORDISK IN MUMBAI, India. WE ARE CONSIGNEE AGENT OF WELL KNOWN INTERNATIONAL PRODUCTS OF VENOUS SHUNT (NEUROLOGY) , PENILE PROSTHESIS ... Company Profile Basic Information Company Name: MANTHAN INC. Business Type: Trading Company, Distributor/Wholesaler Medicines, Surgicals, Venous Shunt, Ortho Implants, Product/Service: Penile Prosthiasis Trade & Market HOSPITALS/GOVT.INSTITUTIONS/CORPORATE Main Customers: CO/DOCTORS Total Annual Sales Below US$1 Million Volume: Export Percentage: 1% - 10% Total Annual Below US$1 Million Purchase Volume: 3, POOJA SURGICALS We introduce with our selves, i m bhupen patel, my company established in 2001. Already i export in various country " Africa, Nigeria, malawi, Zambia, angola, seira leon, angola, Congo, netherland, trinidad tobage, lebenon, South Africa, namibia, etc. . I have ISO, ce & gmp certified product. If u any confusion so u can

- 8. contact directly Offering to sell transfusion set, I. v set, blood transfusion set, infusion set, scalp vein set, blood administration set, urine bag, cord clamp-two type Company Profile Basic Information Company Name: Pooja Surgicals Business Type: Manufacturer, Distributor/Wholesaler Surgical Disposable, Medical Disposable, Surgical Product/Service: Equipment, Surgical Dressing, Medical Equipment, Hospital Item Number of 51 - 100 People Employees: Trade & Market North America South America Eastern Europe Southeast Asia Main Markets: Africa Oceania Mid East Western Europe Total Annual Sales Below US$1 Million Volume: Export Percentage: 41% - 50% Total Annual US$2.5 Million - US$5 Million Purchase Volume: Factory Information Factory Size1,000-3,000 square meters

- 9. (Sq.meters): QA/QC: In House Number of Production 4 Lines: Number of R&D Staff: 61 - 70 People Number of QC Staff: 21 - 30 People Management ISO 9000/9001/9004/19011: 2000 Certification: Contract OEM Service Offered Manufacturing: 4.HI-GI LABS PVT LIMITED Our Company Hi-Gi Labs Pvt Ltd., started with an innovative idea of taking the Healthcare products to the doorstep of the patients. It quickly grew from a handful of customers to 10's of 1000's of patients spread in various cities. The high quality and low cost products sent to the patients on subscription basis not only provide convenience to the patients but also offer them great savings. Today, after successfully catering to the Diabetic patients with door-delivery of Insulin syringes Company Profile Basic Information Company Name: HI-GI Labs Pvt Ltd Business Type: Distributor/Wholesaler Product/Service: Post mastectomy breast forms and mastectomy bras Number of 11 - 50 People Employees: Trade & Market North America Main Markets: South America

- 10. Western Europe Eastern Europe Eastern Asia Southeast Asia Mid East Africa Oceania Pharmaceutical Associations In India Pharmaceutical Associations In India Email SNo Name Address Address/Website Indian Drug 102-B, Poonam mailto:E-Mail:idma Manufacturers Chambers, A- Association Wing, Dr. A .B.Road, Worli Mumbai-400018 Tel : 22- @giasbmol, 4974308/4944624 Fax : 22-4950723 vsnl.net.in http:// www.idma-assn.org/ 1

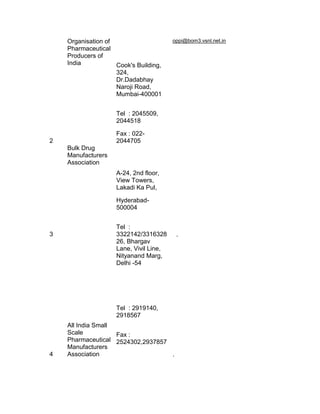

- 11. Organisation of oppi@bom3.vsnl.net.in Pharmaceutical Producers of India Cook's Building, 324, Dr.Dadabhay Naroji Road, Mumbai-400001 Tel : 2045509, 2044518 Fax : 022- 2 2044705 Bulk Drug Manufacturers Association A-24, 2nd floor, View Towers, Lakadi Ka Pul, Hyderabad- 500004 Tel : 3 3322142/3316328 . 26, Bhargav Lane, Vivil Line, Nityanand Marg, Delhi -54 Tel : 2919140, 2918567 All India Small Scale Fax : Pharmaceutical 2524302,2937857 Manufacturers 4 Association .

- 12. Federation ficci.bisnet House, Tansen Marg, New Delhi- 110001 Tel : 3738760-70 @gems.vsnl.net.in Federation of Fax:91-11- Indian 3320714,3721504 Chambers of Commerce and 5 Industry Confederation 23, Industrial td@co.cii.ernet.in of Indian Area, Lodi Estate, Industry New Delhi - 110 003 Tel : 4621874, http://www.indian 4629994-7 Fax: 4633168, industry.com/ 4626149 6 Prospective Buyers Most of the bio drugs and diagnostic products are for the government and private sector hospitals and patients. The second group of buyers of biotechnology products and bio molecules are the research institutes and pharmaceutical companies. The emerging trend of corporate players establishing diagnostic centers in small towns and rural areas will provide opportunities for the import of automated systems and imported reagents. Currently, there are only a few large national players in diagnostics care segment including SRL Ranbaxy, Max Healthcare, Dr. Lal’s Laboratory, Metropolis, Thyrocare, Fortis Healthcare and Apollo Clinics. The large private hospitals are upgrading their facilities and/or adding new facilities.

- 13. MARKET POTENTIAL OF INSULIN DELIVERY SYSTEM IN INDIA: Summary The size of the Indian biotechnology industry is estimated at $1.3 billion. This includes bio-healthcare, bio-agriculture, bio-industrial, bio-informatics, and contract and clinical research markets. Of the total market, healthcare biotechnology products account for 38 percent. The growing population, demand for quality diagnostics products and innovative drugs to combat diseases are leading to increased demand for biotechnology drugs and products. New types of diseases and demand for improved drugs are also leading to greater research and development (R&D) activities Number of Diabetic Patients are on the increase & Insulin Market in India is placed around INR 250 Crores with about 30 % growth rate. The Inject able Insulin Market is comprised of products such as Insulin Syringes, insulin Pen , Insulin Pumps & Jet Injectors Then there are Inhaled Insulin products, Oral Insulin Markets, Nasal Insulin delivery technology, Transdermal Insulin Delivery, Rectal Insulin Delivery, Ultrasound Insulin delivery, Iontophoresis Insulin Delivery Technology, Electro oration Insulin Delivery Technology and so on The products are Highly Technology Oriented and there are very few players in the world Market. Indian Market is served by Imports & therefore priced high. There are attempts to start manufacturing these products in the country & therefore, the Insulin Delivery Systems market in India is considered to be very bright. India has a significant and growing number of people with diabetes. According to the Diabetes Atlas 2007, there are approximately 40.8 million diagnosed patients with diabetes in India. There are also an estimated 35.9 million people who have pre-diabetic conditions which, if not properly treated and managed, could lead to full-blown diabetes. Generex believes that early intervention with insulin therapy could delay the onset and progression of diabetes and its numerous complications. Generex Oral-lyn, as a convenient and pain-free alternative to insulin injections, could encourage prandial insulin therapy among those patients who presently avoid injections Market Trends In line with the global markets the Indian market for recombinant products is showing considerable growth. The Department of Biotechnology (DBT) has estimated the Indian market for recombinant therapeutics products at $90 million, which is growing at a rate of 30 percent per annum.

- 14. Product Market Size Growth Rate Erythropoietin $16.6 million 20 percent G-CSF $6 million 25-30 percent FSH Market $6 million 20 percent Interferon $12-13 million 30-40 percent Insulin $55 million 40 percent Hepatitis B Vaccine $22 million NA Streptokinase $17 million 25 percent In 2030, the number of diabetics is expected to reach 80 million in India According to WHO statistics, the number of people with diabetes in India is set to rise from 40.8 million today to approx.75 million in the year 2025. In less than 20 years the number of diabetics in India will be equivalent to the whole population of Germany today. In 2005, the Indian insulin market was worth approx. CHF 88 million; this figure is likely to grow toCHF 121 million by 2010. Ypsomed sees great potential for pen needles and pen systems in India In India 85% of all insulin is administered with normal syringes and just 15% using cartridges and pen systems. The currently low level of penetration of insulin pen systems will rise significantly in the future as sales of insulin in pen systems are now growing by some 35% annually. “The diabetes market will grow strongly in India in the coming years and holdout very great potential for Ypsomed, both for pen needles and also for insulin pens and new pen systems for liquid Pharmaceuticals,” comments CEO Richard Fritschi. Pen needles are a major source of earnings for Ypsomed with further growth potential The pen needles developed and manufactured by Ypsomed with the patented click-on mechanism fit all pen systems available today for insulin, growth hormones or other therapies. Ypsomed’s pen needles are currently distributed in around30 countries, either through Ypsomed’s own subsidiary companies or via local distributors. Ypsomed’s pen needle business has grown in recent years by an annual average of around 25% and holds out further growth potential. Senior Vice President of Marketing & Sales, Detlef Jantos: “Ypsomed’s click-on pen needles have a number of advantages overthe competition and are very popular with pen users. To enable future demand to be met, Ypsomed will be expanding itspen needle production capacity considerably and will invest in the next two years a total of more than CHF 35 million at theSolothurn site.” Ypsomed has also developed a new safety pen needle which is due to be launched in 2009 to enable pensystems to be used in the public healthcare sector i.e. in hospitals and nursing .

- 15. IMPORTING THE PRODUCT AND GOVERNMENT POLICIES IN INDIA: Globally, 240 recombinant therapeutic products have been approved. The Government of India (GOI) has approved only 14 of these products for sale in India. These include human insulin, blood factor VIII, erythropoietin, granulocyte colony stimulating factor (G-CSF), alpha interferon, interferon b, GMCSF, streptokinase, basiliximab, follicle stimulating hormone (FSH), and hepatitis-B. Of these 14 GOI approved recombinant drugs, 7 are being locally manufactured while the rest are being imported. Sun Pharmaceutical and Torrent Pharmaceutical are into contract manufacturing of recombinant products for Eli Lilly and Novo Nordisk. Though several Indian companies are engaged in research and development of recombinant products, presently only 6 Indian companies are manufacturing them while 16 companies are importing and selling recombinant products in India. Biotech Clusters The central and state governments have been taking many initiatives to support the biotechnology industry through development of biotechnology parks, policy initiatives, and tax incentives. Governments are working towards developing cities for knowledge-based sectors like biotechnology, medical biosciences, and life sciences. It is estimated that India will have at least 20 biotech parks in the next few years. Currently four cities – Chennai, Hyderabad, Lucknow and Pune – have taken the lead in developing biotechnology-dedicated parks. Other states that have announced plans to develop biotechnology parks include Karnataka, Kerala, Tamil Nadu, Gujarat, Chandigarh, Haryana, Himachal Pradesh, Madhya Pradesh, Punjab, Rajasthan, Uttar Pradesh and Uttaranchal, Orissa and West Bengal. The following are the existing biotechnology parks: The Shapoorji Pallonji Biotech Park in Andhra Pradesh is a public-private partnership between the state Government and Shapoorji Pallonji Incorporated. 20 companies both Indian and foreign have established their units in this Park, making an investment of $85-90 million. Sigma Aldrich from U.S. and Altanta AG from Germany are planning to establish facilities in this Park, while Randox Laboratories from U.K. is establishing a diagnostic kits manufacturing unit in Bangalore. Another park in Andhra Pradesh is the ICICI Knowledge Park. This park is focused on facilitating business-driven research and development. The park is spread over 200 acres and about 13-15 companies, both Indian and foreign, are currently operating there.

- 16. Indian government rules and regulation for pharmaceutical firm The drug and pharmaceutical industry in the country today faces new challenges on account of liberalization of the Indian economy, the globalization of the world economy and on account of new obligations undertaken by India under the WTO Agreements. These challenges require a change in emphasis in the current pharmaceutical policy and the need for new initiatives beyond those enumerated in the Drug Policy 1986, as modified in 1994, so that policy inputs are directed more towards promoting accelerated growth of the pharmaceutical industry and towards making it more internationally competitive. The process of liberalization set in motion in 19901, has considerably reduced the scope of industrial licensing and demolished many non-tariff barriers to imports. Some of the steps taken are: Abolition of industrial licensing for manufacture of all drugs and pharmaceuticals except for bulk drugs produced by the use of recombinant DNA technology, bulk drugs requiring in-vivo use of nucleic acids, and specific cell tissue targeted formulation. Reservation of 5 drugs for manufacture by the public sector only was abolished in Feb.1999, thus opening them up for manufacture by the private sector also. Foreign investment through automatic route was raised from 51% to 74% in March, 2000 and the same has been raised to 100%. Drugs and pharmaceuticals manufacturing units in the public sector are being allowed to face competition including competition from imports. Wherever possible, these units are being privatized. Introduction of the Patents (Second Amendment) bill in the Parliament. It, inter- alia, provides for the extension in the life of a patent to 20 years. The main objectives of this policy are:- a. Ensuring abundant availability at reasonable prices within the country of good quality essential pharmaceuticals of mass consumption. b. Strengthening the indigenous capability for cost effective quality production and exports of pharmaceuticals by reducing barriers to trade in the pharmaceutical sector. c. Strengthening the system of quality control over drug and pharmaceutical production and distribution to make quality an essential attribute of the Indian pharmaceutical industry and promoting rational use of pharmaceuticals. d. Encouraging R&D in the pharmaceutical sector in a manner compatible with the country's needs and with particular focus on diseases endemic or relevant to India by creating an environment conducive to channelising a higher level of investment into R&D in pharmaceuticals in India. e. Creating an incentive framework for the pharmaceutical industry which promotes new investment into pharmaceutical industry and encourages the introduction of new technologies and new drugs.

- 17. Industrial Licensing Industrial licensing for all bulk drugs cleared by Drug Controller General (India), all their intermediates and formulations will be abolished, subject to stipulations laid down from time to time in the Industrial Policy, except in the cases of ď‚· bulk drugs produced by the use of recombinant DNA technology, ď‚· bulk drugs requiring in-vivo use of nucleic acids as the active principles, a ď‚· specific cell/tissue targeted formulations Foreign Investment Foreign investment unto 100% will be permitted, subject to stipulations laid down from time to time in the Industrial Policy, through the automatic route in the case of all bulk drugs cleared by Drug Controller General (India), all their intermediates and formulations, except those, referred to in Para 12.I above, kept under industrial licensing Imports Imports of drugs and pharmaceuticals will be as per EXIM policy in force. A centralized system of registration will be introduced under the Drugs and Cosmetics Act and Rules made there under. Ministry of Health and Family Welfare will enforce strict regulatory processes for import of bulk drugs and formulations Pricing of Formulations ď‚· For Scheduled formulations, prices shall be determined as per the present practice. The time frame for granting price approvals will be two months from the date of the receipt of the complete prescribed information. ď‚· The present stipulation that a manufacturer, distributor or wholesaler shall sell a formulation to a retailer, unless otherwise permitted under the provisions of Drugs (Prices Control) Order or any other order made there under, at a price equal to the retail price, as specified by an order or notified by the Government, (excluding excise duty, if any) minus sixteen percent thereof in case of Scheduled drugs, will continue. ď‚· The present provision of limiting profitability of pharmaceutical companies, as per the Third Schedule of the present Drugs (Prices Control) Order, 1995, would be done away with. However, if necessary so to do in public interest, price of any formulation including a non-Scheduled formulation would be fixed or revised by the Government

- 18. Promotional strategy to be followed 1) Targeting the various hospitals within the country which includes: Apollo group. Wockhart., Escort hospital etc 2) Going for the TV commercial and also showing various close associations by showing the approval of drug my the health ministry of India& various other medical associations 3) Running various diabetics awareness by tying up with various news channels and local NGO like rotary club which show we care our customer as well as to gain top of the mind awareness slot in the mind of customers. 4) Going for a celebrity, who might be suffering from diabetes, show how our product had help him/her to control the disease and same thing can work for you to. 5) Going for various print media. Like newspaper again we help in the awareness about the product. 6) Tying up with various distributors like Sherya science private limited so as to make the availability as well as the reach of the product to be as far as possible within the country. 7) High ring various medical representatives (MR) and send them to various doctors at different places within the country so as to again make product getting familiar with the doctor, hence also can be recommended to the various patient arriving for the treatment. 8) Running promotional activities two to three times a year within the country.