Accounting entries under gst

Download as DOCX, PDF1 like715 views

Under GST, businesses will need to maintain fewer accounts than currently required for taxes like VAT, excise and service tax. Accounts will need to track input and output central GST, state GST and integrated GST. Accounting entries will involve debiting input tax accounts and crediting output tax accounts, with the difference credited or debited to an electronic cash ledger for payment or refund. This will simplify record keeping while allowing input taxes on more purchases to be set off against output tax liabilities. The changes will streamline tax compliance and potentially reduce operating costs and tax outflows for businesses.

1 of 8

Downloaded 10 times

![How to pass accounting entries under GST

Updated on Jun 09, 2017 - 08:41:39 PM

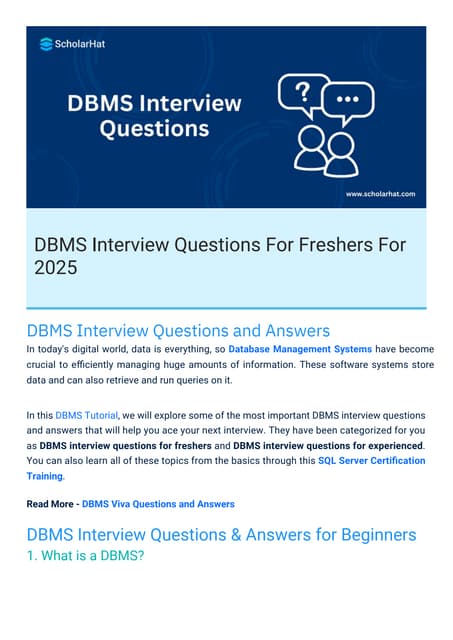

Goods and service tax or GST will be one tax to subsume all taxes. It will bring in ŌĆ£One

nation one taxŌĆØ regime.

While there will be certain initial transition challenges, GST will bring in much clarity in

many areas of business. One of the areas is accounting and bookkeeping. Read on to

find out about accounting entries under GST.

Current scenario:

Separate accounts have to be maintained for excise, VAT, CST and service tax. HereŌĆÖs

a list of the few accounts currently any business has to maintain (apart from accounts

like purchase, sales, stock) ŌĆō

’éĘ Excise payable a/c (for manufacturers)

’éĘ CENVAT credit a/c (for manufacturers)

’éĘ Output VAT a/c

’éĘ Input VAT a/c

’éĘ Input Service tax a/c

’éĘ Output Service tax a/c

For example, a trader Mr. X must maintain the minimum basic accounts ŌĆō

’éĘ Output VAT a/c

’éĘ Input VAT a/c

’éĘ CST A/c (for inter-state sales and purchases)

’éĘ Service tax a/c [He will not be able to claim any service tax input credit as he is a

trader with output VAT. Service tax cannot be setoff against VAT/ CST]

GST Regime

Under GST all these taxes (excise, VAT, service tax) will get subsumed into one

account.

The same trader X has to then maintain the following a/cs (apart from accounts like

purchase, sales, stock) ŌĆō

’éĘ Input CGST a/c

’éĘ Output CGST a/c

’éĘ Input SGST a/c

’éĘ Output SGST a/c

’éĘ Input IGST a/c

’éĘ Output IGST a/c

’éĘ Electronic Cash Ledger (to be maintained on Government GST portal to pay

GST)](https://image.slidesharecdn.com/accountingentriesundergst-180317072319/85/Accounting-entries-under-gst-1-320.jpg)

![Output CGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 2,640

Output SGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 10,640

To Electronic Cash Ledger A/c 13,280

GST impact on financials

Profit & Loss Account

Particulars Rs. Particulars Rs.

Raw material consumption XXX [Decrease] Sales XXX***

Purchases XXX

Depreciation XXX

Other Expenses XXX

Reduction in raw material cost and other expenses

GST will mean seamless input credits for intrastate and interstate purchases of goods.

This will mean reduction in cost of raw materials as input GST can be setoff against the

output GST payable on sales. Also GST paid on many services like legal consultation,

audit fees, engineering consultation etc. can be setoff against output GST. Currently

input credit of service tax paid cannot be adjusted against output excise/VAT.

All this will effectively bring down the expenses.

***Impact on sales may vary depending on the industry and the GST rates.

Balance Sheet

Particulars Rs. Particulars Rs.](https://image.slidesharecdn.com/accountingentriesundergst-180317072319/85/Accounting-entries-under-gst-7-320.jpg)

![Capital XXX Fixed assets XXX [Decrease]

Current liabilities XXX Current assets XXX

Tax payable XXX Credit receivable XXX

Effective cost of fixed assets will come down as input credit will be available on both

capital goods and services related to such goods like installation, inspection etc.

Tax payable and credit receivable will face changes too. There will be only three

accounts under each of them- SGST, CGST, IGST instead of maintaining current excise

payable, CENVAT credit, VAT payable, VAT credit, Service tax accounts.

Accounting principles

GAAP is applicable mandatorily on GST. So, all principles following revenue recognition

etc. will be applicable.

Period of retention of accounts

Every registered taxable person must keep and maintain books of account for five years

from the due date of filing of Annual Return for the relevant year.

Transition to GST will need to address various aspects of financial reporting systems for

proper reporting.

It is important that businesses plan to address changes arising out GST implementation

in the best manner to reduce cost of transition and minimize business disruption.](https://image.slidesharecdn.com/accountingentriesundergst-180317072319/85/Accounting-entries-under-gst-8-320.jpg)

Recommended

Accounting ledgers and entries in gst

Accounting ledgers and entries in gstManishBhatnagar21

╠²

Accounting Ledgers and Entries Under GST Regime and How to pass accounting entries under GST with cross utilisation entryAccounting entries gst

Accounting entries gstCA Aarchana Yadav

╠²

This document contains information about accounting for various GST related transactions including purchases, sales, input tax credit, output tax liability, refunds, and advances received. It provides accounting entries for intra-state and inter-state transactions under CGST, SGST, and IGST and explains concepts like set-off of taxes, separate ledgers for input and output taxes, and accounting for imports. It also covers accounting for tax refunds for exports and output tax on advances received.GST RETURN FILING

GST RETURN FILING Manjunath Raibagi

╠²

The document discusses Goods and Services Tax (GST) returns that businesses in India are required to file. It states that under GST, businesses must file three monthly returns (GSTR-1, GSTR-2, GSTR-3) and one annual return each year, totaling 37 returns. GSTR-1 contains outward supply/sales details. GSTR-2 contains purchase/input tax credit details. GSTR-3 is a summarized return generated from GSTR-1 and GSTR-2 with tax liability details. Failure to file returns on time results in late fees.PPT on GSTR 9C

PPT on GSTR 9Csandesh mundra

╠²

With the introduction of the concept of GST Audit, it is important to know and taken int consideration various facts that is needed before we conduct GST Audit. In this presentation, we have covered the concept of filing of GSTR 9C, its applicability and various other topics that one should take care of. The presentation also covers an example of GSTR 9C based upon a hypothetical case. The PPT is a one shot compilation of various topics associated with GSTR 9C - GST Audit.TDS 194Q vs TCS 206C(1H)

TDS 194Q vs TCS 206C(1H)Amitoz Singh

╠²

COMPARISON BETWEEN TDS 194Q VS. TCS 206C(1H) UNDER THE INCOME TAX ACT, 1961. ARE YOU A SELLER OR BUYER.. WHICH ONE IS APPLICABLE ON YOU ?Presentation on Returns in GST India (Janardhana Gouda)

Presentation on Returns in GST India (Janardhana Gouda)CA Janardhana Gouda

╠²

Overview of Returns in GST, steps to file returns in GST India, Number of returns in GST, Due date for filing returns in GST India, Late Filing Fee in GST, Procedure to File Returns in GST etc.Brief presentation on GSTR -2B along with screenshots from the GST Portal.

Brief presentation on GSTR -2B along with screenshots from the GST Portal.Ramandeep Bhatia

╠²

GSTR 2B is a static ITC statement which provides information regarding ITC available on the basis of returns filed by a supplier. Prepared a brief presentation on the subject along with screenshots from the GST Portal.Chapter 1

Chapter 1Anita Tongli

╠²

The document provides definitions and concepts related to income tax in India. It defines key terms like assessee, assessment, person, income, direct tax, indirect tax. It explains the types of taxes and why taxes are levied. It describes the procedure for computing total income which involves determining residential status, classifying income under different heads, setting off losses, deductions and arriving at tax payable. Invoice & Payment of Tax under GST

Invoice & Payment of Tax under GSTVijaya Kumar Kavilikatta

╠²

1. The document outlines the procedures for issuing tax invoices and maintaining electronic ledgers for payment of goods and service tax (GST) in India. It specifies that registered taxable persons must issue tax invoices before or after supplying goods or services and what information must be included. 2. It also describes how payment of GST is made through electronic cash and credit ledgers that are maintained on a central portal. Any tax, interest, penalties or other amounts are recorded in these ledgers. 3. Specified forms are used to maintain electronic records of tax liabilities, input tax credits, and deposits made in the cash ledger.Gst ppt

Gst ppt jithin koshy

╠²

This document discusses key aspects of the Goods and Services Tax (GST) in India, including:

- GST is a single, destination-based tax levied on the supply of goods and services. It subsumes several taxes into a single tax.

- GST is levied as Central GST (CGST), State GST (SGST), Integrated GST (IGST), and Union Territory GST (UTGST) depending on the nature of the supply.

- There are four GST tax slabs of 0%, 5%, 12%, and 18% for goods and 5% and 18% for services. Composition scheme is available for small businesses with turnover less than RsMinimum alternate tax

Minimum alternate taxAltacit Global

╠²

The document discusses India's Minimum Alternate Tax (MAT), which requires companies to pay tax of at least 30% of their book profits if their total taxable income under normal tax provisions is less than 30% of book profits. Key points include that MAT aims to ensure companies pay some tax even with exemptions, MAT can be carried forward for tax credits for 5 years, and MAT rates have increased over time, most recently to 18.5% for companies and for Limited Liability Partnerships.Income tax introduction

Income tax introductionChitraChellam

╠²

The document provides a history of income tax law in India and definitions of key concepts in income tax. It discusses how income tax was first introduced in 1860 and the various acts passed until the current Income Tax Act of 1961. It defines important terms like assessee, person, income, agricultural income, assessment year, and previous year. It also outlines what constitutes taxable income and exemptions under the law.GST Return Overview by CA Shital Thadeshwar

GST Return Overview by CA Shital ThadeshwarShital Thadeshwar

╠²

GST returns types, applicability of returns with due date to different assessees, CGST, IGST, SGST, Returns for regular Dealer, Composition Dealer, Annual return,Monthly return, Quarterly ReturnGst annual return

Gst annual returnRamaswamy Narasimhachary

╠²

The document provides information about the GSTR-9 annual return filing requirements under the Goods and Services Tax (GST) in India. It states that GSTR-9 must be filed by regular taxpayers to consolidate supplies and input tax credit details for the entire financial year. It outlines the different types of annual returns that must be filed depending on the taxpayer's registration type. It also discusses the due date for filing GSTR-9, which has been extended to 30 June 2019, and penalties for late filing. The key parts of the GSTR-9 form and details required to be reported in each part are also explained.TDS section 194Q Presentation PPT

TDS section 194Q Presentation PPTPrakhar Jain

╠²

This document summarizes the new TDS and TCS provisions introduced under sections 194Q and 206C(1H) respectively. It provides details on who is required to deduct/collect (entities with turnover over Rs. 10 crores), calculation of amount (0.1% of transaction value excluding/including GST), due dates of payment and return filing (monthly and quarterly), and exceptions when TDS/TCS is not applicable. It also discusses section 206AB which provides for higher rate of TDS (twice the specified rate or 5%) in case of non-filers of return.Accounts & Records to be kept under GST

Accounts & Records to be kept under GSTTeam Asija

╠²

This document summarizes the key accounts and records that must be kept under the Goods and Services Tax (GST) in India. It outlines the requirements for tax invoices, credit notes, debit notes, and other documents. It also specifies the accounts and records that must be maintained, including production, inventory, supplies, taxes, and other required documents. All accounts and records must be kept for 5 years or longer if under audit or legal proceedings.GST in Tally

GST in Tallyganesh_channa

╠²

The document discusses Goods and Services Tax (GST) in India and how it will be accounted for in Tally ERP 9 software. It explains that GST will replace existing taxes like VAT and Service Tax with a single tax. There are three types of GST - CGST for intra-state sales, SGST for intra-state sales, and IGST for inter-state sales. Accounting entries in Tally for GST are similar to the current system, with separate ledgers created for CGST, SGST and IGST. A Goods and Services Tax Identification Number (GSTIN) will be assigned to taxpayers based on their PAN and state code.Session on ICDS I to X - Sandeep Jhunjhunwala

Session on ICDS I to X - Sandeep JhunjhunwalaSandeep Jhunjhunwala

╠²

This document provides an overview of Income Computation and Disclosure Standards (ICDS) implementation in India. It discusses the evolution of ICDS from initial notification of 2 accounting standards in 1996 to the notification of 10 ICDS in 2015 that are applicable from AY 2017-18 onwards. It also summarizes key highlights of ICDS including applicability, precedence over accounting standards/judicial rulings, transitional provisions and additional disclosure requirements.Methods of Valuing Material Issues.pptx

Methods of Valuing Material Issues.pptxVasanthSenthil3

╠²

In accounts, this material issue valuation topic is very important and this presentation will help you a lot.GSTR-1 PPT Filling Step by Step

GSTR-1 PPT Filling Step by Step Hina juyal

╠²

The PPT about GSTR-1 , How to filling GSTRR-1 Step by Step all Details here by CA Sanjiv Nanda. .

Mostly people is confused how to file GSTR-1 so this PPT help That people . Transitional Provision Under GST

Transitional Provision Under GSTMASOOM SEKHAR SAHOO

╠²

Transition to GST could be a cumbersome process if preparations are not started immediately. VAT/Service tax taxpayers should complete the GST migration. Know more about GST Transitional Provision at https://cleartax.in/s/transition-to-gst/Decoding GSTR-1 and GSTR-3B

Decoding GSTR-1 and GSTR-3BDVSResearchFoundatio

╠²

OBJECTIVE

Goods and Services Tax (GST) is the Indirect Tax levied in India introduced in July 2017 which was one of the most important reforms in the Indian Economy. There are various periodic compliance requirements and filings under GST. In this webinar, we shall analyse and understand the forms GSTR-1 and GSTR-3B.Presentation1 tax audit

Presentation1 tax auditsnehalchavan225

╠²

This document discusses tax audits in India. It explains that tax audits are required for businesses and professions with annual turnover over Rs. 1 crore or Rs. 25 lakhs respectively under Section 44AB. Tax audits must be completed by September 30th of the assessment year and are conducted to verify the true and fair view of financial statements. The document outlines the pre-audit, during audit, and post-audit processes and provides details on Sections 44AD and 44AE related to presumed income levels. Key aspects reviewed in a tax audit include the nature of business, TDS, cash transactions, related party payments, and financial ratios.Overview of filing return under GST

Overview of filing return under GSTTeam Asija

╠²

GST returns must be filed by taxpayers on a regular basis to report tax liabilities and claims. There are multiple GST return forms depending on the taxpayer category. Taxpayers must self-assess tax obligations and file monthly, quarterly, or annual returns reporting details of outward and inward supplies, input tax credit, tax payable, and tax paid. Input tax credit claims are matched against supplier returns and any discrepancies can result in credits being denied or reversed. Late fees may apply for failure to submit required returns by the due date.Refund under GST updated

Refund under GST updatedgst-trichy

╠²

The document provides an overview of refund provisions under GST including situations where refunds may arise, legal provisions, refund procedures and time limits, refund scenarios, and basic features of the refund process. Key points include:

- Refunds can arise from excess payments, exports, deemed exports, provisional assessments, and other situations.

- The CGST and IGST Acts contain provisions regarding refund of tax, interest, and other amounts paid.

- The time limit to claim a refund is 2 years from the relevant date, and refunds must generally be sanctioned within 60 days.

- Various scenarios where refunds may be claimed are described, along with required documents and restrictions.

-Composition levy GST ( Composition Scheme GST )

Composition levy GST ( Composition Scheme GST )CA-Amit

╠²

Only taxable persons whose ŌĆśaggregate turnoverŌĆÖ does not exceed Rs. 50 lacs in a financial year will be eligible to opt for payment of tax under the composition scheme.As per Section 16, Goods and/or services on which composition tax has been paid under Section 8 is not eligible for input tax credit.General presentation on Income Tax in Bangladesh

General presentation on Income Tax in BangladeshBarrister Mutasim Billah Faruqui

╠²

This document provides an overview of income tax returns in Bangladesh. It discusses key topics like the jurisdiction of different tax authorities, guidelines for filling out the income tax return form, calculating tax liabilities and credits, supporting documents required, and common errors. The return form has 8 pages collecting information on personal details, income sources, assets, liabilities, and expenditures. Examples are provided for correctly filling out sections on salaries, house rental income, interest from securities, agricultural income, and business income.Transition Provision Under GST

Transition Provision Under GSTTeam Asija

╠²

This document provides an overview of key transition provisions under the GST Act relating to claiming input tax credit for taxes paid under previous indirect tax regimes. It explains that transition provisions allow earlier taxpayers to migrate to GST with ease by carrying forward eligible input tax credits. It outlines conditions for claiming credits for cenvat, VAT, entry tax and capital goods, as well as for persons who were previously unregistered or exempt suppliers. It also summarizes the process for filing GST TRAN-1 and TRAN-2 forms.Basics of GST

Basics of GSTShalini Nandwani

╠²

Goods and Services Tax (GST) is a comprehensive indirect tax on the supply of goods and services throughout India that replaced multiple taxes levied by the central and state governments. GST is composed of Central GST and State GST and is levied on all stages of supply of goods and services. Registered businesses can claim input tax credit, reducing the overall tax burden. GST was implemented on July 1, 2017 and aims to create a single, unified Indian market.Gst mechanism

Gst mechanismGautom Mitra

╠²

This document discusses several topics related to accounting, taxes, and the Goods and Services Tax (GST) in India. It provides information on registering for GST if certain turnover thresholds are met, using HSN and SAC codes on invoices, requirements for tax invoices, reverse charge mechanisms, e-way bills, and examples of calculating GST in different situations. Key points covered include how GST applies to inter-state transactions, input tax credit rules, and tax rates for certain transport services.More Related Content

What's hot (20)

Invoice & Payment of Tax under GST

Invoice & Payment of Tax under GSTVijaya Kumar Kavilikatta

╠²

1. The document outlines the procedures for issuing tax invoices and maintaining electronic ledgers for payment of goods and service tax (GST) in India. It specifies that registered taxable persons must issue tax invoices before or after supplying goods or services and what information must be included. 2. It also describes how payment of GST is made through electronic cash and credit ledgers that are maintained on a central portal. Any tax, interest, penalties or other amounts are recorded in these ledgers. 3. Specified forms are used to maintain electronic records of tax liabilities, input tax credits, and deposits made in the cash ledger.Gst ppt

Gst ppt jithin koshy

╠²

This document discusses key aspects of the Goods and Services Tax (GST) in India, including:

- GST is a single, destination-based tax levied on the supply of goods and services. It subsumes several taxes into a single tax.

- GST is levied as Central GST (CGST), State GST (SGST), Integrated GST (IGST), and Union Territory GST (UTGST) depending on the nature of the supply.

- There are four GST tax slabs of 0%, 5%, 12%, and 18% for goods and 5% and 18% for services. Composition scheme is available for small businesses with turnover less than RsMinimum alternate tax

Minimum alternate taxAltacit Global

╠²

The document discusses India's Minimum Alternate Tax (MAT), which requires companies to pay tax of at least 30% of their book profits if their total taxable income under normal tax provisions is less than 30% of book profits. Key points include that MAT aims to ensure companies pay some tax even with exemptions, MAT can be carried forward for tax credits for 5 years, and MAT rates have increased over time, most recently to 18.5% for companies and for Limited Liability Partnerships.Income tax introduction

Income tax introductionChitraChellam

╠²

The document provides a history of income tax law in India and definitions of key concepts in income tax. It discusses how income tax was first introduced in 1860 and the various acts passed until the current Income Tax Act of 1961. It defines important terms like assessee, person, income, agricultural income, assessment year, and previous year. It also outlines what constitutes taxable income and exemptions under the law.GST Return Overview by CA Shital Thadeshwar

GST Return Overview by CA Shital ThadeshwarShital Thadeshwar

╠²

GST returns types, applicability of returns with due date to different assessees, CGST, IGST, SGST, Returns for regular Dealer, Composition Dealer, Annual return,Monthly return, Quarterly ReturnGst annual return

Gst annual returnRamaswamy Narasimhachary

╠²

The document provides information about the GSTR-9 annual return filing requirements under the Goods and Services Tax (GST) in India. It states that GSTR-9 must be filed by regular taxpayers to consolidate supplies and input tax credit details for the entire financial year. It outlines the different types of annual returns that must be filed depending on the taxpayer's registration type. It also discusses the due date for filing GSTR-9, which has been extended to 30 June 2019, and penalties for late filing. The key parts of the GSTR-9 form and details required to be reported in each part are also explained.TDS section 194Q Presentation PPT

TDS section 194Q Presentation PPTPrakhar Jain

╠²

This document summarizes the new TDS and TCS provisions introduced under sections 194Q and 206C(1H) respectively. It provides details on who is required to deduct/collect (entities with turnover over Rs. 10 crores), calculation of amount (0.1% of transaction value excluding/including GST), due dates of payment and return filing (monthly and quarterly), and exceptions when TDS/TCS is not applicable. It also discusses section 206AB which provides for higher rate of TDS (twice the specified rate or 5%) in case of non-filers of return.Accounts & Records to be kept under GST

Accounts & Records to be kept under GSTTeam Asija

╠²

This document summarizes the key accounts and records that must be kept under the Goods and Services Tax (GST) in India. It outlines the requirements for tax invoices, credit notes, debit notes, and other documents. It also specifies the accounts and records that must be maintained, including production, inventory, supplies, taxes, and other required documents. All accounts and records must be kept for 5 years or longer if under audit or legal proceedings.GST in Tally

GST in Tallyganesh_channa

╠²

The document discusses Goods and Services Tax (GST) in India and how it will be accounted for in Tally ERP 9 software. It explains that GST will replace existing taxes like VAT and Service Tax with a single tax. There are three types of GST - CGST for intra-state sales, SGST for intra-state sales, and IGST for inter-state sales. Accounting entries in Tally for GST are similar to the current system, with separate ledgers created for CGST, SGST and IGST. A Goods and Services Tax Identification Number (GSTIN) will be assigned to taxpayers based on their PAN and state code.Session on ICDS I to X - Sandeep Jhunjhunwala

Session on ICDS I to X - Sandeep JhunjhunwalaSandeep Jhunjhunwala

╠²

This document provides an overview of Income Computation and Disclosure Standards (ICDS) implementation in India. It discusses the evolution of ICDS from initial notification of 2 accounting standards in 1996 to the notification of 10 ICDS in 2015 that are applicable from AY 2017-18 onwards. It also summarizes key highlights of ICDS including applicability, precedence over accounting standards/judicial rulings, transitional provisions and additional disclosure requirements.Methods of Valuing Material Issues.pptx

Methods of Valuing Material Issues.pptxVasanthSenthil3

╠²

In accounts, this material issue valuation topic is very important and this presentation will help you a lot.GSTR-1 PPT Filling Step by Step

GSTR-1 PPT Filling Step by Step Hina juyal

╠²

The PPT about GSTR-1 , How to filling GSTRR-1 Step by Step all Details here by CA Sanjiv Nanda. .

Mostly people is confused how to file GSTR-1 so this PPT help That people . Transitional Provision Under GST

Transitional Provision Under GSTMASOOM SEKHAR SAHOO

╠²

Transition to GST could be a cumbersome process if preparations are not started immediately. VAT/Service tax taxpayers should complete the GST migration. Know more about GST Transitional Provision at https://cleartax.in/s/transition-to-gst/Decoding GSTR-1 and GSTR-3B

Decoding GSTR-1 and GSTR-3BDVSResearchFoundatio

╠²

OBJECTIVE

Goods and Services Tax (GST) is the Indirect Tax levied in India introduced in July 2017 which was one of the most important reforms in the Indian Economy. There are various periodic compliance requirements and filings under GST. In this webinar, we shall analyse and understand the forms GSTR-1 and GSTR-3B.Presentation1 tax audit

Presentation1 tax auditsnehalchavan225

╠²

This document discusses tax audits in India. It explains that tax audits are required for businesses and professions with annual turnover over Rs. 1 crore or Rs. 25 lakhs respectively under Section 44AB. Tax audits must be completed by September 30th of the assessment year and are conducted to verify the true and fair view of financial statements. The document outlines the pre-audit, during audit, and post-audit processes and provides details on Sections 44AD and 44AE related to presumed income levels. Key aspects reviewed in a tax audit include the nature of business, TDS, cash transactions, related party payments, and financial ratios.Overview of filing return under GST

Overview of filing return under GSTTeam Asija

╠²

GST returns must be filed by taxpayers on a regular basis to report tax liabilities and claims. There are multiple GST return forms depending on the taxpayer category. Taxpayers must self-assess tax obligations and file monthly, quarterly, or annual returns reporting details of outward and inward supplies, input tax credit, tax payable, and tax paid. Input tax credit claims are matched against supplier returns and any discrepancies can result in credits being denied or reversed. Late fees may apply for failure to submit required returns by the due date.Refund under GST updated

Refund under GST updatedgst-trichy

╠²

The document provides an overview of refund provisions under GST including situations where refunds may arise, legal provisions, refund procedures and time limits, refund scenarios, and basic features of the refund process. Key points include:

- Refunds can arise from excess payments, exports, deemed exports, provisional assessments, and other situations.

- The CGST and IGST Acts contain provisions regarding refund of tax, interest, and other amounts paid.

- The time limit to claim a refund is 2 years from the relevant date, and refunds must generally be sanctioned within 60 days.

- Various scenarios where refunds may be claimed are described, along with required documents and restrictions.

-Composition levy GST ( Composition Scheme GST )

Composition levy GST ( Composition Scheme GST )CA-Amit

╠²

Only taxable persons whose ŌĆśaggregate turnoverŌĆÖ does not exceed Rs. 50 lacs in a financial year will be eligible to opt for payment of tax under the composition scheme.As per Section 16, Goods and/or services on which composition tax has been paid under Section 8 is not eligible for input tax credit.General presentation on Income Tax in Bangladesh

General presentation on Income Tax in BangladeshBarrister Mutasim Billah Faruqui

╠²

This document provides an overview of income tax returns in Bangladesh. It discusses key topics like the jurisdiction of different tax authorities, guidelines for filling out the income tax return form, calculating tax liabilities and credits, supporting documents required, and common errors. The return form has 8 pages collecting information on personal details, income sources, assets, liabilities, and expenditures. Examples are provided for correctly filling out sections on salaries, house rental income, interest from securities, agricultural income, and business income.Transition Provision Under GST

Transition Provision Under GSTTeam Asija

╠²

This document provides an overview of key transition provisions under the GST Act relating to claiming input tax credit for taxes paid under previous indirect tax regimes. It explains that transition provisions allow earlier taxpayers to migrate to GST with ease by carrying forward eligible input tax credits. It outlines conditions for claiming credits for cenvat, VAT, entry tax and capital goods, as well as for persons who were previously unregistered or exempt suppliers. It also summarizes the process for filing GST TRAN-1 and TRAN-2 forms.Similar to Accounting entries under gst (20)

Basics of GST

Basics of GSTShalini Nandwani

╠²

Goods and Services Tax (GST) is a comprehensive indirect tax on the supply of goods and services throughout India that replaced multiple taxes levied by the central and state governments. GST is composed of Central GST and State GST and is levied on all stages of supply of goods and services. Registered businesses can claim input tax credit, reducing the overall tax burden. GST was implemented on July 1, 2017 and aims to create a single, unified Indian market.Gst mechanism

Gst mechanismGautom Mitra

╠²

This document discusses several topics related to accounting, taxes, and the Goods and Services Tax (GST) in India. It provides information on registering for GST if certain turnover thresholds are met, using HSN and SAC codes on invoices, requirements for tax invoices, reverse charge mechanisms, e-way bills, and examples of calculating GST in different situations. Key points covered include how GST applies to inter-state transactions, input tax credit rules, and tax rates for certain transport services.Understanding GST(overview) presentation

Understanding GST(overview) presentation Nikhil Malaiyya

╠²

In this Presentation we will discuss GST for businessman and consumer, Transitional Provision under GST, Input Tax credit carried forward in GST. CAASA Tax Table 1st edition

CAASA Tax Table 1st editionCA Abhishek Agarwal

╠²

This document provides an overview of Goods and Services Tax (GST) in India. It discusses that GST is a dual tax with both central and state governments imposing taxes. It outlines the key aspects of GST including the taxes that will be subsumed, the different models of GST (CGST, SGST, IGST), the GST network, registration process, return filing, and efforts to reduce tax evasion. It also covers revenue neutral rates and the challenges in determining the appropriate tax rate under GST.Gst impact study-icai

Gst impact study-icaiPSPCL

╠²

The document outlines the agenda for a webcast on opportunities in GST, including a brief background on GST and transitional challenges. It then provides details on the timing allocated to various topics, including impact analysis through examples and key impact areas. The impact areas discussed include the need to re-engineer processes, procurement, credit carry forward claims, exemptions, composition scheme, vendor management, agreements, and accounting practices.351119721.ppsx

351119721.ppsxJANCYSUNISH

╠²

This document provides information about taxes in India, including Goods and Services Tax (GST). It defines different types of taxes such as direct and indirect taxes. It explains how GST works as an indirect tax collected from customers by businesses and paid to the government. It outlines the taxes that were merged into GST and how it aims to reduce the tax burden through a unified market. It also gives examples of tax calculations under GST.GST Booklet A5

GST Booklet A5Sidharth Jain

╠²

GST implementation will be challenging but can be turned into an opportunity with proper preparation. It will consolidate indirect taxes, simplify compliance, and eliminate tax cascading. Businesses need to assess how GST may impact their costs, cash flow, margins, and compliance processes and make necessary changes to contracts and IT systems. Proper planning is required to take advantage of GST.GST(Goods and Service Tax)

GST(Goods and Service Tax)Aman Singh (ÓżģÓżĖÓż░)

╠²

This presentation is on GST (Goods and Services Tax), it is about the new taxation system implemented in India. I have tried to keep all information about GST India.GST E-book.pdf

GST E-book.pdfZaynRoy

╠²

This document is a guidebook on GST (Goods and Services Tax) in India published by ClearTax. It provides an overview of key aspects of GST including how it simplifies indirect taxation and reduces the cascading effect of taxes. The guidebook helps readers understand GST concepts and terminology and how GST may impact businesses. It contains chapters on GST registration, returns, input tax credit, and the impact of GST on different industries.Opportunity in GST for Accountant & Chartered Accountant

Opportunity in GST for Accountant & Chartered AccountantNikhil Malaiyya

╠²

In This Presentation we Will discuss Journal Entry require under GST. Also discuss Transition Provision Under GST. Existing Tax Structure & Proposed Tax Structure.GST for Small Enterprises by CA RISHI GOYAL

GST for Small Enterprises by CA RISHI GOYALCA Rishi Goyal

╠²

The document discusses key aspects of the Goods and Services Tax (GST) implemented in India. It notes that GST is a tax on the supply of goods and services, levied at each stage of supply. There are three types of GST: Central GST, State GST, and Integrated GST. Certain state and central taxes are subsumed under GST. Suppliers must register under GST if their aggregate annual turnover exceeds certain thresholds. Special categories of persons also require registration regardless of turnover. Input tax credit rules and return filing requirements are also outlined.Goods and service tax act

Goods and service tax actSuresh Tummala

╠²

GST has been introduced in India to amalgamate multiple taxes into a single tax, mitigate cascading taxes, and make Indian goods more competitive globally. Previously, the constitution clearly demarcated fiscal powers between the central and state governments for levying various taxes on manufacture, sale, and services. GST empowers both the central and state governments to concurrently levy and collect GST, which replaces existing taxes like excise duty, sales tax, VAT, and introduces the Integrated GST for inter-state transactions. GST is implemented as CGST by central states and SGST by state governments. Taxpayers with under Rs. 20 lacs annual turnover are exempt, and those under Rs. 50 lacs canGoods and service tax - GST- A detailed explanation with examples

Goods and service tax - GST- A detailed explanation with examplesShakir Shaikh

╠²

The document provides an overview of the Goods and Services Tax (GST) that was introduced in India in 2017. It explains that GST is a comprehensive indirect tax on the supply of goods and services that aims to replace multiple taxes levied by the central and state governments. The key aspects covered include the constitutional amendment needed to implement GST, the various tax components under GST, input tax credit provisions, tax rates, and exemptions. Examples are also provided to illustrate how tax calculations work under the GST framework for domestic and international transactions.Gst the future of india

Gst the future of indiaChinmay Gangwal

╠²

This document provides an overview of the Goods and Services Tax (GST) that is proposed to be implemented in India. It defines GST as a comprehensive tax on the production and sale of goods and provision of services. The key points are:

1) GST will replace existing indirect taxes and be collected as Central GST and State GST by the central and state governments respectively to reduce complexities and compliance costs.

2) There will be four tax rates for essential goods and services, standard goods and services, precious metals, and exempt categories.

3) Businesses must register for GST if their annual turnover exceeds Rs. 1.5 crore and file regular returns detailing taxes collected. InputPresentation on GST

Presentation on GSTJakey Rohira

╠²

Presentation on Goods & Service Tax (GST) by Indirect Taxes Committee of The Institute of Chartered Accountants of India (ICAI) - 28.08.2015Gst on services in india

Gst on services in indiaPrashant Kalyan Pk

╠²

The biggest ever indirect tax reforms to be implemented ever since 1947 is the GST bill. Execution of this bill is expected to bring economic integration of the Indian economy. Among the group that is highly overwhelmed with the introduction of this form of tax are the start-ups and SMEŌĆÖs. Expectations are that the organizations will benefit the most out of the GST implementation.GST simplified for textile traders

GST simplified for textile tradersSachin Singh

╠²

This presentation plan covers the key aspects of the proposed Goods and Services Tax (GST) regime in India. It begins with an overview of the existing indirect tax structure and its limitations. It then discusses the main benefits of GST such as simplification and harmonization of indirect taxes. The presentation goes on to explain the key features of GST including the dual GST model, registration requirements, input tax credit provisions, invoice rules, payment of tax, and return filing process. It also touches on other aspects like valuation, e-way bill system, reverse charge mechanism and composition scheme. Specific issues related to textile traders are also mentioned. Overall, the document provides a comprehensive overview of the major elements of the proposed GClass-GST.ppt

Class-GST.pptrajasekar643931

╠²

The document provides information about GST compliance for businesses using Tally ERP 9 Release 6.0. It highlights key aspects of GST including the unified tax regime, invoice-level details for input tax credit claims, and mandatory e-filing. It also summarizes current indirect taxes subsumed under GST and registration thresholds. Details on tax payment, returns, and consequences of non-compliance are presented. The last section demonstrates using the offline GSTN utility to import Excel data and generate a .json file for uploading returns.OfficeCentral ICT for Growth_GST_India_v1r6

OfficeCentral ICT for Growth_GST_India_v1r6venturesmarketing

╠²

Now you can do GST Transactions for India using the OfficeCentral Accounting module. The chart of account is already configured for the Indian GST including the Central GST, State GST, Integrated GST and related transactions. You can do the various transactions like receive invoice ( within state, outside state), issue invoice ( within state, outside state), credit notes, imports, exports and other GST transactions. You can generate GSTR1, GSTR2 and GSTR3 reports. The system also prepares for you the file for inward supplies and outward supplies to upload to the GSTN network. Recently uploaded (20)

How to create security group category in Odoo 17

How to create security group category in Odoo 17Celine George

╠²

This slide will represent the creation of security group category in odoo 17. Security groups are essential for managing user access and permissions across different modules. Creating a security group category helps to organize related user groups and streamline permission settings within a specific module or functionality.Azure Solution Architect Interview Questions By ScholarHat

Azure Solution Architect Interview Questions By ScholarHatScholarhat

╠²

Azure Solution Architect Interview Questions By ScholarHatHow to Configure Flexible Working Schedule in Odoo 18 Employee

How to Configure Flexible Working Schedule in Odoo 18 EmployeeCeline George

╠²

In this slide, weŌĆÖll discuss on how to configure flexible working schedule in Odoo 18 Employee module. In Odoo 18, the Employee module offers powerful tools to configure and manage flexible working schedules tailored to your organization's needs.Managing expiration dates of products in odoo

Managing expiration dates of products in odooCeline George

╠²

Odoo allows users to set expiration dates at both the product and batch levels, providing flexibility and accuracy. By using Odoo's expiration date management, companies can minimize waste, optimize stock rotation, and maintain high standards of product quality. The system allows users to set expiration dates at both the product and batch levels, providing flexibility and accuracy.The Constitution, Government and Law making bodies .

The Constitution, Government and Law making bodies .saanidhyapatel09

╠²

This PowerPoint presentation provides an insightful overview of the Constitution, covering its key principles, features, and significance. It explains the fundamental rights, duties, structure of government, and the importance of constitutional law in governance. Ideal for students, educators, and anyone interested in understanding the foundation of a nationŌĆÖs legal framework.

Unit 1 Computer Hardware for Educational Computing.pptx

Unit 1 Computer Hardware for Educational Computing.pptxRomaSmart1

╠²

Computers have revolutionized various sectors, including education, by enhancing learning experiences and making information more accessible. This presentation, "Computer Hardware for Educational Computing," introduces the fundamental aspects of computers, including their definition, characteristics, classification, and significance in the educational domain. Understanding these concepts helps educators and students leverage technology for more effective learning.Azure Administrator Interview Questions By ScholarHat

Azure Administrator Interview Questions By ScholarHatScholarhat

╠²

Azure Administrator Interview Questions By ScholarHatHow to Unblock Payment in Odoo 18 Accounting

How to Unblock Payment in Odoo 18 AccountingCeline George

╠²

In this slide, we will explore the process of unblocking payments in the Odoo 18 Accounting module. Payment blocks may occur due to various reasons, such as exceeding credit limits or pending approvals. We'll walk through the steps to remove these blocks and ensure smooth payment processing.Research & Research Methods: Basic Concepts and Types.pptx

Research & Research Methods: Basic Concepts and Types.pptxDr. Sarita Anand

╠²

This ppt has been made for the students pursuing PG in social science and humanities like M.Ed., M.A. (Education), Ph.D. Scholars. It will be also beneficial for the teachers and other faculty members interested in research and teaching research concepts.Effective Product Variant Management in Odoo 18

Effective Product Variant Management in Odoo 18Celine George

╠²

In this slide weŌĆÖll discuss on the effective product variant management in Odoo 18. Odoo concentrates on managing product variations and offers a distinct area for doing so. Product variants provide unique characteristics like size and color to single products, which can be managed at the product template level for all attributes and variants or at the variant level for individual variants.Meeting the needs of modern students?, Selina McCoy

Meeting the needs of modern students?, Selina McCoyEconomic and Social Research Institute

╠²

NAPD Annual Symposium

ŌĆ£Equity in our Schools: Does the system deliver for all young people?ŌĆØHow to Configure Proforma Invoice in Odoo 18 Sales

How to Configure Proforma Invoice in Odoo 18 SalesCeline George

╠²

In this slide, weŌĆÖll discuss on how to configure proforma invoice in Odoo 18 Sales module. A proforma invoice is a preliminary invoice that serves as a commercial document issued by a seller to a buyer.Dot NET Core Interview Questions PDF By ScholarHat

Dot NET Core Interview Questions PDF By ScholarHatScholarhat

╠²

Dot NET Core Interview Questions PDF By ScholarHatRest API Interview Questions PDF By ScholarHat

Rest API Interview Questions PDF By ScholarHatScholarhat

╠²

Rest API Interview Questions PDF By ScholarHatITI Turner Question Paper MCQ E-Book Free Download

ITI Turner Question Paper MCQ E-Book Free DownloadSONU HEETSON

╠²

ITI Turner Question Paper MCQ Book PDF Free Download. All Questions collected from NIMI Mock Test, CTS Bharat Skills Question Bank, Previous Exam papers. Helpful for CTS Trade Theory 1st & 2nd Year CBT Exam,╠²Apprentice test, AITT, ISRO, DRDO, NAVY, ARMY, Naval Dockyard, Tradesman, Training Officer, Instructor, RRB ALP CBT 2,╠²Railway Technician, CEPTAM, BRO, PWD, PHED, Air India, BHEL, BARC, IPSC, CISF, CTI, HSFC, GSRTC, GAIL, PSC, Viva, Tests, Quiz╠²& all other technical competitive exams.BISNIS BERKAH BERANGKAT KE MEKKAH ISTIKMAL SYARIAH

BISNIS BERKAH BERANGKAT KE MEKKAH ISTIKMAL SYARIAHcoacharyasetiyaki

╠²

BISNIS BERKAH BERANGKAT KE MEKKAH ISTIKMAL SYARIAHEssentials of a Good PMO, presented by Aalok Sonawala

Essentials of a Good PMO, presented by Aalok SonawalaAssociation for Project Management

╠²

APM event hosted by the South Wales and West of England Network (SWWE Network)

Speaker: Aalok Sonawala

The SWWE Regional Network were very pleased to welcome Aalok Sonawala, Head of PMO, National Programmes, Rider Levett Bucknall on 26 February, to BAWA for our first face to face event of 2025. Aalok is a member of APMŌĆÖs Thames Valley Regional Network and also speaks to members of APMŌĆÖs PMO Interest Network, which aims to facilitate collaboration and learning, offer unbiased advice and guidance.

Tonight, Aalok planned to discuss the importance of a PMO within project-based organisations, the different types of PMO and their key elements, PMO governance and centres of excellence.

PMOŌĆÖs within an organisation can be centralised, hub and spoke with a central PMO with satellite PMOs globally, or embedded within projects. The appropriate structure will be determined by the specific business needs of the organisation. The PMO sits above PM delivery and the supply chain delivery teams.

For further information about the event please click here.Accounting entries under gst

- 1. How to pass accounting entries under GST Updated on Jun 09, 2017 - 08:41:39 PM Goods and service tax or GST will be one tax to subsume all taxes. It will bring in ŌĆ£One nation one taxŌĆØ regime. While there will be certain initial transition challenges, GST will bring in much clarity in many areas of business. One of the areas is accounting and bookkeeping. Read on to find out about accounting entries under GST. Current scenario: Separate accounts have to be maintained for excise, VAT, CST and service tax. HereŌĆÖs a list of the few accounts currently any business has to maintain (apart from accounts like purchase, sales, stock) ŌĆō ’éĘ Excise payable a/c (for manufacturers) ’éĘ CENVAT credit a/c (for manufacturers) ’éĘ Output VAT a/c ’éĘ Input VAT a/c ’éĘ Input Service tax a/c ’éĘ Output Service tax a/c For example, a trader Mr. X must maintain the minimum basic accounts ŌĆō ’éĘ Output VAT a/c ’éĘ Input VAT a/c ’éĘ CST A/c (for inter-state sales and purchases) ’éĘ Service tax a/c [He will not be able to claim any service tax input credit as he is a trader with output VAT. Service tax cannot be setoff against VAT/ CST] GST Regime Under GST all these taxes (excise, VAT, service tax) will get subsumed into one account. The same trader X has to then maintain the following a/cs (apart from accounts like purchase, sales, stock) ŌĆō ’éĘ Input CGST a/c ’éĘ Output CGST a/c ’éĘ Input SGST a/c ’éĘ Output SGST a/c ’éĘ Input IGST a/c ’éĘ Output IGST a/c ’éĘ Electronic Cash Ledger (to be maintained on Government GST portal to pay GST)

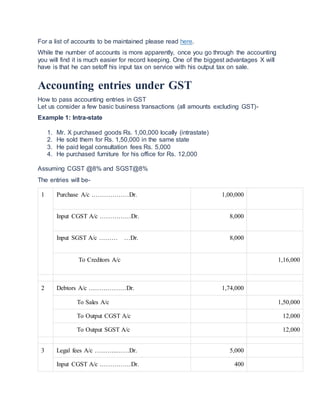

- 2. For a list of accounts to be maintained please read here. While the number of accounts is more apparently, once you go through the accounting you will find it is much easier for record keeping. One of the biggest advantages X will have is that he can setoff his input tax on service with his output tax on sale. Accounting entries under GST How to pass accounting entries in GST Let us consider a few basic business transactions (all amounts excluding GST)- Example 1: Intra-state 1. Mr. X purchased goods Rs. 1,00,000 locally (intrastate) 2. He sold them for Rs. 1,50,000 in the same state 3. He paid legal consultation fees Rs. 5,000 4. He purchased furniture for his office for Rs. 12,000 Assuming CGST @8% and SGST@8% The entries will be- 1 Purchase A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 1,00,000 Input CGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 8,000 Input SGST A/c ŌĆ”ŌĆ”ŌĆ” ŌĆ”Dr. 8,000 To Creditors A/c 1,16,000 2 Debtors A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 1,74,000 To Sales A/c 1,50,000 To Output CGST A/c 12,000 To Output SGST A/c 12,000 3 Legal fees A/c ŌĆ”ŌĆ”ŌĆ”..ŌĆ”ŌĆ”Dr. 5,000 Input CGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 400

- 3. Input SGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 400 To Bank A/c 5,800 4 Furniture A/c ŌĆ”ŌĆ”ŌĆ”..ŌĆ”ŌĆ”Dr. 12,000 Input CGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 960 Input SGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 960 To ABC Furniture Shop A/c 13,920 Have you filed your GSTR-1 yet? File GSTR-1 Now! File now under 15 minutes through ClearTax GST Total Input CGST=8,000+400+960= Rs. 9,360 Total Input SGST=8,000+400+960= Rs. 9,360 Total output CGST=12,000 Total output SGST=12,000 Therefore Net CGST payable=12,000-9,360=2,640 Net SGST payable=12,000-9,360=2,640 5 Output CGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 12,000 Output SGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 12,000 To Input CGST A/c 9,360 To Input SGST A/c 9,360 To Electronic Cash Ledger A/c 5,280 Thus due to input tax credit, tax liability of Rs. 24,000 is reduced to only Rs.5,280. Also, GST on legal fees is also adjusted which was not possible in current tax regime. If there had been any input tax credit left it would have been carried forward to the next year.

- 4. Example 2: Inter-state 1. Mr. X purchased goods Rs. 1,50,000 from outside the State 2. He sold Rs. 1,50,000 locally 3. He sold Rs.1,00,000 outside the state 4. He paid telephone bill Rs. 5,000 5. He purchased an air cooler for his office for Rs. 12,000 (locally) Assuming CGST @8% and SGST@8% 1 Purchase A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 1,50,000 Input IGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 24,000 To Creditors A/c 1,74,000 2 Debtors A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 1,74,000 To Sales A/c 1,50,000 To Output CGST A/c 12,000 To Output SGST A/c 12,000 3 Debtors A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 1,16,000 To Sales A/c 1,00,000 To Output IGST A/c 16,000 4 Telephone Expenses A/c ..ŌĆ”Dr. 5,000

- 5. Input CGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”..Dr. 400 Input SGST A/c ŌĆ”..ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 400 To Bank A/c 5,800 5 Office Equipment A/c.ŌĆ”..Dr. 12,000 Input CGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 960 Input SGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 960 To ABC Furniture Shop A/c 13,920 Total CGST input =400+960=1,360 Total CGST output =12,000 Total SGST input =400+960=1,360 Total SGST output =12,000 Total IGST input =24,000 Total IGST output =16,000 Particulars CGST SGST IGST Output liability 12,000 12,000 16,000 Less: Input tax credit CGST 1,360 SGST 1,360 IGST 8,000 16,000

- 6. Amount payable 2,640 10,640 NIL Any IGST credit will first be applied to set off IGST and then CGST. Balance if any will be applied to setoff SGST. So out of total input IGST of Rs. 24,000, firstly it will be completely setoff against IGST. Then balance Rs.8,000 against CGST. From the total Rs.40,000, only Rs. 13,280 is payable. So the setoff entries will be- Setoff against CGST output 1 Output CGST ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 9,360 To Input CGST A/c 1,360 To Input IGST A/c 8,000 2 Setoff against SGST output Output SGST ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 1,360 To Input SGST A/c 1,360 3 Setoff against IGST output Output IGST ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 16,000 To Input IGST A/c 16,000 4 Final payment

- 7. Output CGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 2,640 Output SGST A/c ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ”Dr. 10,640 To Electronic Cash Ledger A/c 13,280 GST impact on financials Profit & Loss Account Particulars Rs. Particulars Rs. Raw material consumption XXX [Decrease] Sales XXX*** Purchases XXX Depreciation XXX Other Expenses XXX Reduction in raw material cost and other expenses GST will mean seamless input credits for intrastate and interstate purchases of goods. This will mean reduction in cost of raw materials as input GST can be setoff against the output GST payable on sales. Also GST paid on many services like legal consultation, audit fees, engineering consultation etc. can be setoff against output GST. Currently input credit of service tax paid cannot be adjusted against output excise/VAT. All this will effectively bring down the expenses. ***Impact on sales may vary depending on the industry and the GST rates. Balance Sheet Particulars Rs. Particulars Rs.

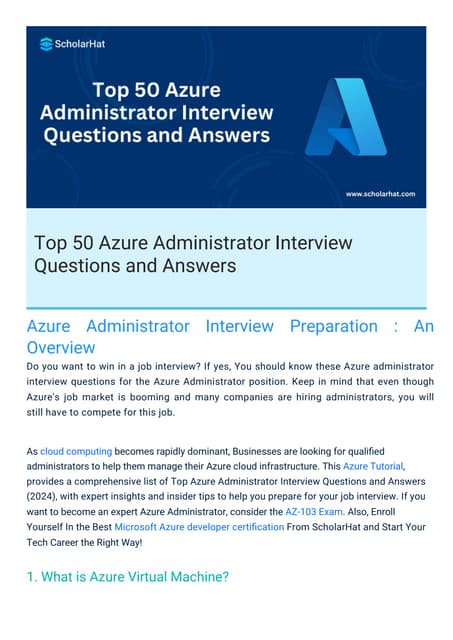

- 8. Capital XXX Fixed assets XXX [Decrease] Current liabilities XXX Current assets XXX Tax payable XXX Credit receivable XXX Effective cost of fixed assets will come down as input credit will be available on both capital goods and services related to such goods like installation, inspection etc. Tax payable and credit receivable will face changes too. There will be only three accounts under each of them- SGST, CGST, IGST instead of maintaining current excise payable, CENVAT credit, VAT payable, VAT credit, Service tax accounts. Accounting principles GAAP is applicable mandatorily on GST. So, all principles following revenue recognition etc. will be applicable. Period of retention of accounts Every registered taxable person must keep and maintain books of account for five years from the due date of filing of Annual Return for the relevant year. Transition to GST will need to address various aspects of financial reporting systems for proper reporting. It is important that businesses plan to address changes arising out GST implementation in the best manner to reduce cost of transition and minimize business disruption.