Accounts

- 1. Accounting concepts Accounting conventions Accounting policies Accounting standards

- 2. Accounting concepts ? Rules of accounting that should be followed in preparation of all accounts and financial statements are known as accounting concepts. ? Now the concept of Debits and Credits is actually more than 500 years old, being used extensively by the Venetian merchants of Italy in the 15th century Renaissance period. The concepts were first documented in Latin in the 1400ˇŻs and were later translated into English in the 16th century.

- 3. Basic rules : Debit the receiver Credit the giver Debit the assets Credit all liabilities Debit what comes in , Credit what goes out

- 4. The four fundamental concepts: ? (1) Accruals concept: revenue and expenses are recorded when they occur and not when the cash is received or paid out; (2) Consistency concept: once an accounting method has been chosen, that method should be used unless there is a sound reason to do otherwise; (3) Going concern: the business entity for which accounts are being prepared is in good condition and will continue to be in business in the foreseeable future;

- 5. ? (4) Prudence concept (also conservation concept): revenue and profits are included in the balance sheet only when they are realized (or there is reasonable 'certainty' of realizing them) but liabilities are included when there is reasonable 'possibility' of incurring them.

- 6. Accounting conventions ? Guidelines that arise from the practical application of accounting principles. An accounting convention is not a legally-binding practice; rather, it is a generally-accepted convention based on customs, and is designed to help accountants overcome practical problems that arise out of the preparation of financial statements. As customs change, so to will accounting conventions.

- 8. Convention of disclosure ? The disclosure of all significant information is one of the important accounting conventions. It implies that accounts should be prepared in such a way that all material information is clearly disclosed to the reader. ? The idea behind this convention is that any body who want to study the financial statements should not be mislead. He should be able to make a free judgment. The disclosures can be in the way of foot notes.

- 9. Convention of materiality ? According to this convention only those events or items should be recorded which have a significant bearing and insignificant things should be ignored. ? There is no formula in making a distinction between material and immaterial events. It is a matter of judgment and it is left to the accountant for taking a decision. It should be noted that an item material for one concern may be immaterial for another. Similarly, an item material in one year may not be material in the next year.

- 10. Convention of consistency ? This convention means that accounting practices should remain uncharged from one period to another. For example, if stock is valued at cost or market price whichever is less; this principle should be followed year after year. Similarly, if depreciation is charged on fixed assets according to diminishing balance method, it should be done year after year. This is necessary for the purpose of comparison.

- 11. Convention of conservatism ? This convention ensures that uncertainties and risks inherent in business transactions should be given a proper consideration. If there is a possibility of loss, it should be taken into account at the earliest. On the other hand, a prospect of profit should be ignored up to the time it does not materialise. On account of this reason, the accountants follow the rule 'anticipate no profit but provide for all possible losses'

- 12. Accounting principles ? There are general rules and concepts that govern the field of accounting. These general rules- referred to as basic accounting principles and guidelinesˇŞform the groundwork on which more detailed, complicated, and legalistic accounting rules are based. For example, the Financial Accounting Standards Board (FASB) uses the basic accounting principles and guidelines as a basis for their own detailed and comprehensive set of accounting rules and standards.

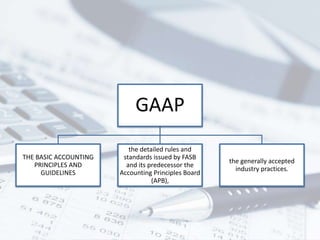

- 13. GAAP THE BASIC ACCOUNTING PRINCIPLES AND GUIDELINES the detailed rules and standards issued by FASB and its predecessor the Accounting Principles Board (APB), the generally accepted industry practices.

- 14. ? Since accounting principles differ across the world, investors should be aware of these differences and account for them when comparing companies in different countries. The problem of differences in accounting principles does not much affect mature markets. Still, investors should be careful, since there is still leeway for the distortion of numbers under many sets of accounting principles

- 15. EXAMPLES ? Generally accepted accounting principles (USA) ? Generally accepted accounting principles (United Kingdom) ? Generally accepted accounting principles (Plan Comptable G¨¦n¨¦ral) (France) ? Generally accepted accounting principles (RAP) (Russia) ? Chinese Accounting Standards (Zh¨nggu¨® q¨«y¨¨ ku¨¤ij¨¬ zh¨łnz¨¦ ÖĐąúą«Ëľ»áĽĆ׼Ôň) (China) ? International Financial Reporting Standards (international)

- 16. Accounting policies ? The specific policies and procedures used by a company to prepare its financial statements. These include any methods, measurement systems and procedures for presenting disclosures. Accounting policies differ from accounting principles in that the principles are the rules and the policies are a company's way of adhering to the rules.

- 17. ? Accounting principles are lenient at times, so the policies of a company can be very important. Looking into a specific company's accounting policies can signal whether management is conservative or aggressive when reporting earnings. This should be taken into account by investors when reviewing earnings reports. Also, outside accountants that are hired to review a company's financial statements should check the company's policies to ensure they conform to accounting principles.

- 18. Difference in policies of India and USA ? Depreciation: Under the Indian GAAP, depreciation is provided based on rates prescribed by the Companies Act, 1956. Higher depreciation provision based on estimated useful life of the assets is permitted, but must be disclosed in Notes to Accounts.( Guidance note no 49) . Depreciation cannot be provided at a rate lower than prescribed in any circumstance. Contrary to this, under the US GAAP , depreciation has to be provided over the estimated useful life of the asset, thus making the Accounting more realistic and providing sufficient funds for replacement when the asset becomes obsolete and fully worn out.

Editor's Notes

- #14: GAAP : GENERALLY ACCEPTED ACCOUNTING RULES.