Afs banking

- 1. PRESENTED BY : ’āś Swapnil Turakane ’āś Deepanjali Ahire ’āś Akshaya Lad ’āś Nikita Rane ’āś Gaurav Tarkar.

- 2. UNION BANK OF ALLAHABAD ANDHRA BANK INDIA BANK Performance for FY10 (In MILLIONS) Total Business 1,338,397.80 2,893,547.40 1,776,606.30 Total Assets 903,804.70 1,951,618.40 1,216,992.10 Total Income 73,374.90 152,774.20 98,851.00 Net Profit / Loss 10,496.70 20,749.20 12,060.00 No. of Branches 1,549 2,832 2,231

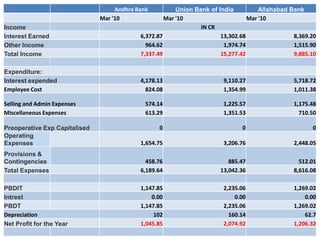

- 3. Andhra Bank Union Bank of India Allahabad Bank Mar '10 Mar '10 Mar '10 Income IN CR Interest Earned 6,372.87 13,302.68 8,369.20 Other Income 964.62 1,974.74 1,515.90 Total Income 7,337.49 15,277.42 9,885.10 Expenditure: Interest expended 4,178.13 9,110.27 5,718.72 Employee Cost 824.08 1,354.99 1,011.38 Selling and Admin Expenses 574.14 1,225.57 1,175.48 Miscellaneous Expenses 613.29 1,351.53 710.50 Preoperative Exp Capitalised 0 0 0 Operating Expenses 1,654.75 3,206.76 2,448.05 Provisions & Contingencies 458.76 885.47 512.01 Total Expenses 6,189.64 13,042.36 8,616.08 PBDIT 1,147.85 2,235.06 1,269.02 Intrest 0.00 0.00 0.00 PBDT 1,147.85 2,235.06 1,269.02 Depreciation 102 160.14 62.7 Net Profit for the Year 1,045.85 2,074.92 1,206.32

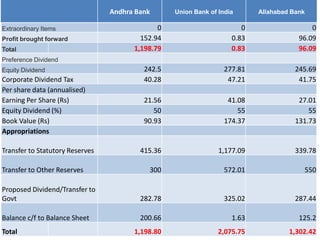

- 4. Andhra Bank Union Bank of India Allahabad Bank Extraordinary Items 0 0 0 Profit brought forward 152.94 0.83 96.09 Total 1,198.79 0.83 96.09 Preference Dividend Equity Dividend 242.5 277.81 245.69 Corporate Dividend Tax 40.28 47.21 41.75 Per share data (annualised) Earning Per Share (Rs) 21.56 41.08 27.01 Equity Dividend (%) 50 55 55 Book Value (Rs) 90.93 174.37 131.73 Appropriations Transfer to Statutory Reserves 415.36 1,177.09 339.78 Transfer to Other Reserves 300 572.01 550 Proposed Dividend/Transfer to Govt 282.78 325.02 287.44 Balance c/f to Balance Sheet 200.66 1.63 125.2 Total 1,198.80 2,075.75 1,302.42

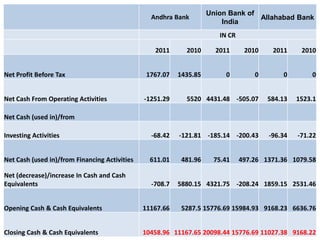

- 5. Union Bank of Andhra Bank Allahabad Bank India IN CR 2011 2010 2011 2010 2011 2010 Net Profit Before Tax 1767.07 1435.85 0 0 0 0 Net Cash From Operating Activities -1251.29 5520 4431.48 -505.07 584.13 1523.1 Net Cash (used in)/from Investing Activities -68.42 -121.81 -185.14 -200.43 -96.34 -71.22 Net Cash (used in)/from Financing Activities 611.01 481.96 75.41 497.26 1371.36 1079.58 Net (decrease)/increase In Cash and Cash Equivalents -708.7 5880.15 4321.75 -208.24 1859.15 2531.46 Opening Cash & Cash Equivalents 11167.66 5287.5 15776.69 15984.93 9168.23 6636.76 Closing Cash & Cash Equivalents 10458.96 11167.65 20098.44 15776.69 11027.38 9168.22

- 6. Mar '10 Mar '10 Mar '10 Proprietary ratio 0.022265 0.020148 0.023808 Debt Equity ratio 172.2488 354.8762 249.5886 Quick ratio 0.768869 0.721239 0.684233 Operating Expenses ratio 25.96554 24.10612 29.2507 Expenses ratio: Selling & admn exps ratio 0.090091 0.09213 0.140453 Net Profit ratio 16.41097 15.59776 14.4138 Return on Investment (ROI) 19.61319 24.25377 23.34697 Divident per share 5.830515 6.434765 6.434744 Return on Equity Capital 165.6392 355.7788 215.0504