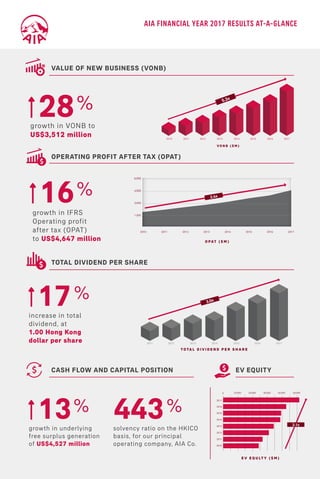

AIA Financial Year 2017 Results At-A-Glance

- 1. AIA FINANCIAL YEAR 2017 RESULTS AT-A-GLANCE VALUE OF NEW BUSINESS (VONB) growth in VONB to US$3,512 million 28% 16% OPERATING PROFIT AFTER TAX (OPAT) growth in IFRS Operating profit after tax (OPAT) to US$4,647 million O PAT ( $ M ) 2010 1,500 3,000 4,500 6,000 2011 2012 2013 2014 2015 2016 2017 5.3x 2016 2017201520142013201220112010 V O N B ( $ M ) 2.4x 13% CASH FLOW AND CAPITAL POSITION EV EQUITY growth in underlying free surplus generation of US$4,527 million 443% solvency ratio on the HKICO basis, for our principal operating company, AIA Co. 2010 0 10,000 20,000 30,000 40,000 50,000 2011 2012 2013 2014 2016 2017 2015 E V E Q U LT Y ( $ M ) 2.1x TOTAL DIVIDEND PER SHARE 17% increase in total dividend, at 1.00 Hong Kong dollar per share T O TA L D I V I D E N D P E R S H A R E 3.0x 2016 201720152014201320122011