Alternative Financing

Download as ppt, pdf0 likes300 views

Credit scores in the United States have been declining, with over 40 million Americans now having credit scores below 600. Conventional loans have become increasingly difficult to obtain for those with less than perfect credit or insufficient down payments. It is estimated that 35-40% of Americans now have credit scores below 640, meaning about half the population may not qualify for institutional financing. This poses problems both for individuals seeking loans and for the broader housing market and economy. The document discusses alternative financing options such as lease-purchase agreements, all-inclusive trust deeds, and contracts for deed as potential solutions to help more people participate in the housing market.

1 of 16

Download to read offline

Ad

Recommended

Whole Cash Advance Debtor Guide

Whole Cash Advance Debtor Guidehaltingoration771

?

The document discusses the varying regulations and perceptions of payday loans across different jurisdictions, particularly focusing on the United States. It highlights the complexities of interest rates, borrower demographics, and the necessity for payday loans among those with lower incomes or less education. Additionally, it outlines the legal landscape surrounding payday lending, including federal regulations and the practices of some lenders to bypass state laws through partnerships with Native American tribes.Whole Payday Loan Borrower Guide

Whole Payday Loan Borrower Guidecervantesdoeroyriry

?

The document outlines the complexities of payday loans, highlighting the variability in regulations across states and the demographic characteristics of borrowers. It discusses the risks involved in payday lending, the methods of calculating annual percentage rates (APR), and the common use of these loans for covering living expenses during emergencies. The document also notes the regulatory landscape, including the Consumer Financial Protection Bureau's oversight and the exploitation of tribal laws by some lenders.Whole Cash Advance Debtor Guide

Whole Cash Advance Debtor Guideobsoletespoof7502

?

The document provides an overview of payday loans, highlighting the varying laws and regulations across different states and countries. It discusses the financial risks and characteristics of borrowers, who often rely on these loans for everyday expenses, while also noting the industry's controversial nature and the presence of high-interest rates. Additionally, it outlines the role of regulatory bodies, such as the CFPB, in overseeing payday lending practices and the challenges of enforcing laws against lenders operating on native reservations.Alternative Energy

Alternative Energyzacharyreid

?

Stephen Yu Zhang, a solar market analyst, likens the oversupply of solar manufacturers in China to contestants in 'The Hunger Games', predicting that many will fail due to financial instability rather than technology. He emphasizes the importance of monitoring cash flows and loans, cautioning investors against falling for the attractiveness of low solar costs, which can lead to no profit margins. Zhang does not foresee a market turnaround for solar stocks in 2013 and suggests that any temporary stock price increases create short-selling opportunities.How To Buy A HUD Home

How To Buy A HUD HomeWant More Leads

?

HUD homes are homes owned by the Department of Housing and Urban Development that are available for purchase. This document discusses how to purchase a HUD home, including that they require low or no down payment, earnest money is typically 1% of the purchase price, and buyers may be able to purchase HUD homes at a significant discount or for as little as $1 in some cases. It also provides contact information for real estate and lending professionals who can assist buyers in purchasing HUD homes.Alternative Financing

Alternative FinancingWant More Leads

?

The document discusses seller financing options for real estate transactions. It provides an overview of different types of seller financing agreements like contract for deed, lease options, and AITD. It also discusses the benefits of seller financing for buyers and sellers, as well as the importance of customizing agreements, educating parties, and obtaining proper legal advice for each transaction. The document encourages real estate agents to educate themselves and others on seller financing to expand their client pool and increase successful transactions.Down payment assistance programs az booklet 04-22-14

Down payment assistance programs az booklet 04-22-14Dean Wegner of Guardian Mortgage, Arizona 602-432-6388

?

The document provides an overview of various down payment assistance programs available in Arizona, including programs offered by various cities, non-profits, and government agencies. It lists 33 different programs that provide assistance with down payments, closing costs, rehabilitation funds, and subsidized mortgages. The programs have different eligibility requirements related to income limits, homebuyer qualifications, property eligibility, and subsidy terms.Why kay-dub

Why kay-dubWant More Leads

?

Keller Williams Realty has evolved from traditional real estate companies by offering associates an interdependent relationship with mutual financial interests in success. Associates at Keller Williams Realty are independent and have more opportunities to accumulate wealth through profit sharing, education, and technology support compared to traditional and 100% commission models.FES Biz Opp Presentation

FES Biz Opp PresentationWant More Leads

?

The document discusses a company that provides financial education services and products to help people improve their credit, protect their identity, create a will and living trust, and pay off debt. It outlines the company's history and products, including credit restoration services and youth financial literacy programs. It then discusses the financial opportunities and compensation structure for becoming an agent to refer customers to the company's services. Finally, it provides steps for getting started as an agent.2008 Nar Profile Of Home Buyers And Sellers

2008 Nar Profile Of Home Buyers And SellersWant More Leads

?

The typical home buyer in 2008 was 39 years old, with over 60% under age 45. The median household income of home buyers was $74,900 nationally. First-time buyers tended to be younger, with a median income of $60,600, while repeat buyers were older with a higher median income of $88,200.Dynamic Finance Presentation

Dynamic Finance PresentationWant More Leads

?

Seller financing options are discussed as an alternative to traditional mortgages. Three main options are covered: lease options, contracts for deed, and installment land contracts. Legal and real estate professionals provide guidance on properly structuring and closing these types of transactions. Education is emphasized as key to ensuring the credibility and comfort of all parties involved.Utah Realtor's Seller Finance Addendum

Utah Realtor's Seller Finance AddendumWant More Leads

?

This document is a seller financing addendum to a real estate purchase contract. It provides details on the terms of financing being offered by the seller. Specifically:

1) The seller will provide financing to the buyer in the form of a note and deed of trust.

2) The financing terms include a principal amount, interest rate, monthly payment amount, and requirement that the full balance is due within a set number of months.

3) The addendum also specifies responsibilities for taxes, insurance, late payments and prepayment of the loan.2009 NAR Profile of Home Buyers and Sellers Demographic Breakdown

2009 NAR Profile of Home Buyers and Sellers Demographic BreakdownNAR Research

?

The document provides demographic information about home buyers and sellers from a 2009 survey. It found that 30-year-olds made up the largest share of first-time home buyers, while repeat buyers averaged 48-years-old. Married couples comprised the majority of buyers across all age groups. Use of the internet to search for homes was nearly universal, with 90% of buyers using it as an information source. The top motivating factors for buying were the desire to own a home and job or family relocation. Most buyers expected to remain in their new home for 10-15 years.8 Mistakes to avoid when testifying at your disability hearing

8 Mistakes to avoid when testifying at your disability hearingJames Publishing

?

This document provides advice on what to avoid when testifying at a Social Security disability benefits hearing. It recommends:

1) Do not argue your case or draw conclusions for the judge - leave arguing to your lawyer and let the judge draw their own conclusions.

2) Do not compare your case to others or try to play on the judge's sympathy by discussing your financial situation.

3) Do not try to demonstrate how virtuous you are or tell the judge how honest you are, as benefits are awarded based on disability alone.

4) Do not engage in dramatics or give irrelevant testimony about being unable to get work or economic conditions. Stick to the facts of your medical symptoms and limitations.2.5 Employment and Community Engagement Strategies for Homeless People with D...

2.5 Employment and Community Engagement Strategies for Homeless People with D...National Alliance to End Homelessness

?

The document discusses supportive housing as a transitional phase rather than a final destination, emphasizing the importance of life skills, self-determination, and community integration for individuals in recovery. It highlights the role of humanities education in expanding perspectives and decision-making, and the necessity of effective case management and landlord relationships in facilitating housing transitions. Through personal stories, it illustrates the journey of individuals navigating mental health and societal challenges while underscoring that recovery involves ongoing relationships and community engagement.Pre-Conference Session: HEARTH Implications for Youth (Alliance)

Pre-Conference Session: HEARTH Implications for Youth (Alliance)National Alliance to End Homelessness

?

This document discusses increasing funding for youth housing through the Department of Housing and Urban Development (HUD). It notes that federal funding for general affordable housing is much higher than funding specifically for youth housing. The HEARTH Act expanded HUD's definition of homelessness to include more youth and increased funding for homelessness prevention and rapid re-housing. The new funding rules provide greater flexibility to fund services like transitional housing that support homeless youth.Investar multifamily webinarfinal

Investar multifamily webinarfinalrealestatemarket101

?

This webinar presentation provides an overview of multifamily real estate investing. It discusses the types of multifamily investments, benefits of investing in multifamily properties like cash flow, appreciation, tax benefits, and long-term demand drivers. The presentation outlines how to select a profitable market and reviews tax strategies used by wealthy investors. It also describes the investment process, including understanding your goals and assets, evaluating partners and deals, allocating funds, and monitoring performance. The goal is to educate attendees on multifamily investing and how to potentially achieve total returns of 15-18% through this asset class.Everything You Need to Know About Small Multifamily Lending

Everything You Need to Know About Small Multifamily LendingIvan Kaufman

?

The document provides an overview of small multifamily lending, highlighting its growth and the available loan options from Arbor, Fannie Mae, and Freddie Mac, with loan amounts ranging from $1 million to $5 million. It emphasizes the benefits of small multifamily loans, such as non-recourse options and interest-only payments, and includes case studies of successful loans. Additionally, it introduces 'Alex', an online lending platform designed to streamline the loan process in the small multifamily space.1.11 Transitional Housing: Assessing and Targeting for Effective Transitions ...

1.11 Transitional Housing: Assessing and Targeting for Effective Transitions ...National Alliance to End Homelessness

?

The document discusses transitional housing programs for at-risk youth, particularly those aged 12-24, emphasizing the challenges they face and the need for a continuum of care. It highlights the significance of transitional housing in fostering independence through skill-building and supportive services, with a focus on LGBTQ youth and recent immigrants. Examples of successful outcomes from youth participants show the impact of these programs on their lives, illustrating the importance of comprehensive support systems.Canal Street Veterans Housing

Canal Street Veterans HousingHousing Assistance Council

?

Canal Street Veterans Housing, a joint project by COTS and Housing Vermont, opened in January 2011 in Winooski, Vermont, featuring 16 transitional and 12 permanent apartments. The facility is energy-efficient, fully accessible, and provides full-time support services and a residential manager. It also engages with the community through special programming for children of veterans and various events.Feldman Debra Job Whiz şÝşÝߣshare June 2012 Network Purposefully

Feldman Debra Job Whiz şÝşÝߣshare June 2012 Network PurposefullyDebra Feldman

?

The document outlines strategies for purposeful networking aimed at uncovering the hidden job market and establishing lifelong career connections. It emphasizes the importance of developing relationships with decision makers, eliminating barriers to job opportunities, and leveraging both traditional and social networking methods. The author, Debra Feldman, presents networking as a continual process that enhances personal visibility and fosters mutually beneficial professional relationships.How to Package a Loan Request for Construction, Rehab, and Commercial Loans

How to Package a Loan Request for Construction, Rehab, and Commercial LoansBeau Eckstein

?

The document provides a template for a financing request package that borrowers should submit to SFR Ventures Inc. when requesting a loan. The package should include a cover page with property and contact details, an executive summary with the loan request specifics and exit strategy, a property description, location and market analysis with comparables, financial analysis pro forma, information about the borrower, and appendices with supporting documents. A completed financing request package following this template can help streamline the review process and potentially result in funding within 5-7 business days.Finding And Recruiting Top Talent For Your Real Estate Team

Finding And Recruiting Top Talent For Your Real Estate TeamPremier Agent | Zillow & Trulia

?

The document discusses effective strategies for finding and recruiting top real estate talent, emphasizing the importance of aligning candidates with team values and business goals. It provides insights on what qualities to look for in potential agents, whether they are experienced or new, and suggests leveraging personal networks for recruitment. Key considerations include understanding market offerings, creating value for agents, and maintaining a continuous recruitment approach.Introduction To The Music Business The Hidden Network

Introduction To The Music Business The Hidden Networkaostroy

?

The document outlines essential roles in the music industry, emphasizing the importance of an artist's understanding of their business and vision for success. Key team members include managers, booking agents, tour managers, promotions directors, business managers, and talent buyers, each with specific responsibilities and compensation structures. Additionally, it provides an overview of record labels, including major companies and independents, along with resources for further information about the music business.7 Steps Needed to Get Lenders to Fund Your Real Estate Deals

7 Steps Needed to Get Lenders to Fund Your Real Estate DealsJoshua Dorkin

?

The document outlines a webinar on securing financing for real estate deals, focusing on the reasons banks deny loans and the seven steps to obtaining approval. It emphasizes the importance of crafting a professional loan proposal using the '6 C's' and includes bonus resources for attendees. Additionally, it promotes BiggerPockets Pro membership for those serious about real estate investing.A Complete Guide to Credit and Qualifying

A Complete Guide to Credit and QualifyingFindMyWayHome.com

?

This document outlines a class for first-time home buyers focused on credit, loan applications, and qualification processes. It covers essential topics such as understanding credit reports, myths about credit score improvement, steps for enhancing credit scores, and the loan application and qualification processes. The goal is to empower participants with knowledge to make informed financial decisions and successfully navigate the home buying process.Your Credit Score

Your Credit Scoretschindler

?

Todd Schindler is a mortgage banker with Envoy Mortgage. This document provides an overview of credit scores and how they can impact prospective home buyers. It discusses the five factors that determine credit scores, including payment history, credit utilization, credit history, types of credit, and credit inquiries. The document also outlines strategies for improving a low credit score, such as paying down credit card balances, opening new credit accounts, and disputing errors on credit reports. Borrowers are advised not to close credit accounts or pay off collections unless specifically instructed by their lender.Credit Its A Brand New Day

Credit Its A Brand New DayAndre Williams

?

This document discusses the importance of credit scores and provides tips for improving credit scores. It explains that credit scores range from 350-850 and affect the cost of financing a home or auto loan. Borrowers can save thousands of dollars over the life of a loan by improving their credit score. The summary also outlines the key factors that influence credit scores and provides steps people can take to optimize their credit, such as reviewing credit reports regularly and disputing any inaccurate information.Credit Qualifying, and Completing Loan Application

Credit Qualifying, and Completing Loan ApplicationScott Schang

?

This document summarizes a presentation about credit, qualifying for a mortgage loan, and completing a loan application for first-time home buyers. The presentation covers understanding credit reports and credit scores, the different components of a loan application including employment and housing history, assets/liabilities, and legal declarations. It also discusses the loan qualification process, including automated underwriting systems and compensating factors. The presentation aims to educate home buyers on improving their credit, completing a strong loan application, and the steps to get approved for a mortgage loan.The Lifecycle of a Credit Score

The Lifecycle of a Credit ScoreFreeScoresAndMore

?

The document discusses the importance of understanding credit scores and how they can impact various life events such as buying a car, securing a mortgage, and even marriage. It highlights the potential negative effects of missed payments on credit scores and provides tips for managing credit effectively. Additionally, it emphasizes the necessity of monitoring credit reports and scores throughout different life milestones.More Related Content

Viewers also liked (17)

FES Biz Opp Presentation

FES Biz Opp PresentationWant More Leads

?

The document discusses a company that provides financial education services and products to help people improve their credit, protect their identity, create a will and living trust, and pay off debt. It outlines the company's history and products, including credit restoration services and youth financial literacy programs. It then discusses the financial opportunities and compensation structure for becoming an agent to refer customers to the company's services. Finally, it provides steps for getting started as an agent.2008 Nar Profile Of Home Buyers And Sellers

2008 Nar Profile Of Home Buyers And SellersWant More Leads

?

The typical home buyer in 2008 was 39 years old, with over 60% under age 45. The median household income of home buyers was $74,900 nationally. First-time buyers tended to be younger, with a median income of $60,600, while repeat buyers were older with a higher median income of $88,200.Dynamic Finance Presentation

Dynamic Finance PresentationWant More Leads

?

Seller financing options are discussed as an alternative to traditional mortgages. Three main options are covered: lease options, contracts for deed, and installment land contracts. Legal and real estate professionals provide guidance on properly structuring and closing these types of transactions. Education is emphasized as key to ensuring the credibility and comfort of all parties involved.Utah Realtor's Seller Finance Addendum

Utah Realtor's Seller Finance AddendumWant More Leads

?

This document is a seller financing addendum to a real estate purchase contract. It provides details on the terms of financing being offered by the seller. Specifically:

1) The seller will provide financing to the buyer in the form of a note and deed of trust.

2) The financing terms include a principal amount, interest rate, monthly payment amount, and requirement that the full balance is due within a set number of months.

3) The addendum also specifies responsibilities for taxes, insurance, late payments and prepayment of the loan.2009 NAR Profile of Home Buyers and Sellers Demographic Breakdown

2009 NAR Profile of Home Buyers and Sellers Demographic BreakdownNAR Research

?

The document provides demographic information about home buyers and sellers from a 2009 survey. It found that 30-year-olds made up the largest share of first-time home buyers, while repeat buyers averaged 48-years-old. Married couples comprised the majority of buyers across all age groups. Use of the internet to search for homes was nearly universal, with 90% of buyers using it as an information source. The top motivating factors for buying were the desire to own a home and job or family relocation. Most buyers expected to remain in their new home for 10-15 years.8 Mistakes to avoid when testifying at your disability hearing

8 Mistakes to avoid when testifying at your disability hearingJames Publishing

?

This document provides advice on what to avoid when testifying at a Social Security disability benefits hearing. It recommends:

1) Do not argue your case or draw conclusions for the judge - leave arguing to your lawyer and let the judge draw their own conclusions.

2) Do not compare your case to others or try to play on the judge's sympathy by discussing your financial situation.

3) Do not try to demonstrate how virtuous you are or tell the judge how honest you are, as benefits are awarded based on disability alone.

4) Do not engage in dramatics or give irrelevant testimony about being unable to get work or economic conditions. Stick to the facts of your medical symptoms and limitations.2.5 Employment and Community Engagement Strategies for Homeless People with D...

2.5 Employment and Community Engagement Strategies for Homeless People with D...National Alliance to End Homelessness

?

The document discusses supportive housing as a transitional phase rather than a final destination, emphasizing the importance of life skills, self-determination, and community integration for individuals in recovery. It highlights the role of humanities education in expanding perspectives and decision-making, and the necessity of effective case management and landlord relationships in facilitating housing transitions. Through personal stories, it illustrates the journey of individuals navigating mental health and societal challenges while underscoring that recovery involves ongoing relationships and community engagement.Pre-Conference Session: HEARTH Implications for Youth (Alliance)

Pre-Conference Session: HEARTH Implications for Youth (Alliance)National Alliance to End Homelessness

?

This document discusses increasing funding for youth housing through the Department of Housing and Urban Development (HUD). It notes that federal funding for general affordable housing is much higher than funding specifically for youth housing. The HEARTH Act expanded HUD's definition of homelessness to include more youth and increased funding for homelessness prevention and rapid re-housing. The new funding rules provide greater flexibility to fund services like transitional housing that support homeless youth.Investar multifamily webinarfinal

Investar multifamily webinarfinalrealestatemarket101

?

This webinar presentation provides an overview of multifamily real estate investing. It discusses the types of multifamily investments, benefits of investing in multifamily properties like cash flow, appreciation, tax benefits, and long-term demand drivers. The presentation outlines how to select a profitable market and reviews tax strategies used by wealthy investors. It also describes the investment process, including understanding your goals and assets, evaluating partners and deals, allocating funds, and monitoring performance. The goal is to educate attendees on multifamily investing and how to potentially achieve total returns of 15-18% through this asset class.Everything You Need to Know About Small Multifamily Lending

Everything You Need to Know About Small Multifamily LendingIvan Kaufman

?

The document provides an overview of small multifamily lending, highlighting its growth and the available loan options from Arbor, Fannie Mae, and Freddie Mac, with loan amounts ranging from $1 million to $5 million. It emphasizes the benefits of small multifamily loans, such as non-recourse options and interest-only payments, and includes case studies of successful loans. Additionally, it introduces 'Alex', an online lending platform designed to streamline the loan process in the small multifamily space.1.11 Transitional Housing: Assessing and Targeting for Effective Transitions ...

1.11 Transitional Housing: Assessing and Targeting for Effective Transitions ...National Alliance to End Homelessness

?

The document discusses transitional housing programs for at-risk youth, particularly those aged 12-24, emphasizing the challenges they face and the need for a continuum of care. It highlights the significance of transitional housing in fostering independence through skill-building and supportive services, with a focus on LGBTQ youth and recent immigrants. Examples of successful outcomes from youth participants show the impact of these programs on their lives, illustrating the importance of comprehensive support systems.Canal Street Veterans Housing

Canal Street Veterans HousingHousing Assistance Council

?

Canal Street Veterans Housing, a joint project by COTS and Housing Vermont, opened in January 2011 in Winooski, Vermont, featuring 16 transitional and 12 permanent apartments. The facility is energy-efficient, fully accessible, and provides full-time support services and a residential manager. It also engages with the community through special programming for children of veterans and various events.Feldman Debra Job Whiz şÝşÝߣshare June 2012 Network Purposefully

Feldman Debra Job Whiz şÝşÝߣshare June 2012 Network PurposefullyDebra Feldman

?

The document outlines strategies for purposeful networking aimed at uncovering the hidden job market and establishing lifelong career connections. It emphasizes the importance of developing relationships with decision makers, eliminating barriers to job opportunities, and leveraging both traditional and social networking methods. The author, Debra Feldman, presents networking as a continual process that enhances personal visibility and fosters mutually beneficial professional relationships.How to Package a Loan Request for Construction, Rehab, and Commercial Loans

How to Package a Loan Request for Construction, Rehab, and Commercial LoansBeau Eckstein

?

The document provides a template for a financing request package that borrowers should submit to SFR Ventures Inc. when requesting a loan. The package should include a cover page with property and contact details, an executive summary with the loan request specifics and exit strategy, a property description, location and market analysis with comparables, financial analysis pro forma, information about the borrower, and appendices with supporting documents. A completed financing request package following this template can help streamline the review process and potentially result in funding within 5-7 business days.Finding And Recruiting Top Talent For Your Real Estate Team

Finding And Recruiting Top Talent For Your Real Estate TeamPremier Agent | Zillow & Trulia

?

The document discusses effective strategies for finding and recruiting top real estate talent, emphasizing the importance of aligning candidates with team values and business goals. It provides insights on what qualities to look for in potential agents, whether they are experienced or new, and suggests leveraging personal networks for recruitment. Key considerations include understanding market offerings, creating value for agents, and maintaining a continuous recruitment approach.Introduction To The Music Business The Hidden Network

Introduction To The Music Business The Hidden Networkaostroy

?

The document outlines essential roles in the music industry, emphasizing the importance of an artist's understanding of their business and vision for success. Key team members include managers, booking agents, tour managers, promotions directors, business managers, and talent buyers, each with specific responsibilities and compensation structures. Additionally, it provides an overview of record labels, including major companies and independents, along with resources for further information about the music business.7 Steps Needed to Get Lenders to Fund Your Real Estate Deals

7 Steps Needed to Get Lenders to Fund Your Real Estate DealsJoshua Dorkin

?

The document outlines a webinar on securing financing for real estate deals, focusing on the reasons banks deny loans and the seven steps to obtaining approval. It emphasizes the importance of crafting a professional loan proposal using the '6 C's' and includes bonus resources for attendees. Additionally, it promotes BiggerPockets Pro membership for those serious about real estate investing.2.5 Employment and Community Engagement Strategies for Homeless People with D...

2.5 Employment and Community Engagement Strategies for Homeless People with D...National Alliance to End Homelessness

?

Pre-Conference Session: HEARTH Implications for Youth (Alliance)

Pre-Conference Session: HEARTH Implications for Youth (Alliance)National Alliance to End Homelessness

?

1.11 Transitional Housing: Assessing and Targeting for Effective Transitions ...

1.11 Transitional Housing: Assessing and Targeting for Effective Transitions ...National Alliance to End Homelessness

?

Similar to Alternative Financing (20)

A Complete Guide to Credit and Qualifying

A Complete Guide to Credit and QualifyingFindMyWayHome.com

?

This document outlines a class for first-time home buyers focused on credit, loan applications, and qualification processes. It covers essential topics such as understanding credit reports, myths about credit score improvement, steps for enhancing credit scores, and the loan application and qualification processes. The goal is to empower participants with knowledge to make informed financial decisions and successfully navigate the home buying process.Your Credit Score

Your Credit Scoretschindler

?

Todd Schindler is a mortgage banker with Envoy Mortgage. This document provides an overview of credit scores and how they can impact prospective home buyers. It discusses the five factors that determine credit scores, including payment history, credit utilization, credit history, types of credit, and credit inquiries. The document also outlines strategies for improving a low credit score, such as paying down credit card balances, opening new credit accounts, and disputing errors on credit reports. Borrowers are advised not to close credit accounts or pay off collections unless specifically instructed by their lender.Credit Its A Brand New Day

Credit Its A Brand New DayAndre Williams

?

This document discusses the importance of credit scores and provides tips for improving credit scores. It explains that credit scores range from 350-850 and affect the cost of financing a home or auto loan. Borrowers can save thousands of dollars over the life of a loan by improving their credit score. The summary also outlines the key factors that influence credit scores and provides steps people can take to optimize their credit, such as reviewing credit reports regularly and disputing any inaccurate information.Credit Qualifying, and Completing Loan Application

Credit Qualifying, and Completing Loan ApplicationScott Schang

?

This document summarizes a presentation about credit, qualifying for a mortgage loan, and completing a loan application for first-time home buyers. The presentation covers understanding credit reports and credit scores, the different components of a loan application including employment and housing history, assets/liabilities, and legal declarations. It also discusses the loan qualification process, including automated underwriting systems and compensating factors. The presentation aims to educate home buyers on improving their credit, completing a strong loan application, and the steps to get approved for a mortgage loan.The Lifecycle of a Credit Score

The Lifecycle of a Credit ScoreFreeScoresAndMore

?

The document discusses the importance of understanding credit scores and how they can impact various life events such as buying a car, securing a mortgage, and even marriage. It highlights the potential negative effects of missed payments on credit scores and provides tips for managing credit effectively. Additionally, it emphasizes the necessity of monitoring credit reports and scores throughout different life milestones.Credit, Qualifying & Completing an Application

Credit, Qualifying & Completing an ApplicationScott Schang

?

This document summarizes a presentation about credit, qualifying for a mortgage loan, and completing a loan application for first-time home buyers. The presentation covers understanding credit reports and credit scores, the different types of loans and how they affect credit, steps to improve credit, completing a loan application including income, asset, and liability documentation, the loan qualification process through automated underwriting systems, and next steps for attendees. The presentation aims to educate home buyers on building good credit, qualifying for a loan, and completing the application process.5 credit secrets revealed on getting approved for financing powerpoint

5 credit secrets revealed on getting approved for financing powerpointDane Wilson

?

This document reveals secrets for getting approved for financing with challenged credit. It discusses what credit scores and histories mortgage, auto, and other lenders typically require. The key tips are to dispute negative items on your credit report to have them removed, and to add new positive credit accounts to show re-established credit and increase credit limits available. Following these steps can boost your credit scores into the range needed to qualify for loans by deleting negative information and building positive payment histories over time.Fthb Credit Its A Brand New Day

Fthb Credit Its A Brand New DayMaryPat Alroth

?

This document discusses the importance of credit scores and provides tips for improving your credit score. It explains that a credit score is a 3-digit number between 350-850 that lenders use to evaluate lending risk. Higher credit scores above 720 can save borrowers thousands of dollars in interest costs over the life of a 30-year mortgage compared to those with scores below 620. The document advises reviewing credit reports regularly and disputing any inaccurate information in order to optimize credit scores.The McBreen Group Credit Score Booklet

The McBreen Group Credit Score BookletThe McBreen Group

?

The document discusses the importance of credit scores and how they are used to assess risk for lenders. It outlines the five main factors that determine a credit score as well as how credit scores can significantly impact interest rates on loans. The document provides tips on maintaining and improving credit scores during the loan application process.Credit Scores and What You Need To Know

Credit Scores and What You Need To Know Nikitas Kouimanis

?

This document provides an overview of credit scoring and its importance. It discusses the five factors that determine a credit score, including payment history, credit utilization, credit history length, credit mix, and number of inquiries. A low credit score can significantly increase interest rates on loans like mortgages, costing borrowers thousands over the life of the loan. It also outlines tips for improving credit scores, such as paying bills on time, keeping credit utilization low, and maintaining a mix of different credit types. The document emphasizes the importance of not making changes to credit reports or applying for new credit during the loan application process.Credit Score

Credit ScorePacWest Home Loans

?

Este documento discute la importancia de la puntuaci¨®n crediticia para los compradores de viviendas, destacando c¨®mo afecta las tasas de inter¨¦s y la elegibilidad para pr¨¦stamos. Se describen los factores que componen la puntuaci¨®n de cr¨¦dito y su historia desde la d¨¦cada de 1950, as¨Ş como las formas en que los consumidores pueden acceder a sus informes de cr¨¦dito y corregir errores. Adem¨˘s, se abordan las implicaciones de puntajes bajos, incluyendo tasas m¨˘s altas de inter¨¦s y la posibilidad de no calificar para un pr¨¦stamo hipotecario.Credit Its A Brand New Day

Credit Its A Brand New Daypeglover

?

This document discusses the importance of good credit and the costs of poor credit. It explains that a credit score is a 3-digit number that evaluates lending risk, and that scores above 720 are considered excellent while scores below 620 are poor. Borrowers with lower credit scores will pay significantly more over the life of a loan, with some paying over $300,000 more in interest for a 30-year mortgage. The document provides tips for improving credit scores by carefully managing payment history, credit utilization, credit mix, and inquiries.Presentation2

Presentation2cdesalvo

?

The document discusses factors that affect credit scores, including payment history, revolving debt ratio, average age of accounts, credit mix, and inquiries. It provides details on each factor and recommendations for improving credit scores, such as keeping balances low, paying bills on time, and maintaining a variety of credit account types over long periods of time. The overall message is that understanding how credit scores are calculated and managing accounts appropriately can help buyers qualify for the best mortgage rates.102 credit

102 creditJim Johnston

?

This document provides information about credit, credit reports, credit scores, and maintaining good credit. It defines credit and explains how credit reports and FICO credit scores are calculated. Key factors that influence credit scores are payment history, amount of debt, credit history length, recent credit applications, and credit mix. The document advises paying bills on time, keeping balances low, and carefully managing credit accounts to maintain good credit over time.102 credit

102 creditJim Johnston

?

This document provides information about credit, credit reports, credit scores, and maintaining good credit. It defines credit and explains how credit reports and FICO credit scores are calculated. Key factors that influence credit scores are payment history, amount of debt, credit history length, recent credit applications, and credit mix. The document advises paying bills on time, keeping balances low, and carefully managing credit applications and accounts to maintain good credit over time.Credit Its A Brand New Day

Credit Its A Brand New Daybaumang

?

Credit scores are important for home financing and loan approval. A higher credit score can save borrowers thousands of dollars in interest over the life of a loan. Factors like payment history, credit utilization, length of credit history, and types of credit used make up a credit score. The document recommends borrowers review and optimize their credit by checking credit reports, verifying accuracy, and disputing any errors to improve their credit scores. Partnering with a local lender for credit analysis and repairs can help borrowers qualify for the best rates.Quizzle's credit reports & scores basics

Quizzle's credit reports & scores basicsquizzle

?

This document provides information about credit reports, scores, and managing credit. It discusses the factors that affect credit scores like payment history, credit utilization, and credit inquiries. It also debunks common myths about credit and provides tips for building credit from scratch, protecting identity, and maintaining good credit over time. The document is an informative guide for understanding credit reports and scores.10 steps to_improved_credit

10 steps to_improved_creditJeteye Enterprises Inc.

?

The document outlines the importance of understanding credit scores and reports, highlighting how they impact the ability to borrow money and maintain financial stability. It provides steps to establish and improve credit, including budgeting, credit counseling, and monitoring credit reports. Additionally, it emphasizes the risks of identity theft and offers protective measures and resources for consumers.Understanding FICO scores in 2012

Understanding FICO scores in 2012Mark Taylor

?

This document provides information about FICO scoring and credit reports. It discusses how FICO scores are calculated using various factors related to credit usage and payment history. The key factors that affect FICO scores are payment history, amounts owed, length of credit history, new credit, and types of credit used. The document also discusses how to improve credit scores by correcting credit reports, paying down debt, and establishing new credit lines over time. Maintaining positive payment histories is important for achieving higher FICO scores that are favorable for loans and insurance rates.Educating The Consumer Public Forum Shared Pp 112608 şÝşÝߣ Show View Only

Educating The Consumer Public Forum Shared Pp 112608 şÝşÝߣ Show View Onlypjparke

?

This document provides information about credit reports and credit scores. It discusses how inaccurate credit reports can be, listing studies that found 20-79% of reports contain errors. These inaccuracies can significantly impact a person's credit score and interest rates. The document also outlines factors that affect credit scores, such as payment history, credit utilization, length of credit history, and types of credit used. It provides tips for maintaining good credit and improving credit scores.Ad

Recently uploaded (20)

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehta

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehtaimccci

?

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehta

Why the Most Successful Restaurants Never Touch Their Own Books.pdf

Why the Most Successful Restaurants Never Touch Their Own Books.pdfPacific Accounting & Business Services

?

Discover why thriving restaurants outsource accounting: navigate compliance, manage diverse revenue from platforms, and master financial strategies for success.

https://www.pacificabs.com/knowledge-center/blog/restaurant-accounting-services-why-owners-never-touch-their-books/RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUST

RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUSTimccci

?

RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUST

The Impact of Blockchain Technology on IndiaˇŻs Financial Sector

The Impact of Blockchain Technology on IndiaˇŻs Financial Sectorrealtaxindia07

?

Introduction

IndiaˇŻs financial sector is on the brink of a digital revolution, with blockchain technology emerging as a key disruptor. Once considered a buzzword linked only to cryptocurrencies, blockchain has now evolved into a powerful tool with real-world applications in banking, finance, and even government services. But what does this mean for IndiaˇŻs economy and its people?

LetˇŻs explore how blockchain is reshaping IndiaˇŻs financial landscape and what the future might hold.Middle East Conflict Sparks Oil Price Surge ¨C Global Markets on Alert

Middle East Conflict Sparks Oil Price Surge ¨C Global Markets on Alert Swiss International University SIU

?

Tensions between Israel and Iran have intensified, with recent strikes on key oil and gas facilities sending shockwaves through global markets. HUMAN BEHAVIOR cultural intelligence and global leadeership.pptx

HUMAN BEHAVIOR cultural intelligence and global leadeership.pptxzeriannebochorno

?

human behavior organizationHow Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...

How Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...Ratiobox Limited

?

Zenko Properties, a dynamic and fast-growing real estate agency based in the UK, faced mounting operational challenges as its portfolio and client base expanded. Managing financial workflows across multiple property types, client accounts, and compliance requirements had become increasingly complex. Manual bookkeeping, fragmented systems, and limited in-house financial oversight were slowing down growth and exposing the company to potential compliance risks.

Recognising the need for a scalable, technology-driven solution, Zenko Properties partnered with Ratiobox to transform its financial operations. This case study explores how Ratiobox enabled Zenko to achieve greater operational efficiency, compliance assurance, and real-time financial clarity ˇŞ all without the burden of maintaining a full in-house finance team.

Through a tailored combination of outsourced accounting services, automated bookkeeping, and integrated reporting tools, Ratiobox provided Zenko Properties with an end-to-end financial management solution. Our team began by conducting a deep-dive assessment of ZenkoˇŻs legacy accounting practices, identifying critical inefficiencies and opportunities for automation. We then implemented a streamlined accounting framework using cloud-based platforms such as Xero, integrated with ZenkoˇŻs CRM and property management systems.

Key improvements included:

Automated transaction processing, eliminating manual errors and reducing month-end closing time by over 50%.

Real-time financial dashboards, giving directors clear visibility into cash flow, revenue streams, and liabilities.

Fully managed payroll and HMRC submissions, ensuring Zenko stayed compliant and up to date with the latest tax regulations.

Scalable support for property acquisitions, enabling the finance function to grow in lockstep with ZenkoˇŻs portfolio.

Beyond day-to-day accounting, Ratiobox also delivered strategic insights through periodic reporting and advisory input, helping Zenko's leadership make data-backed decisions on expansion, cost control, and investment timing.

As a result, Zenko Properties not only improved operational efficiency but also gained a future-proof financial infrastructure that supports long-term growth. With fewer internal resources tied up in routine tasks, the team was free to focus on delivering exceptional service to clients and exploring new market opportunities.

Invoice Factoring Broker Training | Charter Capital

Invoice Factoring Broker Training | Charter CapitalKeith Mabe

?

If you are new to brokering invoice factoring deals. Here is a quick primer to get you started.How Abhay Bhutada Foundation Strengthens Cultural Education at Shivsrushti.pdf

How Abhay Bhutada Foundation Strengthens Cultural Education at Shivsrushti.pdfSwapnil Pednekar

?

This presentation highlights how the Abhay Bhutada Foundation is actively strengthening cultural education through its long-term support of Shivsrushti, a heritage theme park near Pune dedicated to the life of Chhatrapati Shivaji Maharaj. By funding regular maintenance, technological upgrades, and inclusive programs, the Foundation ensures that Shivsrushti remains an engaging learning space for students and visitors. The park combines traditional craftsmanship with digital storytelling to make history accessible and memorable. It also empowers local youth and artisans through training and employment while promoting hands-on education through creative workshops. With plans for future expansion, Shivsrushti stands as a living example of cultural preservation powered by collaboration and philanthropy.×îĐ°ćĂŔąúÍţËążµĐÇ´óѧĂܶűÎÖ»ů·ÖĐŁ±Ďҵ֤Ł¨±«°Â˛Ń±Ďҵ֤Ę飩԰涨ÖĆ

×îĐ°ćĂŔąúÍţËążµĐÇ´óѧĂܶűÎÖ»ů·ÖĐŁ±Ďҵ֤Ł¨±«°Â˛Ń±Ďҵ֤Ę飩԰涨ÖĆtaqyea

?

2025Ô°ćÍţËążµĐÇ´óѧĂܶűÎÖ»ů·ÖĐŁ±Ďҵ֤Ęépdfµç×Ӱ桾qޱ1954292140ˇżĂŔąú±Ďҵ֤°ěŔíUWMÍţËążµĐÇ´óѧĂܶűÎÖ»ů·ÖĐŁ±Ďҵ֤Ęé¶ŕÉŮÇ®Łżˇľqޱ1954292140ˇżşŁÍâ¸÷´óѧDiploma°ć±ľŁ¬ŇňÎŞŇßÇéѧУÍƳٷ˘·ĹÖ¤Ę顢֤ĘéÔĽţ¶ŞĘ§˛ą°ěˇ˘Ă»ÓĐŐýłŁ±ĎҵδÄÜČĎ֤ѧŔúĂćÁŮľÍҵĚáą©˝âľö°ě·¨ˇŁµ±ÔâÓöąŇżĆˇ˘żőżÎµĽÖÂÎŢ·¨ĐŢÂúѧ·ÖŁ¬»ňŐßÖ±˝Ó±»Ń§ĐŁÍËѧŁ¬×îşóÎŢ·¨±ĎҵÄò»µ˝±Ďҵ֤ˇŁ´ËʱµÄÄăŇ»¶¨ĘÖ×ăÎ޴룬ŇňÎŞÁôѧһłˇŁ¬Ă»ÓĐ»ńµĂ±Ďҵ֤ŇÔĽ°Ń§ŔúÖ¤Ă÷żĎ¶¨ĘÇÎŢ·¨¸ř×ÔĽşşÍ¸¸Ä¸Ň»¸ö˝»´úµÄˇŁ

ˇľ¸´żĚÍţËążµĐÇ´óѧĂܶűÎÖ»ů·ÖĐŁłÉĽ¨µĄĐĹ·â,Buy University of Wisconsin-Milwaukee Transcriptsˇż

ąşÂňČŐş«łÉĽ¨µĄˇ˘Ó˘ąú´óѧłÉĽ¨µĄˇ˘ĂŔąú´óѧłÉĽ¨µĄˇ˘°ÄÖŢ´óѧłÉĽ¨µĄˇ˘ĽÓÄĂ´ó´óѧłÉĽ¨µĄŁ¨q΢1954292140Ł©ĐÂĽÓĆ´óѧłÉĽ¨µĄˇ˘ĐÂÎ÷ŔĽ´óѧłÉĽ¨µĄˇ˘°®¶űŔĽłÉĽ¨µĄˇ˘Î÷°ŕŃŔłÉĽ¨µĄˇ˘µÂąúłÉĽ¨µĄˇŁłÉĽ¨µĄµÄŇâŇĺÖ÷ŇŞĚĺĎÖÔÚÖ¤Ă÷ѧϰÄÜÁ¦ˇ˘ĆŔąŔѧĘő±łľ°ˇ˘ŐąĘľ×ŰşĎËŘÖʡ˘Ěá¸ß¼ȡÂĘŁ¬ŇÔĽ°ĘÇ×÷ÎŞÁôĐĹČĎÖ¤ÉęÇë˛ÄÁϵÄŇ»˛ż·ÖˇŁ

ÍţËążµĐÇ´óѧĂܶűÎÖ»ů·ÖĐŁłÉĽ¨µĄÄÜą»ĚĺĎÖÄúµÄµÄѧϰÄÜÁ¦Ł¬°üŔ¨ÍţËążµĐÇ´óѧĂܶűÎÖ»ů·ÖĐŁżÎłĚłÉĽ¨ˇ˘×¨ŇµÄÜÁ¦ˇ˘ŃĐľżÄÜÁ¦ˇŁŁ¨q΢1954292140Ł©ľßĚĺŔ´ËµŁ¬łÉĽ¨±¨¸ćµĄÍ¨łŁ°üş¬Ń§ÉúµÄѧϰĽĽÄÜÓëĎ°ąßˇ˘¸÷żĆłÉĽ¨ŇÔĽ°ŔĎʦĆŔÓďµČ˛ż·ÖŁ¬Ňň´ËŁ¬łÉĽ¨µĄ˛»˝öĘÇѧÉúѧĘőÄÜÁ¦µÄÖ¤Ă÷Ł¬Ň˛ĘÇĆŔąŔѧÉúĘÇ·ńĘĘşĎÄł¸ö˝ĚÓýĎîÄżµÄÖŘŇŞŇŔľÝŁˇ

ÎŇĂÇłĐŵ˛ÉÓõÄĘÇѧУ԰ćÖ˝ŐĹŁ¨Ô°ćÖ˝Öʡ˘µ×É«ˇ˘ÎĆ·Ł©ÎŇĂÇą¤ł§ÓµÓĐČ«Ě×˝řżÚÔ×°É豸Ł¬ĚŘĘ⹤ŇŐ¶ĽĘDzÉÓò»Í¬»úĆ÷ÖĆ×÷Ł¬·ÂŐć¶Č»ů±ľżÉŇÔ´ďµ˝100%Ł¬ËůÓĐłÉĆ·ŇÔĽ°ą¤ŇŐЧąű¶ĽżÉĚáÇ°¸řżÍ»§ŐąĘľŁ¬˛»ÂúŇâżÉŇÔ¸ůľÝżÍ»§ŇŞÇó˝řĐе÷ŐűŁ¬Ö±µ˝ÂúŇâÎŞÖąŁˇ

ˇľÖ÷ÓŞĎîÄżˇż

Ň»ˇ˘ą¤×÷δȷ¶¨Ł¬»ŘąúĐčĎȸř¸¸Ä¸ˇ˘Ç×ĆÝĹóÓŃż´ĎÂÎÄĆľµÄÇéżöŁ¬°ěŔí±Ďҵ֤|°ěŔíÎÄĆľ: Âň´óѧ±Ďҵ֤|Âň´óѧÎÄĆľˇľqޱ1954292140ˇżÍţËążµĐÇ´óѧĂܶűÎÖ»ů·ÖУѧλ֤Ă÷ĘéČçşÎ°ěŔíÉęÇ룿

¶ţˇ˘»Řąú˝řË˝Ćóˇ˘ÍâĆóˇ˘×ÔĽş×öÉúŇâµÄÇéżöŁ¬ŐâĐ©µĄÎ»ĘDz»˛éŃŻ±Ďҵ֤ŐćαµÄŁ¬¶řÇŇąúÄÚĂ»ÓĐÇţµŔČĄ˛éŃŻąúÍâÎÄĆľµÄŐćĽŮŁ¬Ň˛˛»ĐčŇŞĚáą©Őćʵ˝ĚÓý˛żČĎÖ¤ˇŁĽřÓÚ´ËŁ¬°ěŔíĂŔąúłÉĽ¨µĄÍţËążµĐÇ´óѧĂܶűÎÖ»ů·ÖĐŁ±Ďҵ֤ˇľqޱ1954292140ˇżąúÍâ´óѧ±Ďҵ֤, ÎÄĆľ°ěŔí, ąúÍâÎÄĆľ°ěŔí, ÁôĐĹÍřČĎÖ¤Why Alternative Payment Methods Are Changing the International Business Lands...

Why Alternative Payment Methods Are Changing the International Business Lands...PayXBorder

?

This document explores how Alternative Payment Methods (APMs) like mobile wallets, fintech platforms, and cryptocurrencies are transforming international business. It highlights the benefits of faster settlements, lower costs, and global reachˇŞwhile showcasing how platforms like PayXBorder are leading the charge in enabling seamless cross-border transactions.Macroeconomic Study of the country - Vietnam.pptx

Macroeconomic Study of the country - Vietnam.pptxAnkush Upadhyay

?

PPT summarises our study of the economy as a whole of VietnamSTOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)

STOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)AndrewBorisenko3

?

Unlock the Power of the Stock Market ¨C Stock Trading Course by FinanceWorld.io (PDF)

Take your first step towards financial independence with FinanceWorld.ioˇŻs in-depth Stock Trading Course. This easy-to-follow PDF guide demystifies the stock market, providing you with all the essential tools and knowledge to begin trading with confidence.

WhatˇŻs Included in This Course:

Introduction to stocks and the stock market ecosystem

Understanding shares, indices, and different market sectors

How to open a brokerage account and place your first trades

Fundamental analysis: reading financial statements and news

Technical analysis: chart patterns, trends, and indicators

Time-tested strategies for beginners and experienced traders

Essential risk management techniques to protect your capital

Trading psychology: mastering emotions and staying disciplined

Real-world examples, practice exercises, and actionable tips

Who Is This PDF For?

New investors looking to enter the world of stock trading

Current traders wanting to refine their approach and strategy

Anyone seeking to build wealth through the stock market

Why Choose FinanceWorld.io?

Our expert-written guides strip away the jargon and focus on practical, real-world trading skills. With FinanceWorld.io, you gain clarity, confidence, and a proven roadmap to succeed in the markets.Why the Most Successful Restaurants Never Touch Their Own Books.pdf

Why the Most Successful Restaurants Never Touch Their Own Books.pdfPacific Accounting & Business Services

?

Middle East Conflict Sparks Oil Price Surge ¨C Global Markets on Alert

Middle East Conflict Sparks Oil Price Surge ¨C Global Markets on Alert Swiss International University SIU

?

Ad

Alternative Financing

- 1. The Market Has Shifted

- 2. Credit Scores Are Going Down Credit Criteria Is Going Up ˇ° July 12th of 2010 the Wall Street Journal reported that 43 million Americans had credit scores of 599 or below ¨C 25.5% of adultsˇ±

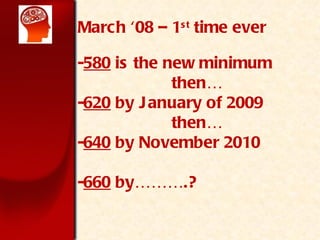

- 3. March ˇ®08 ¨C 1 st time ever - 580 is the new minimum thenˇ - 620 by January of 2009 thenˇ - 640 by November 2010 - 660 byˇˇˇ.?

- 4. Conventional Has Punitive Pricing For Everything Less Than Perfect Credit and a Large Down Payment

- 5. There Are Estimates That 35-40% of Credit Reports Are Below 640

- 6. What About the Self Employed That Have Good Credit But Cannot Get A Loan

- 7. Which Means About 50 % Do Not Qualify For Institutional Financing

- 8. If 10% Cannot Get A Loan ThatˇŻs The BuyerˇŻs Problem

- 9. When 50% Cannot Get A Loan It Is EverybodyˇŻs Problem

- 10. So You Have Three Options Get Out of the Business Prospect Sooooo Much You Have Enough People Learn To Do Business In TodayˇŻs Market

- 11. Alternative Financing Options 3 unique ways to structure a transaction Lease option All-inclusive Trust Deed aka Wrap around mortgage and WhatˇŻs that 3 rd option???

- 12. Contract for Deed (comes with an instruction manual from FHA no less) Ever heard of it?

- 13. Identify The Problem Map A Solution

- 14. Enroll Buyers in Credit Restoration

- 15. Coming March 3 rd 2011 To A Computer Screen Near You

- 16. Sign Up Below