Antonie de Wilde- De-Risking Geothermal Development

- 1. De-risking Geothermal Development Mindoro Geothermal Project Dr. Antonie de Wilde Chief Technical Officer Emerging Power Inc.

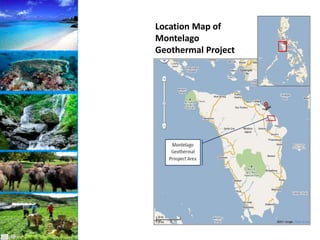

- 2. Location Map of Montelago Geothermal Project

- 3. The Odds • First and only Private Sector developed green field in Philippines • No subsidies (Other than RE 2008 (No import tax, no VAT) • No Feed-in-Tariff • No previous drilling by PNOC • First large-scale medium enthalpy field (potential 40 MW) • Field located in Protected Area

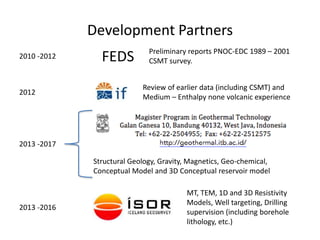

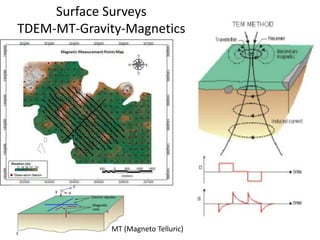

- 4. Development Partners 2013 -2017 2012 Review of earlier data (including CSMT) and Medium – Enthalpy none volcanic experience FEDS2010 -2012 Preliminary reports PNOC-EDC 1989 – 2001 CSMT survey. Structural Geology, Gravity, Magnetics, Geo-chemical, Conceptual Model and 3D Conceptual reservoir model 2013 -2016 MT, TEM, 1D and 3D Resistivity Models, Well targeting, Drilling supervision (including borehole lithology, etc.)

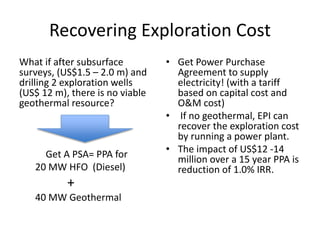

- 6. Recovering Exploration Cost • Get Power Purchase Agreement to supply electricity! (with a tariff based on capital cost and O&M cost) • If no geothermal, EPI can recover the exploration cost by running a power plant. • The impact of US$12 -14 million over a 15 year PPA is reduction of 1.0% IRR. What if after subsurface surveys, (US$1.5 – 2.0 m) and drilling 2 exploration wells (US$ 12 m), there is no viable geothermal resource? Get A PSA= PPA for 20 MW HFO (Diesel) + 40 MW Geothermal

- 7. IMPROVE SURFACE AND SUB- SURFACE SURVEYS

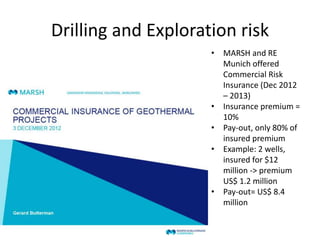

- 10. Drilling and Exploration risk • MARSH and RE Munich offered Commercial Risk Insurance (Dec 2012 – 2013) • Insurance premium = 10% • Pay-out, only 80% of insured premium • Example: 2 wells, insured for $12 million -> premium US$ 1.2 million • Pay-out= US$ 8.4 million

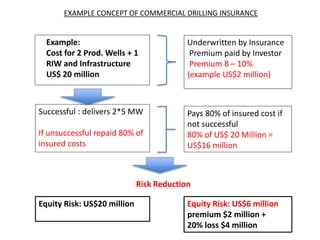

- 16. EXAMPLE CONCEPT OF COMMERCIAL DRILLING INSURANCE Example: Cost for 2 Prod. Wells + 1 RIW and Infrastructure US$ 20 million Underwritten by Insurance Premium paid by Investor Premium 8 – 10% (example US$2 million) Successful : delivers 2*5 MW If unsuccessful repaid 80% of insured costs Pays 80% of insured cost if not successful 80% of US$ 20 Million = US$16 million Risk Reduction Equity Risk: US$20 million Equity Risk: US$6 million premium $2 million + 20% loss $4 million

- 17. DEEP SMALL HOLE DRILLING

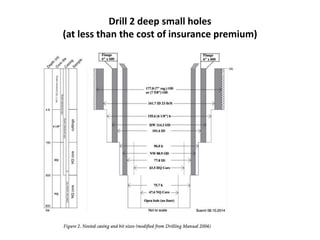

- 18. Drill 2 deep small holes (at less than the cost of insurance premium)

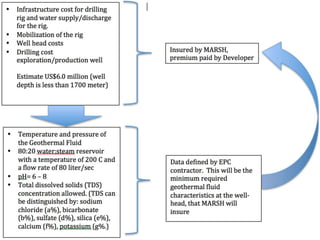

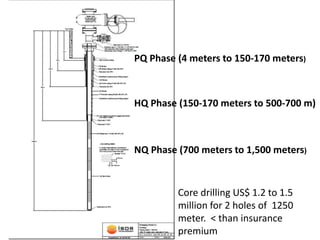

- 19. PQ Phase (4 meters to 150-170 meters) HQ Phase (150-170 meters to 500-700 m) NQ Phase (700 meters to 1,500 meters) Core drilling US$ 1.2 to 1.5 million for 2 holes of 1250 meter. < than insurance premium

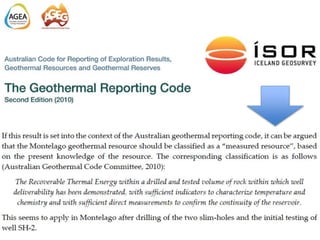

- 20. Risk Reduction using Small Deep Holes • Cost of insurance premium US$1.2 – 1.5 million • Cost of drilling small deep hole with coring rig < US$ 1,5 million • Drilling 2 holes makes assessment of reservoir possible • If the wells flow, can use for production (.75 – 1.2 MW) -> reduce cost for water pumping during production well drilling • From financing perspective using Australian code, the reservoir moves from “measured reservoir” to “productive reservoir” • Lithology for production drilling known: faster production drilling (reduce production drilling 4 -5 days

- 21. First deep small holes in Philippines many have followed (12) From: "Rimando, Philip M." <pmrimando@phinma.com.ph> Date: March 11, 2015 at 12:13:54 PM GMT+8 To: Antonie De Wilde <adewilde@emergingpowerinc.com> Cc: Meg Ledesma-Honrado <mlhonrado@basicenergy.ph>, "Buena, Sheryl L." <slbuena@phinma.com.ph> Subject: Thanks for the Meeting …………………… You have also treaded on a realm that other geothermal explorationists in the Philippines have not dared to go before – that is, drilling slimholes to probe a geothermal resource. That’s a bold step if I may say so and it goes against conventional wisdom in the Philippine setting. It is also a pioneering venture that hopefully would open up the mindset of other players in the local industry……… Philip M. Rimando Trans-Asia Oil & Energy Dev’t Corp.

- 24. We are pleased by the success of our exploration drilling work in Naujan,” EPI Chairman Antonio G. Zamora said in the statement. “It shows we have the geothermal resources needed to produce close to our target of 40 MW power,” he added. Mr. Zamora said QED worked with geothermal consultants Iceland Geosurvey (ISOR) and the Magister Geothermal Program of the Institute Teknologi Bandung for the exploratory activity. Antonie de Wilde, EPI chief technical officer, said based on “flow testing obtained during the last days, we are very pleased to confirm that our earlier assessment of a reservoir with the capacity to generate a minimum of 35 to 40 MW, is now confirmed with actual measured data.”

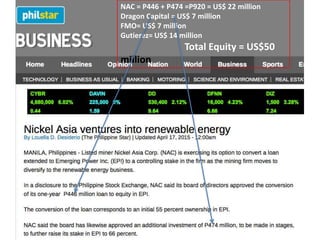

- 25. NAC = P446 + P474 =P920 = US$ 22 million Dragon Capital = US$ 7 million FMO= US$ 7 million Gutierez= US$ 14 million Total Equity = US$50 million

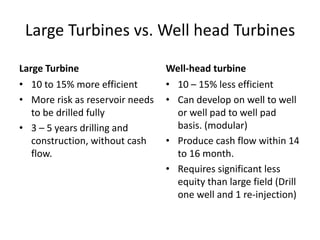

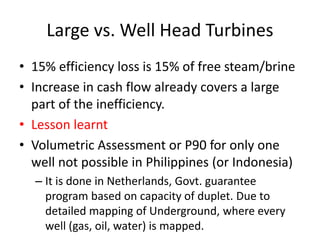

- 27. Large Turbines vs. Well head Turbines Large Turbine • 10 to 15% more efficient • More risk as reservoir needs to be drilled fully • 3 – 5 years drilling and construction, without cash flow. Well-head turbine • 10 – 15% less efficient • Can develop on well to well or well pad to well pad basis. (modular) • Produce cash flow within 14 to 16 month. • Requires significant less equity than large field (Drill one well and 1 re-injection)

- 28. Large vs. Well Head Turbines • 15% efficiency loss is 15% of free steam/brine • Increase in cash flow already covers a large part of the inefficiency. • Lesson learnt • Volumetric Assessment or P90 for only one well not possible in Philippines (or Indonesia) – It is done in Netherlands, Govt. guarantee program based on capacity of duplet. Due to detailed mapping of Underground, where every well (gas, oil, water) is mapped.

- 29. - Thank You! Terima Kasih adewilde@emergingpowerinc.com Antonie de Wilde

Editor's Notes

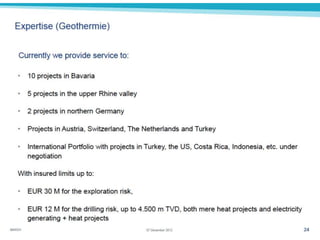

- Although PNOC-IDC had done some preliminary investigations, there was no reliable data set that could be used for well targeting. Also in Philippines and Indonesia there is no experience with actual developing a 20 to 40 MW low enthalpy resource. Thus EPI turned to firms in Europe, with experience with low enthalpy. IF technology in the Netherlands, which had advised over 8 projects in the Netherlands, drilling more than 3,500 meter for a brine temperature of 90° C was contracted to review all the existing data and present a development plan. This was done in collaboration with the Magister Program in Geothermal Technology of the Institute Teknologi Bandung, Indonesia’s