1 of 29

Download to read offline

Ad

Recommended

žó┘ģ┘łž▓ž┤ ž│█īž│ž¬┘ģ žŁž│ž¦ž©ž»ž¦ž▒█ī ┘ć┘ģ┌®ž¦ž▒ž¦┘å ž│█īž│ž¬┘ģ

žó┘ģ┘łž▓ž┤ ž│█īž│ž¬┘ģ žŁž│ž¦ž©ž»ž¦ž▒█ī ┘ć┘ģ┌®ž¦ž▒ž¦┘å ž│█īž│ž¬┘ģAli Masoombeigi

╠²

www.MODiRiATMAli.com160┘å┘āž¬┘ć ž»ž▒ ┘ģž»┘Ŗž▒┘Ŗž¬ ž¦ž¼ž▒ž¦┘Ŗ┘Ŗ

160┘å┘āž¬┘ć ž»ž▒ ┘ģž»┘Ŗž▒┘Ŗž¬ ž¦ž¼ž▒ž¦┘Ŗ┘ŖAli Masoombeigi

╠²

160┘å┘āž¬┘ć ž»ž▒ ┘ģž»┘Ŗž▒┘Ŗž¬ ž¦ž¼ž▒ž¦┘Ŗ┘ŖESLABON PERDIDO EL BOSON DE HIGGS

ESLABON PERDIDO EL BOSON DE HIGGSZuniga Agustin

╠²

Los aplausos tronaron en todos los costados del auditorio, los asistentes parados le dieron la bienvenida al veterano profesor Peter Higgs (ingles), porque su propuesta te├│rica estar├Ła a punto de ser corroborada, la existencia del bos├│n de Higgs. El cient├Łfico, tambale├│, se sonroj├│ con cierta inocencia y humildad, y solo atin├│ a agradecer y secarse algunas l├Īgrimas inoportunas que pretendieron denunciar su emoci├│n y alegr├Ła; ž¦┘äž¼ž▓žĪ ž¦┘䞦┘ł┘ä žŻž│ž”┘äž® ž¬┘å┘ü┘Ŗž░┘Ŗž® ┘ģ┘ć┘åž»ž│ ┘ģžŁ┘ģž» ž▓┘ā┘ē žźž│┘ģž¦ž╣┘Ŗ┘ä

ž¦┘äž¼ž▓žĪ ž¦┘䞦┘ł┘ä žŻž│ž”┘äž® ž¬┘å┘ü┘Ŗž░┘Ŗž® ┘ģ┘ć┘åž»ž│ ┘ģžŁ┘ģž» ž▓┘ā┘ē žźž│┘ģž¦ž╣┘Ŗ┘äMohamed Saeed

╠²

žŻž│ž”┘äž® ž¬┘å┘ü┘Ŗž░Unidad 4 muestra apuntes iaee 4┬║

Unidad 4 muestra apuntes iaee 4┬║Eva Baena Jimenez

╠²

Apuntes para la materia de Iniciaci├│n a la actividad emprendedora y empresarial de 4┬║ de la ESOPropuestas del consejo de administraci├│n de Sniace

Propuestas del consejo de administraci├│n de SniaceDiego Guti├®rrez

╠²

Propuestas del consejo de administraci├│n a los distintos puntos del orden del d├Ła de la junta general ordinaria de Sniace S. A. convocada para los d├Łas 29, 30 de junio, en primera y segunda convocatoriaSeptember 2021 Calendar of Events

September 2021 Calendar of EventsFloodwoodvern

╠²

Hope Lutheran Church Floodwood MN

September 2021 Calendar of EventsIXXUS - Unlocking revenue in the digital age - David Worlock May 2013

IXXUS - Unlocking revenue in the digital age - David Worlock May 2013David Worlock

╠²

Presentation by David R Worlock. Spiced orange segments

Spiced orange segmentsMerlin Cottage Kitchen

╠²

Recipe card from Pinterest: https://uk.pinterest.com/merlincottage/Strategic learning and training management

Strategic learning and training management Reza Seifollahy

╠²

This is my presentation for HR managers in Business Training Center about strategic learning and training management and ISO 29990 approach. The key idea of presentation is the understanding of Strategic Management, Strategic HR management, and related issues of ISO 29990. Thanks to Fuad Sultanov for his excellent presentation which I use several ideas from him (ISO 29990:2010 Defining Quality of Workplace Training & Education).Casden, Mobile Sensors: Building an Open Source Staff-Facing Tablet App for L...

Casden, Mobile Sensors: Building an Open Source Staff-Facing Tablet App for L...National Information Standards Organization (NISO)

╠²

This presentation was provided by Jason Casden of N.C. State University Libraries during the NISO Forum "Mobile Technologies in Libraries," held on May 20, 2011.Apresenta├¦├Żo call tiete 3 q13_eng_final

Apresenta├¦├Żo call tiete 3 q13_eng_finalAES Tiet├¬

╠²

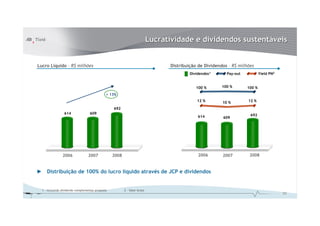

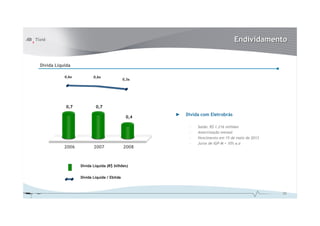

AES Tiet├¬ reported strong third quarter 2013 results. Energy generation was 19% higher than the physical guarantee and net revenue increased 7% to R$580 million. Forced outages declined 39% due to improved asset management. R$242 million in dividends will be distributed. EBITDA was down 7% to R$393 million due to lower energy allocation to a partner, while net income declined 8% to R$225 million. The company maintained manageable costs in line with 2012 through efficiency gains offsetting inflation. A modernization program supported a 12% reduction in outages. Strong cash flow of R$397.9 million was partly used to invest R$54.9 million in power plant upgrades whileApresenta├¦├Żo call tiete 1 t13_pt_finalAES Tiet├¬

╠²

O documento resume os resultados do primeiro trimestre de 2013 da empresa. A gera├¦├Żo de energia ficou acima da garantia f├Łsica, por├®m abaixo do mesmo per├Łodo de 2012. Os custos com energia comprada no mercado spot aumentaram significativamente, reduzindo o EBITDA e lucro l├Łquido em 21% e 25% respectivamente. A receita l├Łquida aumentou 11% em rela├¦├Żo ao primeiro trimestre de 2012.More Related Content

What's hot (20)

Propuestas del consejo de administraci├│n de Sniace

Propuestas del consejo de administraci├│n de SniaceDiego Guti├®rrez

╠²

Propuestas del consejo de administraci├│n a los distintos puntos del orden del d├Ła de la junta general ordinaria de Sniace S. A. convocada para los d├Łas 29, 30 de junio, en primera y segunda convocatoriaSeptember 2021 Calendar of Events

September 2021 Calendar of EventsFloodwoodvern

╠²

Hope Lutheran Church Floodwood MN

September 2021 Calendar of EventsIXXUS - Unlocking revenue in the digital age - David Worlock May 2013

IXXUS - Unlocking revenue in the digital age - David Worlock May 2013David Worlock

╠²

Presentation by David R Worlock. Spiced orange segments

Spiced orange segmentsMerlin Cottage Kitchen

╠²

Recipe card from Pinterest: https://uk.pinterest.com/merlincottage/Strategic learning and training management

Strategic learning and training management Reza Seifollahy

╠²

This is my presentation for HR managers in Business Training Center about strategic learning and training management and ISO 29990 approach. The key idea of presentation is the understanding of Strategic Management, Strategic HR management, and related issues of ISO 29990. Thanks to Fuad Sultanov for his excellent presentation which I use several ideas from him (ISO 29990:2010 Defining Quality of Workplace Training & Education).Casden, Mobile Sensors: Building an Open Source Staff-Facing Tablet App for L...

Casden, Mobile Sensors: Building an Open Source Staff-Facing Tablet App for L...National Information Standards Organization (NISO)

╠²

This presentation was provided by Jason Casden of N.C. State University Libraries during the NISO Forum "Mobile Technologies in Libraries," held on May 20, 2011.Casden, Mobile Sensors: Building an Open Source Staff-Facing Tablet App for L...

Casden, Mobile Sensors: Building an Open Source Staff-Facing Tablet App for L...National Information Standards Organization (NISO)

╠²

Viewers also liked (10)

Apresenta├¦├Żo call tiete 3 q13_eng_final

Apresenta├¦├Żo call tiete 3 q13_eng_finalAES Tiet├¬

╠²

AES Tiet├¬ reported strong third quarter 2013 results. Energy generation was 19% higher than the physical guarantee and net revenue increased 7% to R$580 million. Forced outages declined 39% due to improved asset management. R$242 million in dividends will be distributed. EBITDA was down 7% to R$393 million due to lower energy allocation to a partner, while net income declined 8% to R$225 million. The company maintained manageable costs in line with 2012 through efficiency gains offsetting inflation. A modernization program supported a 12% reduction in outages. Strong cash flow of R$397.9 million was partly used to invest R$54.9 million in power plant upgrades whileApresenta├¦├Żo call tiete 1 t13_pt_finalAES Tiet├¬

╠²

O documento resume os resultados do primeiro trimestre de 2013 da empresa. A gera├¦├Żo de energia ficou acima da garantia f├Łsica, por├®m abaixo do mesmo per├Łodo de 2012. Os custos com energia comprada no mercado spot aumentaram significativamente, reduzindo o EBITDA e lucro l├Łquido em 21% e 25% respectivamente. A receita l├Łquida aumentou 11% em rela├¦├Żo ao primeiro trimestre de 2012.12 03-2010 - apresenta├¦├Żo da teleconfer├¬ncia 2009AES Tiet├¬

╠²

O documento discute as perspectivas financeiras e operacionais de v├Īrias empresas para os pr├│ximos anos, incluindo proje├¦├Ąes de receita, despesas, lucros e participa├¦├Żo de mercado. As declara├¦├Ąes sobre o futuro s├Żo consideradas previs├Ąes, sujeitas a incertezas do mercado e da economia brasileira.Apimec presentation 03-31-2009

Apimec presentation 03-31-2009AES Tietê

╠²

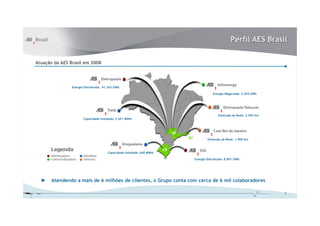

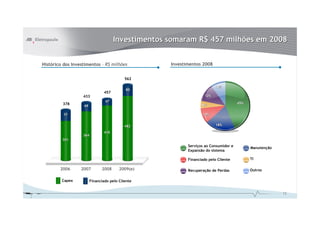

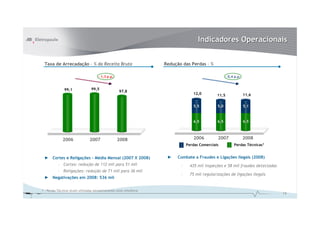

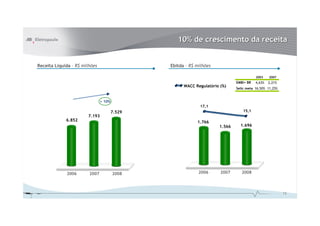

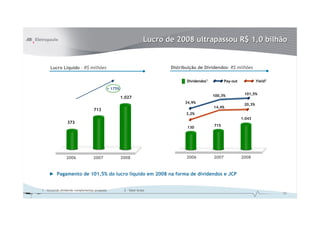

This document provides an overview of AES Brasil for 2008. It discusses the following key points:

- AES Brasil has over 6,000 employees serving over 6 million customers across its distributed energy, negotiated energy, and installed capacity totals.

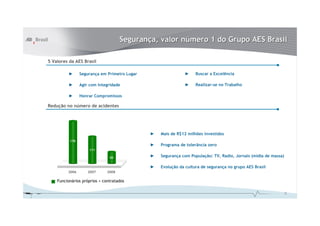

- Safety is the top value at AES Brasil. Investments in safety programs have helped reduce accidents from 178 in 2006 to 111 in 2008.

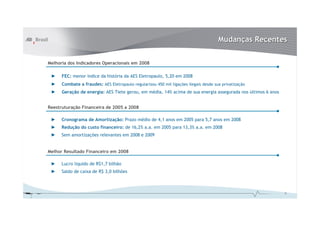

- AES Brasil saw improved operational and financial performance in 2008, with higher EBITDA, net income, and dividends while continuing to reduce debt levels.

- The company remains focused on social responsibility programs in areas like education, culture, and volunteer initiatives.Apresenta├¦├Żo bradesco ceo_forum2013_final (1)

Apresenta├¦├Żo bradesco ceo_forum2013_final (1)AES Tiet├¬

╠²

9M12

9M13

2010

2011

2012

9M12

9M13

Ebitda Margin

Net Revenue

Ebitda

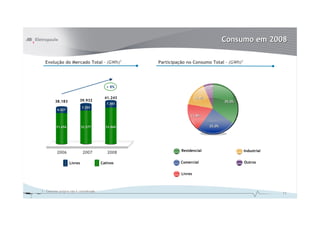

1. AES Tietê is a leading private hydroelectric power generation company in Brazil with over 2,600 MW of installed capacity. It has a long-term power purchase agreement with AES Eletropaulo, Brazil's largest utility.

2. AES Eletropaulo is Brazil's largest utility, serving over 17 million customers in the metropolitan region of S├Żo Paulo. It has a distribution concession agreement that expires in 2028.

3. Both companies reported declines in revenueApresenta├¦├Żo bradesco ceo_forum2013_final

Apresenta├¦├Żo bradesco ceo_forum2013_finalAES Tiet├¬

╠²

9M12

9M13

2010

2011

2012

9M12

9M13

Ebitda Margin

- AES Tietê is a leading hydroelectric power generation company in Brazil with over 2,600 MW of installed capacity. It has a long-term power purchase agreement with AES Eletropaulo, the largest distribution company in Brazil.

- AES Eletropaulo distributes electricity to over 7 million customers in the metropolitan region of S├Żo Paulo. It has been investing to improve reliability and reduce losses.

- Both companies have been reporting declines in revenues and earnings recently due to lower energy consumption in Brazil and regulatory changesApresenta├¦├Żo institucional 4_t10_eng

Apresenta├¦├Żo institucional 4_t10_engAES Tiet├¬

╠²

The document provides an overview of AES Brasil Group, which has a presence in Brazil since 1997 operating in the energy generation, distribution, trade and telecommunications sectors. It employs over 7,700 people and has invested $5.8 billion from 1998-2009. Specifically, the document discusses AES Tiet├¬, the second largest private energy generator in Brazil, and AES Eletropaulo, the largest electricity distribution company in Latin America serving the S├Żo Paulo metropolitan region. It provides financial highlights and operational details for both companies.Apresentao institucional 3_t09_ing_final_grafica_26012010pdf

Apresentao institucional 3_t09_ing_final_grafica_26012010pdfAES Tietê

╠²

The document provides an overview of AES Brasil Group, a major electricity company in Brazil. It operates distribution companies serving over 7 million clients across several states. AES Brasil has invested $5 billion since privatization in 1998 and generated $3.2 billion in EBITDA in 2008. The document also outlines the shareholding structure and regulatory environment of Brazil's electricity sector. It concludes with an overview of AES Eletropaulo, the largest distribution company in Latin America serving the S├Żo Paulo metropolitan region.Apresenta├¦├Żo institucional 4_q12_en_v5

Apresenta├¦├Żo institucional 4_q12_en_v5AES Tiet├¬

╠²

AES Brasil is a large electricity company in Brazil with over 7 million customers. It has invested $9.4 billion since 1998 and has 7,400 employees. AES Brasil has generation assets with 2,658 MW of installed capacity through its subsidiary AES Tiet├¬. It also has distribution operations serving over 7 million customers through its subsidiaries AES Eletropaulo and AES Sul. AES Brasil aims to be a leader in the Brazilian energy sector through expansion of its generation fleet and being the best electricity distributors in Brazil.Apresenta├¦├Żo institucional 4_q12_en_v5

Apresenta├¦├Żo institucional 4_q12_en_v5AES Tiet├¬

╠²

AES Brasil is one of the largest electricity companies in Brazil, with 7.7 million consumption units, 54.4 TWh of distributed energy, and 2,658 MW of installed capacity. AES Tiet├¬ is a subsidiary of AES Brasil and is the third largest private electricity generator in Brazil with over 2,600 MW of installed capacity. AES Tiet├¬ has 12 hydroelectric plants in S├Żo Paulo and generates the majority of its revenue from a long-term contract with AES Eletropaulo, another AES Brasil subsidiary and one of the largest distributors in Latin America. AES Tiet├¬ has pursued a strategy of modernizing its power plants, expanding its client portfolio beyond AES Eletropaulo,Ad

More from AES Tietê (20)

Apresenta├¦├Żo call tiete 2 t12_finalAES Tiet├¬

╠²

O documento resume os resultados financeiros e operacionais da empresa no 2T12. Teve aumento de 31% na receita l├Łquida, alcan├¦ando R$ 535 milh├Ąes, e lucro l├Łquido 43% maior que no 2T11, totalizando R$ 229 milh├Ąes. Os investimentos de R$ 17 milh├Ąes foram direcionados principalmente ├Ā moderniza├¦├Żo de usinas.Apresenta├¦├Żo call tiete 3 t12_eng

Apresenta├¦├Żo call tiete 3 t12_engAES Tiet├¬

╠²

Power generation was 22% higher than the physical guarantee and 10% higher than 3Q11. Net revenue increased 4.7% to R$543 million due to higher prices in the spot market, a contract adjustment with AES Eletropaulo, and higher energy sales. EBITDA was R$423 million with a margin of 78%, and net income increased 7% to R$244 million. The company continues with a modernization program and its debt level remains low with a net debt to EBITDA ratio of 0.3x.Apresenta├¦├Żo call tiete 3 t12_sem discursoAES Tiet├¬

╠²

A AES Tiet├¬ teve um bom desempenho no 3T12, com gera├¦├Żo de energia 22% acima da garantia f├Łsica. A receita l├Łquida cresceu 4,7% em rela├¦├Żo ao 3T11, impulsionada pelo aumento da energia vendida no mercado spot e pelo reajuste no contrato com a AES Eletropaulo. O Ebitda alcan├¦ou R$ 423 milh├Ąes, com margem de 78%, e o lucro l├Łquido foi de R$ 244 milh├Ąes, aumento de 7% em rela├¦├Żo ao 3T11.Presentation credit suisse - v brazil equity ideas conference

Presentation credit suisse - v brazil equity ideas conferenceAES Tietê

╠²

AES Brasil Group operates in the energy generation and distribution sectors in Brazil. It is comprised of four companies with over 7,400 employees and has invested $6.9 billion from 1998-2010. AES Brasil has good governance practices and focuses on sustainability. It has strong cash generation and differentiated dividend practices among its companies. AES Tiet├¬ specifically has 17 hydroelectric plants in Sao Paulo and Minas Gerais with over 2,600 MW of installed capacity and high operational availability, generating over its physical guarantee levels. Nearly all of AES Tiet├¬'s energy is contracted to AES Eletropaulo until end of 2015.Apresenta├¦├Żo credit suisse - v brazil equity ideas conferenceAES Tiet├¬

╠²

O documento fornece um resumo sobre o Grupo AES Brasil, destacando sua presen├¦a no setor el├®trico brasileiro desde 1997, com investimentos de R$6,9 bilh├Ąes e 7,4 mil funcion├Īrios. Tamb├®m descreve a estrutura acion├Īria e os neg├│cios das subsidi├Īrias AES Tiet├¬ e AES Eletropaulo, que atuam respectivamente na gera├¦├Żo e distribui├¦├Żo de energia.Presentation barclays capital latin america regulated industries conferenceAES Tiet├¬

╠²

O documento fornece um resumo do Grupo AES Brasil, descrevendo sua atua├¦├Żo no setor el├®trico brasileiro desde 1997, sua estrutura acion├Īria e de neg├│cios, al├®m de perspectivas para o setor el├®trico brasileiro.Apresenta├¦├Żo barclays capital latin america regulated industries conferenceAES Tiet├¬

╠²

O documento fornece um resumo sobre o Grupo AES Brasil, destacando sua atua├¦├Żo no setor el├®trico brasileiro desde 1997, com investimentos de R$6,9 bilh├Ąes e 7,4 mil funcion├Īrios. Tamb├®m descreve o perfil da AES Tiet├¬, sua segunda maior geradora com 2,6 GW de capacidade instalada.Apresenta├¦├Żo expo money apimec 2012AES Tiet├¬

╠²

O documento resume as informa├¦├Ąes sobre o grupo AES Brasil e suas subsidi├Īrias AES Tiet├¬ e AES Eletropaulo. Apresenta dados operacionais e financeiros das empresas, incluindo investimentos, gera├¦├Żo e distribui├¦├Żo de energia, reconhecimentos recebidos e estrutura acion├Īria.Apresenta├¦├Żo institucional 3_q12_en_v8

Apresenta├¦├Żo institucional 3_q12_en_v8AES Tiet├¬

╠²

The document provides an overview of AES Brasil, one of the largest electricity generation and distribution groups in Brazil. Some key details include:

- AES Brasil has over 7 million consumption units, 53.6 TWh of distributed energy, and 2,658 MW of installed generation capacity.

- It has a presence in Brazil since 1997 and over 7,400 employees.

- AES Tietê is the second largest private electricity generator in Brazil and AES Eletropaulo is one of the largest distribution companies.

- The Brazilian electricity sector is undergoing expansion to meet growing demand, with opportunities for renewable energy growth.Apresenta├¦├Żo institucional 3_q12_en_v8

Apresenta├¦├Żo institucional 3_q12_en_v8AES Tiet├¬

╠²

The document provides an overview of AES Brasil, one of the largest electricity generation and distribution groups in Brazil. Some key details include:

- AES Brasil has over 7 million consumption units, 53.6 TWh of distributed energy, and 2,658 MW of installed generation capacity.

- It has a presence in Brazil since 1997 and over 7,400 employees.

- Two of its subsidiaries, AES Tietê and AES Eletropaulo, are publicly listed on the Brazilian stock exchange.

- AES Brasil is recognized for its management excellence, quality and safety practices, and environmental stewardship.

- It has a mission to provide reliable, sustainable energy solutions while promoting development and improving livesApresenta├¦├Żo institucional 3_q12_en_v11

Apresenta├¦├Żo institucional 3_q12_en_v11AES Tiet├¬

╠²

The document provides an overview of AES Brasil Group, which has been operating in Brazil since 1997, with 7.7 million consumption units, 53.6 TWh of distributed energy, and 2,658 MW of installed capacity. It details AES Brasil's operations across generation, transmission, distribution, and service provision segments. The document also discusses AES Brasil's recognized management excellence and commitment to quality, safety, and environmental concerns.Apresenta├¦├Żo institucional 3_q12_en_v11

Apresenta├¦├Żo institucional 3_q12_en_v11AES Tiet├¬

╠²

The document provides an overview of AES Brasil Group, which has been operating in Brazil since 1997. It details AES Brasil's operational figures including 7.7 million consumption units, 53.6 TWh of distributed energy, and 2,658 MW of installed capacity. It also discusses AES Brasil's mission of providing safe, reliable, and sustainable energy solutions. Finally, it summarizes AES Brasil's recognition for management excellence, quality and safety, and environmental concern between 2009-2012.Apresenta├¦├Żo call tiete 4 q12_en

Apresenta├¦├Żo call tiete 4 q12_enAES Tiet├¬

╠²

AES Tiet├¬ had a strong financial performance in 2012. Power generation was 27% higher than the physical guarantee. Net revenue increased 12% to R$2.1 billion due to a contract readjustment and higher spot prices. EBITDA grew 5% to R$1.54 billion with a margin of 73%. Net income increased 7% to R$901 million. The company proposes dividends of R$182 million. Investments focused on modernizing power plants. Exposure to higher spot prices in 4Q12 pressured costs. The company maintained a net debt to EBITDA ratio of 0.3 times and expects continued cash generation and debt reduction in 2013.Apresenta├¦├Żo call tiete 4 t12_ptAES Tiet├¬

╠²

A AES Tiet├¬ teve um bom desempenho operacional e financeiro em 2012, com gera├¦├Żo de energia acima da garantia f├Łsica, investimentos de R$ 139 milh├Ąes em moderniza├¦├Żo de usinas, aumento da receita l├Łquida em 12% e lucro l├Łquido 7% maior. No entanto, a exposi├¦├Żo ao mercado spot no 4T12 resultou em maiores custos com energia.Apresenta├¦├Żo call tiete 1 t13_eng_final

Apresenta├¦├Żo call tiete 1 t13_eng_finalAES Tiet├¬

╠²

- Energy generation in 1Q13 was 2% higher than the physical guarantee but 17% lower than 1Q12 due to a 10% reduction in the physical guarantee, requiring AES Tietê to purchase 309 GWh in the spot market for R$115 million.

- Net revenue increased 11% to R$598 million in 1Q13 compared to 1Q12. However, higher energy purchase costs reduced EBITDA by 21% and net profit by 25%.

- For 2013, AES Tiet├¬ expects its physical guarantee to be reduced by 4-9% on average, requiring additional spot market purchases of R$231-441 million to cover the exposure. Dividends of R$204 millionApresenta├¦├Żo call tiete 1 t13_pt_finalAES Tiet├¬

╠²

O documento resume os resultados do primeiro trimestre de 2013 da empresa. A gera├¦├Żo de energia ficou acima da garantia f├Łsica, por├®m abaixo do mesmo per├Łodo de 2012. Os custos com energia comprada no mercado spot aumentaram devido ao rebaixamento da garantia f├Łsica. Isso reduziu o EBITDA e lucro l├Łquido em 21% e 25% respectivamente. A empresa prev├¬ mais compras no mercado spot para 2013 devido ├Ās proje├¦├Ąes de rebaixamento da garantia f├Łsica.Apresenta├¦├Żo call tiete 2 t13_ing

Apresenta├¦├Żo call tiete 2 t13_ingAES Tiet├¬

╠²

- The company saw a 52% reduction in unscheduled outage rates in 1H13 compared to 1H12. Net revenues increased 9% to R$583 million in 2Q13, while EBITDA grew 4.1% to R$421 million. Interim dividends of R$258 million will be distributed on September 25, 2013. Reservoir levels recovered due to higher thermal dispatch, supporting operational performance, while spot prices declined in 2Q13 from 1Q13.Apresenta├¦├Żo call tiete 2 t13_pt_finalAES Tiet├¬

╠²

O documento resume os resultados do 2T13, destacando: 1) redu├¦├Żo de 52% nas indisponibilidades n├Żo programadas; 2) investimentos de R$26 milh├Ąes em moderniza├¦├Żo de usinas; 3) aumento do portf├│lio de contratos bilaterais para 455 MWm. Apresenta tamb├®m o desempenho financeiro do per├Łodo, com destaque para o crescimento de 9% na receita l├Łquida e de 5% no lucro l├Łquido.Apresenta├¦├Żo call tiete 3 t13_pt_finalAES Tiet├¬

╠²

O resumo do documento ├® o seguinte:

1. A gera├¦├Żo de energia foi 19% superior ├Ā garantia f├Łsica, por├®m 12% abaixo do mesmo per├Łodo do ano anterior.

2. Houve redu├¦├Żo de 39% no fator equivalente de paradas for├¦adas e foram vendidos 413MWm de energia no mercado livre.

3. A receita l├Łquida aumentou 7% em rela├¦├Żo ao mesmo per├Łodo do ano anterior, enquanto os custos gerenci├Īveis se mantiveram no mesmo patamar.Iv confer├¬ncia santander finalAES Tiet├¬

╠²

Este documento resume uma confer├¬ncia sobre o setor el├®trico brasileiro realizada em abril de 2013. Discutiu-se a situa├¦├Żo dos reservat├│rios, a evolu├¦├Żo da matriz energ├®tica e as tend├¬ncias dos leil├Ąes de energia. A capacidade de armazenamento de energia n├Żo acompanhou o crescimento do mercado e eventos clim├Īticos t├¬m afetado os reservat├│rios. Termel├®tricas s├Żo importantes para a estabilidade do sistema, mas os leil├Ąes t├¬m priorizado pre├¦o em vez de confiabilidade.Ad

Apimec 31-03-2009

- 2. ! " # $ %&' %( ) ! 2 ! . * + $ ',,, / ) $ ' 0 1 $ ' ,& -) . * + / $ &'0 1 $ % -) ! " # $ ' 0& ) 2

- 3. ! 3 4 & ,9 ! ! > / . = ! + / ! ? 7 @ 8 * 4 A - / 5& 3 &A ! 6 7 &&& ! , 3 $ 89 / ! : ; # < ! A 3

- 4. - + / B C *$ * $ ! ! $ / ' C * ! 7 " $ 1 ( $- " $ / # ! $ ! )#* % ! ! " & + , , / - ! " ( ), * / / #) . )0 0* / / % C 2 34) . 5 6 34 0 & 5 $ 4

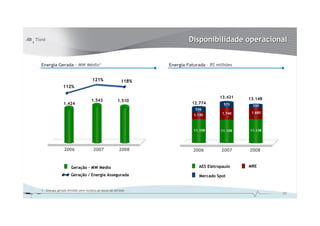

- 5. / +3 E ( @ F F (' AA0 A&% % A A "#3 (' (% '%0 =#D = =#D @ %(F E A'%(& F &' 0, &'%&, ,' A A %' ,%0 A 5

- 6. 6

- 7. / * * * # <% 5 7 8% % 34 ) : $ % % ! ! ! * + 5 8% 9 = 7 7 ) ; + & 5 ( =G 34 ) : ! & , & ! 7

- 8. / ! 9 1 " > 5< % : & ?! % )# 5 ! < = 5 7 & 5 6 % % $ = % @ * 5 A B/ 8

- 10. I - ! % H H = # %'&%& , / ! B / ! / ! / ! / ! 2 * = 10

- 11. * 3 - 8 * E F F %&' %( (0'0( ( '& ( 8 &, 0F (, F A'( ( A'(,, ', A &A 0F %& (&' , ( ',AA / A =3 , F ((' * 3 + * B =3 )?C & ( 11

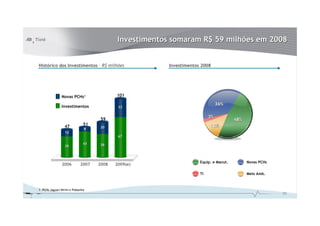

- 12. +3 > J / 5 %,A +3 +3 , & F %(( %,A & F %A (A %,F ,F 0 & F AA & F % %& ( % ( & 3 * - . C A * . C 0; < / * 8+ B * 12

- 13. " *& C * J C * ( ( && & ( && (% & & 0 %0 A , , , " * ; < " * C * ;3 7 - & : G $ 1 D % , A A )DE %& 0 0 A & 2 F & < H ! A3 E C * 5 $ 13

- 14. + # 8 . $ % B # / @&( ' ' 00 , 00 & @ 0A % ' ' & && , && , , , , & , , , A A * / ! @ -H - ; AK D )?- '( * C D !" D 2 ! < 3 $ ,( " % 7 F D &! & 8H * =! ' + ! ( ) ; < $ * 14

- 15. & F / =#D ( ) ** / ! J - + / E ;F < A # ,0* )* ), * )) * E& F &A & ' , A'&0( &, & A', 0 &'A &' 0 &', A A 15

- 16. = = /5 & " =#D "3 L & "3 M@ N E &A,F &' & A & & ,F (F (% 0F A&( ( F &' %( (A( A&, &( A A ! )?8 % (F &% %F & & ,F #D ?I 3 5 :* 16

- 17. * "#3 * =#D # ! #3 #D 7 &. & (. & . &'& &&A (A ( , A &&A , &&A &&A , , , && , % & &( 0 0 A "#3 =#D ;/5 "#3 =#D P . B )?) + < +" 8 O - O #3 A8 'E < 2 ; P C* < &% &, - C* (A, & , ! & @ ( & 3 H & &&A &&A , / H ? & C J 3 - * "+ E - & ( F G C * ' ' 0?' 6 K 5 0)L) L D9 4) J 34 00. 17

- 18. - - * ? Q 2 0 @A M A % R ! @ ; 2R< N & G D G %/ B . D> ? / B )' D ? ? 4 " D & A @3 % * 9 5 C 8 D #! / B ! ! H @ 5 D ! / B 3 18

- 19. 3 K+ 3 K+ 9 3 -H "G @ ( ' & ,' AA & && & 0 @&& F A @ 0 0F A', %'&A& @%& F , 7@ A & 3@ @ O @ &( ! @ @ 7@ , A 0 & , = = & &F & &&, + && + B9 ( F F & , & 0, 7@ +' $ ,- O @ 0 -. / .. 3@ 0 +' $ !.- - ..( / .. @ 0 ! 0 1 ) '$ % 19

- 21. 8 ? I * & ( 8 9O A 9O 8 5 9O 9O G % + " 9 O P! 0 H * 9O A . , & ? - ! ' ,& -) F #D # 3 I 9O C A ! 9O & % C 9O 1 % -CO ! ?; 21

- 22. " 2 ! 23 ! & &F C && F && F &',%( &'% % &',& &('% & & 'AA% &('&% ,A( (( ,( &'&( &&'& A )D ! ! % + ! &&'&( &&'& A -/ L -) -H P &' &'A% ! - 22

- 23. +3 > J +3 2 3 / 5 ,0 +3 *> & & & +3 ( F (( (F ,0 ,& %A % F & F & A %( (, (0 A 0; < D 8+ )? -CO Q ! - 5 ' - ' 2 3 - *> ' 23

- 24. &AF / =#D E &%F E &AF &' &'( A &' ,% & &'% % &' 0A A &' 00 A 24

- 25. = = 3 =#D 3 " G3 "3 & "3 & F M@ & F N & 2 F E &(F & F & F &% & F 0 0 &% 0 A " )?8 & % F 0 A #D ?I 3H 5 :* 3 25

- 26. 3 "#3 =#D . . A (. A % "#3 D D D D A "#3 =#D ;/ 5 "#3 =#D G 4 5 " 0 * ' 6 '$ ' 7 8 1 2 9 .# 5 . ! < P 26

- 27. - - * S Q 0 %2 : ;% < @ S # &, 4 ' > < < - ! G H 9 4 # < 'D ' ?$ 'C ?@02 ? A 5.( 6 $B 4505 - ?@02 ? 4 5 .( H T = <5.( & 2 7 ' 2 6 ?$ 'C < $ 7 5.( ?@02 ? 7 5.( , $ E ; 6 7 5.( 27

- 28. 3 8 ?K+ 3 9 K+ -H * "G 3 @ 0' 0A & '& & (', & ' 0 ,'A & @ &&F @& F &',A( ('( , &' @ %&F & %'& ,',(& ,'% &'A % % A& 7@ @ O @ @ 7@ , 0 A B & G E &(F E %F & E (F 8+ % + + B9 7@ )?E A : O @ 0 L) L . J) 3@ 0 DE @ 0 5 : L) L J) 28