Application of Extreme Value Theory to Risk Capital Estimation

- 1. Life conference and exhibition 2010 Steven Morrison and Alex McNeil Application of Extreme Value Theory to Risk Capital Estimation 7-9 November 2010 ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk

- 2. Application of EVT to risk capital estimation: Agenda ŌĆó Motivation ŌĆó Background theory ŌĆó VaR case study ŌĆó Summary ŌĆó Questions or comments? ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 1

- 3. Application of extreme value theory to risk capital estimation Steven Morrison and Alex McNeil Motivation ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk

- 4. Motivation ŌĆó Measures of risk capital are based on the (extreme) tail of a distribution ŌĆō Value at Risk (VaR) ŌĆō Conditional Value at Risk (CVaR) / Expected Shortfall ŌĆó In particular, Solvency II SCR is defined as a 99.5% VaR over a one year horizon ŌĆó Generally needs to be estimated using simulation 1. Generate real-world economic scenarios for all risk drivers affecting the balance sheet over one year 2. Revalue the balance sheet under each real-world scenario ŌĆō e.g. Monte Carlo (ŌĆ×nested stochastic), Replicating Formula, Replicating Portfolio 3. Estimate the statistics of interest ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 3

- 5. Motivation ŌĆó An insurer who has gone through such a simulation exercise states ŌĆō ŌĆ£Our Solvency Capital Requirement is ┬Ż77.5mŌĆØ ŌĆó How confident can we be in this number? ŌĆó Many sources of uncertainty ŌĆō Choice of economic scenario generator (ESG) models and their calibration ŌĆō Liability model assumptions e.g. dynamic lapse rules ŌĆō Choice of scenarios sampled i.e. choice of real-world ESG random number seed ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 4

- 6. Motivation ŌĆó The same insurer re-runs their internal model using a different random number seed (but all other assumptions are unchanged) ŌĆō ŌĆ£Our Solvency Capital Requirement is now ┬Ż82.8mŌĆØ ŌĆó So, simulation-based capital estimates are subject to statistical uncertainty ŌĆō Can we estimate this statistical uncertainty? ŌĆō How can we reduce the amount of statistical uncertainty? ŌĆó In this presentation, we will address these questions using a statistical technique known as Extreme Value Theory (EVT) ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 5

- 7. Application of extreme value theory to risk capital estimation Steven Morrison and Alex McNeil Background theory ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk

- 8. Application of extreme value theory to risk capital estimation Steven Morrison and Alex McNeil VaR case study ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk

- 9. VaR Case study Liability book ŌĆó UK-style with profits ŌĆō Management actions, dynamic EBR, dynamic bonus rates, regular premiums Valuation methodology ŌĆó Nested stochastic ŌĆō 1,000 real-world outer scenarios ŌĆō 1,000 risk-neutral inner scenarios per outer scenario ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 8

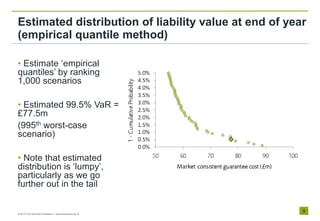

- 10. Estimated distribution of liability value at end of year (empirical quantile method) ŌĆó Estimate ŌĆ×empirical quantilesŌƤ by ranking 1,000 scenarios ŌĆó Estimated 99.5% VaR = ┬Ż77.5m (995th worst-case scenario) ŌĆó Note that estimated distribution is ŌĆ×lumpyŌƤ, particularly as we go further out in the tail ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 9

- 11. Estimated distributions using different scenario sets (empirical quantile method) Initial set of 1,000 real- world scenarios ŌĆó 99.5% VaR = ┬Ż77.5m Second set of 1,000 real-world scenarios ŌĆó 99.5% VaR = ┬Ż82.8m ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 10

- 12. What is the ŌĆśtrueŌĆÖ VaR? ŌĆó Two different estimates for VaR ŌĆō ┬Ż77.5m ŌĆō ┬Ż82.8m ŌĆō Which is ŌĆ×correctŌƤ? ŌĆó Both use same (subjective) modelling assumptions ŌĆō Same economic scenario generator and calibration ŌĆō Same liability model assumptions e.g. dynamic lapse rules ŌĆó Difference is purely due to different random number streams used to generate the economic scenarios ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 11

- 13. Two important questions 1. Can we reduce the sensitivity of the estimate to the choice of random numbers? ŌĆō Run more scenarios ŌĆō May not be feasible because of model run-time ŌĆō Find a ŌĆ×betterŌƤ estimator than the empirical quantile 2. Given a particular estimate of the 99.5% VaR, can we estimate the uncertainty around this? ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 12

- 14. Application of Extreme Value Theory ŌĆó Recall that Extreme Value Theory tells us something about the shape of the distribution in the tail ŌĆō Distribution of liability value beyond some threshold is (approximately) Generalised Pareto ŌĆō Parameterised by 2 parameters ŌĆó Estimate the tail of the distribution by: 1. Picking a threshold 2. Fitting the 2 parameters of the Generalised Pareto Distribution to values in excess of the threshold ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 13

- 15. Choice of threshold 20 ŌĆó Choice of threshold is subjective ŌĆō But examination of ŌĆ×mean excess Mean Excess (┬Żm) 15 functionŌƤ helps identify a suitable choice 10 5 ŌĆó We have judged that a threshold of 20 40 60 80 100 Threshold (┬Żm) ┬Ż40m is suitable for this particular 20 case study Mean Excess (┬Żm) ŌĆō Approximately 26% of scenarios 15 exceed the threshold 10 5 20 40 60 80 100 Threshold (┬Żm) ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 14

- 16. Estimated distributions using different scenario sets (Extreme Value Theory method) Initial set of 1,000 real-world scenarios ŌĆó 99.5% VaR = ┬Ż75.9m ŌĆó 95% confidence interval = [71.1m, 84.3m] Second set of 1,000 real- world scenarios ŌĆó 99.5% VaR = ┬Ż77.8m ŌĆó 95% confidence interval = [72.2m, 87.7m] ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 15

- 17. Application of extreme value theory to risk capital estimation Steven Morrison and Alex McNeil Summary ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk

- 18. Summary ŌĆó Simulation-based measures of risk capital, e.g. VaR, are subject to statistical uncertainty ŌĆó Extreme Value Theory provides a robust method for estimating VaR ŌĆō Allows statistical uncertainty to be estimated ŌĆō Statistical uncertainty lower than ŌĆ×na├»veŌƤ quantile estimation ŌĆō Provides an estimate of entire tail of distribution, allowing estimate of more extreme VaR, CVaR etc. ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 17

- 19. Questions or comments? Expressions of individual views by members of The Actuarial Profession and its staff are encouraged. The views expressed in this presentation are those of the presenter. ┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk 18

![Estimated distributions using different scenario sets

(Extreme Value Theory method)

Initial set of 1,000 real-world

scenarios

ŌĆó 99.5% VaR = ┬Ż75.9m

ŌĆó 95% confidence interval =

[71.1m, 84.3m]

Second set of 1,000 real-

world scenarios

ŌĆó 99.5% VaR = ┬Ż77.8m

ŌĆó 95% confidence interval =

[72.2m, 87.7m]

┬® 2010 The Actuarial Profession ’é¤ www.actuaries.org.uk

15](https://image.slidesharecdn.com/f3part1-13170220924265-phpapp01-110926023050-phpapp01/85/Application-of-Extreme-Value-Theory-to-Risk-Capital-Estimation-16-320.jpg)