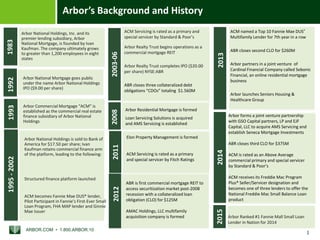

Arbor Businesses Timeline

- 1. ARBOR.COM âĒ 1.800.ARBOR.10 Arbor National Holdings, Inc. and its premier lending subsidiary, Arbor National Mortgage, is founded by Ivan Kaufman. The company ultimately grows to greater than 1,200 employees in eight states 1983 Arbor National Mortgage goes public under the name Arbor National Holdings IPO ($9.00 per share) 1992 2003 ACM named a Top 10 Fannie Mae DUSÂŪ Multifamily Lender for 7th year in a row ABR closes second CLO for $260M Arbor partners in a joint venture of Cardinal Financial Company called Sebonic Financial, an online residential mortgage business Arbor launches Seniors Housing & Healthcare Group 2013 Arbor Residential Mortgage is formed Loan Servicing Solutions is acquired and AMS Servicing is established 2008 2014 Arbor forms a joint venture partnership with GSO Capital partners, LP and EJF Capital, LLC to acquire AMS Servicing and establish Seneca Mortgage Investments ABR closes third CLO for $375M ACM is rated as an Above Average commercial primary and special servicer by Standard & Poorâs ACM receives its Freddie Mac Program PlusÂŪ Seller/Servicer designation and becomes one of three lenders to offer the National Freddie Mac Small Balance Loan product Arbor Commercial Mortgage âACMâ is established as the commercial real estate finance subsidiary of Arbor National Holdings 19931995-2002 Arbor National Holdings is sold to Bank of America for $17.50 per share; Ivan Kaufman retains commercial finance arm of the platform, leading to the following: Structured finance platform launched ACM becomes Fannie Mae DUSÂŪ lender, Pilot Participant in Fannieâs First-Ever Small Loan Program, FHA MAP lender and Ginnie Mae Issuer ACM Servicing is rated as a primary and special servicer by Standard & Poorâs Arbor Realty Trust begins operations as a commercial mortgage REIT Arbor Realty Trust completes IPO ($20.00 per share) NYSE:ABR ABR closes three collateralized debt obligations âCDOsâ totaling $1.560M 2003-06 Elon Property Management is formed ACM Servicing is rated as a primary and special servicer by Fitch Ratings 2011 ABR is first commercial mortgage REIT to access securitization market post-2008 recession with a collateralized loan obligation (CLO) for $125M AMAC Holdings, LLC multifamily acquisition company is formed 2012 Arborâs Background and History 1 2015 Arbor Ranked #1 Fannie Mall Small Loan Lender in Nation for 2014