Arriba Financial Services Overview May 2008

- 1. The trusted provider of financial services to the Hispanic market

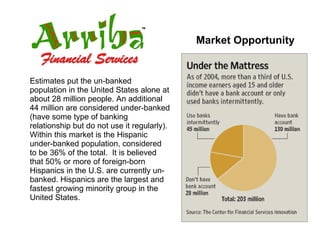

- 2. Market Opportunity Estimates put the un-banked population in the United States alone at about 28 million people. An additional 44 million are considered under-banked (have some type of banking relationship but do not use it regularly). Within this market is the Hispanic under-banked population, considered to be 36% of the total. It is believed that 50% or more of foreign-born Hispanics in the U.S. are currently un-banked. Hispanics are the largest and fastest growing minority group in the United States.

- 3. The Arriba Mission Arriba Financial Services, Inc. intends to become the international trusted provider of financial education and services to under-banked people. By combining education with innovative tools and services, the company can provide real value to this underserved segment of society, reducing their costs and increasing convenience.

- 4. Ability to Execute Arriba has assembled an international team of business, marketing and sales professionals from the US, Mexico, Columbia and Chile. Nobody has been able to own this market and no financial services provider has been able to become a partner of the Hispanic consumer. Our strategy to grow together with this community is not only admirable, but is relevant, courageous, aggressive, competitive and enduring.

- 5. Management Team Strong management team Jay Goth, experience starting and building companies Jim Oliver, Fortune 100 CFO experience Andre Doren, proven Hispanic marketing guru Bill Kincaid, technology expert in processing and networks Rafael Abdo, community marketing expert Two current high level executives from industry on board Brad Cates, advisor, former federal judge and AML expert

- 6. Step One Basic Services The company has obtained marketing rights to a check cashing platform that can incorporate identity verification and documentation through biometric (fingerprint), physical (photo) and documentary evidence. This platform reduces the risks and costs associated with cashing checks, thereby reducing the costs to the consumer. Arriba has incorporated bill payment into its check cashing platform to offer additional cost savings and convenience.

- 7. Step Two Education Along with financial services, financial education is extremely important and for the most part missing in the Hispanic community. The company has been invited by community groups and local outreach organizations to participate in educational seminars. Arriba will use information from both the FDIC and Freddie Mac as well as material developed in-house.

- 8. Step Three Additional Services Arriba will work with its platform provider to add new services to the check cashing system. The first additions will be money transfer, prepaid long distance and cellular service, closely followed by prepaid debit card loading. Consumers will be able to cash their checks, send money, pay bills and top up their prepaid devices at one convenient location.

- 9. Step Four The Arriba Card This prepaid debit card will take convenience and cost savings to a new level. With the Arriba card consumers can have their paychecks directly deposited to their card, avoiding check cashing fees entirely. They can pay their bills, transfer money, set up automatic payments and more from their home via telephone or Internet.

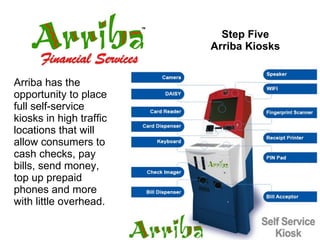

- 10. Step Five Arriba Kiosks Arriba has the opportunity to place full self-service kiosks in high traffic locations that will allow consumers to cash checks, pay bills, send money, top up prepaid phones and more with little overhead.

- 11. Step Six Arriba Finance Centers Arriba intends to open small manned service centers in strategic Hispanic-oriented sites. Many third party retailers and check cashers may wish to become Arriba Finance Centers.

- 12. Step Seven Franchising Once the company has successfully demonstrated the Finance Center concept, it intends to grow the network of Centers through franchising. Being able to offer a potential franchisee an exclusive territory with both manned Finance Centers and unmanned kiosks will allow the company to grow without expending internal resources.

- 13. Step Eight International While Arriba is building a customer base in the U.S. it will also begin building a base of customers in Latin America, beginning with remittance recipients and growing the company through payment network partners and financial service companies in those countries. Our management team is uniquely qualified to build and expand an international financial services giant that can leverage the exclusive brand of Arriba throughout the Latin markets.

- 14. Profit Opportunities Sales of check cashing platform Bill payment fees Prepaid debit cards Money transfer Cash advance Insurance Mortgage Real Estate Franchise Fees and Royalties Other value adds ŌĆō travel, Internet, Cellular, Long Dist.

- 15. Recap The business plan for Arriba allows the company to begin selling services to the market at low initial costs and build in value as it grows. Once the Arriba Cards and kiosks reach the market, the company can utilize direct selling, community marketing and the Internet to grow the brand nationally. The company can then leverage its brand to create a network of franchised Finance Centers, and at the same time build a large and valuable database of consumers that will be receptive to cross-selling offers.

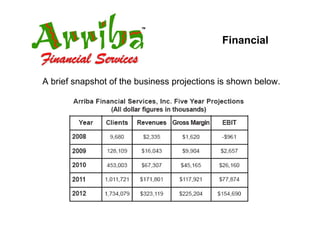

- 16. Financial A brief snapshot of the business projections is shown below.

- 17. Contact For More Information Jay Goth, CEO 951-704-6792 This presentation contains information that management believes to be true. All forward-looking statements reflect our current views about future results of operations and other forward-looking information. You should not rely on forward-looking statements because our actual results may differ materially from those indicated by these forward-looking statements as a result of a number of important factors. We encourage any prospective investor to perform their own due diligence prior to investing in the company. This presentation is not an offering to sell nor a solicitation of an offer to sell securities to any persons who are not qualified to purchase. Common stock in Arriba Financial Services, Inc. is only offered to qualified accredited investors. Any projections of future sales, earnings, expenses and dividends are projections only and are not based upon any historical factors. Any persons interested in learning more about our company must contact Jay Goth.