AS_Company_inv_eng_100414_Resume

- 1. Technical service and spare parts distribution

- 2. Business overview Company Agro-Soyuz is a multibrand technician reliable after- sales services and spare parts provider. We support technical professionals to face the challenges everyday. The company collaborates with more than 20000 ag companies, farmers, manufacturing, transport, mining companies in Ukraine to help them become high-performance business.

- 3. History 1991 ŌĆō Founded distribution business of spare parts for agricultural machinery and trucks 1992- Opened first branches in Ukraine. 1993 - Established delivery department. Service range grew with delivery spare parts to all clients. 1994-2001 ŌĆō Expanding branch net throughout Ukraine. 2003 - Started export operations of agricultural spare parts to Europe 2004 - Put into operations logistic center ŌĆ£Agro-Star LogisticŌĆØ (20 000 sq.m.) 2005 ŌĆō Established department of after-sales services of agricultural machinery 2008 ŌĆō Redesigned the biggest branches into Spare parts supermarkets. Expanded brand portfolio with HANIA, HOWO, Buhler Versatile. 2009-2013 ŌĆō Became official distributor of KAMAZ. Expanded products range, network of after-sales services centers in Ukraine.

- 4. Service and distribution in numbers Foundation ŌĆō 1991 Product range ŌĆō 24 000 SKU Supply network ŌĆō more than 800 partners Orders per day ŌĆō 1 000 Customers ŌĆō 24 000 Revenue ŌĆō Stock ŌĆō Coverage ŌĆō 24 from 27 regions, 51 branch offices Sales staff ŌĆō 217 people Service teams ŌĆō 15

- 5. Ukraine: facts and figures ŌĆó Total area 603ŌĆÖ550 sq. km (71,2% agricultural area) ŌĆó 27% of world black soils located in Ukraine ŌĆó Potential capability to feed 600 mio people in the world ŌĆó Corn export - 2nd place in the world ŌĆó Sunflower oil export - 1st place in the world ŌĆó 32 mio Ha arable area, 19 mio Ha is employed in agriculture operations

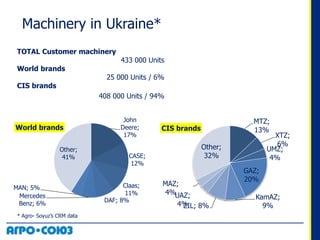

- 6. Agricultural business trends ŌĆó M&A deal as the main way of horizontal integration for agricultural holdings with farmland over 50 000 Ha. ŌĆó Strategic goals of customers are: ŌĆō to increase profit per hectare, ŌĆō to enhance business performance. ŌĆó Enlargement land banks by middle size customers from 20 000 Ha to 50 000 Ha. ŌĆó Cluster (division) management system expansion. ŌĆó IT systems implementation for human factor minimizing. ŌĆó Agricultural machinery performance improvement. ŌĆó Majority of agricultural machinery (94%) is still locally produced (CIS production), but international brands presence is growing every year and process of equipment renovation is going. ŌĆó Shortage of agricultural machinery and average deprecation rate is between 60 and 70% of total agricultural machinery. ŌĆó Lack of qualified staff on the field and in operational top and middle management. ŌĆó Vertical integration as part of customers strategy ŌĆ£field ŌĆō granary ŌĆō processing ŌĆō retail shelfŌĆØ. ŌĆó Sustainable growth on logistic service market for agricultural commodities.

- 7. Agricultural market overview Farmland (ths.Ha) Segment name Management system Machinery depreciation From To 0,5 12,0 Small ag producer Usually single owner, who is CEO. He takes responsibility for lots questions. His duties are technology, machinery, sale, supply and other More than 70% depreciation rate. Rare machinery renovation. 12,0 30,0 Middle ag producer Companies have 2-level of management system. Owner and farms. Nearby several farms are consolidated in company. Budgeting presents. More than 70% depreciation rate. Every 3 year machinery renovation. 30,0 + Holding Holding companies. Farmlands are deversified on Ukraine. Companies have 2-level and 3-level of management system. Burocracy system. Strategy presents.High stuff turnover on middle and top levels. More than 50% depreciation rate. Every year machinery renovation. 2 793 7 519 91 112655 17 043 1 668 7 634 From 0 ths.Ha To ths.Ha 0,5 From 0,5 ths.Ha To ths.Ha 12 From 12 ths.Ha To ths.Ha 30 30 ths.Ha + Customer segmentation Quantity of agricultural companies, pcs. Farmland, ths.Ha

- 8. Machinery in Ukraine* * Agro- SoyuzŌĆÖs CRM data TOTAL Customer machinery 433 000 Units World brands 25 000 Units / 6% CIS brands 408 000 Units / 94% John Deere; 17% CASE; 12% Claas; 11% DAF; 8% Mercedes Benz; 6% MAN; 5% Other; 41% World brands MTZ; 13% XTZ; 6% UMZ; 4% GAZ; 20% KamAZ; 9%ZIL; 8% UAZ; 4% MAZ; 4% Other; 32% CIS brands

- 9. Competitive environment Ukrainian ag machinery market has a high potential value growth according to forecasts (market growth 8-12% annually) of world machinery brands (JD, CNH, AGCO etc). They have expanded dealers networks in Ukraine. There are present original and replacement spare parts. Also there are national producers and distributors of CIS ag machinery and trucks (Technotorg, Omegaavtopostavka, Ukravtozapchast). They could be also dealers of world brands. Market is flooded with contraband of spare parts. Market consists of big number of small local companies who provides spare parts for ag machinery and trucks. After-sales services have poor quality. Approximately market value of ag machinery spare parts and after-sales services is 250 mio Ōé¼ per year. Company Products Brands John Deere and dealers Ag machinery + spare parts + services John Deere CNH and dealers Ag machinery + spare parts + services Case , New Holland AGCO and dealers Ag machinery + spare parts + services Fendt, Challenger, Massey Fergusson Technotorg Ag machinery + truck + spare parts + services KamAZ, MTZ, XTZ, Rostselmash, New Holland OmegaAvtoPostavka Spare parts for cars and trucks GAZ, KamAZ, KAMA, DK UkrAvtoZapchast Ag machinery + truck + spare parts + services MTZ, Foton, KamAZ

- 10. Value proposition Providing sustainable performance customerŌĆÖs technician system Wide range of ag and truck spare parts Exceptional delivery services After-sale services

- 11. Value network Producer OE dealer Non-OE dealer AGRO- SOYUZ Own retail Whole seller End customer Key account - End customer

- 12. Customers groups Database 24 100 customers 12 900 ŌĆō Active base 11 200 ŌĆō Non-Active base* 5 600 ŌĆō Ag. 7 300 ŌĆō Other 5 400 ŌĆō Ag. 5 800 ŌĆō Other 54% 23% 31% 46% 22% 24% * Non-active base ŌĆō customers were out of orders in 2013 Focus on Agriculture Second priority Manufacturing Transport Utilities Development Mining Service stations

- 13. Agro-SoyuzŌĆÖs deliverable stock in 2013 CIS's brands stock items Share, % Other brands 49% Universal items 15% GAZ 14% ąÜą░ą╝ąÉZ 10% YAMZ, ą£ąÉZ 6% ą£ąóZ 6% TOTAL stock 25 267 SKU * Items are used with different equipment 4413 6911 16543 CIS's brands stock items World's brands stock items Universal items*

- 14. Management team Position Name Education Experience CEO Alexander Zhuk KIBIT (MBA) Former CEO Sea Group Director Andrey Korneev State inst. of management of education Former CEO Sea Trade Director Vitaliy Krytin Dnepropetrovsk state agriculture university Former Head of analytical dep. Agro-Soyuz Director Oleg Barzion State inst. aftergraduate education Former CFO of Pharmacy distribution company Director Dmitriy Iyevlyev KMBS (MBA) Former Board Member JSC ŌĆ£Plant ŌĆ£FregatŌĆØ

- 15. Core strengths ŌĆó Individual approach to the customer ŌĆó Brand awareness (23 year on Ukraine market) ŌĆó Closer to end customer (~ 24 thousand clients) ŌĆó CIS machinery product expertise ŌĆó Synergy (spare parts + after-sales services + technical support) ŌĆó Logistics (35 000 m2 warehouses in Ukraine regions) ŌĆó Transparency (auditing financial statements) ŌĆó Equity structure (Horizon Capital)

- 16. Mission We are connecting suppliers network through wide retail chain to technician professionals to provide them products and services in responsiveness and convenient way through IT platform, using individual approach.

- 17. Strategy 1) Expand range of deliverable stock of original and replacement spare parts for world brand machinery according to projected demand. 2) Improve product range management system and implement new logistics system. 3) Develop on-line tools for increasing customer usability of ordering system. 4) Expand after-sales service range and geography. 5) Develop online monitoring platform to improve service performance. 6) Implement key account management approach.