ASPE Mandatory Filing Dates for Canadian Corporations

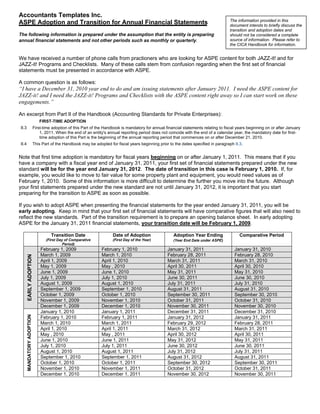

- 1. Accountants Templates Inc. The information provided in this ASPE Adoption and Transition for Annual Financial Statements document intends to briefly discuss the transition and adoption dates and The following information is prepared under the assumption that the entity is preparing should not be considered a complete annual financial statements and not other periods such as monthly or quarterly. source of information. Please refer to the CICA Handbook for information. We have received a number of phone calls from practioners who are looking for ASPE content for both JAZZ-it! and for JAZZ-it! Programs and Checklists. Many of these calls stem from confusion regarding when the first set of financial statements must be presented in accordance with ASPE. A common question is as follows: ŌĆ£I have a December 31, 2010 year end to do and am issuing statements after January 2011. I need the ASPE content for JAZZ-it! and I need the JAZZ-it! Programs and Checklists with the ASPE content right away so I can start work on these engagements.ŌĆØ An excerpt from Part II of the Handbook (Accounting Standards for Private Enterprises): FIRST-TIME ADOPTION II.3 First-time adoption of this Part of the Handbook is mandatory for annual financial statements relating to fiscal years beginning on or after January 1, 2011. When the end of an entity's annual reporting period does not coincide with the end of a calendar year, the mandatory date for first- time adoption of this Part is the beginning of the annual reporting period that commences on or after December 21, 2010. II.4 This Part of the Handbook may be adopted for fiscal years beginning prior to the dates specified in paragraph II.3. Note that first time adoption is mandatory for fiscal years beginning on or after January 1, 2011. This means that if you have a company with a fiscal year end of January 31, 2011, your first set of financial statements prepared under the new standard will be for the year end January 31, 2012. The date of transition in this case is February 1, 2010. If, for example, you would like to move to fair value for some property plant and equipment, you would need values as of February 1, 2010. Some of this information is more difficult to determine the further you move into the future. Although your first statements prepared under the new standard are not until January 31, 2012, it is important that you start preparing for the transition to ASPE as soon as possible. If you wish to adopt ASPE when presenting the financial statements for the year ended January 31, 2011, you will be early adopting. Keep in mind that your first set of financial statements will have comparative figures that will also need to reflect the new standards. Part of the transition requirement is to prepare an opening balance sheet. In early adopting ASPE for the January 31, 2011 financial statements, your transition date will be February 1, 2009. Transition Date Date of Adoption Adoption Year Ending Comparative Period (First Day of Comparative (First Day of the Year) (Year End Date under ASPE) Period) February 1, 2009 February 1, 2010 January 31, 2011 January 31, 2010 March 1, 2009 March 1, 2010 February 28, 2011 February 28, 2010 EARLY ADOPTION April 1, 2009 April 1, 2010 March 31, 2011 March 31, 2010 May 1, 2009 May , 2010 April 30, 2011 April 30, 2010 June 1, 2009 June 1, 2010 May 31, 2011 May 31, 2010 July 1, 2009 July 1, 2010 June 30, 2011 June 30, 2010 August 1, 2009 August 1, 2010 July 31, 2011 July 31, 2010 September 1, 2009 September 1, 2010 August 31, 2011 August 31, 2010 October 1, 2009 October 1, 2010 September 30, 2011 September 30, 2010 November 1, 2009 November 1, 2010 October 31, 2011 October 31, 2010 December 1, 2009 December 1, 2010 November 30, 2011 November 30, 2010 January 1, 2010 January 1, 2011 December 31, 2011 December 31, 2010 MANDATORY ADOPTION February 1, 2010 February 1, 2011 January 31, 2012 January 31, 2011 March 1, 2010 March 1, 2011 February 29, 2012 February 28, 2011 April 1, 2010 April 1, 2011 March 31, 2012 March 31, 2011 May , 2010 May , 2011 April 30, 2012 April 30, 2011 June 1, 2010 June 1, 2011 May 31, 2012 May 31, 2011 July 1, 2010 July 1, 2011 June 30, 2012 June 30, 2011 August 1, 2010 August 1, 2011 July 31, 2012 July 31, 2011 September 1, 2010 September 1, 2011 August 31, 2012 August 31, 2011 October 1, 2010 October 1, 2011 September 30, 2012 September 30, 2011 November 1, 2010 November 1, 2011 October 31, 2012 October 31, 2011 December 1, 2010 December 1, 2011 November 30, 2012 November 30, 2011