ATm Machine Presentaion of Progaramming Fundamentals

Download as PPTX, PDF0 likes7 views

Here is a detailed presentation on ATM machine presentation

1 of 10

Download to read offline

Recommended

Out sources of atm

Out sources of atmDharmik

╠²

This document provides information about ATMs, including their history, structure, and uses. It discusses how ATMs work, allowing customers to access cash 24/7 without human intervention. The key components of an ATM are described as the processor, consumer interface panel, card reader, printers, dispenser, and depositor. Alternative uses of ATMs beyond cash withdrawal are also mentioned, such as depositing, checking balances, and transferring funds.E010313141

E010313141IOSR Journals

╠²

This document summarizes a research paper on developing a multi-account embedded ATM card with enhanced security. Key points include:

1) The proposed system would embed multiple bank accounts onto a single smart ATM card, allowing customers to access all accounts from any ATM without carrying multiple cards.

2) Security would be enhanced through fingerprint authentication instead of just a PIN. A fingerprint scanner would be integrated into the ATM to verify customers' identities.

3) This would provide more convenience for customers while reducing fraud risks compared to traditional single-account cards authenticated solely with PINs.Automated Teller Machine

Automated Teller MachineDiotima Gupta

╠²

The document provides an overview of automated teller machines (ATMs). It discusses what an ATM is, the history and growth of ATMs, their functions and structure. Key points covered include that an ATM allows customers to access financial transactions without a human clerk, the first ATM was installed in 1967 in London, and ATMs now number in the millions worldwide. Functions of ATMs include withdrawing cash, checking balances, paying bills and transferring funds. Common ATM components are also outlined such as card readers, displays, cash dispensers and receipt printers.205 fmbounit 5b

205 fmbounit 5bASM's IBMR- Chinchwad

╠²

Concepts in Banking and Accounting of transactions: Accounting in banks, Electronic Banking, RTGS, ATM, MICR,

OCR, OMR, and DATANET, Petty Cash, Electronic Clearing Service (ECS), National Electronic Funds Transfer (NEFT) System,

Real Time Gross Settlement (RTGS) System, IMPS.ATM Security

ATM SecurityRoushan Jha

╠²

The document discusses the key components and security features of an ATM system. It describes the parts of an ATM like the card reader, keypad, display screen and cash dispenser. It explains how ATMs connect to a host computer and database to authenticate users and process transactions. The document outlines security measures like physical security of the machine, limits on withdrawal amounts, authentication of users, ensuring data integrity and confidentiality when transmitted over the network. It emphasizes the importance of keeping PINs secure and reporting lost cards. In conclusion, it notes how ATMs have become widely used globally for their convenience of allowing cash access anytime without human assistance.Atm

AtmVinoth Kumar

╠²

The document discusses the functions and evolution of automated teller machines (ATMs). It describes how ATMs allow customers to withdraw cash, check balances, make deposits, transfer funds between accounts, and complete other banking transactions. It also outlines some of the technical components of ATMs including hardware, software, and international usage statistics. The conclusion is that ATMs provide a convenient, reliable, and secure way for customers to complete banking transactions anytime.Cash Is Still King: ATM market research '2023

Cash Is Still King: ATM market research '2023Vladislav Solodkiy

╠²

Cash May Not Be King, but It's Still Royalty. ATMaaS for 350+ digital banks and e-wallets (crypto-, digital identity projects, border control, airport&hotel check-in, even offline-to-online voting on elections) by Nansen.ID. More pics&images here: https://l.Nansen.id/smartATMATM and E- Banking

ATM and E- BankingAniketPujari

╠²

The document discusses the history and features of automatic teller machines (ATMs). It begins by explaining how ATMs provide convenient banking access for customers 24/7. It then describes the basic functions of an ATM and how customers can deposit, withdraw, and check balances without bank employees. The document outlines the origins of the first ATM in the 1960s and its growth. It also covers the types of ATMs, how to use an ATM, the advantages and disadvantages, and newer technologies like biometric authentication and real-time gross settlement systems.Atm Research

Atm Research ┘ģžŁ┘ģ┘łž» ┘üž▒ž║┘ä┘Ŗ

╠²

An ATM, or automated teller machine, allows customers to access financial transactions without a human clerk by using a card with a magnetic stripe or chip containing account information and a personal identification number for security. Key functions of ATMs include withdrawing cash, checking balances, transferring funds between accounts, and paying bills. The first ATM was installed in 1967 in London, and the modern networked ATM was invented in 1968 in Dallas, Texas. ATMs consist of components like card readers, keypads, displays, receipt printers, and cash dispensers to complete transactions.ATM2.pdf.pdf

ATM2.pdf.pdfRashmibansal15

╠²

This research paper analyzes ATM fraud, including cash withdrawal fraud, fund transfer fraud, password hacking, and pin misplacement. The paper proposes combining biometric identification like thumbprint scans with PINs to authenticate ATM users and reduce fraud. Currently, fraudsters can use stolen card information and PINs obtained through phishing emails to commit ATM fraud. The paper suggests designing ATMs with integrated biometric scanners without slowing down transaction speeds to strengthen security.Mahnoor p1

Mahnoor p1Mah Noor

╠²

Banks use different types of computers to seamlessly provide services to customers. A mainframe computer located at the bank is used to store all customer data and coordinate interactions between systems. Individual computers like ATMs and teller terminals are linked to the mainframe and allow customers to access their accounts remotely. Scanners are also used to convert documents like checks or identification cards into digital formats for processing.IRJET- Artificial Intelligence based Smart ATM

IRJET- Artificial Intelligence based Smart ATMIRJET Journal

╠²

This document proposes an artificial intelligence-based smart ATM system with enhanced security features. It summarizes existing ATM security issues and proposes adding biometric authentication using fingerprints instead of cards and PINs. The proposed system uses AI for easy user interaction, image processing to detect issues like insufficient funds, and additional security measures like automatic door locking, alerts to law enforcement, and limiting the number of users in the ATM area at one time. The goal is to add multiple layers of security to reduce ATM fraud and theft compared to existing card-and-PIN based systems.Concepts of Digital Banking

Concepts of Digital BankingAbinayaS31

╠²

The document defines key terms related to digital banking such as digitization, digitalization, and digital transformation. It explains that digital banking utilizes digital technologies like analytics, social media, payments, and mobile to enhance traditional online and mobile banking services. The main channels of digital banking are described as ATMs, mobile/internet banking, cards, cash machines, and more. The document provides details on the input/output components of ATMs, how ATM networks function to process transactions, and the basic steps for withdrawing money from an ATM.Atm (bm)

Atm (bm)Neha Patel

╠²

The document provides information about Automated Teller Machines (ATMs) in India, including their history, how they work, security measures, and benefits. It notes that ATMs were first introduced in 1967 in London and have since gained prominence as a delivery channel for banking in India. The number of ATMs in India has grown significantly in recent years and is expected to continue growing.Area of impact -banking and finance

Area of impact -banking and financeJia

╠²

EFT (Electronic Funds Transfer) allows transferring money between bank accounts electronically without paper money changing hands. It is used for payments, refunds, withdrawals, deposits and more. To perform EFT, one must have a bank account and register online for the service. Major banks provide EFT services for customers. Benefits include reduced transaction times and no paperwork, while disadvantages include potential for private information release and lack of human interaction. Security is ensured through unique login credentials and dedicated online gateways.Automated taller machine (atm)

Automated taller machine (atm)amanjit9306

╠²

ATMs allow bank account holders to access their accounts and perform transactions without interacting with bank staff. An ATM uses a customer's plastic card with a magnetic strip containing their account information to identify them. The first ATM was installed in London in 1967. There are now over 1.8 million ATMs globally. ATMs provide convenience for customers as they offer 24/7 access to accounts and can be found in many public locations. However, they also pose security risks if cards are stolen and fees are sometimes charged. An ATM consists of components like a CPU, magnetic card reader, display, function keys and vault to control transactions securely.E banking-130826111407-phpapp01

E banking-130826111407-phpapp01haris ali

╠²

The presentation discusses e-banking and was presented by group members Haris Ali Jamshaid, Zohaib Ali Jamshaid, Anas Bhatti, Bilal Arshad, and Bakth Shah. It provides a history of e-banking beginning in the 1980s and defines an e-bank as providing banking services virtually through technologies like internet banking, ATMs, smart cards, and phone banking. The presentation outlines electronic delivery channels for banking including ATMs, smart cards, telebanking, and internet banking and discusses the advantages and limitations of e-banking.Mordern banking technologies

Mordern banking technologiesParvathy Ashok

╠²

The document discusses various modern banking technologies and payment systems including e-banking, internet banking, electronic payment systems, ATMs, credit and debit cards, smart cards, electronic signatures, MICR cheques, EFTS, RTGS, and core banking. It provides details on how each technology works and the benefits they provide to both banks and customers like improved efficiency, faster transactions, and 24/7 banking access.Enhancing security features

Enhancing security featuresNana Kwame(Emeritus) Gyamfi

╠²

This document discusses enhancing security features for automated teller machines (ATMs) from a Ghanaian perspective. It proposes using biometric authentication, like fingerprint scanning, instead of personal identification numbers (PINs) for ATM access. The document provides an overview of common ATM fraud and recommends approaches to prevent fraud, including developing a prototype biometrically equipped ATM model. It notes that ATMs in Ghanaian banks currently do not use biometric technology, so the research aims to increase security.ATM / Electronic Clearing Service

ATM / Electronic Clearing ServiceANANDHU BALAN

╠²

An ATM, or automated teller machine, allows customers to access their bank accounts and perform transactions without a human bank teller. Customers insert their debit or credit card and enter their PIN to access their accounts. Using an ATM, customers can withdraw cash, check balances, transfer funds between accounts, and perform other banking tasks. ATMs are connected to financial networks so customers can access their funds from machines not owned by their bank. Estimates show there are over 2.2 million ATMs globally, providing convenient banking access.Ijcsi 9-4-2-457-462

Ijcsi 9-4-2-457-462Hai Nguyen

╠²

This document discusses two-factor authentication in the banking sector, specifically evaluating its performance for automated teller machines (ATMs). It provides background on ATMs, including a brief history of their development from the late 1960s onward. It describes how two-factor authentication works for ATM transactions, requiring both the physical ATM card and a personal identification number (PIN). The document examines different factors of authentication and classifications of factors into things the user has, knows, and is (biometrics).Banking law & and operation

Banking law & and operationMadhu Sudan S

╠²

The document summarizes various banking innovations including new technologies like e-banking, debit/credit cards, internet banking, ATMs, and electronic fund transfers. It discusses these innovations and how they have modernized banking by allowing customers to perform transactions remotely without visiting a branch in person. Traditional banking is compared to e-banking and various electronic delivery channels like ATMs, smart cards, telephone banking, and internet banking are explained.An atm with an eye

An atm with an eyeChand Pasha

╠²

This document discusses adding facial recognition technology to ATMs. It proposes combining a physical access card, PIN, and facial recognition for added security. The main challenges are keeping verification time negligible, allowing for variation in a customer's face, and enabling credit card use without banks having customer photos. Facial recognition could match a live image to one stored in a bank database associated with the account, neutralizing stolen card and PIN fraud. With appropriate lighting and software, variations could be accounted for, and additional images stored over time to decrease false negatives. This added security could reduce theft by bank employees and the impact of stolen cards and PINs.Ppt

PptShashank Bhat

╠²

Bank computerization in India increased after economic liberalization in 1991. The Reserve Bank of India set up committees in 1984 and 1988 to define banking technology standards and coordinate computerization efforts. The 1984 committee recommended introducing MICR technology and standardized cheque forms. The 1988 committee emphasized computerizing clearing house settlement operations and increasing branch connectivity through computers. Automated teller machines allow customers to perform basic transactions without a bank representative. Customers use an ATM card and PIN for authentication. ATMs make cash available 24/7 and are part of interbank networks. HSBC introduced the first ATM in India in 1987. Electronic clearing service is an electronic funds transfer between bank accounts, used for payments like salaries, dividends, and loanPpt on atm machine

Ppt on atm machinePrabhat Singh

╠²

The document provides information about ATM machines, including:

- It describes the basic functions of an ATM machine and how customers can access their bank accounts and perform transactions even when the bank is closed.

- It discusses the history and development of the first ATM machines in the late 1960s.

- It outlines the key components of an ATM machine, including the card reader, host processor, keypad/touchscreen, screen, receipt printer, cash dispenser, and their basic functions.

- It briefly explains how ATM machines connect to host processors and bank servers to authorize transactions and access customer account information.Innovation of Products & Services in Banking

Innovation of Products & Services in BankingSaad Sair

╠²

The document discusses the innovations in the Pakistani banking industry brought about by information technology. It outlines various digital banking services that have emerged, including automated teller machines (ATMs), point of sale (POS) terminals, mobile banking, smart cards, online and offline debit cards, and e-banking/internet banking. It also mentions several examples of Pakistani banks adopting new technologies or partnering with telecom companies to expand digital services.Biometric ATM2.docx

Biometric ATM2.docxKanchanRaut13

╠²

1) The document proposes a smart ATM security system using face recognition to authenticate users. It notes that current ATM security methods have limitations and fraud is a growing issue.

2) The proposed system uses a fingerprint module and camera on the ATM to verify a user's fingerprint and face match what is on file before allowing transactions. If an unauthorized person tries to use the card, their image and one-time password will be sent to the cardholder.

3) The system is controlled with a Raspberry Pi and aims to prevent ATM theft, fraud, and support secure transactions by only allowing authorized users after biometric verification.Presentationonsecurityfeatureofatm2 130621034116-phpapp02

Presentationonsecurityfeatureofatm2 130621034116-phpapp02Divyaprathapraju Divyaprathapraju

╠²

The document discusses the security features of ATM systems. It describes how ATMs work by having customers authenticate using cards and PINs. ATM security relies on crypto-processors, database security, and network security. It provides security through mechanisms like time-outs for invalid PIN entries and recognizing stolen cards. Additional security features include identity verification, data confidentiality, accountability, and audit capabilities. The document emphasizes the importance of keeping ATM cards and PINs secure and reporting any loss or theft.Industrial Valves, Instruments Products Profile

Industrial Valves, Instruments Products Profilezebcoeng

╠²

WeŌĆÖre excited to share our product profile, showcasing our expertise in Industrial Valves, Instrumentation, and Hydraulic & Pneumatic Solutions.

We also supply API-approved valves from globally trusted brands, ensuring top-notch quality and internationally certified solutions. LetŌĆÖs explore valuable business opportunities together!

We specialize in:

ŌĆó Industrial Valves (Gate, Globe, Ball, Butterfly, Check)

ŌĆó Instrumentation (Pressure Gauges, Transmitters, Flow Meters)

ŌĆó Pneumatic Products (Cylinders, Solenoid Valves, Fittings)

As authorized partners of trusted global brands, we deliver high-quality solutions tailored to meet your industrial needs with seamless support.Engineering at Lovely Professional University (LPU).pdf

Engineering at Lovely Professional University (LPU).pdfSona

╠²

LPUŌĆÖs engineering programs provide students with the skills and knowledge to excel in the rapidly evolving tech industry, ensuring a bright and successful future. With world-class infrastructure, top-tier placements, and global exposure, LPU stands as a premier destination for aspiring engineers.More Related Content

Similar to ATm Machine Presentaion of Progaramming Fundamentals (20)

Atm Research

Atm Research ┘ģžŁ┘ģ┘łž» ┘üž▒ž║┘ä┘Ŗ

╠²

An ATM, or automated teller machine, allows customers to access financial transactions without a human clerk by using a card with a magnetic stripe or chip containing account information and a personal identification number for security. Key functions of ATMs include withdrawing cash, checking balances, transferring funds between accounts, and paying bills. The first ATM was installed in 1967 in London, and the modern networked ATM was invented in 1968 in Dallas, Texas. ATMs consist of components like card readers, keypads, displays, receipt printers, and cash dispensers to complete transactions.ATM2.pdf.pdf

ATM2.pdf.pdfRashmibansal15

╠²

This research paper analyzes ATM fraud, including cash withdrawal fraud, fund transfer fraud, password hacking, and pin misplacement. The paper proposes combining biometric identification like thumbprint scans with PINs to authenticate ATM users and reduce fraud. Currently, fraudsters can use stolen card information and PINs obtained through phishing emails to commit ATM fraud. The paper suggests designing ATMs with integrated biometric scanners without slowing down transaction speeds to strengthen security.Mahnoor p1

Mahnoor p1Mah Noor

╠²

Banks use different types of computers to seamlessly provide services to customers. A mainframe computer located at the bank is used to store all customer data and coordinate interactions between systems. Individual computers like ATMs and teller terminals are linked to the mainframe and allow customers to access their accounts remotely. Scanners are also used to convert documents like checks or identification cards into digital formats for processing.IRJET- Artificial Intelligence based Smart ATM

IRJET- Artificial Intelligence based Smart ATMIRJET Journal

╠²

This document proposes an artificial intelligence-based smart ATM system with enhanced security features. It summarizes existing ATM security issues and proposes adding biometric authentication using fingerprints instead of cards and PINs. The proposed system uses AI for easy user interaction, image processing to detect issues like insufficient funds, and additional security measures like automatic door locking, alerts to law enforcement, and limiting the number of users in the ATM area at one time. The goal is to add multiple layers of security to reduce ATM fraud and theft compared to existing card-and-PIN based systems.Concepts of Digital Banking

Concepts of Digital BankingAbinayaS31

╠²

The document defines key terms related to digital banking such as digitization, digitalization, and digital transformation. It explains that digital banking utilizes digital technologies like analytics, social media, payments, and mobile to enhance traditional online and mobile banking services. The main channels of digital banking are described as ATMs, mobile/internet banking, cards, cash machines, and more. The document provides details on the input/output components of ATMs, how ATM networks function to process transactions, and the basic steps for withdrawing money from an ATM.Atm (bm)

Atm (bm)Neha Patel

╠²

The document provides information about Automated Teller Machines (ATMs) in India, including their history, how they work, security measures, and benefits. It notes that ATMs were first introduced in 1967 in London and have since gained prominence as a delivery channel for banking in India. The number of ATMs in India has grown significantly in recent years and is expected to continue growing.Area of impact -banking and finance

Area of impact -banking and financeJia

╠²

EFT (Electronic Funds Transfer) allows transferring money between bank accounts electronically without paper money changing hands. It is used for payments, refunds, withdrawals, deposits and more. To perform EFT, one must have a bank account and register online for the service. Major banks provide EFT services for customers. Benefits include reduced transaction times and no paperwork, while disadvantages include potential for private information release and lack of human interaction. Security is ensured through unique login credentials and dedicated online gateways.Automated taller machine (atm)

Automated taller machine (atm)amanjit9306

╠²

ATMs allow bank account holders to access their accounts and perform transactions without interacting with bank staff. An ATM uses a customer's plastic card with a magnetic strip containing their account information to identify them. The first ATM was installed in London in 1967. There are now over 1.8 million ATMs globally. ATMs provide convenience for customers as they offer 24/7 access to accounts and can be found in many public locations. However, they also pose security risks if cards are stolen and fees are sometimes charged. An ATM consists of components like a CPU, magnetic card reader, display, function keys and vault to control transactions securely.E banking-130826111407-phpapp01

E banking-130826111407-phpapp01haris ali

╠²

The presentation discusses e-banking and was presented by group members Haris Ali Jamshaid, Zohaib Ali Jamshaid, Anas Bhatti, Bilal Arshad, and Bakth Shah. It provides a history of e-banking beginning in the 1980s and defines an e-bank as providing banking services virtually through technologies like internet banking, ATMs, smart cards, and phone banking. The presentation outlines electronic delivery channels for banking including ATMs, smart cards, telebanking, and internet banking and discusses the advantages and limitations of e-banking.Mordern banking technologies

Mordern banking technologiesParvathy Ashok

╠²

The document discusses various modern banking technologies and payment systems including e-banking, internet banking, electronic payment systems, ATMs, credit and debit cards, smart cards, electronic signatures, MICR cheques, EFTS, RTGS, and core banking. It provides details on how each technology works and the benefits they provide to both banks and customers like improved efficiency, faster transactions, and 24/7 banking access.Enhancing security features

Enhancing security featuresNana Kwame(Emeritus) Gyamfi

╠²

This document discusses enhancing security features for automated teller machines (ATMs) from a Ghanaian perspective. It proposes using biometric authentication, like fingerprint scanning, instead of personal identification numbers (PINs) for ATM access. The document provides an overview of common ATM fraud and recommends approaches to prevent fraud, including developing a prototype biometrically equipped ATM model. It notes that ATMs in Ghanaian banks currently do not use biometric technology, so the research aims to increase security.ATM / Electronic Clearing Service

ATM / Electronic Clearing ServiceANANDHU BALAN

╠²

An ATM, or automated teller machine, allows customers to access their bank accounts and perform transactions without a human bank teller. Customers insert their debit or credit card and enter their PIN to access their accounts. Using an ATM, customers can withdraw cash, check balances, transfer funds between accounts, and perform other banking tasks. ATMs are connected to financial networks so customers can access their funds from machines not owned by their bank. Estimates show there are over 2.2 million ATMs globally, providing convenient banking access.Ijcsi 9-4-2-457-462

Ijcsi 9-4-2-457-462Hai Nguyen

╠²

This document discusses two-factor authentication in the banking sector, specifically evaluating its performance for automated teller machines (ATMs). It provides background on ATMs, including a brief history of their development from the late 1960s onward. It describes how two-factor authentication works for ATM transactions, requiring both the physical ATM card and a personal identification number (PIN). The document examines different factors of authentication and classifications of factors into things the user has, knows, and is (biometrics).Banking law & and operation

Banking law & and operationMadhu Sudan S

╠²

The document summarizes various banking innovations including new technologies like e-banking, debit/credit cards, internet banking, ATMs, and electronic fund transfers. It discusses these innovations and how they have modernized banking by allowing customers to perform transactions remotely without visiting a branch in person. Traditional banking is compared to e-banking and various electronic delivery channels like ATMs, smart cards, telephone banking, and internet banking are explained.An atm with an eye

An atm with an eyeChand Pasha

╠²

This document discusses adding facial recognition technology to ATMs. It proposes combining a physical access card, PIN, and facial recognition for added security. The main challenges are keeping verification time negligible, allowing for variation in a customer's face, and enabling credit card use without banks having customer photos. Facial recognition could match a live image to one stored in a bank database associated with the account, neutralizing stolen card and PIN fraud. With appropriate lighting and software, variations could be accounted for, and additional images stored over time to decrease false negatives. This added security could reduce theft by bank employees and the impact of stolen cards and PINs.Ppt

PptShashank Bhat

╠²

Bank computerization in India increased after economic liberalization in 1991. The Reserve Bank of India set up committees in 1984 and 1988 to define banking technology standards and coordinate computerization efforts. The 1984 committee recommended introducing MICR technology and standardized cheque forms. The 1988 committee emphasized computerizing clearing house settlement operations and increasing branch connectivity through computers. Automated teller machines allow customers to perform basic transactions without a bank representative. Customers use an ATM card and PIN for authentication. ATMs make cash available 24/7 and are part of interbank networks. HSBC introduced the first ATM in India in 1987. Electronic clearing service is an electronic funds transfer between bank accounts, used for payments like salaries, dividends, and loanPpt on atm machine

Ppt on atm machinePrabhat Singh

╠²

The document provides information about ATM machines, including:

- It describes the basic functions of an ATM machine and how customers can access their bank accounts and perform transactions even when the bank is closed.

- It discusses the history and development of the first ATM machines in the late 1960s.

- It outlines the key components of an ATM machine, including the card reader, host processor, keypad/touchscreen, screen, receipt printer, cash dispenser, and their basic functions.

- It briefly explains how ATM machines connect to host processors and bank servers to authorize transactions and access customer account information.Innovation of Products & Services in Banking

Innovation of Products & Services in BankingSaad Sair

╠²

The document discusses the innovations in the Pakistani banking industry brought about by information technology. It outlines various digital banking services that have emerged, including automated teller machines (ATMs), point of sale (POS) terminals, mobile banking, smart cards, online and offline debit cards, and e-banking/internet banking. It also mentions several examples of Pakistani banks adopting new technologies or partnering with telecom companies to expand digital services.Biometric ATM2.docx

Biometric ATM2.docxKanchanRaut13

╠²

1) The document proposes a smart ATM security system using face recognition to authenticate users. It notes that current ATM security methods have limitations and fraud is a growing issue.

2) The proposed system uses a fingerprint module and camera on the ATM to verify a user's fingerprint and face match what is on file before allowing transactions. If an unauthorized person tries to use the card, their image and one-time password will be sent to the cardholder.

3) The system is controlled with a Raspberry Pi and aims to prevent ATM theft, fraud, and support secure transactions by only allowing authorized users after biometric verification.Presentationonsecurityfeatureofatm2 130621034116-phpapp02

Presentationonsecurityfeatureofatm2 130621034116-phpapp02Divyaprathapraju Divyaprathapraju

╠²

The document discusses the security features of ATM systems. It describes how ATMs work by having customers authenticate using cards and PINs. ATM security relies on crypto-processors, database security, and network security. It provides security through mechanisms like time-outs for invalid PIN entries and recognizing stolen cards. Additional security features include identity verification, data confidentiality, accountability, and audit capabilities. The document emphasizes the importance of keeping ATM cards and PINs secure and reporting any loss or theft.Recently uploaded (20)

Industrial Valves, Instruments Products Profile

Industrial Valves, Instruments Products Profilezebcoeng

╠²

WeŌĆÖre excited to share our product profile, showcasing our expertise in Industrial Valves, Instrumentation, and Hydraulic & Pneumatic Solutions.

We also supply API-approved valves from globally trusted brands, ensuring top-notch quality and internationally certified solutions. LetŌĆÖs explore valuable business opportunities together!

We specialize in:

ŌĆó Industrial Valves (Gate, Globe, Ball, Butterfly, Check)

ŌĆó Instrumentation (Pressure Gauges, Transmitters, Flow Meters)

ŌĆó Pneumatic Products (Cylinders, Solenoid Valves, Fittings)

As authorized partners of trusted global brands, we deliver high-quality solutions tailored to meet your industrial needs with seamless support.Engineering at Lovely Professional University (LPU).pdf

Engineering at Lovely Professional University (LPU).pdfSona

╠²

LPUŌĆÖs engineering programs provide students with the skills and knowledge to excel in the rapidly evolving tech industry, ensuring a bright and successful future. With world-class infrastructure, top-tier placements, and global exposure, LPU stands as a premier destination for aspiring engineers.Air pollution is contamination of the indoor or outdoor environment by any ch...

Air pollution is contamination of the indoor or outdoor environment by any ch...dhanashree78

╠²

Air pollution is contamination of the indoor or outdoor environment by any chemical, physical or biological agent that modifies the natural characteristics of the atmosphere.

Household combustion devices, motor vehicles, industrial facilities and forest fires are common sources of air pollution. Pollutants of major public health concern include particulate matter, carbon monoxide, ozone, nitrogen dioxide and sulfur dioxide. Outdoor and indoor air pollution cause respiratory and other diseases and are important sources of morbidity and mortality.

WHO data show that almost all of the global population (99%) breathe air that exceeds WHO guideline limits and contains high levels of pollutants, with low- and middle-income countries suffering from the highest exposures.

Air quality is closely linked to the earthŌĆÖs climate and ecosystems globally. Many of the drivers of air pollution (i.e. combustion of fossil fuels) are also sources of greenhouse gas emissions. Policies to reduce air pollution, therefore, offer a win-win strategy for both climate and health, lowering the burden of disease attributable to air pollution, as well as contributing to the near- and long-term mitigation of climate change.

decarbonization steel industry rev1.pptx

decarbonization steel industry rev1.pptxgonzalezolabarriaped

╠²

Webinar Decarbonization steel industryautonomous vehicle project for engineering.pdf

autonomous vehicle project for engineering.pdfJyotiLohar6

╠²

autonomous vehicle project for engineeringUnit II: Design of Static Equipment Foundations

Unit II: Design of Static Equipment FoundationsSanjivani College of Engineering, Kopargaon

╠²

Design of Static Equipment, that is vertical vessels foundation.Multi objective genetic approach with Ranking

Multi objective genetic approach with Rankingnamisha18

╠²

Multi objective genetic approach with Ranking How to Make an RFID Door Lock System using Arduino

How to Make an RFID Door Lock System using ArduinoCircuitDigest

╠²

Learn how to build an RFID-based door lock system using Arduino to enhance security with contactless access control.UNIT 1FUNDAMENTALS OF OPERATING SYSTEMS.pptx

UNIT 1FUNDAMENTALS OF OPERATING SYSTEMS.pptxKesavanT10

╠²

UNIT 1FUNDAMENTALS OF OPERATING SYSTEMS.pptxOptimization of Cumulative Energy, Exergy Consumption and Environmental Life ...

Optimization of Cumulative Energy, Exergy Consumption and Environmental Life ...J. Agricultural Machinery

╠²

Optimal use of resources, including energy, is one of the most important principles in modern and sustainable agricultural systems. Exergy analysis and life cycle assessment were used to study the efficient use of inputs, energy consumption reduction, and various environmental effects in the corn production system in Lorestan province, Iran. The required data were collected from farmers in Lorestan province using random sampling. The Cobb-Douglas equation and data envelopment analysis were utilized for modeling and optimizing cumulative energy and exergy consumption (CEnC and CExC) and devising strategies to mitigate the environmental impacts of corn production. The Cobb-Douglas equation results revealed that electricity, diesel fuel, and N-fertilizer were the major contributors to CExC in the corn production system. According to the Data Envelopment Analysis (DEA) results, the average efficiency of all farms in terms of CExC was 94.7% in the CCR model and 97.8% in the BCC model. Furthermore, the results indicated that there was excessive consumption of inputs, particularly potassium and phosphate fertilizers. By adopting more suitable methods based on DEA of efficient farmers, it was possible to save 6.47, 10.42, 7.40, 13.32, 31.29, 3.25, and 6.78% in the exergy consumption of diesel fuel, electricity, machinery, chemical fertilizers, biocides, seeds, and irrigation, respectively. Lecture -3 Cold water supply system.pptx

Lecture -3 Cold water supply system.pptxrabiaatif2

╠²

The presentation on Cold Water Supply explored the fundamental principles of water distribution in buildings. It covered sources of cold water, including municipal supply, wells, and rainwater harvesting. Key components such as storage tanks, pipes, valves, and pumps were discussed for efficient water delivery. Various distribution systems, including direct and indirect supply methods, were analyzed for residential and commercial applications. The presentation emphasized water quality, pressure regulation, and contamination prevention. Common issues like pipe corrosion, leaks, and pressure drops were addressed along with maintenance strategies. Diagrams and case studies illustrated system layouts and best practices for optimal performance.Frankfurt University of Applied Science urkunde

Frankfurt University of Applied Science urkundeLisa Emerson

╠²

Duplicate Frankfurt University of Applied Science urkunde, make a Frankfurt UAS degree.15. Smart Cities Big Data, Civic Hackers, and the Quest for a New Utopia.pdf

15. Smart Cities Big Data, Civic Hackers, and the Quest for a New Utopia.pdfNgocThang9

╠²

Smart Cities Big Data, Civic Hackers, and the Quest for a New UtopiaAI, Tariffs and Supply Chains in Knowledge Graphs

AI, Tariffs and Supply Chains in Knowledge GraphsMax De Marzi

╠²

How tarrifs, supply chains and knowledge graphs combine.Gauges are a Pump's Best Friend - Troubleshooting and Operations - v.07

Gauges are a Pump's Best Friend - Troubleshooting and Operations - v.07Brian Gongol

╠²

No reputable doctor would try to conduct a basic physical exam without the help of a stethoscope. That's because the stethoscope is the best tool for gaining a basic "look" inside the key systems of the human body. Gauges perform a similar function for pumping systems, allowing technicians to "see" inside the pump without having to break anything open. Knowing what to do with the information gained takes practice and systemic thinking. This is a primer in how to do that.How Engineering Model Making Brings Designs to Life.pdf

How Engineering Model Making Brings Designs to Life.pdfMaadhu Creatives-Model Making Company

╠²

This PDF highlights how engineering model making helps turn designs into functional prototypes, aiding in visualization, testing, and refinement. It covers different types of models used in industries like architecture, automotive, and aerospace, emphasizing cost and time efficiency.Optimization of Cumulative Energy, Exergy Consumption and Environmental Life ...

Optimization of Cumulative Energy, Exergy Consumption and Environmental Life ...J. Agricultural Machinery

╠²

ATm Machine Presentaion of Progaramming Fundamentals

- 1. Hanzla 021 Haseeb 015 Anas 030 Talha 009 Uzair 020 Role of ATM machine in modern Banking Programming Fundamentals Lab

- 2. ATM Machines: A Vital Part of Modern Banking An ATM (Automated Teller Machine) is a self-service electronic device that allows users to perform a variety of banking transactions smoothly. It enables account holders to check their balances, withdraw or deposit cash, transfer money between accounts, and perform other banking services securely. ATMs are widely accessible and are designed to provide 24/7 access to banking services, offering convenience and efficiency for managing personal finances.

- 3. History of ATM Technology 1 Early Days The first ATM was introduced in London in 1967. It was developed by Barclays Bank and called the "Automatic Teller Machine." 2 Expansion and Innovation ATMs spread rapidly throughout the world in the 1970s and 1980s. New features such as card reader technology and PINs emerged. 3 Digital Transformation The rise of mobile banking and online payments has led to advancements in ATM technology, with enhanced security and interactive features.

- 4. Key Components of an ATM Card Reader Reads your debit or credit card and verifies your identity. Cash Dispenser Dispensers money from the vault through a secure mechanism. Keyboard and Screen Allows you to interact with the machine to make transactions. Communication Network Connects the ATM to the bank's computer system.

- 5. ATM Security Measures PIN Protection A personal identification number (PIN) protects your account from unauthorized access. Anti-Skimming Devices Skimming is a common method of stealing card information. Devices are deployed to prevent skimming. Surveillance Cameras Cameras deter criminals and aid in investigations if a crime occurs. Encryption Technology Data transmitted between the ATM and the bank is encrypted to protect against interception.

- 6. Transactions Facilitated by ATMs New User Registry New customers register by providing personal details and setting a PIN. Login Users can deposit cash into their account by entering amount to be deposited. Balance Inquiry Displays the current balance of the userŌĆÖs bank account after login. Deposit Users can transfer funds to another account by entering the recipientŌĆÖs account username. Users enter their credentials to access the system. Withdraw Send Money Users can withdraw cash from their account by entering the desired amount. Exit Logs the user out of the session securely

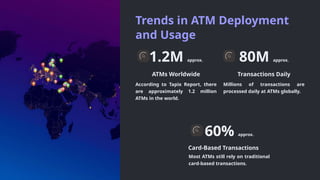

- 7. Trends in ATM Deployment and Usage 1.2M approx. ATMs Worldwide According to Tapix Report, there are approximately 1.2 million ATMs in the world. 80M approx. Transactions Daily Millions of transactions are processed daily at ATMs globally. 60% approx. Card-Based Transactions Most ATMs still rely on traditional card-based transactions.

- 8. Regulatory Landscape for ATMs 1 Consumer Protection Regulations ensure fair and transparent ATM fees. 2 Security Standards Regulations require ATMs to meet security standards to protect user data and money. 3 Accessibility Regulations promote accessibility for people with disabilities.

- 9. Challenges Facing the ATM Industry Rising Operational Costs Maintaining and securing ATMs is becoming increasingly expensive. Declining ATM Usage The rise of mobile and online banking is decreasing the reliance on ATMs. Fraud and Security Threats The ATM industry is constantly battling against new forms of fraud and security threats.

- 10. Conclusion ATM machines have revolutionized banking, offering a wide range of essential functions for convenient and secure financial transactions. Their user-friendly interface and advanced security measures make them indispensable tools for managing personal finances.