Seminar in Auditing - Shared Audits

- 2. TODAY WE WILL DISCUSS: ŌĆóNecessity of Auditors to Rely on Work of Other Auditors ŌĆóCurrent Requirements for Shared Audit Reports ŌĆóProblems with Current Requirements ŌĆóPossible Changes ŌĆóImplications ŌĆóConclusion / Future Model

- 3. TODAY WE WILL DISCUSS: ŌĆóNecessity of Auditors to Rely on Work of Other Auditors ŌĆóCurrent Requirements for Shared Audit Reports ŌĆóProblems with Current Requirements ŌĆóPossible Changes ŌĆóImplications ŌĆóConclusion / Future Model

- 4. Why Do Auditors Need to Rely on the Work of Other Auditors? GEOGRAPHY EXPERTISE HUMAN RESOURCES

- 5. TODAY WE WILL DISCUSS: ŌĆóNecessity of Auditors to Rely on Work of Other Auditors ŌĆóCurrent Requirements for Shared Audit Reports ŌĆóProblems with Current Requirements ŌĆóPossible Changes ŌĆóImplications ŌĆóConclusion / Future Model

- 6. Current Auditor Reporting Requirements Shared Audit Reports -Audit firm (principal auditor) or audit client may hire a subsidiary auditor to conduct part of an audit. -Principal auditor decides whether or not to mention work of subsidiary auditor in audit report. -Subsidiary auditorŌĆÖs name is usually not mentioned. -Wording is added to three standard paragraphs, no additional paragraph is required -End of introductory paragraph -End of scope paragraph -Beginning of opinion paragraph -Principal auditor can be subject to legal and regulatory action for work of subsidiary auditor.

- 7. TODAY WE WILL DISCUSS: ŌĆóNecessity of Auditors to Rely on Work of Other Auditors ŌĆóCurrent Requirements for Shared Audit Reports ŌĆóProblem with Current Requirements ŌĆóPossible Changes ŌĆóImplications ŌĆóConclusion / Future Model

- 8. GRANT THORNTON EXAMPLE- GRANT THORNTON AS SUBSIDIARY AUDITOR: Grant Thornton had been the auditor of Parmalat for several years until Italian law required the rotation of audit firms. Deloitte was then hired as principal auditor but Grant Thornton was kept on as a subsidiary auditor because of its familiarity of the business. Much of the fraud that had taken place in the company was hidden in these subsidiaries. Deloitte relied on the subsidiary audit of Grant Thornton and is now facing legal and regulatory action.

- 9. GRANT THORNTON EXAMPLE (CONTŌĆÖD)- GRANT THORNTON AS PRINCIPAL AUDITOR: The SEC has instituted fraud action against Grant Thornton related to the audit of MCA Financial CorporationŌĆÖs 1998 financial statements. The SEC claims Grant Thornton ŌĆ£rentedŌĆØ its name to the audit work of a smaller firm that did most of the work on the MCA audit. MCA had inflated its books by utilizing related party transactions. The fraud resulted in millions of dollars in losses by public investors.

- 10. TODAY WE WILL DISCUSS: ŌĆóNecessity of Auditors to Rely on Work of Other Auditors ŌĆóCurrent Requirements for Shared Audit Reports ŌĆóProblems with Current Requirements ŌĆóPossible Changes ŌĆóImplications ŌĆóConclusion / Future Model

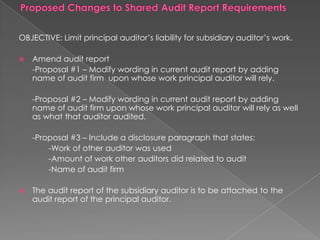

- 11. OBJECTIVE: Limit principal auditorŌĆÖs liability for subsidiary auditorŌĆÖs work. ’é× Amend audit report -Proposal #1 ŌĆō Modify wording in current audit report by adding name of audit firm upon whose work principal auditor will rely. -Proposal #2 ŌĆō Modify wording in current audit report by adding name of audit firm upon whose work principal auditor will rely as well as what that auditor audited. -Proposal #3 ŌĆō Include a disclosure paragraph that states: -Work of other auditor was used -Amount of work other auditors did related to audit -Name of audit firm ’é× The audit report of the subsidiary auditor is to be attached to the audit report of the principal auditor.

- 12. TODAY WE WILL DISCUSS: ŌĆóNecessity of Auditors to Rely on Work of Other Auditors ŌĆóCurrent Requirements for Shared Audit Reports ŌĆóProblems with Current Requirements ŌĆóPossible Changes ŌĆóImplications ŌĆóConclusion / Future Model

- 13. ’é× Implications: ŌĆ║ Principal ŌĆō may increase (or decrease) the reliability of opinion due to reputation of subsidiary ŌĆ║ Subsidiary ŌĆō slightly increases liability ŌĆ║ Investors ŌĆō slight increase in investor confidence of company ŌĆ║ Auditing industry ŌĆō hold subsidiary to higher standard

- 14. ’é× Implications: ŌĆ║ Principal ŌĆō shows extent of their work -> decrease liability ŌĆ║ Subsidiary ŌĆō name -> increase liability ’é¢ Extent holds firm more accountable ŌĆ║ Investors ŌĆō know who else worked and what they did -> decrease/increase confidence in company ŌĆ║ Industry ŌĆō hold firms more accountable ’é¢ May increase outsourcing to other auditors

- 15. ’é× Implications: ŌĆ║ Principal ŌĆō lower liability of firm -> shows what they audited and did not audit ŌĆ║ Subsidiary ŌĆō more responsible for poor reports -> increased liabilities ’é¢ GT example ŌĆ║ Investors ŌĆō may miss modified wording -> increase/decrease confidence ŌĆ║ Industry ŌĆō decrease principal liability ’é¢ May increase work slightly

- 16. ’é× Implications: ŌĆ║ Principal ŌĆō liable to the extent of audit work performed ’é¢ No punishments for poor subsidiary work ŌĆ║ Subsidiary ŌĆō complete liability for their work ’é¢ Extent and scope mentioned ŌĆ║ Investors ŌĆō see the number of auditors, extent of work -> increase/decrease confidence ŌĆ║ Industry ŌĆō increase quality of audit by holding firms accountable for their OWN work

- 17. TODAY WE WILL DISCUSS: ŌĆóNecessity of Auditors to Rely on Work of Other Auditors ŌĆóCurrent Requirements for Shared Audit Reports ŌĆóProblems with Current Requirements ŌĆóPossible Changes ŌĆóImplications ŌĆóConclusion / Future Model

- 18. ’é× Audit report should refer to other auditors involved. ’é× Reference other audit firms by name. ’é× Include audit reports from other auditors.

- 19. ’é× Must be consistent with the sufficiency and appropriateness of evidence gathered by all auditors involved. ’é× Clearly show extent of the divided responsibility.

- 20. ŌĆ£ We did not audit the financial statements of Georgia Tech Company, a consolidated subsidiary, which statements reflect total assets constituting 30 percent in 2007 and 34 percent in 2006, and total revenues constituting 15 percent in 2007, 17 percent in 2006, and 14 percent in 2005 of the related consolidated totals, or the 2006 and 2005 financial statements of Bumblebee Company, used as a basis for recording the companyŌĆÖs equity in net income of that corporation. Those statements were audited by Barrow and Debeb, CPAs, whose reports have been furnished to us and are attached, and our opinion, insofar as it relates to the amounts included for Georgia Tech Company and Bumblebee Company, ŌĆØ is based solely on the reports of Barrow and Debeb.

- 21. ŌĆ£We believe that our audits and the reports of Barrow and Debeb provide a reasonable basis for our opinion. ŌĆØ ŌĆ£In our opinion, based upon our audits and the reports of Barrow and Debeb, the financial statements referred to above present fairly, in all material respects, the consolidated financial positionŌĆ”. ŌĆØ

- 22. Thank you.