Availability and pricing of innovative pharmaceuticals in the top 5 european pharmaceutical markets

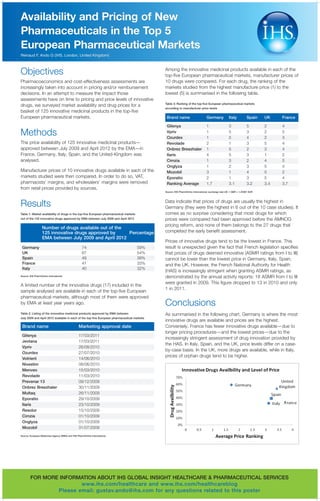

- 1. Availability and Pricing of New Pharmaceuticals in the Top 5 European Pharmaceutical Markets Reinaud F, Ando G (IHS, London, United Kingdom) Objectives Among the innovative medicinal products available in each of the top-five European pharmaceutical markets, manufacturer prices of Pharmacoeconomics and cost-effectiveness assessments are 10 drugs were compared. For each drug, the ranking of the increasingly taken into account in pricing and/or reimbursement markets studied from the highest manufacture price (1) to the decisions. In an attempt to measure the impact those lowest (5) is summarised in the following table. assessments have on time to pricing and price levels of innovative Table 3: Ranking of the top-five European pharmaceutical markets drugs, we surveyed market availability and drug prices for a according to manufacturer price levels basket of 125 innovative medicinal products in the top-five European pharmaceutical markets. Brand name Germany Italy Spain UK France Gilenya 1 3 5 2 4 Methods Vpriv Ozurdex 1 1 5 5 3 4 2 2 5 3 The price availability of 125 innovative medicinal products— Revolade 2 1 3 5 4 approved between July 2009 and April 2012 by the EMA—in Onbrez Breezhaler 1 5 2 3 4 France, Germany, Italy, Spain, and the United-Kingdom was Ilaris 4 5 3 1 2 analysed. Cimzia 1 3 2 4 5 Onglyza 1 2 3 5 4 Manufacturer prices of 10 innovative drugs available in each of the Mozobil 3 1 4 5 2 markets studied were then compared. In order to do so, VAT, Eporatio 2 1 3 5 4 pharmacists’ margins, and wholesalers’ margins were removed Ranking Average 1.7 3.1 3.2 3.4 3.7 from retail prices provided by sources. Source: IHS PharmOnline International; exchange rate UK: 1 GBP = 1.25367 EUR Results Data indicate that prices of drugs are usually the highest in Germany (they were the highest in 6 out of the 10 case studies). It Table 1: Market availability of drugs in the top-five European pharmaceutical markets comes as no surprise considering that most drugs for which out of the 125 innovative drugs approved by EMA between July 2009 and April 2012 prices were compared had been approved before the AMNOG pricing reform, and none of them belongs to the 27 drugs that Number of drugs available out of the 125 innovative drugs approved by Percentage completed the early benefit assessment. EMA between July 2009 and April 2012 Prices of innovative drugs tend to be the lowest in France. This Germany 74 59% result is unexpected given the fact that French legislation specifies UK 67 54% that prices of drugs deemed innovative (ASMR ratings from I to III) Spain 49 39% cannot be lower than the lowest price in Germany, Italy, Spain, France 41 33% and the UK. However, the French National Authority for Health Italy 40 32% (HAS) is increasingly stringent when granting ASMR ratings, as Source: IHS PharmOnline International demonstrated by the annual activity reports: 18 ASMR from I to III were granted in 2009. This figure dropped to 13 in 2010 and only A limited number of the innovative drugs (17) included in the 1 in 2011. sample analysed are available in each of the top-five European pharmaceutical markets, although most of them were approved by EMA at least year years ago. Conclusions Table 2: Listing of the innovative medicinal products approved by EMA between As summarised in the following chart, Germany is where the most July 2009 and April 2012 available in each of the top-five European pharmaceutical markets innovative drugs are available and prices are the highest. Brand name Marketing approval date Conversely, France has fewer innovative drugs available—due to longer pricing procedures—and the lowest prices—due to the Gilenya 17/03/2011 increasingly stringent assessment of drug innovation provided by Jevtana 17/03/2011 the HAS. In Italy, Spain, and the UK, price levels differ on a case- Vpriv 26/08/2010 by-case basis. In the UK, more drugs are available, while in Italy, Ozurdex 27/07/2010 prices of orphan drugs tend to be higher. Votrient 14/06/2010 Nivestim 08/06/2010 Menveo 15/03/2010 Revolade 11/03/2010 Prevenar 13 09/12/2009 Onbrez Breezhaler 30/11/2009 Multaq 26/11/2009 Eporatio 29/10/2009 Ilaris 23/10/2009 Resolor 15/10/2009 Cimzia 01/10/2009 Onglyza 01/10/2009 Mozobil 31/07/2009 Source: European Medicines Agency (EMA) and IHS PharmOnline International FOR MORE INFORMATION ABOUT IHS GLOBAL INSIGHT HEALTHCARE & PHARMACEUTICAL SERVICES www.ihs.com/healthcare and www.ihs.com/healthcareblog Please email: gustav.ando@ihs.com for any questions related to this poster