Ba?n sao Purple Light Grey Modern Business Marketing Presentation .pptx

- 2. MEMBERS OF TEAM C?NG L? TH?Y NGA Y?N VY THANH NG?N DUY PHAN B?NH AN THANH B?NH

- 3. WHAT IS BOND ? Bonds are long-term debt instruments issued by governments or companies to raise capital. Bonds issued by governments are called government bonds, while those issued by companies are known as corporate bonds. Every bond has a specified amount printed on it, known as its face value. Face value represents the stated value of the bond.

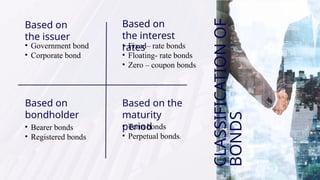

- 4. CLASSIFICATION OF BONDS ? Based on the issuer. ? Based on the interest rate. ? Based on the bondholder. ? Based on the maturity date.

- 5. ? Government bond ? Corporate bond Based on the issuer Based on the interest rates Based on bondholder Based on the maturity period ? Fixed¨C rate bonds ? Floating- rate bonds ? Zero ¨C coupon bonds ? Bearer bonds ? Registered bonds ? Term bonds ? Perpetual bonds. CLASSIFICATION OF BONDS

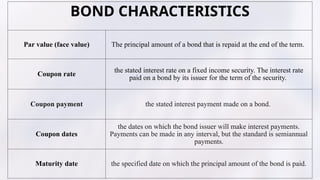

- 6. BOND CHARACTERISTICS Par value (face value) The principal amount of a bond that is repaid at the end of the term. ? Coupon rate the stated interest rate on a fixed income security. The interest rate paid on a bond by its issuer for the term of the security. ? Coupon payment the stated interest payment made on a bond. Coupon dates the dates on which the bond issuer will make interest payments. Payments can be made in any interval, but the standard is semiannual payments.? Maturity date the specified date on which the principal amount of the bond is paid.?

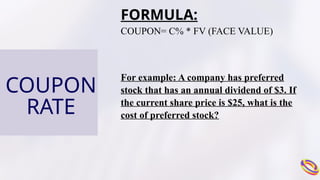

- 7. COUPON RATE FORMULA: COUPON= C% * FV (FACE VALUE) For example: A company has preferred stock that has an annual dividend of $3. If the current share price is $25, what is the cost of preferred stock?

- 8. ? The rate required in the market on a bond. ? ? The annual return that a bond is expected to generate if it is held till its maturity, given its coupon rate, payment frequency and current market price? ? Is the discount rate at which the present value of a bond`s coupon payment and maturity value is equal to its current market price. ? ? Change according to the market YIELD TO MATURIT Y ? C%=YTM ? C%<YTM -> DISCOUNT ? C%> YTM -> PREMIUM

- 9. BOND VALUATIO N Bond valuation is the process of determining the true market value of a bond at the current point in time. Essentially, it involves calculating the present value of all expected future cash flows generated by the bond. Intrinsic value depends on the stream of income generated from bond interest and investors' expected interest rates for present value calculation. CONCEPT

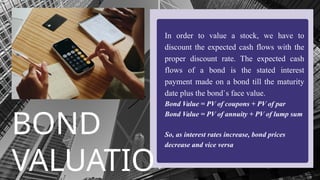

- 10. BOND VALUATIO In order to value a stock, we have to discount the expected cash flows with the proper discount rate. The expected cash flows of a bond is the stated interest payment made on a bond till the maturity date plus the bond`s face value.? Bond Value = PV of coupons + PV of par? Bond Value = PV of annuity + PV of lump sum So, as interest rates increase, bond prices decrease and vice versa?

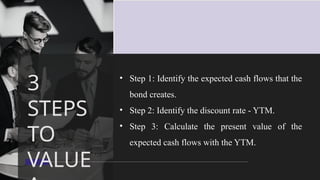

- 11. 3 STEPS TO VALUE ? Step 1: Identify the expected cash flows that the bond creates. ? ? Step 2: Identify the discount rate - YTM. ? ? Step 3: Calculate the present value of the expected cash flows with the YTM. ?

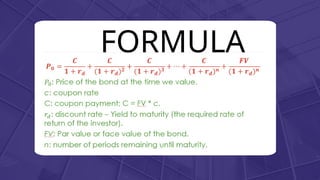

- 12. FORMULA

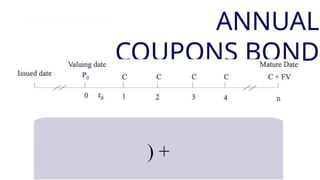

- 13. ) + ANNUAL COUPONS BOND ANNUAL COUPONS BOND

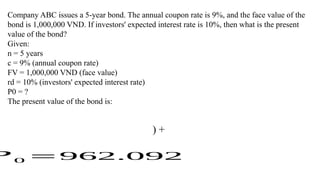

- 14. Company ABC issues a 5-year bond. The annual coupon rate is 9%, and the face value of the bond is 1,000,000 VND. If investors' expected interest rate is 10%, then what is the present value of the bond? Given: n = 5 years c = 9% (annual coupon rate) FV = 1,000,000 VND (face value) rd = 10% (investors' expected interest rate) P0 = ? The present value of the bond is: ) + ? 0 =962.092

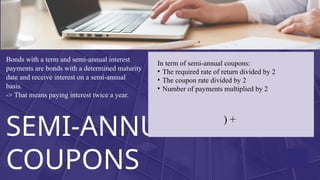

- 15. SEMI-ANNUAL COUPONS Bonds with a term and semi-annual interest payments are bonds with a determined maturity date and receive interest on a semi-annual basis. -> That means paying interest twice a year. In term of semi-annual coupons: ? The required rate of return divided by 2 ? The coupon rate divided by 2 ? Number of payments multiplied by 2 ) +

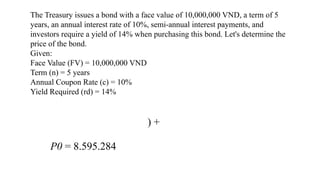

- 16. The Treasury issues a bond with a face value of 10,000,000 VND, a term of 5 years, an annual interest rate of 10%, semi-annual interest payments, and investors require a yield of 14% when purchasing this bond. Let's determine the price of the bond. Given: Face Value (FV) = 10,000,000 VND Term (n) = 5 years Annual Coupon Rate (c) = 10% Yield Required (rd) = 14% ) + P0 = 8.595.284

- 17. PERPETU AL A perpetual bond is a fixed income security with no maturity date. This type of bond is often considered a type of equity, rather than debt. One major drawback to these types of bonds is that they are not redeemable. However, the major benefit of them is that they pay a steady stream of interest payments forever.

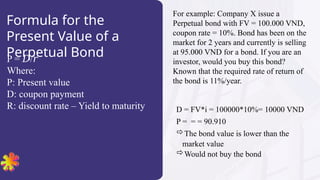

- 18. Formula for the Present Value of a Perpetual Bond P = / ? ? Where: P: Present value D: coupon payment R: discount rate ¨C Yield to maturity For example: Company X issue a Perpetual bond with FV = 100.000 VND, coupon rate = 10%. Bond has been on the market for 2 years and currently is selling at 95.000 VND for a bond. If you are an investor, would you buy this bond? Known that the required rate of return of the bond is 11%/year. D = FV*i = 100000*10%= 10000 VND P = = = 90.910 ?The bond value is lower than the market value ?Would not buy the bond

- 19. (Formula for the Present Value of a Perpetual Bond) P = / ? ? Where: P: Present value D: coupon payment R: discount rate ¨C Yield to maturity

- 21. THANK YOU FOR YOUR ATTENTION Telephone +123-456-7890 www.reallygreatsite.com 123 Anywhere St., Any City Website Address