Bancassurance: It's time for Digital

- 2. BANCASSURANCE SUMMARY ŌĆó Bancassurance refers to an agreement between banks and insurance companies. ŌĆó In bancassurance, insurance companies sell their products through the bankŌĆÖs outlet. ŌĆó It can benefit banks and insurance companies, as well as customers.

- 3. FR

- 4. FR CHALLENGES CONCERN Bancassurance requires both banks and insurance companies to work together; however, it is not an easy task to integrate the business operations of two sectors. insurance companies lack direct control over the selling of their products. It can be harder to manage marketing strategies. In the case of multiple bancassurance agreements, bank advisors may have conflict incentives. To solve the problems, banks and insurance companies need to align their objectives. Moreover, insurance companies can provide sales training for bank employees. This helps to achieve mutual goals and reduce miscommunication.

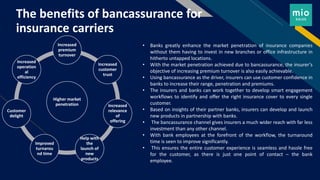

- 5. FR The benefits of bancassurance for insurance carriers Higher market penetration Increased premium turnover Increased customer trust Increased relevance of offering Help with the launch of new products Improved turnarou nd time Customer delight Increased operation al efficiency ŌĆó Banks greatly enhance the market penetration of insurance companies without them having to invest in new branches or office infrastructure in hitherto untapped locations. ŌĆó With the market penetration achieved due to bancassurance, the insurerŌĆÖs objective of increasing premium turnover is also easily achievable. ŌĆó Using bancassurance as the driver, insurers can use customer confidence in banks to increase their range, penetration and premiums. ŌĆó The insurers and banks can work together to develop smart engagement workflows to identify and offer the right insurance cover to every single customer. ŌĆó Based on insights of their partner banks, insurers can develop and launch new products in partnership with banks. ŌĆó The bancassurance channel gives insurers a much wider reach with far less investment than any other channel. ŌĆó With bank employees at the forefront of the workflow, the turnaround time is seen to improve significantly. ŌĆó This ensures the entire customer experience is seamless and hassle free for the customer, as there is just one point of contact ŌĆō the bank employee.

- 6. FR DIGITAL TRANSFORMATION - THE WAY FORWARD FOR BANKS AND INSURERS According to a study by McKinsey & Company, digitization has driven development in many bancassurance organizations. Businesses that have digitalized non-life product sales have seen a growth of nearly 20%. Add a footer 6 Improve customer engagement and customer experience by focusing on the larger financial objectives of different target customer groups In order to retain the relevant third parties for holistic customer propositions a digital open standards platform should be set up with the bank and the insurer to support customer omnichannel access. The advisory role of the branch staff must be augmented integrating regulatory requirements to provide customers with a seamless omnichannel process. Customised insurance offerings can be offered by setting up relevant and curated customer data sets to allow joint customer analytics by the bank and the insurer.

- 7. FR Add a footer 7 HOW ARTIVATIC MEETS THE INDUSTRY DEMANDS? MiOSales Platform designed for Bancassurance for future allowing sales team to have better experience, building partnerships & relationships, increase in customer base, Improvement in ROI and get better insights, recommendation & analytics.

- 8. FR 8 ŌĆó Winning with digital and analytics in bancassurance ŌĆó Personalization that makes the most of unique banking data and analytics ŌĆó The data make it clear that digitization is a core ingredient of growth ŌĆó Superior, digitally enabled customer experience ŌĆó Bancassurers need simple, fully automated, and end-to-end processes that reduce barriers to sales in digital channels. ŌĆó Omnichannel customer engagement

- 9. For more insights, visit https://blog.artivatic.ai/