Bank relation with other institutions

- 1. Banking BANK RELATION WITH OTHER INSTITUTIONS 1

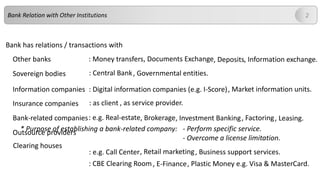

- 2. Bank Relation with Other Institutions 2 Bank has relations / transactions with Other banks Sovereign bodies Information companies Insurance companies Bank-related companies Outsource providers : Money transfers, Documents Exchange, Deposits, Information exchange. : Central Bank, Governmental entities. : Digital information companies (e.g. I-Score), Market information units. : as client , as service provider. : e.g. Real-estate, Brokerage, Investment Banking, Factoring, Leasing. * Purpose of establishing a bank-related company: - Perform specific service. - Overcome a license limitation. : e.g. Call Center, Retail marketing, Business support services. Clearing houses : CBE Clearing Room, E-Finance, Plastic Money e.g. Visa & MasterCard.

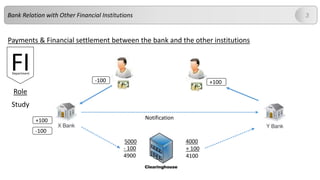

- 3. Bank Relation with Other Financial Institutions 3 Payments & Financial settlement between the bank and the other institutions FIDepartment Role Study -100 +100 5000 - 100 4900 4000 + 100 4100 +100 Notification -100

- 4. Bank Relation with Other Financial Institutions 4

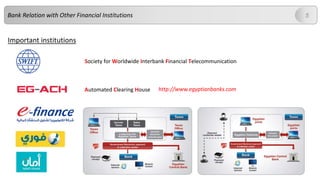

- 5. Bank Relation with Other Financial Institutions 5 Important institutions Society for Worldwide Interbank Financial Telecommunication Automated Clearing House http://www.egyptianbanks.com

- 6. 6 Thank you Ahmed MOUSTAPHA Manager ŌĆō Corporate Finance QNB ALAHLI Bank am.moustapha3@gmail.com