Bank reonciliation statement

- 1. I.H.M , DEHRADUN ACCOUNTANCY TOPIC -: BANK RECONCILIATION STATEMENT Notes by-: G.K Sawhney 7895190950

- 2. MEANING A businessman generally opens a current account with a bank. The bank column of a cash book is used for making entries regarding deposited and withdrawals in this account. On the other hand, the bank also maintains the customerŌĆÖs account in its books. A copy of this account, it submits to the customer from time to time. The account so submitted by the bank of the customer is known as the bank pass book or bank statement. Cont..

- 3. When money or cheque is deposited by the customer into the bank account, the customer debits the bank account while the bank credits the customerŌĆÖs account. Similarly, when money is withdrawn from the bank, the customer credits the bank account while bank debits the customerŌĆÖs account.

- 4. DEFINITION OF BANK RECONCILIATION STATEMENT According to Patil, ŌĆ£ Bank reconciliation statement is a statement prepared mainly to reconcile the difference between the ŌĆśBank BalanceŌĆÖ shown by the cash book and pass book.ŌĆØ

- 5. According to William Pickles, ŌĆ£Generally a statement is prepared to show the effect of unpresented and uncredited cheques. Such statement is known as bank reconciliation statement.ŌĆØ

- 6. CAUSES OF DIFFERENCE BETWEEN CASH BOOK AND PASS BOOK ’ü« The following are the causes of difference between the balance as shown by the bank pass book and balance as shown by the cash book. 1. Cheque issued but not yet presented for payment: When cheque is issued to the creditor in payment of his dues, it is immediately recorded in the cash book in the bank column. If the cheque is not presented for payment in the bank, the bank will not record in the firmŌĆÖs account. Generally, there is a time lag between the issue of a cheque and its presentation to the bank. Thus, until the cheques are presented for payment, the cash book will show lesser balance in comparison.

- 7. 2. Cheques paid into bank for collection but not yet credited by the bank: A trader receives from time to time cheques, drafts, etc. from its customers and he sends them to its bankers for collection. The trader debit bank column of cash book as soon as he deposited cheques, drafts etc. with the bank for collection but the bank creditŌĆÖs the traderŌĆÖs account only after these cheques have been collected. The collection generally takes a few days. It results in bank balance as per cash book higher than the balance as per pass book.

- 8. 3. Cheques paid into bank for collection but dishonoured by the bank: Sometimes, a cheque deposited into bank is dishonoured. It has the same effect as a cheque deposited but not yet credited.

- 9. 4. Interest allowed by the bank: When bank alow interest to a cutomer for deposits, it will credit customerŌĆÖs account and his bank balance will increase. But the customer is not making the entry in the cash book simultaneously till he knows the fact, therefore, the balance differ. Thus, the balance shown in cash book is less than the balance shown in the cash book.

- 10. 5. Interest and dividend collected by the bank: A banker may receive amounts due to te customer by way of dividends, interest etc. directly from the persons on account of standing instructions of the customer to such persons. The bank credits the account of the customer for such collection as soon as it gets such payments. But same will be entered in the cash book only when customer receives the statement fro the bank. So long, the balance shown in the cash book is less than the balance shown by the pass book.

- 11. 6. Bank charges and commission charged by the bank: The bank charges by way of incidental charges, commission, collection charges etc. from its customers for the services it renders to the customer from time to time. The bank debits the customerŌĆÖs account as soon as it renders such a service and this reduce the bank balance. But the customer will know such charges only when he receives a statement of account from the bank, until then, bank balance as per pass book will be less than bank balance as per cash book.

- 12. 7. Interest on bank overdraft: When a trader is allowed by the bank to withdraw more than his deposits in the account, the excess withdrawal is known as ŌĆ£overdraftŌĆØ. The bank charges interest on overdrafts and debits the customerŌĆÖs account with these charges. But the customer will record this in the cash book either on receiving intimation from the bank in his regard or when he receives the bank pass book duly completed. Thus, the balances of both books differ.

- 13. 8. Direct payment made by the bank on behalf of customer: Usually an accountholder instructs the bank to made certain payment on his behalf such as payment for insurance premium, interest on loan, electricity bill etc. The bank will debit the partyŌĆÖs account on making the payment and this reduces the bank balance. But the party has no information of the same till it is informed. Thus, the balance shown in the cash book is more than the balance shown by the pass book.

- 14. 9. Direct deposit into bank by the debtors: Sometimes, debtors may directly deposit the amount due in the firmŌĆÖs bank account. The bank credits the firmŌĆÖs account immediately on receipt of such payment but the firm will make entry in the cash book only after receiving intimation in this regard. Thus, pass book shows more balance than the cash book.

- 15. 10. Other reasons: Sometimes, the firm commits an error such as-: (i) Cheque deposited into the bank omitted to be recorded in the cash book. (ii) Cheque issued to a creditor but omitted to be recorded in the cash book. (iii) Error in totalling or balancing the bank column of the cash book.

- 16. NEEDS AND IMPORTANCE O BANK RECONCILIATION STATEMENT The need and importance of bank reconciliation statement can be judged on the basis of the following facts: 1) It identifies the reasons for difference between the bank balance as per cash book and the bank balance as per pass book. Necessary adjustments or corrections can, therefore, be carried out at the earliest.

- 17. 2) By preparing bank reconciliation statement, the customer becomes sure of the correctness of the bank balance depicted by the cash book. It helps him in making the further transactions with bank. 3) Periodic preparation of the bank reconciliation statement reduces the chances of fraud by the cash staff. It may be possible that the cashier may not deposit the money in the bank in time though he might have passed the entry in the bank column of the cash book. The bank reconciliation statement will point out to such discrepancies.

- 18. 4) There is a moral check on the staff of the business organisation to keep the cash records always up-to-date.

- 19. UTILITY OF BANK RECONCILIATION STATEMENT 1) It gives an authentic proof of the accuracy of the cash book and pass book balances. 2) Entries in both the books are automatically checked. 3) The cash book may be made up-to-date by recording some either unknown entries. 4) Error, if any, may be rectified.

- 20. MAIN POINTS REGARDING BANK RECONCILIATION STATEMENT 1) Bank reconciliation statement is prepared by the customer. 2) Bank reconciliation statement may be prepared at any time. 3) Bank reconciliation statement is prepared by taking the balance of cash book or pass book and at the end, the balance of pass bookmor cash book is calculated.

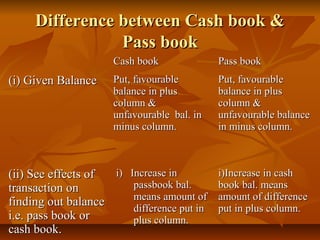

- 21. Difference between Cash book & Pass book Cash book Pass book (i) Given Balance Put, favourable Put, favourable balance in plus balance in plus column & column & unfavourable bal. in unfavourable balance minus column. in minus column. (ii) See effects of i) Increase in i)Increase in cash transaction on passbook bal. book bal. means means amount of amount of difference finding out balance difference put in put in plus column. i.e. pass book or plus column. cash book.

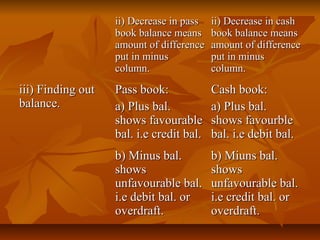

- 22. ii) Decrease in pass ii) Decrease in cash book balance means book balance means amount of difference amount of difference put in minus put in minus column. column. iii) Finding out Pass book: Cash book: balance. a) Plus bal. a) Plus bal. shows favourable shows favourble bal. i.e credit bal. bal. i.e debit bal. b) Minus bal. b) Miuns bal. shows shows unfavourable bal. unfavourable bal. i.e debit bal. or i.e credit bal. or overdraft. overdraft.