Banking mgt

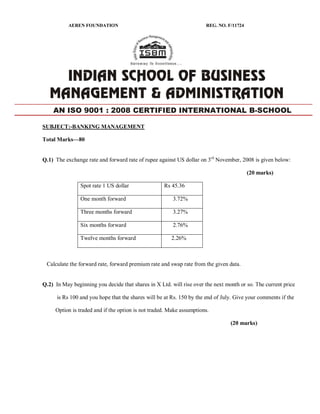

- 1. AEREN FOUNDATION REG. NO. F/11724 SUBJECT:-BANKING MANAGEMENT Total Marksâ80 Q.1) The exchange rate and forward rate of rupee against US dollar on 3rd November, 2008 is given below: (20 marks) Spot rate 1 US dollar Rs 45.36 One month forward 3.72% Three months forward 3.27% Six months forward 2.76% Twelve months forward 2.26% Calculate the forward rate, forward premium rate and swap rate from the given data. Q.2) In May beginning you decide that shares in X Ltd. will rise over the next month or so. The current price is Rs 100 and you hope that the shares will be at Rs. 150 by the end of July. Give your comments if the Option is traded and if the option is not traded. Make assumptions. (20 marks) AN ISO 9001 : 2008 CERTIFIED INTERNATIONAL B-SCHOOL

- 2. Q.3) (15 marks) A) The unit price of TSS scheme of a mutual fund is Rs 10. The public offer price (POP) of the unit is Rs 10.204 and the redemption price is Rs 9.80. Calculate i) Front-end load and ii) Back-end load. B) Mr. A can earn a return of 16% by investing in equity shares on his own. Now he is considering a recently announced equity based mutual fund scheme in which initial expenses are 5.5 percent and annual recurring expenses are 1.5 percent. How much should the mutual fund earn to provide Mr. A a return of 16% (5 Marks) Q.4) The closing price of the stock of Veryfine Ltd. at the stock exchange for 20 successive days was as follows: (20 Marks) Day 1 2 3 4 5 6 7 8 9 10 Closing Price(Rs.) 25 26 25 24 26 26 28 26 25 27 You are required to calculate a 7 day moving average of stock price of the company and comment on its short-term trend Day 11 12 13 14 15 16 17 18 19 20 Closing price(Rs) 27 25 26 28 26 26 24 25 26 25