Basel accord

- 1. 1

- 2. Why Capital Requirement?Why Capital Requirement?  While bank’s assets (loans & investments) are risky and prone to losses, its liability (deposits) are certain.  Bank failures - mainly by losses in assets – default by borrowers (Credit Risk), losses of investment in different securities (Market Risk) and frauds, system and process failures (Operational Risk)  Assets = External Liabilities + Capital. Liabilities (deposits) to be honoured. Hence reduction in capital. When capital is wiped out – Bank fails. 2

- 3. Need For Basel AccordNeed For Basel Accord  1970 – Banks were operating on ‘wafer thin’ capital.  Failure of German Bank Herstatt in 1974.  Central Banks of G-10 (then) formed Basel Committee on banking supervision under the aegis of BIS – Bank Of International Settlement in 1974.  Definition of regulatory capital differed from country to country.  BIS (estd.1930) – involved in securing & maintaining international central banks co-operation.  In July 1988 – Basel Committee – set of recommendations – minimum level of capital for the internationally active banks. 3

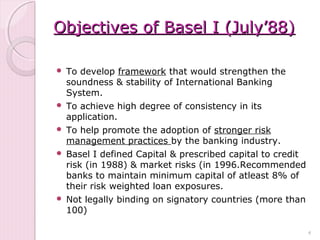

- 4. Objectives of Basel I (July’88)Objectives of Basel I (July’88)  To develop framework that would strengthen the soundness & stability of International Banking System.  To achieve high degree of consistency in its application.  To help promote the adoption of stronger risk management practices by the banking industry.  Basel I defined Capital & prescribed capital to credit risk (in 1988) & market risks (in 1996.Recommended banks to maintain minimum capital of atleast 8% of their risk weighted loan exposures.  Not legally binding on signatory countries (more than 100) 4

- 5. Implementation of Basel I By RBIImplementation of Basel I By RBI  RBI decided C.R.A.R.( Capital to Risk Assets Ratio) or CAR (Capital Adequacy Ratio) as 9% for India.  Different risk weights for different category of exposures e.g. Govt. Bonds 0%, Corporate loans 100%.  Laid down standard definitions for different types of Capital – Tier I & Tier II capital.  Tier I Permanent Capital Equity.  Tier II Supplementary Capital – Subordinate Debt.  Risk adjusted asset would mean weighted aggregate of funded and non-funded items.  Degrees of credit risk expressed as percentage.  Weightings have been assigned to B/S assets and conversion factors to off – B/S items.  Value of each asset/ item shall be multiplied by relevant weights to produce risk adjusted values of assets & off B/S items – Aggregate taken into account for reckoning min. Capital Ratio. 5

- 6. Basel I - Implementation ÔÇóCapital charge for credit risk introduced since 1992-93 on the lines of Basel I. ÔÇóCapital charge on market risk on par with Basel I introduced from 2004-05 -Interest rate risk -Equity risk -Foreign exchange risk * India became fully compliant with Basel I

- 7. Why Revision In Basel I ?Why Revision In Basel I ?  In Feb 1995 – Downfall of oldest Merchant Bank in U.K. – Inadequate regulations & poor system & practices – Market Risk in 1996 .  In July 1997, there was Asian Financial Crisis because of poor risk management & perfunctory supervision by regulatory authority. Credit Risk – Not Risk Sensitive – One size fits all – Fixed risk weights on all assets irrespective of quality of assets. • Basel II- Evolution & Features: 1)International convergence of capital measurement & standards 2)Three mutually reinforcing pillars: Pillar I-Minimum capital requirement, Pillar II-Supervisory Review, Pillar III-Market Discipline. * To address rigidities of Basel I & promote adoption of strong risk management system by banks. “YOU CANNOT MANAGE TOMORROW’S EVENTS BY YESTERDAY’S SYSTEM & TODAYS’S HUMAN SKILL SET” 7

- 8. Bank‚Äôs overall Capital RequirementBank‚Äôs overall Capital Requirement Will be sum of the following: a) Capital requirement for credit risk on all credit exposures b) Capital requirement for market risk in the trading book (Market Risk ‚Äì Since 1996) c) Capital requirement for operational risk-Basic Indicator Approach. (Refer ∫›∫›fl£ 22) 8

- 9. Basel II Accord – 2004 (June 2004)Basel II Accord – 2004 (June 2004)  Basel Committee on Banking Supervision (BCBS) brought out a report titled “International Convergence of Capital Measurement and Capital Standards – A Revised Framework 2004” (Commonly called Basel Report II ).  Basel II provides capital incentive for banks with better risk management practices. 9

- 10. Three Pillars of Basel IIThree Pillars of Basel II ÔÇó The First Pillar: Minimum Capital Requirement. ÔÇó The Second Pillar: Supervisory Review Process. ÔÇó The Third Pillar: Market Discipline. ÔÇó The First Pillar: Minimum Capital Requirement. a) Calculation of minimum capital requirement and constituents of Capital. There are two tiers of capital fund namely Tier I and Tier II, both eligible for inclusion in capital base.Tier I should be atleast 6% to be achieved by 31.03.2010. tier II cannot be more than 50% of the total capital. 10

- 11. Constituents of Tier I & Tier IIConstituents of Tier I & Tier II Tier I Tier II • Paid up capital • Undisclosed reserves and cumulative perpetual preference shares. • Statutory reserves • Revaluation Reserves (at a discount of 55%) • Other disclosed free reserves. • General Provision and Loss Reserves upto a maximum of 1-25x of weighted risk assets. • Capital reserves representing surplus arising out of sale proceeds of assets. • Hybrid debt capital instruments (say bonds) • Investment fluctuation Reserve. • Subordinated debt (long term unsecured loans) • Innovative perpetual debt instruments (IPDI).* • Debt capital instruments. • Perpetual Non- cumulative Preference Shares (PNCPS)* • Redeemable cumulative & non- cumulative preference shares • Both not to be more than 40% of Tier I. IPDI not more than 15% of Tier I. No maturity period. Call option after 10 years. • Perpetual cumulative preference shares. 11

- 12. 12 The following are to be deducted while arriving at Tier I 1)Equity investments in subsidiaries 2)Intangible assets & 3)Losses in the current period & those brought forward from previous periods. 4)Investments in the capital of other banks & FIs. Approaches For Risk Calculation in Basel II Credit Risk:- Standard Approach, IRB – Internal Rating Based Approach ( Comprise foundation approach & advance approach) Market Risk:- Standard Approach ( Comprising maturity method & duration method ) Internal Risk Based Approach. Operational Risk:- Basic Indicator Approach, Standard Approach, Advance Measurement Approach Already implemented w.e.f. 31.03.2008 and 31.03.2009.

- 13. 13 RBI Plan for Shifting To Advance Approaches Approach Earliest Date + + Likely Date + ++ Internal Models Approach for market risk 01.04.2010 31.03.2011 Standardised Approach for Operational Risk 01.04.2010 30.09.2010 Advanced Measurement Approach For Operational Risk 01.04.2012 31.03.2014 Internal rating – based approaches for credit risk ( Foundation as well as advanced) 01.04.2012 31.03.2014 ++ Earliest date to make application by banks to RBI +++ Likely date of approval by RBI.

- 14. External Credit Rating Assessment RBI has identified following credit rating agencies – for assigning risk weights for credit risk as External Credit Assessment Institutions status under Basel norms. CARE, CRISIL, FITCH RATING, ICRA, and BRICKWORK (w.e.f.15.04.2012) (Brickwork Ratings India Pvt. Ltd.) Eligibility Criteria for Rating Agencies: 1) Objectivity 2)Independence 3)Transperency 4)Disclosure 5)Resources 6) Credibility

- 15. Risk Weights For Important AssetsRisk Weights For Important Assets Cash balance with RBI 0% Balances with other banks complying with 9%CAR or documents negotiated under LC for such banks. 20% Govt./Approved Securities 2.5% Secured Loans to Staff Members 20% Housing Loan max. Rs. 30Lac to individual (secured by Mortgage) Housing loan > Rs.30 Lac to individual (secured By Mortgage) 50% 75% Forex and Gold open positions 100% Central / State Govt. guaranteed advances ÔÇßLoans against FDR,LIC Policy, NSC with margin ÔÇßSSI advances upto CGF guarantee ÔÇßLoans guaranteed by DICGC/ ECGC ÔÇßLoans against gold / silver jewellery upto Rs. 1 /- lac ÔÇßEducation Loan ÔÇßLoans to PSUs ÔÇßClaims on unrated corporates ÔÇßCommercial real estate ÔÇßLoans to non-deposit taking NBFCs for on-lending ÔÇßConsumer credit / credit cards ÔÇßExposure to capital market ÔÇßVenture capital investment as part of capital Market Exposure. 0% 0% 0% 50% 50% 75% 100% 100% 100% 100% 125% 125% 150% Retail Lending upto Rs.5/- crores 75% 15

- 16. Risk Weights of Assets under Standardised ApproachRisk Weights of Assets under Standardised Approach Asset Category ( Called Claim) Risk % Rated Corporates (20% to 150%) AAA to AA A+ to A BBB+ to BB Below BB 20% 50% 100% 150% Retail portfolio not past due for more than 90 days (small loans / credit card exposure to individuals with proper diversification 75% Loans secured by mortgage of residential property 50% to 75% Loans secured by Commercial real estate 100% Past due loans (100% to 150% ) (can be upto 50% with RBI permission if provision is not less than 50%) • Where provisions are less than 20% • Where provision is not less than 20% • Higher risk categories (as decided by Central Bank of the respective country) 150% 100% 150% Off-B/S items (after conversion by applying conversion factor (0% to 50%) For cancelable commitment For upto 1 year maturity For more than 1 year maturity 0% 20% 50% 16

- 17. The Second Pillar: Supervisory Review ProcessThe Second Pillar: Supervisory Review Process - 4- Key Principles. Principle 1:- Banks should have a process for assessing their overall capital adequacy in relation to their risk profile & strategy for maintaining their capital needs. ICAAP- Internal capital Adequacy Assessment Process 1)identify, measure & report all material risks 2)link capital to level of risk 3) state capital adequacy goals 4)internal controls, reviews & audit to ensure integrity to entire process. Principle 2:- Supervisors to review & evaluate banks internal capital adequacy assessments & strategies as well as their ability to monitor & ensure their compliance with regulatory Capital ratios. Supervisors to take appropriate steps if not satisfied. 17

- 18. Principle 3:- Supervisors should expect banks to operate above minimum required capital ratios & should have the ability to require banks to hold capital in excess of the minimum. Principle 4:- Supervisors should seek to intervene at an early stage to prevent capital from falling below the required minimum to support risk characteristics & should require rapid remedial action if capital is not maintained / restored. 18

- 19. Increased capital – not only option for addressing increased risks confronting banks. Other means such as a) Strengthening Risk Management b) Applying Internal Limit c) Strengthening the levels of Provisions & Reserves d) Improving Internal Controls 19

- 20. The Third Pillar: Market DisciplineThe Third Pillar: Market Discipline Purpose:- Disclosures to compliment Pillar I –Min. Cap. Req. & Pillar II Supervisory Review Process.  A set of disclosure requirements which will allow market participants to assess key pieces of information on the scope of application, capital Risk Exposures, Risk Assessment Processes & hence the capital adequacy of the institution.  Disclosures- Qualitative & Quantitative aspects at an end March along with annual financial statements.  Banks with capital funds> 500 Crs.- To disclose capital related information on quarterly basis.  Board approved disclosure policy.  13 Tables- B/S disclosures- validated by auditors- Others by bank 20

- 21. Market discipline contributes to a safe & sound banking environment which is required by supervisors. The steps by supervisors range from ‘Moral Suation’ through dialogue or financial penalties depending upon the legal powers of the superior & the seriousness of the disclosure deficiency. Direct additional capital required to be a response to non-disclosure is not intended. 21

- 22. Basel I (1988) Basel II (2004) 1) Only two risks. Credit Risk (1988) & Market Risk (1996) 2) One size fits all. Fixed risk weights on all assets irrespective of quality of assets. 3) Emphasis only on minimum capital requirement. 1) Three Risks. Credit Risk, Market Risk & Operational Risk 2) Risk weights to be determined on quality of assets. 3) Three Pillars. Min. capital adequacy, supervisory Review on min. capital & Market discipline. 22

- 23.  Basel II provides capital incentive for banks with better risk management practices.  Potential audiences of disclosure ( Under market Discipline Pillar III ) are supervisors, bank’s customers, rating agencies, depositors & investors.  Market signaling in form of change in Bank’s share prices or change in bank’s borrowing rates are important components of Market Discipline. 23

- 24. Basic Indicator Approach For Operational RiskBasic Indicator Approach For Operational Risk Bank to hold capital equal to average of previous -3- years positive annual gross income as a fixed % (i.e. 15%) If there is negative gross in come for any year, it will be excluded both from numerator & denominator. Gross Income means net int. income + net non-interest income. Capital = Annual +ve Gross Income for -3 years √ó 15% Required No. of yrs. for which gross income is +ve 24

- 25. Improvements To Basel II ÔÇóIn July 2009 BCBS announced enhancements to 3 Pillars of Basel II. ÔÇóPillar I- Risk weights enhanced for securitisation exposures. ÔÇóPillar II- Changes involve measures to address risk concentration ÔÇóPillar III- Additional disclosures for securitisation & resecuritisation exposures.

- 26. Regulatory Retail ÔÇóThreshold limit may be computed by taking sanctioned limit or o/s whichever is higher for all funded/non funded facilities except for term loans/EMI based facilities with no redrawal scope in which case exposure means actual outstanding. ÔÇóRBI will evaluate quality of regulatory retail portfolio under supervisory review process of Pillar II.