Between a Rock and a Hard Place: Navigating Conflicting U.S. and Canadian Trade Controls: The Cuba Thaw - Implications for Transnational Companies

- 1. Between a Rock and a Hard Place: Navigating Conflicting U.S. and Canadian Trade Controls John W. Boscariol October 24, 2009 International Law Weekend 88 th Annual Meeting of the American Branch of the International Law Association Fordham University School of Law, New York City The Cuba Thaw – Implications for Transnational Companies

- 2. Navigating Between Conflicting U.S. and Canadian Trade Controls: The Cuba Conundrum navigating Canadian and U.S. trade controls generally close alignment of policies adoption of most stringent rules critical exceptions U.S. ITAR/EAR licensing Cuban trade or investment opportunities

- 3. The United States, Canada and Cuba Canada’s expanding economic relationship with Cuba Canada is one of Cuba’s largest trading partners Canadian exports to Cuba CDN$563 million in 2007 (CDN$273 million in 2003) - machinery, agrifood products, sulphur, electrical machinery, newsprint Canadian imports from Cuba CDN$1.1 billion million in 2007 (CDN$371 million in 2003) - ores, fish and seafood, tobacco, copper and aluminum scrap and rum Canada is one of Cuba’s largest source of foreign direct investment Canadian FDI CDN$830 million (CDN$337 million in 1998) - nickel and cobalt mining, oil and gas, power plants, food processing

- 4. The United States, Canada and Cuba expanding extraterritorial reach of U.S trade embargo 1962 – imposition of full trade embargo under Trading With the Enemy Act 1975 – elimination of general license allowing trade by foreign non-banking entities had to apply for specific license and demonstrate independent operation re decision-making, risk-taking, negotiation and financing 1990 – Mack Amendment proposed outright prohibition on issuance of licenses to foreign affiliates of U.S. firms 1992 – Cuban Democracy Act 1996 – Helms-Burton Act extends aspects of Cuban embargo to Canadian companies that have no connection with U.S. entities

- 5. Current U.S. Measures vs. Cuba Cuban Assets Control Regulations administered by U.S. Treasury’ Office of Foreign Assets Control prohibition on foreign entities owned or controlled by U.S. persons from doing business with Cuba Export Administration Regulations administered by the U.S. Department of Commerce’s Bureau of Industry and Security requires that a re-export license be applied for where U.S. content is 10% or more Helms-Burton Act Title III – private right of action vs. “traffickers” in “confiscated property” (right suspended) Title IV – bar on entry in the United States for traffickers, their spouses and minor children

- 6. Canadian Response to U.S. Trade Embargo of Cuba diplomatic NAFTA/WTO? primarily FEMA and the 1996 FEMA Order

- 7. The Foreign Extraterritorial Measures Act extraterritorial anti-trust motivations authorization for Attorney General to make orders where foreign state or tribunal takes measures impairing Canada’s interests regarding international trade or infringing on Canadian sovereignty Canadian Attorney General can prohibit production or disclosure of records before foreign tribunals declare that judgements of foreign tribunals not be recognized or enforceable in Canada require notification of directives or other communications relating to such measures prohibit compliance with such directives or measures

- 8. The Foreign Extraterritorial Measures Act (cont’d) “ Helms-Burton amendments” block recognition or enforcement of Title III judgements restrict production of records for Title III actions “ clawback” of damages from successful Title III plaintiffs recovery of defense expenses prior to Title III judgement criminal penalties corporation – up to CDN$1.5 million individual – up to CDN$150,000 and/or five years imprisonment

- 9. The Foreign Extraterritorial Measures Act (cont’d) 1996 “blocking” order obligation to notify Canadian Attorney General of certain communications prohibition against complying with certain U.S. trade embargo measures penalty exposure: up to $1.5 million and/or 5 years imprisonment

- 10. The Notification Obligation “ Every Canadian corporation and every director and officer of a Canadian corporation shall forthwith give notice to the Attorney General of Canada of any directive, instruction, intimation of policy or other communication relating to an extraterritorial measure of United States in respect of any trade or commerce between Canada and Cuba that the Canadian corporation, director or officer has received from a person who is in a position to direct or influence the policies of the Canadian corporation in Canada.”

- 11. The Non-Compliance Obligation “ No Canadian corporation and no director, officer, manager or employee in a position of authority of a Canadian corporation shall, in respect of any trade or commerce between Canada and Cuba, comply with an extraterritorial measure of United States or with any directive, instruction, intimation of policy or other communication relating to such a measure that the Canadian corporation or director, officer, manager or employee has received from a person who is in a position to direct or influence the policies of the Canadian corporation in Canada.”

- 12. What is an “Extraterritorial Measure of the United States”? defined as the U.S. Cuban Assets Control Regulations and any law, ruling, guideline or other communication having a purpose similar to that of the CACRs “to the extent that they operate or are likely to operate so as to prevent, impede or reduce trade or commerce between Canada and Cuba” “ trade or commerce between Canada and Cuba” defined as trade (i) between Canadian entities and Cuban entities and (ii) between Canadian entities and Canadian nationals or corporations that are designated as Cuban nationals or corporations pursuant to an extraterritorial measure of the United States (e.g., “specially designated nationals”)

- 13. What is an “Extraterritorial Measure of the United States”? (cont’d) U.S. laws that may be considered “extraterritorial measures of the United States”: Cuban Assets Control Regulations Export Administration Regulations Helms-Burton (?) other

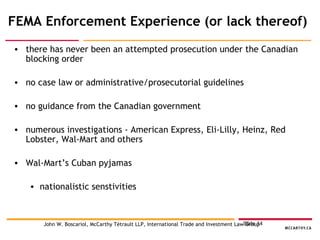

- 14. FEMA Enforcement Experience (or lack thereof) there has never been an attempted prosecution under the Canadian blocking order no case law or administrative/prosecutorial guidelines no guidance from the Canadian government numerous investigations - American Express, Eli-Lilly, Heinz, Red Lobster, Wal-Mart and others Wal-Mart’s Cuban pyjamas nationalistic senstivities

- 15. Canadian Controls on U.S.-Origin Goods FEMA and Canadian restrictions on supplying U.S.-origin items to Cuba U.S.-origin goods (ECL item 5400) – “designed to ensure Canada is not used as a diversionary route to circumvent U.S. embargoes” includes U.S. trade embargoes of Cuba, Iran, Syria and North Korea

- 16. Canadian Controls on U.S.-Origin Goods (cont’d) ECL item 5400: a permit is required for the export of all U.S.-origin goods from Canada excludes “goods that have been further processed or manufactured outside of the United States so as to result in a substantial change in value, form or use of the goods or in the production of new goods” 50% rule of thumb

- 17. Canadian Controls on U.S.-Origin Goods (cont’d) available GEP No. 12 permits export of U.S.-origin goods to all destinations except Belarus, Myanmar, Cuba, North Korea, Iran and Syria no written DFAIT policy for granting permits for export of U.S.-origin goods to these countries

- 18. Canadian Controls on U.S.-Origin Goods (cont’d) DFAIT’s verbal administrative policy currently permits U.S.-origin goods to be shipped to Cuba in only three circumstances: a U.S. licence has been obtained or humanitarian purposes (for the “basic necessities of human life”) or in support of a previously permitted export to Cuba

- 19. Resolving Conflicts between Canadian and U.S. Law on Cuba when apparent conflicts arise, key issues to be addressed include: Is the U.S. measure at issue subject to the FEMA Order? is it an “extraterritorial of the United States”? Does the U.S. measure operate or is it like to operate to reduce or impede trade or commerce between Canada and Cuba? - compliance with the U.S. measure may not reduce trade or commerce between Canada and Cuba

- 20. Resolving Conflicts between Canadian and U.S. Law on Cuba (cont’d) Is the communication at issue in the nature of a directive or intimation of policy? depending on the context, a simple statement as to what U.S. law provides regarding trade with Cuba may not be notifiable

- 21. Resolving Conflicts between Canadian and U.S. Law on Cuba (cont’d) Is the source of the communication in a position to direct or influence the policies of the Canadian corporation in Canada? - consider the position or authority of the person that has made the communication to the Canadian entity

- 22. Resolving Conflicts between Canadian and U.S. Law on Cuba (cont’d) 5. Does the Canadian entity’s act or omission constitute “compliance”? by following a particular course of action, is the Canadian entity actually complying with applicable U.S. law? what is the reason for the act or omission? is the reason compliance with Canadian law? are there other reasons unrelated to the U.S. trade embargo?

- 23. Resolving Conflicts between Canadian and U.S. Law on Cuba (cont’d) 6. If the issue concerns goods to be supplied to Cuba, what is their U.S.-origin content? if they are of U.S.-origin, Canadian law may not allow for their export to Cuba need to consider and possibly apply for Canadian export permit

- 24. Managing the Relationship Between U.S. and Canadian Export Controls and Trade Sanctions critical conflict points training programs compliance manuals communications and instructions server accessibility meetings and telephone conversations M&A due diligence contracts – e.g., supply agreements with U.S. companies, intercompany agreements, purchase orders, etc. end-use certificates

- 25. Managing the Relationship Between U.S. and Canadian Export Controls and Trade Sanctions (cont’d) cannot simply adopt U.S. trade control policies for Canadian operations export control and trade sanctions compliance manuals and any related directives should be “home grown”

- 26. Managing the Relationship Between U.S. and Canadian Export Controls and Trade Sanctions (cont’d) when potential conflicts arise: case-by-case analysis, very context-specific addressing exposure of U.S. citizens in Canada involvement of Canadian and U.S. counsel cultural - sovereignty issues particularly sensitive

- 27. John W. Boscariol Partner McCarthy TĂ©trault LLP Suite 53 00 Toronto Dominion Bank Tower Toronto-Dominion Centre Toronto, Ontario M5K 1E6 www.mccarthy.ca Direct Line: Â 416-601-7835 E-mail: Â jboscariol @ mccarthy.ca

- 28. Examples of Conflicts Example 1: A U.S. company conducts export compliance training at its Canadian subsidiary. U.S. staff travel to Canada, provide employees and officers of the Canadian company with export control manuals and training sessions which identify Cuba, among other countries, as being subject to the OFAC rules. Is the Canadian company required to make a notification to the Attorney General?

- 29. Examples of Conflicts (cont’d) Example 2: A European-based company has a subsidiary in the United States and a subsidiary in Canada. The CEO of U.S. subsidiary advises her Canadian counterpart that her company should not be supplying products to Cuba. Is the Canadian subsidiary required to notify the Attorney General?

- 30. Examples of Conflicts (cont’d) Example 3: The Canadian subsidiary in Example 2 uses the systems of its U.S. sister company to process orders that it receives. In order to avoid penalties under the CACRs, the Canadian subsidiary develops a new order system that red flags Cuban orders so that they are processed in Canada. Has the Canadian company violated the non-compliance obligation?

- 31. Examples of Conflicts (cont’d) Example 4: An Asian multi-national has a subsidiary in the United States which in turn has a subsidiary in Canada. The Canadian company receives a request to provide engineering services to a Cuban mining project. The Canadian company refuses because the CACRs prevent U.S.-owned foreign subsidiaries from doing business with Cuba. However, another Canadian company, a direct subsidiary of the Asian parent, steps in to provide the services. Is there a requirement to notify the Attorney General of any directions that may have been given to the Canadian company that refused the order? Is there a violation of the non-compliance obligation?

- 32. Examples of Conflicts (cont’d) Example 5: A Canadian investor participating in an hotel project in Cuba backs out of the deal when she realizes that the financial terms are not worth the risk, and she fears exposure to Title III actions under Helms-Burton. Has the Canadian investor violated her non-compliance obligation?

- 33. Examples of Conflicts (cont’d) Example 6: A Canadian distributor sources widgets from the United States and receives an order to ship to Cuba. He applies for a U.S. re-export license, perhaps in the hope that they are considered medical supplies, but is refused. He advises his customer that he is unable to ship. Has he violated the non-compliance obligation?

- 34. Examples of Conflicts (cont’d) Example 7: A Canadian manufacturer uses U.S.-origin components to produce widgets. The components comprise over 50 percent of the value of the widgets. It refuses a purchase order for Cuba assuming the shipment would not qualify for a Canadian export permit. Could this constitute a violation of the non-compliance obligation?