BILL OF EXCHANGE.ppt

- 2. Cheque & Bill of Exchange Presenters Jibral Ahmad Gul e faris Faisal M. Ejaz Irum Nawaz

- 3. Modren Banking Instrument Bankers cheque ATM cards Cheque Draft Bill of exchange Promissory Notes Letter of Credit

- 4. ’ü¼ What Is Cheque ? ’ü¼ What is Bill Of Exchange? Popularity of cheque over bill of exchange

- 5. Definition of a Cheque 1) A cheque is an UNCONDITIONAL ORDER IN WRITING that; a) Is addressed by a person to another person (being a FINANCIAL INSTITUTION) b) Is signed by the person giving it and c) Requires the FINANCIAL INSTITUTION to pay ON DEMAND A SUM CERTAIN in money

- 6. Bill Of Exchange Seller Buyer Clearing House Bill Accept Transfer Bill Payment (on due date) Payment 1 2 3 4 5

- 7. Bill Of Exchange ’ü¼ Can be drawn on anyone ’ü¼ Often used for international transactions ’ü¼ Does not use crossings ’ü¼ Accepted by party on whom drawn

- 8. A Cheque is ’ü¼ Drawn only on a financial institution ’ü¼ Mostly for commercial transactions within a country ’ü¼ Payable on demand ’ü¼ Financial institution pays because of banker/customer relationship rather than acceptance

- 9. Usage of Cheque and Bills of exchange Institutes Cheque Usage in one month Bill of exchange Usage in one month HBL 230 0 UBL 200 0 NBP 270 0 ABL 260 0 Meezan Bank 500 0

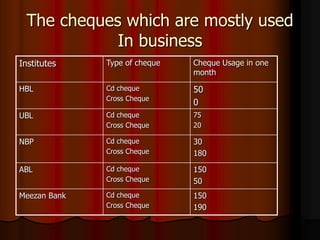

- 10. The cheques which are mostly used In business Institutes Type of cheque Cheque Usage in one month HBL Cd cheque Cross Cheque 50 0 UBL Cd cheque Cross Cheque 75 20 NBP Cd cheque Cross Cheque 30 180 ABL Cd cheque Cross Cheque 150 50 Meezan Bank Cd cheque Cross Cheque 150 190

- 11. Conclusion