Blackmoon crypto due diligence

- 1. Blackmoon Crypto Be Careful, Your Capital Is At Risk Why we think BMC could be a fraud. ICO Research from: ŌĆ£The Buy-SidekicksŌĆØ

- 2. Who We Are We are a small group of investment professionals working in London on the buy-side. We have been particularly taken aback by the recent euphoria surrounding ICOs ŌĆō which we have concluded many are fraudulent. Blackmoon Crypto is particularly interesting because: 1. Their investment case is predicated on the belief that investment managers ŌĆ£the buy-sideŌĆØ will want or need their services. We doubt this very much and believe there is much scope for Blackmoon to mislead in this regard because they are marketing to people with no knowledge or understanding of investment management and ŌĆ£the buy-sideŌĆØ i.e. they are marketing to unqualified investors. 2. Their marketing is very professional and as such we believe they have strong backing and we believe this is a deliberate attempt to mislead. We do not wish to see the reputation of the ICO market further tarnished. Please note, where we have used screenshots participants have shared with us from the Blackmoon Crypto Telegram group. We have blanked out usernames to maintain anonymity of people posting apart from the Blackmoon team. We are keen observers of multiple ICO telegram groups and will be releasing similar work in the future. Please refer to us as, ŌĆ£The Buy-SidekicksŌĆØ

- 3. Summary We make a number of statements, and provide verifiable evidence to back these up in this document: ŌĆó Blackmoon Financial has only existed as a registered company since June 2016, not 3 years and 2 months like the founder claims. ŌĆó We are highly sceptical of Blackmoon FinancialŌĆÖs track record of investment management owing to their unaudited track record which is used in their marketing of Blackmoon crypto. ŌĆó The founder of Blackmoon has no strong VC or Private Equity experience outside of Russia and his experience has been extremely hyped up. At best we can tell he was a management consultant. ŌĆó Flint Capital, where Oleg Seydak worked at in the past, made false claims regarding its size and scale. ŌĆó We believe Flint Capital has mislead with respect to its claim to have invested in LendingClub. ŌĆó Who is Dmitry Smirnov and what was his role at Finam Global? ŌĆó BlackmoonŌĆÖs whitepaper is not a whitepaper ŌĆō it is a marketing document. As such, there is nothing special regarding Blackmoon. We welcome clarifying statements with evidence to these allegations from the Blackmoon team.

- 4. BLACKMOON FINANCIAL HAS ONLY EXISTED FOR 2 YEARS, NOT 3 YEARS LIKE THE FOUNDER CLAIMS. ICO Research from: ŌĆ£The Buy-SidekicksŌĆØ

- 5. https://search.cro.ie/company/CompanyDetail s.aspx?id=583698&type=C Blackmoon Financial was incorporated in 2016 ŌĆō how can it have a track record from 2014?

- 6. Source: https://web.archive.org/web/20150417191532/https://blackmoonfg.com Using web.archive.org we show that Blackmoon Financial https://blackmoonfg.com/ was actually called BFG Capital ŌĆō earliest record is April 17th 2015: Amazing yet unsubstantiated claimsŌĆ”

- 7. WE ARE HIGHLY SCEPTICAL OF BLACKMOON FINANCIALŌĆÖS TRACK RECORD AND OF INVESTMENT MANAGEMENT. ICO Research from: ŌĆ£The Buy-SidekicksŌĆØ

- 8. https://blackmooncrypto.com/bmc_whitepaper_170911_v1.18.pdf From the BMC Whitepaper, BFG has no proven track record of delivering solid double digit returns as this track record is unaudited. That is rule #1 when looking at investment performanceŌĆ”the track record needs to be audited and GIPS compliant. No proven investment track recordŌĆ”

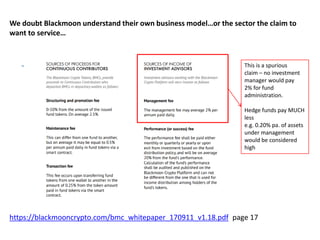

- 9. This is a spurious claim ŌĆō no investment manager would pay 2% for fund administration. Hedge funds pay MUCH less e.g. 0.20% pa. of assets under management would be considered high https://blackmooncrypto.com/bmc_whitepaper_170911_v1.18.pdf page 17 We doubt Blackmoon understand their own business modelŌĆ”or the sector the claim to want to serviceŌĆ”

- 10. THE FOUNDER OF BLACKMOON HAS NO STRONG VC OR PRIVATE EQUITY EXPERIENCE OUTSIDE OF RUSSIA ŌĆō THIS HAS BEEN EXTREMELY HYPED. ICO Research from: ŌĆ£The Buy-SidekicksŌĆØ

- 11. From Oleg SeydakŌĆÖs LinkedIn: https://www.linkedin.com/in/olegseydak/ On Telegram he said he left Flint Capital in 2015, why is he still there on LinkedIn? We know this was incorporated in Ireland in 2016ŌĆ” and was a loan financing company in Eastern EuropeŌĆ” Oleg makes it look like he was working on BMC for 3 yearsŌĆ”

- 12. From Oleg SeydakŌĆÖs LinkedIn: https://www.linkedin.com/in/olegseydak/ It looks like Oleg has never worked at any single firm for more 2 years apart from Blackmoon Financial (which we have shown previously was incorporated in Ireland in 2016) and Flint CapitalŌĆ”but he claims he doesnŌĆÖt actually ŌĆ£workŌĆØ for Flint, rather he was a ŌĆ£Non Executive Co-founding PartnerŌĆØ However according to Flint CapitalŌĆÖs website, 2 years ago Oleg was a partner (next slide). Being ŌĆ£non-executiveŌĆØ means he would not have actually been working for Flint, sourcing deals etc. rather played an advisory role. All 1 year All 1 year, 4 months 1 year, 4 months 1 year, 7 months How does one go from a Client Relationship Manager (sales job) to a Senior Consultant in ŌĆ£Managemnet consulting companyŌĆØ which is a spurious company name? This is all part of working at Finam, see slide 14.

- 13. Oleg was a ŌĆ£PartnerŌĆØ at Flint just 2 years agoŌĆ”. Flint was much smaller back thenŌĆ” We would like to understand Flint CapitalŌĆÖs source of funding?

- 14. From Oleg SeydakŌĆÖs LinkedIn: https://www.linkedin.com/in/olegseydak/ A participant asked Oleg, ŌĆ£What kind of Venture Capital Track Record do you have?ŌĆØ Oleg worked at Finam for 1 yearŌĆ”doubtful he managed many deals in 1 year as he was busy advising.

- 15. OlegŌĆÖs profile on flintcap.com from September 2014 explains he has ŌĆ£considerable experience in banking and consulting sectors. Managing positions in VC funds since 2011ŌĆØ ŌĆō but how can he have ŌĆ£considerable experienceŌĆØ considering he did not run any VC funds himself . He most likely performed management consulting.

- 16. Flint Capital website in 2014ŌĆ”

- 17. FLINT CAPITAL, WHERE OLEG SEYDAK WORKED AT IN THE PAST, MADE FALSE CLAIMS REGARDING ITS SIZE AND SCALE. ICO Research from: ŌĆ£The Buy-SidekicksŌĆØ

- 18. On Flint CapitalŌĆÖs current website, http://www.flintcap.com/ they state it was founded in 2013 with $30m in committed capital, but back in 2013, they claimed to have $50m committed capital:

- 19. They also claimed to have $1.2bn in projects and 20 years experienceŌĆ”.difficult to verifyŌĆ”20 years between Dmitry and Oleg? Look at their linkedin profiles.

- 20. Flint Capital in 2014ŌĆ” Please note, this project list does not include LendingClubŌĆ”note the dates on these is 28 September 2014

- 21. On August 27, 2014, Lending Club filed for an IPO with the SEC https://www.sec.gov/Archives/edgar/data/1409970/000119312514323136/d766811ds1.htm 17 December 2014: LendingClub appears as their project: Wow!!

- 22. From Flint CapitalŌĆÖs website as of 11 September 2017 ŌĆō LendingClub IPO! Unless Flint Capital bought the IPO when LendingClub was listedŌĆ”which anyone could have, we cannot find any evidence from SEC filings they participated in the actual listing of the stock.

- 23. WHO IS DMITRY SMIRNOV AND HIS ROLE AT FINAM GLOBAL? ICO Research from: ŌĆ£The Buy-SidekicksŌĆØ

- 24. Who is Dmitry Smirnov? ŌĆó This is the Russian entrepreneur and politician, Dmirty Smirnov: https://en.wikipedia.org/wiki/Dmitry_Smirnov_(entrepreneur) - itŌĆÖs very easy for people to confuse the 2. They are not the same person. ŌĆó Here is VC DmitryŌĆÖs linkedin: https://www.linkedin.com/in/dmitrysmirnov2/?ppe=1 ŌĆó The company he was CEO of for 6 years from Aug 2007 to Sept 2013 (and Oleg worked there for a year) was Finam Global Investments, which is no longer operational: http://www.finamglobal.com/error/?lipi=urn%3Ali%3Apage%3Ad_fla gship3_company%3BPEAO2igEQ3GHaMl0yBCwPw%3D%3D ŌĆó Finam Global (https://www.linkedin.com/company/2576763/ ), is not the same as Finam Investment Bank (https://www.linkedin.com/company/44102/ ) or Finam Capital. Finam Global has 15 employees on linkedin, Finam Investment Bank has 410 employees on Linkedin.

- 25. Finam Global company structure ŌĆō source: Factset Finam Global, where Dmitry was CEO Finam Technology Fund ETF (great track record with Badoo)

- 26. Finam Capital was the entity within Finam Global that ran their Technology VC funds. Fortunately, we can see who the management team of Finam Capital were: No mention of Dmitry or Oleg??!!

- 27. Finam Capital had 3 investment pools; 1) Direct 2) Technology Fund 1 ETF and 3) Technology Fund II L.P, an offshore vehicle.

- 28. The ETF was successful, but thereŌĆÖs no way we can be sure who worked on whatŌĆ”all we know is that the ETF launched in 2005 and had itŌĆÖs big success in 2008. Dmitry was CEO of Finam Global from August 2007, so doubtful he had a significant impact on the early deals...

- 29. WE VISITED FLINT CAPITAL IN LONDON ICO Research from: ŌĆ£The Buy-SidekicksŌĆØ

- 30. We visited Flint CapitalŌĆÖs London Office TheyŌĆÖre in a We Work centre ŌĆō costs ┬Ż400 a month for a deskŌĆ”not what you would expect from a successful Venture Capital firm managing to raise $100m+ Petr Zhegin is the only Flint Capital employee on the roster. https://www.linkedin.com/in/peter- zhegin-526a993/?ppe=1 HeŌĆÖs got 3 yearsŌĆÖ work experience (2 at Flint) and heŌĆÖs running their London Office? Not bad... Why is Flint Capital so desperate to hype up their image? Perhaps because they need to for the ICO?

- 31. BLACKMOONŌĆÖS WHITEPAPER & WEBSITE ICO Research from: ŌĆ£The Buy-SidekicksŌĆØ

- 32. Whitepaper & Website ŌĆó Contains no technical text ŌĆō just diagrams of structures which are meaningless. ŌĆó Has great images of astronauts (like Gemini Exchange?), Owles, Rockets ŌĆō all made to look fractal and techy. ThereŌĆÖs even a wall-street bull! ŌĆó DeloitteŌĆÖs logo is being used ŌĆō we wonder if they realise that? ŌĆó At least they explain on page 31, 20% of the tokens issued are going straight to the Team & advisersŌĆ” ŌĆó Financial projections on page 33 are far too preciseŌĆ”this is a red flag. ŌĆó https://youtu.be/DaEaAqJQGJY great video of Oleg speaking to a fake audience with a robotic voiceŌĆ”

- 33. What is special about Blackmoon? We found the questions of one user particularly pertinent: ŌĆ£IŌĆÖm trying to understand what is exclusive to Blackmoon Crypto?ŌĆØ We found the responses interesting and we provide our commentary in red: ŌĆó #1: ŌĆ£Speaking of big players, they are more likely to buy companies, rather than create something from scratchŌĆØ ŌĆō Sergey trying to hype up BCM by intimating that Blackmoon could be bought by a bigger player ŌĆó #2 the participant was not happy with the response received, Oleg responded ŌĆ£because they want it and canŌĆÖt do it themselvesŌĆØ ŌĆō this is a big assumption (ŌĆ£they want itŌĆØ) and doesnŌĆÖt answer the question asked. ŌĆó #3: question asked again, the response is again without foundation or evidence. OlegŌĆÖs statement about tokenization being 10 times cheaper is completely unfounded, he provides no facts to back this up. #1 #2 #3 #4 Oleg: ŌĆ£There is no things that can not be replicatedŌĆØ ŌĆō i.e. Nothing is unique to BMC Oleg: ŌĆ£Perhaps we just believe in our vision and do our bestŌĆØ ŌĆō i.e. every man for himself once weŌĆÖve collected 50% of the ICO proceeds.

- 34. Summary By ŌĆ£investingŌĆØ in the Blackmoon ICO, you are: ŌĆó Giving 20% of the money you commit to the project to the founders and their advisors immediately, upfront. The other 30% goes to the company, which could pay it to the employees (themselves) on day 1. ThatŌĆÖs 50%. ŌĆó Buying into a team which has provided misleading information about their experience. ŌĆó Buying a ŌĆ£tokenŌĆØ which is ŌĆ£not a securityŌĆØ (according to the founder) but somehow gives the bearer the right to the profits of the platformŌĆ”umm ok? Howey test anyone? ŌĆó Buying into a team expecting to make inroads into the buy-side asset management community with no actual experience of that community, nor the legal and regulatory framework (team is all Russian, unregulated in the USA and Europe which is where 90% of the buy-side and assets are located). ŌĆó Buying into zero competitive advantage in the founderŌĆÖs own words ŌĆō they possess nothing that canŌĆÖt be copied, no patents or technology, just greed masquerading as innovation.