Bonds

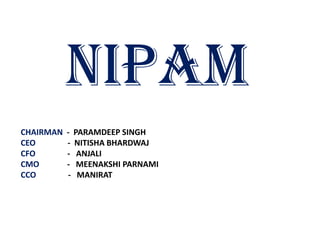

- 1. NIPAM CHAIRMAN - PARAMDEEP SINGH CEO - NITISHA BHARDWAJ CFO - ANJALI CMO - MEENAKSHI PARNAMI CCO - MANIRAT

- 2. BONDS

- 3. ÔÉò Bond is a debt security ÔÉòin which the authorized issuer owes the holders a debt ÔÉò and is obliged to pay interest ÔÉò and repay the principal at a later date, termed maturity ÔÉòit is a formal contract to repay borrowed money with interest at fixed intervals ÔÉòThe holder of bond is called lender ( creditor ) ÔÉòThe issuer of the bond is called borrower (lender) ÔÉò interest is termed as coupon

- 5. WHAT IS A USE OF A BOND ?  Bonds provide the borrower with external funds to finance long-term investments  In the case of government bonds, to finance current expenditure.  Lender gets risk free Investment.

- 6. BONDS AND STOCKS ARE BOTH SECURITIES BUT THERE IS A MAJOR DIFERENCE IN BOTH Stockholders have an equity stake in the company ( they are owners) Bondholders have credit stake in the company ( they are lenders ) Bonds have maturity time ( redemption time ) Stocks may be outstanding indefinitely.

- 7. TYPES OF BONDS ÔÉò INFRASTRUCTURE BONDS ÔÉòCAPITAL GAINS BONDS ÔÉòZERO COUPON BONDS

- 8. INFRASTRUCTURE BONDS ÔÉò They are same as other bonds available in investment market ÔÉòDifference is only this the funds collected through the sale of these bonds is used for the infrastructural development, highway projects, railways project. ÔÉò Have fixed rate of interest ÔÉòHave tax deduction upto 20,000 for 1 financial year ( 80 CCF ) ÔÉòLong term investment , have maturity period 10-15 years ÔÉò Pan card , address proof , demat ac is required to apply. ÔÉòOnly govt. companies can issue these ÔÉòMajor provider IDFC ( infrastructure dev finance company )

- 9. CAPITAL GAINS BONDS Sect 54EC: •Any person •Tax exemption •Bonds issued by: 1. NHAI 2. REC •Payment 6 months •Lock in 3year •GUARANTEED RETURNS

- 10. ZERO COUPON BONDS BONDS ÔÉò DEEP DISCOUNT ÔÉò DISCOUNT ÔÉò MATURITY ÔÉò LONGER MATURITY ->LESSER ISSUE PRICE ÔÉò NO CASH INFLOW