Bookkeeping primer

Download as PPT, PDF2 likes446 views

This document provides an overview of managing finances, bookkeeping basics, and tax tips for small business owners. It discusses the responsibilities of business owners, including generating income, funding expenses, tracking income and expenses, and paying taxes. It offers tips for getting paid, paying others, using contractors, keeping simple bookkeeping records, deducting expenses, paying quarterly estimated taxes, and penalties for underpayment. The document aims to help small business owners stay organized with their finances and taxes.

1 of 10

Download to read offline

Recommended

Managing Financial Transactions, *Bookkeeping Basics* and Small Business Tax ...

Managing Financial Transactions, *Bookkeeping Basics* and Small Business Tax ...Outright

Ã˝

Outright.com founder covers the critical fundamentals of starting your own business including: What it means to be in business for yourself, Getting paid and paying others, Working with independent contractors, Bookkeeping – the simplified version,

Handling the more confusing deductions, and Taxes: what and when you have to pay.The Lowdown on Taxes for Etsy Sellers

The Lowdown on Taxes for Etsy SellersOutright

Ã˝

This slide deck is from an educational seminar series that Etsy and Outright hosted for Etsy sellers throughout the United States. The focus is on helping Etsy sellers prepare for the 2012 income tax filing.Have you outgrown your tax preparer

Have you outgrown your tax preparerTony Novak, CPA, MBA, MT

Ã˝

This document discusses the benefits of hiring a professional tax accountant like Tony Novak over a chain tax store or seasonal preparer. It notes that a professional can provide strategic tax planning to reduce taxes over multiple years rather than just filing a return. The document also emphasizes that professionals have extensive experience advising clients on tax saving strategies and keeping them safe from IRS inquiries. Hiring a professional allows for a simple online process of exchanging documents and discussing taxes without compromising privacy or security.Tax Tips for MLM Reps

Tax Tips for MLM RepsCharles Holmes

Ã˝

This document provides tips for MLM representatives on organizing their business taxes. It recommends keeping meticulous records of all business expenses and receipts organized by category in a spreadsheet or profit and loss statement. This makes taxes easier at the end of the year. Common deductions include advertising, business education, travel, phone and internet, car expenses, home office, supplies, and meals related to business. Tracking expenses can save thousands in taxes by reducing taxable income. The document provides an example and urges reps to get organized, use tax software, and consult professionals to understand deductions.How to pay less taxes

How to pay less taxes Heather Dunn

Ã˝

This document provides tips on how owner-operators can pay less taxes through important tax deductions and credits. It recommends tracking expenses, keeping good records, choosing an advantageous business structure like an LLC or S-corp, and working with a tax professional to lower tax liability. Deductions mentioned include home office, per diem, medical expenses, and business miles.Lowdown on Taxes for Online Sellers

Lowdown on Taxes for Online SellersOutright

Ã˝

The document provides an overview of annual income taxes for online sellers. It discusses filing requirements and deadlines, including paying estimated quarterly taxes. It explains that PayPal, Amazon, and Etsy send sellers a 1099-K tax form if their annual sales exceed $20,000 and 200 transactions. The document advises sellers to reconcile their records with the 1099-K, deduct expenses to lower their taxes, and take common deductions like the home office deduction and mileage. It emphasizes the importance of reporting gross receipts that match or exceed the 1099-K amount to avoid potential audits.2015 Year-End Tax Planning

2015 Year-End Tax PlanningDillon Wright

Ã˝

This document provides an overview of key year-end tax planning considerations for 2015, including: changes to the Affordable Care Act provisions, unchanged income tax rates but higher exemption amounts for the alternative minimum tax, unchanged capital gains and dividend tax rates, and increased contribution limits for retirement accounts. It also outlines various tax deductions and credits that individuals and small business owners should consider like the home office deduction, education credits, and depreciation rules. Lastly, it provides tips for last minute tax planning and protecting against identity theft.Shae Givens - Sample Presentation 1

Shae Givens - Sample Presentation 1Shae Givens

Ã˝

This document discusses the complexities of managing sales and use tax compliance and provides an overview of how outsourcing to Taxware STS can help. It notes there are over 210 million tax rules across 13,000 jurisdictions in the US. Managing compliance in-house requires significant resources to research rules, file returns, remit payments, manage notices and more. Using Taxware STS allows a company to leverage a team of tax experts and offload the daily tax compliance tasks, freeing up resources for strategic initiatives. An example is provided showing the potential cost savings and ROI that can be achieved by outsourcing to Taxware STS.Tax Planning Update: Client CPE Day 2013

Tax Planning Update: Client CPE Day 2013Cohen and Company

Ã˝

Tax Planning Update by Tracy Monroe, CPA. Presented at Cohen & Company's Client CPE Day. Covers business as well as individual tax updates.

www.cohencpa.comChapter 3

Chapter 3Morten Andersen

Ã˝

This document provides an overview of personal taxes in the United States. It discusses the major types of taxes individuals pay, including taxes on purchases, property, wealth, and earnings. It explains how the federal income tax is calculated, including determining taxable income, deductions, credits, and the taxes owed. It also reviews strategies for tax planning, preparing and filing tax returns, and what to do if your return is audited. The overall goal is to help people understand their tax obligations while taking advantage of available tax benefits.Manufacturing Co ROI

Manufacturing Co ROIBurke Gibson

Ã˝

This document presents the case for automating supplier payment operations for a manufacturing company. It highlights the current inefficient and costly manual processes, including high costs from payment errors, reconciliation issues, and lack of visibility. The proposed solution is to implement a single automated system to manage global supplier payments. This would save over 8,000 manual hours per year and generate estimated net savings of over $1.2 million over 3 years with a 0 month payback period and ROI improvements of 12.4x in year 1, 17.6x in year 2, and 22.7x in year 3. Areas that would benefit include reduced onboarding costs, fewer payment errors, streamlined invoice processing, and improved compliance.ISO_Tax_Strategies

ISO_Tax_StrategiesMartin Curiel, CFA

Ã˝

The decision to exercise ISOs can be very important to technology and other professionals. Understanding the AMT and other tax implications of exercising these options is not always a straight-forward exercise.

This presentation covers the basics of taxes and tax strategies related to these instruments. The objective is to give participants a framework for deciding if and when to exercise ISOs and if so, when to sell the underlying shares.For Apartment Communities : Cost Saving & Financial Sustainability In The New...

For Apartment Communities : Cost Saving & Financial Sustainability In The New...KarnikaRoy2

Ã˝

The fourth webisode of the Neighborhoods of Tomorrow - Interactive Webinar Series is aimed to help Associations and Management Committees of Apartment Complexes/Housing Societies/Gated Communities to streamline community finances, save more and earn more.C-Suite Snacks Webinar Series: Reducing Risk and Cost in the Global Supply Chain

C-Suite Snacks Webinar Series: Reducing Risk and Cost in the Global Supply ChainCitrin Cooperman

Ã˝

This webinar discusses various strategies companies can use to reduce risk and costs in their global supply chains, particularly in light of increased tariffs. It outlines areas for companies to consider like leveraging free trade agreements, drawback programs, bonded warehousing, and foreign trade zones. It also discusses alternative sourcing, tariff engineering, and improved demand planning. The presentation aims to help companies assess opportunities to lower costs and mitigate tariff impacts through a collaborative cross-functional process.What Documents to Bring When Meeting Your Income Tax Accountant

What Documents to Bring When Meeting Your Income Tax AccountantGavin Ma & Co.

Ã˝

Meeting with your income tax accountant can seem daunting, especially if you're new to Australian tax laws. However, with the right preparation, it can be a smooth and stress-free experience.

Supporting Community Entrepreneurs: Business Startup Basics

Supporting Community Entrepreneurs: Business Startup Basicsicablearning

Ã˝

This document provides an overview of starting a small business and covers topics such as defining a business, getting started, record keeping, expenses, and requirements. It discusses the differences between being a sole proprietor versus incorporated and outlines options for basic accounting, payments, and software to help organize finances. Resources from the CRA, Small Business BC, and WorkSafe BC are listed to support entrepreneurs with registration, consultation, education, and compliance requirements.Get Money Awesome

Get Money AwesomeKatherine-CWACanada

Ã˝

This document provides an outline for a workshop on getting money management skills improved for freelancers. The workshop covers identifying common money pitfalls, establishing personal and business budgets, tracking business income and expenses for tax purposes, and preparing tax returns. It provides tips on tracking both personal and business finances, expenses that can be written off, and resources for budgeting, bookkeeping, and doing taxes to help freelancers get their money management organized and "awesome."SCORE presentation_Fit Books Accounting

SCORE presentation_Fit Books AccountingCarmen Weyland, CPA

Ã˝

The document provides an overview of important accounting considerations for small business owners, including how to select an appropriate business entity, manage taxes, cash flow, bookkeeping, payroll, and how to assemble a professional advisory team. It discusses key decisions around entity structure, accounting methods, tax obligations, and recommends outsourcing tasks like payroll and bookkeeping to ensure compliance.Bookkeeping Success

Bookkeeping SuccessConnieRHarvey

Ã˝

The document provides guidance on proper bookkeeping practices including organizing paperwork into relevant sections, setting up a chart of accounts in a logical order, entering transactions regularly such as weekly, and reconciling statements monthly. It also discusses the importance of financial statements like the balance sheet and income statement, as well as bookkeeping for payroll, taxes, and following best practices like using templates and getting help when needed.Attorney profitability project

Attorney profitability projectRyanKimler

Ã˝

This document summarizes strategies for increasing attorney profitability presented by Ryan Kimler. It recommends allocating income using the Profit First system to set aside money for profit, owner's pay, taxes, and expenses. It also provides formulas and budgets for defining revenue goals and marketing costs. Additional tips include using trust funds, minimizing credit card processing fees, reviewing software subscriptions, outsourcing hiring, implementing management accounting, reducing S-Corp salaries to lower taxes, hiring family members, contributing to Roth IRAs for children, and closing with an example attorney's success story.Bookkeeping for Small Business in Ireland.pptx

Bookkeeping for Small Business in Ireland.pptxrosekervick

Ã˝

For new small business owners in Ireland, accountantonline.ie presents webinars regularly to its clients on how to manage the financial aspects of your new small business. In this webinar we talk about --Keeping records – what types of records you should keep, for how long, and what are the most efficient and organised ways to store your documents

VAT – Revenue compliance requirements

Financial terminology – we’ll help you to understand key bookkeeping terms like bank reconciliation, accounts payable and accounts receivable

Understanding financial data – the importance of accurate data to make good business decisions.

Bookkeeping involves keeping track of your financial records, such as receipts, expenses, invoices, and bank statements in your business.

From a practical perspective it involves:

Data entry

Reconciliations

Aged analysis & credit control

Reporting

Good bookkeeping can help to grow your business. But what is good bookkeeping?

Accounting is a bit more complicated than bookkeeping.

Accountants may oversee your bookkeeping and make sure the records are maintained correctly but they don’t usually carry out any data entry. Your accountant will prepare technical accounting duties like preparing profit and loss accounts, balance sheets and file your tax returns.

Types of documents needed for bookkeeping: Sales and purchase invoices/receipts

Bank and Visa statements

Payslips and wage sheets

Stock / ecommerce / Point Of Sale (POS) reports

Verification records for assets such as property, machinery or vehicles

Cash books and receipts

We also cover Accounting software, VAT registrations, reverse charge VAT

Understanding Financial Data – What do I need to have/know

Budgets

Income Statement

Profit and Loss A/C

Balance Sheet

Cash Flow

Debtors/Creditors

Sales & Use Tax: A Different Approach

Sales & Use Tax: A Different ApproachMcKonly & Asbury, LLP

Ã˝

Understanding the advantages of having an expert review your company’s sales and use tax transactions; awareness of opportunities that potentially exist for obtaining refunds of sales and use tax already paid by your organization; learning more about the ins and outs of sales and use tax.Avalara | The 2nd Annual eCommerce Expo South Florida

Avalara | The 2nd Annual eCommerce Expo South Florida Rand Internet Marketing

Ã˝

Katherine Cxypoliski of Avalra offered a much needed and often underestimated topic, the impact of global taxation issues on ecommerce and business generally, at the 2nd Annual eCommerce Expo South Florida sponsored by Rand Marketing in Fort Lauderdale, Florida.

The presentation focused on sales tax challenges, including why sales tax matters, product taxability, how to automate the process, sales tax compliance challenges, and taxation issues as they relate to zip codes and geolocation.Enterprise week march 2017 presentation anthony boyle

Enterprise week march 2017 presentation anthony boyleDonegal Local Enterprise Office

Ã˝

Anthony Boyle, originally from Burtonport is a Chartered Tax Advisor. He is co-owner of Tax Assist Accountants and The Glackin Business Institute Ltd which provide Tax, Accounting, Banking and Financial advice to SMEs in the Northwest.

His business focuses on helping clients

manage their business and personal finances efficiently, minimise taxes, avail of available incentives, remain compliant and become

financially secure. Prior to starting his own business in 2015, Anthony worked in various senior roles with the Financial Engineering Network, Bank of Ireland Private Banking and Ulster Bank. He has a degree in Bank & Finance from the University of Ulster and is a Qualified Financial advisor.Taxes and Record Keeping Presentation

Taxes and Record Keeping PresentationAsian Women In Business

Ã˝

Taxes and Record Keeping

This will cover the importance of keeping your finances in order, including a record system, bookkeeping, accounting, payroll, and other financial and tax issues.Tax Preparation - Essential Tips for Efficient and Accurate Filing

Tax Preparation - Essential Tips for Efficient and Accurate Filingfinalert.net

Ã˝

For efficient tax preparation, gather documents early, choose the right filing status, maximize deductions and credits, and file on time.

Startup Accounting Essentials

Startup Accounting EssentialsDavid Ehrenberg

Ã˝

Whether you're bootstrapping or venture-backed, pre-funding or post-funding, pre-revenue or turning a profit, there are steps you need to take to stay on top of your finances, maintain compliance, and establish the foundation you'll need to scale.

This presentation will help get you up to speed on startup accounting: what you need to know, what you should be doing, and how to do it including: implementing your accounting system, the best system for expense tracking, creating an effective payment collection process, staying on top of your taxes, top-down and bottom-up financial projections, how to get your best valuation, and more.

What is tax and how do I pay it?

What is tax and how do I pay it?Dean Renshaw

Ã˝

This document provides a summary of taxes in the UK, including income tax, corporation tax, VAT, and how to spread the costs of taxes through financing options from White Oak UK. It defines each major tax, how often payments are due, and tips for tax filing and claiming deductions. White Oak UK offers short-term loans to help businesses pay tax bills in installments rather than a lump sum. The loans can be arranged quickly online and provide cash flow benefits over using cash reserves.Tax Compliance Solutions Your Key to Stress-Free Tax Seasons.docx

Tax Compliance Solutions Your Key to Stress-Free Tax Seasons.docxfigmentglobal

Ã˝

Tax season travel doesn’t have to be a stressful experience. By implementing effective tax compliance solutions.Importance of the IRS Form 990 (September 25, 2013)

Importance of the IRS Form 990 (September 25, 2013)United Way of the National Capital Area

Ã˝

Mitch Weintraub, CPA and Michael Drennan, CPA of Cordia Partners, and Tamara Vineyard, CPA of Dixon Hughes Goodman delivered a workshop sponsored by United Way of the National Capital Area on September 25, 2013.

Learn about events for our nonprofit members here:

http://www.unitedwaynca.org/events/membersMore Related Content

What's hot (6)

Tax Planning Update: Client CPE Day 2013

Tax Planning Update: Client CPE Day 2013Cohen and Company

Ã˝

Tax Planning Update by Tracy Monroe, CPA. Presented at Cohen & Company's Client CPE Day. Covers business as well as individual tax updates.

www.cohencpa.comChapter 3

Chapter 3Morten Andersen

Ã˝

This document provides an overview of personal taxes in the United States. It discusses the major types of taxes individuals pay, including taxes on purchases, property, wealth, and earnings. It explains how the federal income tax is calculated, including determining taxable income, deductions, credits, and the taxes owed. It also reviews strategies for tax planning, preparing and filing tax returns, and what to do if your return is audited. The overall goal is to help people understand their tax obligations while taking advantage of available tax benefits.Manufacturing Co ROI

Manufacturing Co ROIBurke Gibson

Ã˝

This document presents the case for automating supplier payment operations for a manufacturing company. It highlights the current inefficient and costly manual processes, including high costs from payment errors, reconciliation issues, and lack of visibility. The proposed solution is to implement a single automated system to manage global supplier payments. This would save over 8,000 manual hours per year and generate estimated net savings of over $1.2 million over 3 years with a 0 month payback period and ROI improvements of 12.4x in year 1, 17.6x in year 2, and 22.7x in year 3. Areas that would benefit include reduced onboarding costs, fewer payment errors, streamlined invoice processing, and improved compliance.ISO_Tax_Strategies

ISO_Tax_StrategiesMartin Curiel, CFA

Ã˝

The decision to exercise ISOs can be very important to technology and other professionals. Understanding the AMT and other tax implications of exercising these options is not always a straight-forward exercise.

This presentation covers the basics of taxes and tax strategies related to these instruments. The objective is to give participants a framework for deciding if and when to exercise ISOs and if so, when to sell the underlying shares.For Apartment Communities : Cost Saving & Financial Sustainability In The New...

For Apartment Communities : Cost Saving & Financial Sustainability In The New...KarnikaRoy2

Ã˝

The fourth webisode of the Neighborhoods of Tomorrow - Interactive Webinar Series is aimed to help Associations and Management Committees of Apartment Complexes/Housing Societies/Gated Communities to streamline community finances, save more and earn more.C-Suite Snacks Webinar Series: Reducing Risk and Cost in the Global Supply Chain

C-Suite Snacks Webinar Series: Reducing Risk and Cost in the Global Supply ChainCitrin Cooperman

Ã˝

This webinar discusses various strategies companies can use to reduce risk and costs in their global supply chains, particularly in light of increased tariffs. It outlines areas for companies to consider like leveraging free trade agreements, drawback programs, bonded warehousing, and foreign trade zones. It also discusses alternative sourcing, tariff engineering, and improved demand planning. The presentation aims to help companies assess opportunities to lower costs and mitigate tariff impacts through a collaborative cross-functional process.Similar to Bookkeeping primer (20)

What Documents to Bring When Meeting Your Income Tax Accountant

What Documents to Bring When Meeting Your Income Tax AccountantGavin Ma & Co.

Ã˝

Meeting with your income tax accountant can seem daunting, especially if you're new to Australian tax laws. However, with the right preparation, it can be a smooth and stress-free experience.

Supporting Community Entrepreneurs: Business Startup Basics

Supporting Community Entrepreneurs: Business Startup Basicsicablearning

Ã˝

This document provides an overview of starting a small business and covers topics such as defining a business, getting started, record keeping, expenses, and requirements. It discusses the differences between being a sole proprietor versus incorporated and outlines options for basic accounting, payments, and software to help organize finances. Resources from the CRA, Small Business BC, and WorkSafe BC are listed to support entrepreneurs with registration, consultation, education, and compliance requirements.Get Money Awesome

Get Money AwesomeKatherine-CWACanada

Ã˝

This document provides an outline for a workshop on getting money management skills improved for freelancers. The workshop covers identifying common money pitfalls, establishing personal and business budgets, tracking business income and expenses for tax purposes, and preparing tax returns. It provides tips on tracking both personal and business finances, expenses that can be written off, and resources for budgeting, bookkeeping, and doing taxes to help freelancers get their money management organized and "awesome."SCORE presentation_Fit Books Accounting

SCORE presentation_Fit Books AccountingCarmen Weyland, CPA

Ã˝

The document provides an overview of important accounting considerations for small business owners, including how to select an appropriate business entity, manage taxes, cash flow, bookkeeping, payroll, and how to assemble a professional advisory team. It discusses key decisions around entity structure, accounting methods, tax obligations, and recommends outsourcing tasks like payroll and bookkeeping to ensure compliance.Bookkeeping Success

Bookkeeping SuccessConnieRHarvey

Ã˝

The document provides guidance on proper bookkeeping practices including organizing paperwork into relevant sections, setting up a chart of accounts in a logical order, entering transactions regularly such as weekly, and reconciling statements monthly. It also discusses the importance of financial statements like the balance sheet and income statement, as well as bookkeeping for payroll, taxes, and following best practices like using templates and getting help when needed.Attorney profitability project

Attorney profitability projectRyanKimler

Ã˝

This document summarizes strategies for increasing attorney profitability presented by Ryan Kimler. It recommends allocating income using the Profit First system to set aside money for profit, owner's pay, taxes, and expenses. It also provides formulas and budgets for defining revenue goals and marketing costs. Additional tips include using trust funds, minimizing credit card processing fees, reviewing software subscriptions, outsourcing hiring, implementing management accounting, reducing S-Corp salaries to lower taxes, hiring family members, contributing to Roth IRAs for children, and closing with an example attorney's success story.Bookkeeping for Small Business in Ireland.pptx

Bookkeeping for Small Business in Ireland.pptxrosekervick

Ã˝

For new small business owners in Ireland, accountantonline.ie presents webinars regularly to its clients on how to manage the financial aspects of your new small business. In this webinar we talk about --Keeping records – what types of records you should keep, for how long, and what are the most efficient and organised ways to store your documents

VAT – Revenue compliance requirements

Financial terminology – we’ll help you to understand key bookkeeping terms like bank reconciliation, accounts payable and accounts receivable

Understanding financial data – the importance of accurate data to make good business decisions.

Bookkeeping involves keeping track of your financial records, such as receipts, expenses, invoices, and bank statements in your business.

From a practical perspective it involves:

Data entry

Reconciliations

Aged analysis & credit control

Reporting

Good bookkeeping can help to grow your business. But what is good bookkeeping?

Accounting is a bit more complicated than bookkeeping.

Accountants may oversee your bookkeeping and make sure the records are maintained correctly but they don’t usually carry out any data entry. Your accountant will prepare technical accounting duties like preparing profit and loss accounts, balance sheets and file your tax returns.

Types of documents needed for bookkeeping: Sales and purchase invoices/receipts

Bank and Visa statements

Payslips and wage sheets

Stock / ecommerce / Point Of Sale (POS) reports

Verification records for assets such as property, machinery or vehicles

Cash books and receipts

We also cover Accounting software, VAT registrations, reverse charge VAT

Understanding Financial Data – What do I need to have/know

Budgets

Income Statement

Profit and Loss A/C

Balance Sheet

Cash Flow

Debtors/Creditors

Sales & Use Tax: A Different Approach

Sales & Use Tax: A Different ApproachMcKonly & Asbury, LLP

Ã˝

Understanding the advantages of having an expert review your company’s sales and use tax transactions; awareness of opportunities that potentially exist for obtaining refunds of sales and use tax already paid by your organization; learning more about the ins and outs of sales and use tax.Avalara | The 2nd Annual eCommerce Expo South Florida

Avalara | The 2nd Annual eCommerce Expo South Florida Rand Internet Marketing

Ã˝

Katherine Cxypoliski of Avalra offered a much needed and often underestimated topic, the impact of global taxation issues on ecommerce and business generally, at the 2nd Annual eCommerce Expo South Florida sponsored by Rand Marketing in Fort Lauderdale, Florida.

The presentation focused on sales tax challenges, including why sales tax matters, product taxability, how to automate the process, sales tax compliance challenges, and taxation issues as they relate to zip codes and geolocation.Enterprise week march 2017 presentation anthony boyle

Enterprise week march 2017 presentation anthony boyleDonegal Local Enterprise Office

Ã˝

Anthony Boyle, originally from Burtonport is a Chartered Tax Advisor. He is co-owner of Tax Assist Accountants and The Glackin Business Institute Ltd which provide Tax, Accounting, Banking and Financial advice to SMEs in the Northwest.

His business focuses on helping clients

manage their business and personal finances efficiently, minimise taxes, avail of available incentives, remain compliant and become

financially secure. Prior to starting his own business in 2015, Anthony worked in various senior roles with the Financial Engineering Network, Bank of Ireland Private Banking and Ulster Bank. He has a degree in Bank & Finance from the University of Ulster and is a Qualified Financial advisor.Taxes and Record Keeping Presentation

Taxes and Record Keeping PresentationAsian Women In Business

Ã˝

Taxes and Record Keeping

This will cover the importance of keeping your finances in order, including a record system, bookkeeping, accounting, payroll, and other financial and tax issues.Tax Preparation - Essential Tips for Efficient and Accurate Filing

Tax Preparation - Essential Tips for Efficient and Accurate Filingfinalert.net

Ã˝

For efficient tax preparation, gather documents early, choose the right filing status, maximize deductions and credits, and file on time.

Startup Accounting Essentials

Startup Accounting EssentialsDavid Ehrenberg

Ã˝

Whether you're bootstrapping or venture-backed, pre-funding or post-funding, pre-revenue or turning a profit, there are steps you need to take to stay on top of your finances, maintain compliance, and establish the foundation you'll need to scale.

This presentation will help get you up to speed on startup accounting: what you need to know, what you should be doing, and how to do it including: implementing your accounting system, the best system for expense tracking, creating an effective payment collection process, staying on top of your taxes, top-down and bottom-up financial projections, how to get your best valuation, and more.

What is tax and how do I pay it?

What is tax and how do I pay it?Dean Renshaw

Ã˝

This document provides a summary of taxes in the UK, including income tax, corporation tax, VAT, and how to spread the costs of taxes through financing options from White Oak UK. It defines each major tax, how often payments are due, and tips for tax filing and claiming deductions. White Oak UK offers short-term loans to help businesses pay tax bills in installments rather than a lump sum. The loans can be arranged quickly online and provide cash flow benefits over using cash reserves.Tax Compliance Solutions Your Key to Stress-Free Tax Seasons.docx

Tax Compliance Solutions Your Key to Stress-Free Tax Seasons.docxfigmentglobal

Ã˝

Tax season travel doesn’t have to be a stressful experience. By implementing effective tax compliance solutions.Importance of the IRS Form 990 (September 25, 2013)

Importance of the IRS Form 990 (September 25, 2013)United Way of the National Capital Area

Ã˝

Mitch Weintraub, CPA and Michael Drennan, CPA of Cordia Partners, and Tamara Vineyard, CPA of Dixon Hughes Goodman delivered a workshop sponsored by United Way of the National Capital Area on September 25, 2013.

Learn about events for our nonprofit members here:

http://www.unitedwaynca.org/events/members10 finance and financial planning

10 finance and financial planningIncrementa consulting

Ã˝

Finance and financial planning for your new start up - looking at sales forecasting, profit and loss and cashflow forecasting Professional Tax Return Services - Maximize Your Refund & Minimize Stress

Professional Tax Return Services - Maximize Your Refund & Minimize Stresshuseinccntnts

Ã˝

Maximize your refund with our expert tax return services. We provide accurate, hassle-free filing for individuals and businesses. Start today for a smooth tax experience!Tax Compliance Solutions That Reduce Stress and Maximize Profit.docx

Tax Compliance Solutions That Reduce Stress and Maximize Profit.docxfigmentglobal

Ã˝

Tax compliance solutions is essential to running a successful business. But there's no need to be stressed.Tax Strategies For Real Estate Investors

Tax Strategies For Real Estate InvestorsSonu Shukla, CPA, CFP

Ã˝

This document provides an overview of 10 key tax strategies for real estate investors:

1. Failing to properly plan taxes can be costly. Proper planning through deductions, credits, and income shifting can save significant taxes.

2. Business owners should avoid "audit paranoia" and carefully document expenses.

3. Missing depreciation deductions is a common mistake, especially for improvements, components, and personal property.

4. Distinguishing between repairs and improvements is important for deducting costs.

5. Investors enjoy tax benefits like depreciation, while dealers face self-employment taxes and ordinary income.

6. Employing family members can generate tax savings through deductions and reduced payroll taxes.More from Wray Rives CPA CGMA (8)

Rives CPA PLLC

Rives CPA PLLCWray Rives CPA CGMA

Ã˝

This short document promotes creating presentations using Haiku Deck, a tool for making slideshows. It encourages the reader to get started making their own Haiku Deck presentation and sharing it on ∫›∫›fl£Share. In a single sentence, it pitches the idea of using Haiku Deck to easily create and share slideshow presentations online.What‚Äôs your exit strategy

What’s your exit strategyWray Rives CPA CGMA

Ã˝

The document discusses different exit strategies for business owners, including just closing the business, selling to family or friends, being acquired, or pursuing an IPO. It outlines the pros and cons of each approach. Just closing the business is easy but leaves money on the table. Selling to family risks challenging dynamics and may not get full value. Being acquired provides a bigger payout but risks cultures clashing. An IPO provides the biggest payout if successful but requires giving up control and only works for a small number of companies.Business tax deductions

Business tax deductionsWray Rives CPA CGMA

Ã˝

This document lists various common business tax deductions and some unique examples. It discusses deductions for costs of goods sold, advertising, vehicle expenses, commissions, contract labor, depreciation, payroll/wages, interest expense, rent/lease payments, insurance, professional services, office expenses, repairs, taxes/licenses, travel, entertainment, utilities, and home offices. It also provides a few unusual examples of deductions claimed such as breast implants, beer, cat food, body oil, and money paid to a live-in girlfriend.What’s your exit strategy

What’s your exit strategyWray Rives CPA CGMA

Ã˝

The document discusses different exit strategies for business owners, including just closing the business, selling to family or friends, being acquired, or pursuing an IPO. It outlines the pros and cons of each approach. Just closing the business is easy but leaves money on the table. Selling to family risks challenging dynamics and may not get full value. Being acquired provides a bigger payout but risks cultures clashing. An IPO provides the biggest payout if successful but requires giving up control and only works for a small number of companies.Payroll Service Overview

Payroll Service OverviewWray Rives CPA CGMA

Ã˝

Rives CPA PLLC offers payroll services including handling tax payments, generating reports, and processing paychecks. They work with clients across the US and abroad. Payroll services start at $30 per month for 5 employees and $1 per additional employee, with no setup fees. Rives CPA takes care of all federal and state tax filings and payments to ensure clients face no penalties. Clients receive detailed reports and assistance for issues like workers' compensation. Potential clients can contact Rives CPA to schedule an appointment and start enjoying easy payroll processing.The 2012 Fiscal Cliff

The 2012 Fiscal CliffWray Rives CPA CGMA

Ã˝

The document discusses how many tax provisions are set to expire or change at the end of 2012, which would result in individuals and families paying substantially more in taxes. It outlines how popular tax deductions, credits, and rates that applied to income, capital gains, dividends, payroll taxes, and estate taxes are scheduled to expire or change. The expiration of these tax provisions could remove up to $3,500 from the average taxpayer's annual income and significantly increase taxes for many individuals, families, and businesses.So you want to start a business

So you want to start a businessWray Rives CPA CGMA

Ã˝

Starting a business requires motivation, ability, and dollars. Motivation means having the desire to invest time and resources into turning ideas into a business that provides sufficient payoff. Ability means having the skills, knowledge, and adaptability to organize resources to implement a vision. Dollars refers to the capital needed to launch a business, whether through self-funding, investors, or harnessing other resources. While many new businesses fail, the document cites statistics showing the failure rate may be lower than commonly believed, and that technological advances have made it easier than ever to start a business online or through various platforms.So You Want To Start A Business

So You Want To Start A BusinessWray Rives CPA CGMA

Ã˝

Starting a business requires motivation, ability, and dollars. Motivation means having the desire to invest time and resources into turning ideas into a business that provides sufficient payoff. Ability means having the skills, knowledge, and adaptability to implement a vision. Dollars refers to the capital needed to launch a business, whether through self-funding, investors, or harnessing resources. While many new businesses fail, the rate of failure has been overstated, and online tools have made it easier than ever to start a business. Success requires ongoing learning, networking, defining a niche, and focusing on helping customers rather than just sales.Recently uploaded (20)

The Importance of Swing Tags in Retail sales

The Importance of Swing Tags in Retail salesgerogesmith051

Ã˝

Tags printing refers to the process of producing custom tags that can be attached to products, clothing, gifts, or any items requiring identification, branding, or information. These tags can serve various purposes, including branding, pricing, care instructions, and promotional messages.Megatrends and Macrotrends: Impacting Private Equity, January 2025

Megatrends and Macrotrends: Impacting Private Equity, January 2025David Teece

Ã˝

This presentation, from Dr. David Teece (pioneer of the dynamic capabilities framework) and Ajinkya Tikhe, explores and analyzes ongoing and emerging national, regional, and global trends impacting private equity investment options and decisions. Due to the stable growth expectations with balanced inflation and potential reduction of interest rates, Private Markets in 2025, are expected to witness a cautious growth. Pallas-BrandFare-Credential-Presentation

Pallas-BrandFare-Credential-Presentationteam586612

Ã˝

PALLAS BrandFare is a marketing network consultancy specializing in international providers of technological products and services. The company offers customised solutions for market entry and brand and marketing localisation. In addition, PALLAS BrandFare supports start-ups and micro-enterprises with professional marketing services. Its services span marketing and branding strategies, public relations, content marketing, and growth-focused awareness initiatives. With a regional focus on Asia and Europe, PALLAS BrandFare has a proven track record of helping multinationals and tech start-ups build their brands and implement effective marketing strategiesUser Group Program - Virtual, Hybrid and In-Person Strategy

User Group Program - Virtual, Hybrid and In-Person StrategyEric Stieg

Ã˝

User Group Program Overview - Highlights Key Performance Indicators, processes and logistics for creating a healthy and vibrant program.Design thinking: Divergent vs Convergent- Elements of creativity-

Design thinking: Divergent vs Convergent- Elements of creativity-P&CO

Ã˝

Three elements of creativity

Divergent and convergent thinking

BRAND MARKETING of 2025 - Kolkata Founders Meet

BRAND MARKETING of 2025 - Kolkata Founders MeetSunil Saha Director Redplum India Pvt Ltd

Ã˝

ùêíùê®ùê¶ùêûùê≠ùê¢ùê¶ùêûùê¨ ùêÖùê®ùêÆùêßùêùùêûùê´'ùê¨ - "ùëØùë®ùëµùë´ ùëØùë¨ùë≥ùë´ùë∞ùëµùëÆ ùë©ùëØùë∞ ùë±ùë®ùëπùë∂ùë∂ùëπùë∞ ùëØùë¨"

ùêÅùê´ùêöùêßùêù ùêåùêöùê´ùê§ùêûùê≠ùê¢ùêßùê† ùêíùêûùê¨ùê¨ùê¢ùê®ùêß ùêüùê®ùê´ #ùêäùê®ùê•ùê§ùêöùê≠ùêö ùêíùê≠ùêöùê´ùê≠ùêÆùê© ùêÖùê®ùêÆùêßùêùùêûùê´ùê¨

Tuesday Afternoon some founder got together with an intention to understand what's happening in 2025 with modern age brands.

ùêçùêûùê∞ ùêÄùê†ùêû ùêÅùê´ùêöùêßùêù ùêåùêöùê´ùê§ùêûùê≠ùê¢ùêßùê†:

(ùòìùò¶ùò¥ùò¥ùò∞ùòØùò¥ ùòßùò≥ùò∞ùòÆ ùòõùò∞ùò± ùòêùòØùòµùò¶ùò≥ùòØùò¶ùòµ-ùòçùò™ùò≥ùò¥ùòµ ùòâùò≥ùò¢ùòØùò•ùò¥)

1. The DTC Perfect INSURGENT BRANDS who shook INCUMBENT LEADERS OF AGES

Brands are bypassing traditional retail to own the customer journey.

Wakefit – Reinvented furniture with a direct-to-consumer model.

Mokobara – Made luggage aspirational with sleek branding.

Atomberg Technologies – Positioned home appliances as energy-efficient and tech-driven.

üí° Lesson: Control the brand experience end-to-end.

2. Storytelling Sells, Not Just Products

The best brands create identities, not just merchandise.

BellaVita – Made perfumes an affordable luxury

MIRAGGIO – Handbags New Age Marketing

üí° Lesson: Sell a lifestyle, not just an item.

3. Community & Influencers Drive Growth

Engaged audiences fuel brand success.

SNITCH & BEWAKOOF® – Used meme culture & influencer marketing to stay viral.

Aero Armour – Created buzz with NATIONALITY and INDIAN PRIDE.

March TEE - Amazingly High Quality Product Focused Brand

üí° Lesson: Turn customers into brand advocates.

4. Indian Heritage in Modern Branding

Authenticity connects deeply.

#TAAVI and #ANOUK – Revived Kurta fashion with a contemporary touch.

Vedant Fashions Limited - Manyavar-Mohey – Organised a completely unorganized market. Dominated ethnic wear with tradition-led branding

üí° Lesson: Blend heritage with modern appeal.

5. Content-Led Growth

Content-first brands thrive.

The Souled Store - One of Fav brands played so well on LICENSING with MARVEL and JURRASIC PARK

mCaffeine – Built fandoms through niche INGREDIENT Focused storytelling.

Minimalist – Simplified skincare with transparency & education.

HYPHEN - KIRTI SANON - The cenebrity who worked so well for the brand

VIRAT KOHLI - WROGN and

HRITHIK ROSHAN - HRX by Hrithik Roshan

üí° Lesson: How celebrity face increases the ROAS

Educate, entertain, then sell.

We also discussed a unique concept of THE FAMILIAR SURPRISE

Performance Marketing

What to tell in Ads

And Basics of Building Internet brands with going back to 4Ps

BLOB STUDIO - KOLKATAESET Internet Security Crack with License Key 2025 [Latest]![ESET Internet Security Crack with License Key 2025 [Latest]](https://cdn.slidesharecdn.com/ss_thumbnails/mid-reseach-250317133026-0d208880-250318082658-2538a2bd-thumbnail.jpg?width=560&fit=bounds)

![ESET Internet Security Crack with License Key 2025 [Latest]](https://cdn.slidesharecdn.com/ss_thumbnails/mid-reseach-250317133026-0d208880-250318082658-2538a2bd-thumbnail.jpg?width=560&fit=bounds)

![ESET Internet Security Crack with License Key 2025 [Latest]](https://cdn.slidesharecdn.com/ss_thumbnails/mid-reseach-250317133026-0d208880-250318082658-2538a2bd-thumbnail.jpg?width=560&fit=bounds)

![ESET Internet Security Crack with License Key 2025 [Latest]](https://cdn.slidesharecdn.com/ss_thumbnails/mid-reseach-250317133026-0d208880-250318082658-2538a2bd-thumbnail.jpg?width=560&fit=bounds)

ESET Internet Security Crack with License Key 2025 [Latest]kajpan399

Ã˝

‚û°Ô∏èüëâ DOWNLOAD LINK üëâüëâhttps://upcommunity.net/dl/

ESET Internet Security offers the ultimate defense of your PC against all types of malware, cybercrime, junk mail and hackers. It has added firewall and antispam technology to ESET NOD32 Antivirus. It utilizes the power of the cloud and multiple layers of detection to keep out threats. As a result, it block all potential attacks. Also protects you at the highest level while you work, social network, play online games or exchange data via removable media.

ùó°ùó¢ùóßùóò üëá

üåçüì±üëâ COPY LINK & PASTE INTO GOOGLE üëâüëâ https://upcommunity.net/dl/ùóúùóªùó±ùó∂ùóÆ‚ÄôùòÄ ùóßùóºùòÜ ùó†ùóÆùóøùó∏ùó≤ùòÅ: ùóî ùó£ùóπùóÆùòÜùó¥ùóøùóºùòÇùóªùó± ùóºùó≥ ùó¢ùóΩùóΩùóºùóøùòÅùòÇùóªùó∂ùòÅùó∂ùó≤ùòÄ

ùóúùóªùó±ùó∂ùóÆ‚ÄôùòÄ ùóßùóºùòÜ ùó†ùóÆùóøùó∏ùó≤ùòÅ: ùóî ùó£ùóπùóÆùòÜùó¥ùóøùóºùòÇùóªùó± ùóºùó≥ ùó¢ùóΩùóΩùóºùóøùòÅùòÇùóªùó∂ùòÅùó∂ùó≤ùòÄTitan Capital

Ã˝

India has a deep-rooted legacy in toy-making, dating back to the Indus Valley Civilization. Fast forward to today, the country is at a pivotal moment in reclaiming its position as a global toy manufacturing powerhouse. üöÄ

ùóûùó≤ùòÜ ùóúùóªùòÄùó∂ùó¥ùóµùòÅùòÄ ùó≥ùóøùóºùó∫ ùóøùó≤ùóΩùóºùóøùòÅ:

üîπ ùóõùó∂ùòÄùòÅùóºùóøùó∂ùó∞ùóÆùóπ ùó•ùóºùóºùòÅùòÄ ‚Äì Toys like marbles (2000 BC) and Chaupar (4th century) evolved with Indian civilization.

üîπ ùóòùòÖùóΩùóºùóøùòÅùòÄ ùóºùóª ùòÅùóµùó≤ ùó•ùó∂ùòÄùó≤ ‚Äì Post-1990s liberalization, imports from China dominated, but today, India is reclaiming its space with a ~ùü∞ùü¨% ùó≤ùòÖùóΩùóºùóøùòÅ ùóøùó∂ùòÄùó≤ ùòÄùó∂ùóªùó∞ùó≤ ùüÆùü¨ùüÆùüØ.

üîπ ùóöùóºùòÉùó≤ùóøùóªùó∫ùó≤ùóªùòÅ ùóúùóªùòÅùó≤ùóøùòÉùó≤ùóªùòÅùó∂ùóºùóªùòÄ ‚Äì Import duties up from 20% to 70%, dedicated toy clusters and a national action plan to boost domestic production.

üîπ ùóñùóµùóÆùóªùó¥ùó∂ùóªùó¥ ùóñùóºùóªùòÄùòÇùó∫ùó≤ùóø ùóüùóÆùóªùó±ùòÄùó∞ùóÆùóΩùó≤ ‚ÄìDIWK (Double Income With Kids) households, urbanization (3% YoY), growing e-commerce penetration are fueling demand.

The intersection of ùó≤ùó±ùòÇùó∞ùóÆùòÅùó∂ùóºùóª, ùó≤ùóªùòÅùó≤ùóøùòÅùóÆùó∂ùóªùó∫ùó≤ùóªùòÅ, ùóÆùóªùó± ùó∂ùóªùóªùóºùòÉùóÆùòÅùó∂ùóºùóª is transforming this industry. For entrepreneurs, it‚Äôs about balancing consumer (child) delight with customer (parent) demands while ùóØùòÇùó∂ùóπùó±ùó∂ùóªùó¥ ùóúùó£ùòÄ ùóÆùóªùó± ùóΩùóÆùóøùòÅùóªùó≤ùóøùòÄùóµùó∂ùóΩùòÄ. With the right ecosystem ùó≤ùó∞ùóºùòÄùòÜùòÄùòÅùó≤ùó∫ ùó≤ùóªùóÆùóØùóπùó≤ùóøùòÄ, ùó∫ùóÆùóøùó∏ùó≤ùòÅ ùóΩùóºùòÅùó≤ùóªùòÅùó∂ùóÆùóπ, ùóÆùóªùó± ùòÄùòÅùóøùóÆùòÅùó≤ùó¥ùó∂ùó∞ ùó≥ùóºùó∞ùòÇùòÄ, India is set to ùóØùó≤ùó∞ùóºùó∫ùó≤ ùóÆ ùó¥ùóπùóºùóØùóÆùóπ ùòÅùóºùòÜ ùóΩùóºùòÑùó≤ùóøùóµùóºùòÇùòÄùó≤. üèÜ

At Titan Capital, We back visionary entrepreneurs who drive India‚Äôs growth story. If you‚Äôre building in this space, we‚Äôd love to hear from you! üöÄ

üì© Reach out: startups@titancapital.vcCONTACT AN ETHEREUM AND USDT RECOVERY EXPERT- REACH OUT TO SALVAGE ASSET RECO...

CONTACT AN ETHEREUM AND USDT RECOVERY EXPERT- REACH OUT TO SALVAGE ASSET RECO...aldopedro148

Ã˝

The moment my Bitcoin wallet froze mid-transfer, stranding $410,000 in cryptographic limbo, I felt centuries of history slip through my fingers. That balance wasn’t just wealth; it was a lifeline for forgotten libraries, their cracked marble floors and water-stained manuscripts waiting to breathe again. The migration glitch struck like a corrupted index: one second, funds flowed smoothly; the next, the transaction hung “Unconfirmed,” its ID number mocking me in glowing red. Days bled into weeks as support tickets evaporated into corporate ether. I’d haunt the stacks of my local library, tracing fingers over brittle Dickens volumes, whispering, “I’m sorry,” to ghosts of scholars past. Then, Marian—a silver-haired librarian with a crypto wallet tucked beside her ledger found me slumped at a mahogany study carrel. “You’ve got the blockchain stare,” she murmured, pressing a Post-it into my palm.

Salvage Asset Recovery. “They resurrected my nephew’s Ethereum after a smart contract imploded. Go.”

I emailed them at midnight, my screen’s blue glare mixing with moonlight through stained-glass windows. By dawn, their engineers had dissected the disaster. The glitch, they explained, wasn’t a hack but a protocol mismatch, a handshake between wallet versions that failed mid-encryption, freezing funds like a book jammed in a pneumatic tube. “Your Bitcoin isn’t lost,” assured a specialist named Leo. “It’s stuck in a cryptographic limbo. We’ll debug the transaction layer by layer.”

Thirteen days of nerve-shredding limbo followed. I’d refresh blockchain explorers obsessively, clinging to updates: “Reverse-engineering OP_RETURN outputs…” “Bypassing nonce errors—progress at 72%...” My library blueprints, quotes for climate-controlled archives, plans for AR-guided tours sat untouched, their ink fading under my doubt. Then, on a frostbitten morning, the email arrived: “Transaction invalidated. Funds restored.” I watched, trembling, as my wallet repopulated $410,000 glowing like a Gutenberg Bible under museum lights.

Salvage Asset Recovery didn’t just reclaim my Bitcoin; they salvaged a bridge between past and future. Today, the first restored library stands in a 19th-century bank building, its vault now a digital archive where blockchain ledgers track preservation efforts. Patrons sip fair-trade coffee under vaulted ceilings, swiping NFTs that unlock rare manuscript scans, a symbiosis of parchment and Python code.

These assets are more than technicians; they’re custodians of legacy. When code fails, they speak its dead languages, reviving what the digital world dismisses as lost. And to Marian, who now hosts Bitcoin literacy workshops between poetry readings, you were the guardian angel this techno-hermit didn’t know to pray for.

If your crypto dreams stall mid-flight, summon Salvage Asset Recovery. They’ll rewrite the code, rebuild the bridge, and ensure history never becomes a footnote. All thanks to Salvage Asset Recovery- their contact info

TELEGRAM---@Sa2024 Anaplan End User Community Results Overview

2024 Anaplan End User Community Results OverviewEric Stieg

Ã˝

This presentation gives an overview of the key initiatives, user generated content results, and overall user engagement and recognition.Young Visionary Dhruv Goyal Redefines India’s Startup Ecosystem

Young Visionary Dhruv Goyal Redefines India’s Startup EcosystemFourLion Capital

Ã˝

Dhruv Goyal, a rising star in India’s entrepreneurial landscape, is making waves with his innovative approach and disruptive business strategies. Known for empowering MSMEs and promoting digital transformation in underserved sectors, Goyal is redefining how startups scale and create impact.

His ventures focus on sustainability, grassroots innovation, and inclusive growth—key elements that are reshaping India’s startup ecosystem. Industry experts and investors applaud his visionary leadership, calling him a catalyst for a new generation of purpose-driven entrepreneurs.

As he continues to break new ground, Dhruv Goyal stands as a symbol of India’s economic and innovation renaissance.

#Dhruv Goyal, #Sustainable #Entrepreneurship #Business #Growth #Storiesùóúùóªùó±ùó∂ùóÆ‚ÄôùòÄ ùóßùóºùòÜ ùó†ùóÆùóøùó∏ùó≤ùòÅ: ùóî ùó£ùóπùóÆùòÜùó¥ùóøùóºùòÇùóªùó± ùóºùó≥ ùó¢ùóΩùóΩùóºùóøùòÅùòÇùóªùó∂ùòÅùó∂ùó≤ùòÄ

ùóúùóªùó±ùó∂ùóÆ‚ÄôùòÄ ùóßùóºùòÜ ùó†ùóÆùóøùó∏ùó≤ùòÅ: ùóî ùó£ùóπùóÆùòÜùó¥ùóøùóºùòÇùóªùó± ùóºùó≥ ùó¢ùóΩùóΩùóºùóøùòÅùòÇùóªùó∂ùòÅùó∂ùó≤ùòÄTitan Capital

Ã˝

Bookkeeping primer

- 1. Managing Financial Transactions, Bookkeeping Basics and Small Business Tax Tips Wray Rives, CPA CGMA Certified Public Accountant Chartered Global Management Accountant

- 2. Topics • What it means to be in business for yourself • Getting paid and paying others • Dealing with independent contractors • Bookkeeping – the simplified version • Handling the more confusing deductions • Taxes • Tips

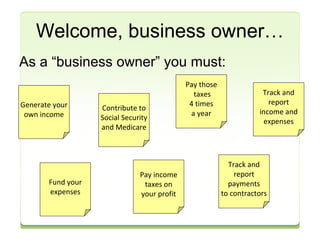

- 3. Welcome, business owner… As a “business owner” you must: Generate your own income Fund your expenses Track and report income and expenses Contribute to Social Security and Medicare Pay income taxes on your profit Pay those taxes 4 times a year Track and report payments to contractors

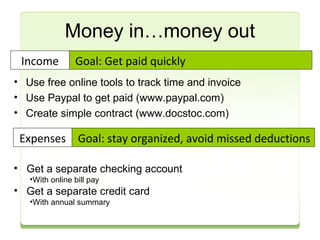

- 4. Money in…money out Goal: Get paid quickly Income • Use free online tools to track time and invoice • Use Paypal to get paid (www.paypal.com) • Create simple contract (www.docstoc.com) Goal: stay organized, Expenses avoid missed deductions • Get a separate checking account •With online bill pay • Get a separate credit card •With annual summary

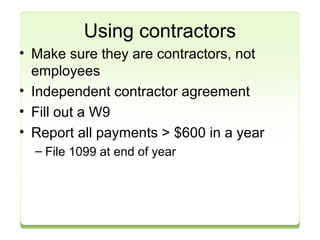

- 5. Using contractors • Make sure they are contractors, not employees • Independent contractor agreement • Fill out a W9 • Report all payments > $600 in a year – File 1099 at end of year

- 6. Bare-bones bookkeeping Keep it simple • Use “cash” method • How much did you earn? • How much did you spend?

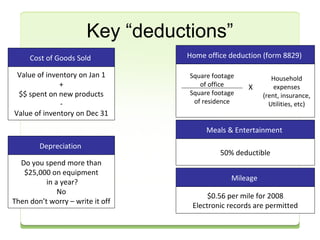

- 7. Key “deductions” Home office deduction (form 8829) Meals & Entertainment 50% deductible Cost of Goods Sold Depreciation Do you spend more than $25,000 on equipment in a year? No Then don’t worry – write it off Mileage $0.56 per mile for 2008 Electronic records are permitted Value of inventory on Jan 1 + $$ spent on new products - Value of inventory on Dec 31 Square footage of office Square footage of residence X Household expenses (rent, insurance, Utilities, etc)

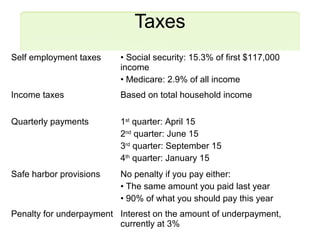

- 8. Taxes Self employment taxes • Social security: 15.3% of first $117,000 income • Medicare: 2.9% of all income Income taxes Based on total household income Quarterly payments 1st quarter: April 15 2nd quarter: June 15 3rd quarter: September 15 4th quarter: January 15 Safe harbor provisions No penalty if you pay either: • The same amount you paid last year • 90% of what you should pay this year Penalty for underpayment Interest on the amount of underpayment, currently at 3%

- 9. Tips • Track/save everything – you can always figure out details later • Be cheap – cash is king, barter • Embrace technology – it is your friend • Value your time

- 10. Wray Rives, CPA CGMA www.NeedaCPA.com • wray@NeedaCPA.com • @rivescpa

Editor's Notes

- #7: - No assets, liabilities and owners equity - No debits and credits - No chart of accounts - No cash vs accrual