BRANCHES OF ACCOUNTIABM1_Concepts and Principles.pptxNG.....pptx

- 2. Accounting Government Accounting Private Accounting Accounting Education Public Accounting ? External Auditing ? Tax Preparation and Planning Services ? Management Advisory Services ? Financial Accounting ? Cost Accounting ? Budgeting ? Accounting Information System ? Tax Accounting

- 4. The accountant performs or offers to perform any activity that will result to the issuance of an attest report that is in accordance with the professional Standards. Consulting services Personal Financial Planning services Preparation of tax returns Advice on tax matters for a fee Public accountant works in a firm offering its services to various clients.

- 5. Public accountants examine the financial statements in order to express an opinion whether statements have been fairly presented or not. External Auditing Tax preparation and Planning Services CPAs offer tax services wherein the advise and help their clients in tax planning and preparing tax returns. They are ¡°Tax specialist¡±. Management Advisory Services CPAs advises management on matters such as the installation of an accounting system, finance, budgeting, business processes, introduction of new products and other business activities.

- 6. ? Involves setting up systems of recording business transactions that are aggregated into financial statements. ? It includes the development and interpretation of accounting information intended to assist management in operating the business. ? A private accountant is a salaried employee who deals with the company¡¯s day- to-day accounting needs. ? He/she is trained in the processing of accounting transactions such as billings and account payables.

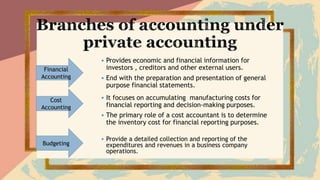

- 7. ? Provides economic and financial information for investors , creditors and other external users. Financial Accounting ? End with the preparation and presentation of general purpose financial statements. Cost Accounting ? It focuses on accumulating manufacturing costs for financial reporting and decision-making purposes. ? The primary role of a cost accountant is to determine the inventory cost for financial reporting purposes. Budgeting ? Provide a detailed collection and reporting of the expenditures and revenues in a business company operations.

- 8. ? Collects and processes transaction data. It involves the designing of both manual and computerized data processing systems. Accounting Information System Tax Accounting Internal Auditing ? It deals with the preparation of various ax returns and doing tax planning for the business. ? Reviews the business operations to check if they are complying to management policies.

- 9. ? A system used in government offices to record and report financial transactions. ? Reveals how public funds have been generated and utilized. ? Employed both national and local governments ? Provincial accountant ? COA Auditors to various agencies ? BIR examiner to local and national businesses ? A budget officer of the DBM ? A bank examiner of bangko Sentral ng Pilipinas

- 10. ? Responsible of training future accountants. ? It engages teaching accounting, financial management, taxation, and other related business course. ? CPAs are encourage to be part of the academe and become an integral force of inspiring learners pursue a career in accounting. ? CPAs in accounting educations should possess the educational qualifications, professional experience, classroom teaching ability, computer literacy, scholarly research productivity and other attributes.

- 11. Which of the Branches of accounting do you want to engage into?