Breakthrough To Fast Growth

- 2. Every year only a few companies make it to the top. Why? ThatˇŻs where we have been working on, thatˇŻs our passion, thatˇŻs our expertiseˇˇ..

- 3. ONLY 1 IN 5 BREAKS THROUGH TO FAST GROWTH? ?? Growing with minimum of 60% revenue growth in 3 years ?? 18,8% of Dutch companies belong to the top growing class ?? Butˇ. 18,8% is not the max. Rate?of?fast?growers? 37,60%? 18,80%? 12,40%?

- 4. CHARACTERISTICS OF THESE FAST GROWERS ARE KNOWN Fast growers share: Characteristics of Fast Growers* ?? Explicit ambition Ambitious growth ?? Active market development targets ?? Active innovation Product innovation ?? Social intelligence and cooperation Service innovation ?? Higher education level ?? Strong international orientation Market development (ˇ°Think bigˇ±) Partnerships Networks Average International outlook Fast growers 0% 20% 40% 60% 80% 100% *Source: Research ACE / EIM (2009) ˇ°Why some companies grow faster than othersˇ±

- 5. ITˇŻS ALL ABOUT CROSSING THE CHASM TO NEXT STAGE Every company has itˇŻs natural revenue barriers (e.g. 1 million) that they canˇŻt grow beyond: ?? Serving a new group of users is required; ?? Breakthrough has to come from inside Well-known thresholds to enter new market successfully: ?? Product vs. market focus; ?? Technical functionalities vs. customer bene?ts; ?? Got to get out of comfort zone again; ?? Drive and ambition to do things differently and improve;

- 6. PRIMARY CONDITION FOR BREAKTHROUGH: AIM FOR EXCELLENCE Attitude of entrepeneur & team ?? Think big, Belief in your goal, Be passionate ?? Be open, Dare to act, Show stamina. Insights in market(s) ?? Go out, gain insights, Know your (potential) customersˇŻ issues; ?? Pinpoint the market, Sell the problem. Management of growth process ?? Execute ?rst, Incorporate feedback loop, Stay open for change; ?? Empower your team (ˇ°you need themˇ±); ?? Focus on clear step by step goals.

- 7. SECONDARY MECHANISM: GROWTH HAS TO BE MANAGED IN 4 STEPS 1) Short term market 2) & 3) Realisation of the ?rst 4) Continuing fast growth development, focus growth and creating basics for high and creating mid term and action revenue growth, but also with ups company value and downs, setbacks and failure THERE IS NO INSTANT SUCCESS

- 8. SWEETSPOT FOR FAST GROWTH IS IN EXECUTION DO AND DEVELOP: Attitude ?? Go out and get feedback ?? Understand & learn ?? Mistakes are OK ?? Killer mentality, ready to improve Insights ?? Test and adjust propositions and market approach ?? Prove with facts & ?gures ?? Accelerate when(ever) possible Management ?? Focus and steer on delivery ?? Scale activities and results step- by-step ?? Get people out-of-comfort zone

- 9. RESULTS DELIVERED PRODUCES OUTPERFORMERS DeBoest Growth Management Partners Average Annual growth 39% *Inspired by Gold Book of Venture Capital Firms, Bob Zider, ˇ°How Venture Capital Works,ˇ± Harvard Business Review

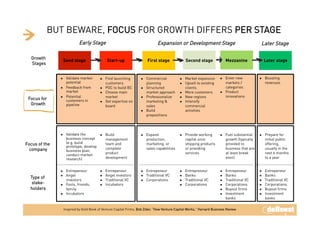

- 10. BUT BEWARE, FOCUS FOR GROWTH DIFFERS PER STAGE Early Stage Expansion or Development Stage Later Stage Growth Seed stage Start-up First stage Second stage Mezzanine Later stage Stages ?? Validate market ?? Find launching ?? Commercial ?? Market expansion ?? Enter new ?? Boosting potential customers planning ?? Upsell to existing markets / revenues ?? Feedback from ?? POC to build BC ?? Structured clients categories market ?? Choose main market approach ?? More customers ?? Product Potential market Professionalize New regions innovations Focus for ?? customers in ?? ?? ?? Get expertise on marketing & ?? Intensify Growth pipeline board sales commercial ?? Build activities propositions ?? Validate the ?? Build ?? Expand ?? Provide working ?? Fuel substantial ?? Prepare for business concept management production, capital once growth (typically initial public Focus of the (e.g. build team and marketing, or shipping products provided to offering, prototype, develop company complete sales capabilities or providing business that are usually in the business plan, product services at least break next 6 months conduct market research) development even) to a year ?? Entrepeneur ?? Entrepeneur ?? Entrepeneur ?? Entrepreneur ?? Entrepeneur ?? Entrepeneur Angel Angel investors Traditional VC Banks Banks Banks Type of ?? ?? ?? ?? ?? ?? investors ?? Traditional VC ?? Corporations ?? Traditional VC ?? Traditional VC ?? Traditional VC stake- ?? Fools, friends, ?? Incubators ?? Corporations ?? Corporations ?? Corporations holders family ?? Buyout ?rms ?? Buyout ?rms ?? Incubators ?? Investment ?? Investment banks banks Inspired by Gold Book of Venture Capital Firms, Bob Zider, ˇ°How Venture Capital Works,ˇ± Harvard Business Review

- 11. Every year only a few companies make it to the top. Is that that your ambition? Then stop asking why! JUST START TODAY? Remarks or questions? Want to discuss with us about these ?ndings? Or looking for practical examples? Please do not hesitate to contact Bram Hulshof of DeBoest at bramhulshof@deboest.nl or +31 6 5339 0015