Bws Pitchbook

- 1. P R E S E N T E D T O :Belleair WealthStrategiesProspective clientsTish Wold, CFP®2531 Landmark Dr, Ste 201Clearwater, FL 33761727-451-3440Tish.wold@raymondjames.comwww.belleairwealth.comSecurities offered throughRaymond James Financial Services, Inc.Member FINRA/SIPCMaterial prepared by Raymond James for use by its advisors.

- 2. Objectives of This PresentationThe purpose of this presentation is to introduce you to Belleair Wealth Strategies, our process and the extensive capabilities that enable us to serve our clients. Our objective is to determine if a relationship with us would be mutually beneficial. Belleair Wealth StrategiesCommitment to Our ClientsOur TeamOur ProcessThe Raymond James AdvantageFinancial Solutions Investment SolutionsSolutions for Businesses and Corporations Next Steps

- 3. Why Hire a Professional Financial Advisor?Significant life events such as retirement and wealth transfer are complex and require careful planning. Individual investors have historically underperformed relevant benchmarks and institutional investors.Emotional factors and natural biases lead individual investors to poor market timing decisions.

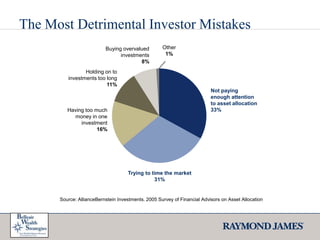

- 4. The Most Detrimental Investor MistakesOther1%Buying overvalued investments8%Holding on to investments too long11%Not paying enough attention to asset allocation33%Having too much money in one investment16%Trying to time the market31%Source: AllianceBernstein Investments. 2005 Survey of Financial Advisors on Asset Allocation

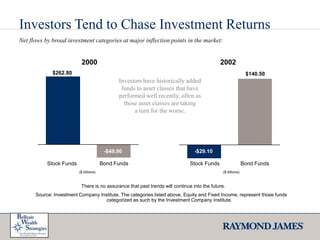

- 5. Investors Tend to Chase Investment ReturnsNet flows by broad investment categories at major inflection points in the market:20002002$262.80$140.50Investors have historically added funds to asset classes that have performed well recently, often as those asset classes are takinga turn for the worse. -$49.90-$29.10Stock FundsStock FundsBond FundsBond Funds($ billions)($ billions)There is no assurance that past trends will continue into the future. Source: Investment Company Institute. The categories listed above, Equity and Fixed Income, represent those funds categorized as such by the Investment Company Institute.

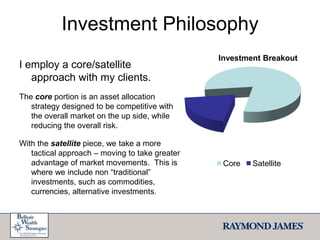

- 6. Investment PhilosophyI employ a core/satellite approach with my clients. The core portion is an asset allocation strategy designed to be competitive with the overall market on the up side, while reducing the overall risk. With the satellite piece, we take a more tactical approach – moving to take greater advantage of market movements. This is where we include non “traditional” investments, such as commodities, currencies, alternative investments.

- 7. OVERVIEWOur MissionTo help our clients achieve their own unique goals by managing their assets, protecting their wealth and building their financial legacies. Our ApproachWe serve our clients with a consultative, team-based approach that examines all aspects of their financial lives. We put our clients’interests above our own or those of our firm. Our ObjectiveTo accomplish our mission profitably, while giving backto our community.

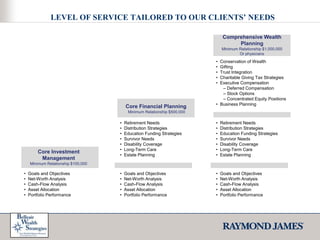

- 8. Core Financial Planning Minimum Relationship $500,000Retirement Needs

- 11. Survivor Needs

- 13. Long-Term Care

- 14. Estate Planning

- 18. Asset Allocation

- 19. Portfolio PerformanceCore Investment ManagementMinimum Relationship $100,000Goals and Objectives

- 22. Asset Allocation

- 23. Portfolio PerformanceLEVEL OF SERVICE TAILORED TO OUR CLIENTS’ NEEDSComprehensive Wealth PlanningMinimum Relationship $1,000,000Or physiciansConservation of Wealth

- 24. Gifting

- 26. Charitable Giving Tax Strategies

- 27. Executive Compensation – Deferred Compensation – Stock Options – Concentrated Equity PositionsBusiness Planning

- 28. Retirement Needs

- 31. Survivor Needs

- 33. Long-Term Care

- 34. Estate Planning

- 38. Asset Allocation

- 39. Portfolio PerformanceOVERVIEW Commitment to Our Belleair Wealth Strategies ClientsMaintaining Focus on Your GoalsProtection of PrivacyA Disciplined Investment ProcessObjective RecommendationsRegular and Effective CommunicationWe make these commitments to our clients:

- 40. OVERVIEW Our Belleair Wealth Strategies TeamOur team is committed to professional development and teamwork. We participate in numerous forms of continuing education programs throughout the year to further our ability to serve our clients.Tish Wold, CFP®• Founder, Belleair Wealth Strategies • Financial Advisor, affiliated with Raymond James Financial Services• Over ten years of industry experience, including three years with Raymond James• Responsible for wealth planning and investment management• Bachelor of Science from the United States Naval Academy in Mathematics• Active in her community, including professional associations such asSecretary of Board, Clearwater Yacht Club

- 41. Pinellas County Estate Planning Council

- 42. Financial Planning Association of Tampa Bay

- 43. Board Member, U. S. Naval Academy Alumni Assn, Tampa Chapter

- 44. Board Member, Business and Professional Women

- 45. Tampa Professional Sales Association

- 46. Board Member, Greater Belleair Young Women’s Society

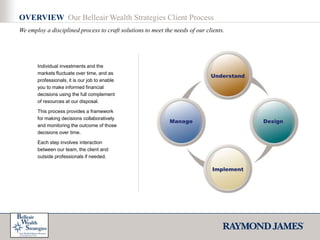

- 47. Women in Philanthropy and Financial Counseling Services, Morton Plant Mease FoundationPast Congregation President, Prince of Peace Lutheran ChurchOVERVIEW Our Belleair Wealth Strategies Client ProcessWe employ a disciplined process to craft solutions to meet the needs of our clients.Individual investments and the markets fluctuate over time, and as professionals, it is our job to enable you to make informed financial decisions using the full complement of resources at our disposal.This process provides a framework for making decisions collaboratively and monitoring the outcome of those decisions over time. Each step involves interaction between our team, the client and outside professionals if needed. UnderstandDesignManageImplement

- 48. OVERVIEW Our Belleair Wealth Strategies ProcessUnderstandWe use a variety of tools including questionnaires and interviews to understand your personal goals, current financial situation, investment experience and risk tolerance. In this step, we make you fully aware of our capabilities and provide educational support to assist our clients in understanding the scope of services we offer to help you meet your objectives. DesignOur team analyzes the information you share with us and designs solutions intended to help you reach your objectives. This step may involve collaboration with other specialists or your existing professionals. We present our recommendations to you, answer your questions, consider alternatives and outline the steps we need to take to implement your plan. Implement In this step, we execute your customized strategy using the extensive tools available to us through Raymond James. This involves the selection of specific account types, investment products and optional services; we then complete the necessary paperwork in a coordinated approach. ManageOnce implemented, we continually monitor the progress of our recommendations relative to your defined objectives and suggest changes where needed. A key to this step is your involvement in the process and communication of any significant changes in your life. We accomplish this by providing ongoing reporting of your account activity and by conducting periodic reviews.This process is a dynamic, team-based endeavor.To be most effective, it should include the client, relevant members of his or her family, our team, select Raymond James specialists, and outside professionals where appropriate.

- 49. OVERVIEW The Raymond James AdvantageThe decision to hire a professional financial planner should take into account the quality and professionalism of the firm that stands behind them. In choosing to do business with Belleair Wealth Strategies, you are also doing business with Raymond James.It is important that you understand how our relationship with Raymond James benefits you by providing us the tools and resources to execute our mission to serve clients to the best of our abilities.

- 50. OVERVIEW The Raymond James AdvantageWhy Raymond James?The Firm Has an Individual Client Focus: Raymond James is a firm with its roots in the business of providing financial guidance and planning to individual investors and families. This remains the firm’s primary business today. Raymond James has been a leader in the industry with client-focused decision-making since the company’s founding in 1962. Full Resources of a Large, Multinational Financial Services Firm: Raymond James is one of the largest financial services firms in the United States, with the scale and resources to support a wide array of products and services. With more than 10,000 associates worldwide and revenues of $3.2 billion in 2008, the company’s business includes investments brokerage, professional asset management, insurance solutions, trust services, investment banking, and private and commercial banking. A Culture of Independence and Objectivity: As financial advisors, we are given flexibility and independence to serve our clients without a corporate “push” of proprietary products. We have access to one of the widest platforms of product choices and account types in our industry with access to over 12,000 mutual funds, 100 money managers and 30 insurance carriers.Consistent Leadership and Independence: Chairman and CEO Tom James has fostered a culture of consistent leadership and independent thinking that enables firm employees and financial advisors to act in the best interests of clients and be innovative in our solutions to meet their needs. Raymond James’ culture and extensive resources enable us to serve our clients effectively with their best interests as our top priority. Raymond James was the first financial services firm to create a Client Bill of Rights and Responsibilities in 1994. Today, our industry has recognized this document as a best practice and many firms have followed its example.

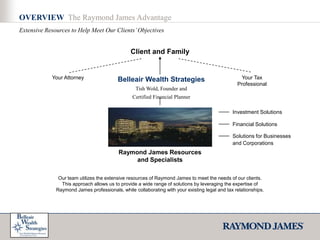

- 51. OVERVIEW The Raymond James AdvantageExtensive Resources to Help Meet Our Clients’ ObjectivesClient and FamilyYour Tax ProfessionalYour AttorneyBelleair Wealth StrategiesTish Wold, Founder and Certified Financial PlannerInvestment SolutionsFinancial SolutionsSolutions for Businessesand CorporationsRaymond James Resources and SpecialistsOur team utilizes the extensive resources of Raymond James to meet the needs of our clients.This approach allows us to provide a wide range of solutions by leveraging the expertise ofRaymond James professionals, while collaborating with your existing legal and tax relationships.

- 52. BY INVITATION ONLYExclusive visits to the Raymond James International Headquarters in St. Petersburg, Florida are available to select clients and prospective clients.Your visit is hosted and coordinated by your financial advisor, and your agenda is customized to meet your situation, concerns and interests.You’ll meet with a wide range of Raymond James experts as well as members of senior management.You’re invited to tour the Tom and Mary James/Raymond James Financial Art Collection. With more than 1,800 works of art, it’s one of Florida’s largest privately-owned collections.

- 53. FINANCIAL SOLUTIONS OverviewRaymond James is a firm founded on the principles of financial planning. While our investment resources are extensive, our Client Process extends beyond the management of portfolios. It encompasses our clients’ lifetime financial needs.Our team has access to a variety of specialists employed by Raymond James who provide meaningful insight into our process.Planning for RetirementProtecting Your Wealth Building Your Legacy Lending and Cash Management Wealth Management SolutionsUnderstandDesignManageImplement

- 54. INVESTMENT SOLUTIONS Portfolio Construction ProcessWe implement our investment process through the use of a variety of tools depending on your objectives, risk tolerance, time horizon, tax situation and investment experience.UnderstandRaymond James Capabilities• Capital Markets Access and Research• Professional Asset Management• Flexible Account Types• Alternative Investment OpportunitiesDesignManageImplement

- 55. SOLUTIONS FOR BUSINESSES AND CORPORATIONSFor business owners and executives, Raymond James provides us additional resources to create unique solutions for challenges facing these clients. 401(k) and Retirement Plan ConsultingInvestment Banking/ Corporate FinanceCommercial Banking Raymond James Bankoffers an array of corporate and real estate lending programs designed to suita variety of needs to businesses in all 50 states. For business owners and executives, along with the Raymond James specialists, we can provide counseling on which retirement plan is appropriate for your company’s situation and advise on plan format and design. For substantial businesses in need of capital markets expertise and advisory work, our team along with Raymond James Investment Banking division may be able to assist.

- 56. SOLUTIONS FOR BUSINESSES AND CORPORATIONS Bank DisclosureRaymond James & Associates, Inc. and Raymond James Financial Services, Inc. are affiliated with Raymond James Bank, member FDIC, a federally chartered savings bank. Unless otherwise specified, products purchased from or held at affiliated Raymond James Financial, Inc. companies are not insured by the FDIC, are not deposits or other obligations of Raymond James Bank, are not guaranteed by Raymond James Bank,and are subject to investment risks, including possible loss of the principal invested. Products, terms and conditions subject to change. Subject to standard credit criteria.Property insurance required. Flood insurance may be required.Raymond James Bank, member FDIC.

- 57. NEXT STEPSDecide if a relationship with us would be beneficial.

- 58. Discuss relevant information we need to collect from you including existing bank and brokerage statements.

- 60. Set up a follow-up meetingor conference call. UnderstandDesignManageImplement

- 61. Tish WoldFounder, Belleair Wealth Strategies and Certified Financial PlannerTM2531 Landmark Dr, Ste 201Clearwater, FL 33761727-451-3440tish.wold@raymondjames.comwww.belleairwealth.comSecurities offered throughRaymond James Financial Services, Inc., member FINRA/SIPC