Calibre Corporate Presentation

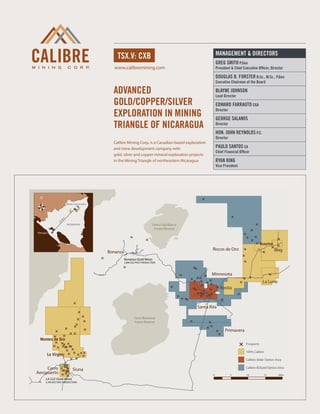

- 1. tsx.v: cxb Advanced gold/copper/silver exploration in mining triangle of nicaragua www.calibremining.com Calibre Mining Corp. is a Canadian-based exploration and mine development company with gold, silver and copper mineral exploration projects in the Mining Triangle of northeastern Nicaragua. Cerro Cola Blanca Forest Reserve Prospects 100% Calibre Calibre-Alder Option Area Calibre-B2Gold Option Area Cerro Banacruz Forest Reserve NICARAGUA Borosi Concessions Managua 275km 0 5 10 15 20km Siuna Riscos de Oro Primavera Cerro Aeropuerto Rosita Minnesota Santa Rita Bonanza La Luna Bonanza (Gold Mine) 2.8M OZS PAST PRODUCTION LA LUZ (Gold Mine) 2.7M OZS PAST PRODUCTION Blag MANAGEMENT & DIRECTORS Greg Smith P.Geo President & Chief Executive Officer, Director Douglas B. Forster B.Sc., M.Sc., P.Geo Executive Chairman of the Board Blayne Johnson Lead Director Edward Farrauto CGA Director George Salamis Director Hon. John Reynolds P.C. Director Paulo Santos CA Chief Financial Officer Ryan King Vice President La Virgen Montes de Oro Guapinol

- 2. Ryan King Vice President rking@calibremining.com 604.681.9944 Calibre Mining Corp. 1620–1066 West Hastings St. Vancouver, BC V6E 3X1 Primavera gold/copper project Calibre, in conjunction with B2Gold, continues to advance Primavera gold-copper project. Primavera is the site of a significant gold and copper soil anomaly covering an area of 800 by 300 metres (open). An approved phase I $2.0M exploration program is underway including additional step out and infill drilling as well as drilling additional gold/copper soil geochem anomalies that have been outlined in the 25 km2 Primavera porphyry target area. Riscos de Oro (100%) gold/silver project Calibre has completed over 9,400 metres of diamond drilling (37 holes) at the 100% owned Riscos de Oro Epithermal Gold-Silver Project. The program has successfully confirmed gold-silver mineralization over a strike length of 725 metres and to a depth of 300 metres. Rosita Alder Resources Option Calibre optioned the Rosita D concession to Alder Resources Ltd., Alder may earn a 65% interest in the Rosita D concession by spending $4 million on exploration. Phase 1 exploration program commenced Dec 2011 which includes 5,000m of RC drilling and 8,000m of diamond drilling. PROJECT Highlights > Primavera Select Drill Result Highlights: • PR-11-002: 0.78 g/t Au and 0.297% Cu over 261.7m • PR-12-016: 0.77g/t Au and 0.357 % Cu over 201.35m project highlights Cumulative strike length of 15 kilometres Previous drilling highlights at Riscos de Oro: • RD-11-10: 10.25 g/t Au and 288.25 g/t Ag over 5.4m • RD-11012: 7.69 g/t Au and 211.87 g/t Ag over 10.6m National Instrument 43-101 Compliant Inferred Resource (using a cutoff grade of 0.6 g/t) Tonnes and Grade Total Contained Metal Deposit Tonnes Gold (g/t) Silver (g/t) Au Eq1 (g/t) Gold (oz) Silver (oz) Au Eq1 (oz) Cerro Aeropuerto 6,052,000 3.64 16.16 3.89 707,750 3,144,500 757,000 Riscos De Oro 2,159,000 3.20 59.67 4.14 222,300 4,142,000 287,100 La Luna 2,539,000 1.56 14.01 1.78 127,700 1,143,570 146,000 Total 1,057,750 8,430,070 1,190,000 CAPITAL STRUCTURE (July 2013) Working Capital ~ $1,900,000 Issued Outstanding 187,910,918 Options 16,105,000 Yamana Warrants 10,000,000 B2Gold Warrants 10,000,000 Fully Diluted 224,015,918 Symbol TSX-V: CXB 1. Au Eq cutoff equivalent calculated using Wardrop’s estimated gold price of US$1058/oz and silver price of US$16.57 per ounce. 2. Mineral resources that are not mineral reserves do not have economic viability. 3. Metallurgical recoveries and net smelter returns are assumed to be 100%. Historical estimates of production from the region: • Gold, 7.9 million ounces • Silver, 4 million ounces • Copper, 305 million pounds Since acquiring Borosi concessions in 2009, Calibre has advanced a number of key prospects Borosi Gold, Silver and Copper concessions The 100% Calibre owned Borosi concessions cover over 785 square kilometres in northeastern Nicaragua. The Mining Triangle has been one of the most prolific mining districts in Central America with a rich history of mining. Calibre has a NI 43-101 compliant inferred resource totaling 1,057,750 ounces of gold and 8,430,070 ounces of silver on the 100% owned Cerro Aeropuerto, La Luna and Riscos de Oro Prospects and a NI 43-101 compliant inferred resource totaling 118,000 ounces of gold, 2,350,000 ounces of silver and 108,000,000 pounds of copper on the Rosita Prospect which is subject to a joint venture with Alder Resources. A portion of the Borosi concessions is party to an agreement with Nicaragua’s largest gold producer, B2Gold Corp. B2Gold has earned 51% interest in these concessions (322 sq. km) by funding $8 million in exploration expenditures. They have an option to go up to 70% by spending an additional $6M over 3 years. National Instrument 43-101 Compliant Inferred Resource Calibre Mining and Alder Resources (using a 0.15% copper cutoff grade) Tonnes and Grade Total Resources Deposit Tonnes Gold (g/t) Silver (g/t) Copper (Cu) Gold (oz) Silver (oz) Copper (lbs) Rosita Stock Piles 7,950,000 0.46 9.20 0.62 118,000 2.35M 108M 1. Base case is reported at a 0.15% copper equivalent cut-off grade which incorporates consideration of mining and processing cost, recoveries, commodity prices and selling cost. 2. Estimate assumes a long term copper price of US$2.90/lb, a gold price of US$1,200/oz and a silver price of US$24/oz. 3. Rounding as required by NI 43-101 reporting guidelines may result in apparent summation differences. 4. Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces, contained copper pounds as imperial pounds. 5. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. 6. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred mineral resources as indicated or measured mineral resources and it is uncertain if further exploration will result in upgrading them to indicated or measured mineral resources. BOROSI CONCESSION highlights Results of extensive district scale exploration program to-date: • Completed 18,091.31m of diamond drilling (68 holes) • Assayed over 1,791 rock samples and 9,773 soil samples • Constructed over 2,244.68m (132 trenches) of trenches • Completed surveying and reconnaissance mapping over 516 km2 project highlights Exciting porphyry target identified at Bambana, 4km northeast of Rosita Historical production estimated at 245 million lbs of copper, 160,000 oz’s of gold and 2,610,000 oz’s of silver from the Santa Rita open pits. Additional high grade copper/gold/silver targets MONTES de Oro (100%) gold/silver/Copper/Zinc project Calibre has recently discovered new gold-silver-copper- zinc mineralization at the Montes de Oro target, North of the Cerro Aeropuerto gold-silver resource. The company is very excited about this new discovery and additional exploration work is underway. project highlights Partially tested a strong gold-silver-copper anomaly extending over a 400 by 650 metre area which remains open to the northeast. Discovery trenching Highlights include: • MTR13-009 - 52.3 metres grading 7.1 g/t gold • MTR13-017 - 23.0 metres grading 5.35 g/t gold