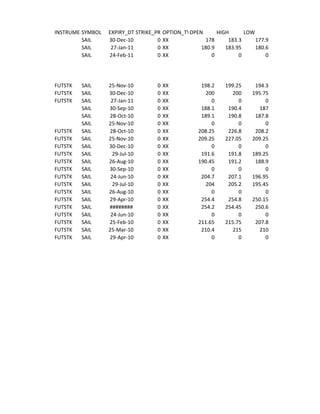

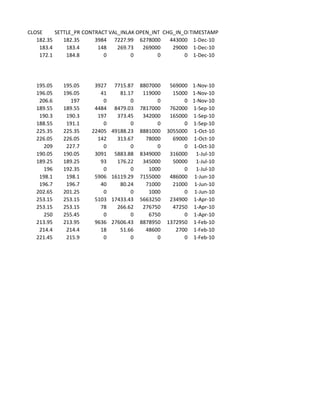

Call option data 2010

Download as xlsx, pdf0 likes144 views

The document contains stock price data for the ticker symbol SAIL including option and futures prices on various dates, with details on strike price, option type, open interest, contracts value and changes over time.

1 of 2

Download to read offline

Ad

Recommended

Lista de Descontinua├¦├Żo Impressoras

Lista de Descontinua├¦├Żo ImpressorasScanSource Brasil

╠²

The document lists printer models, their last order dates, service and support discontinuation dates, and in some cases replacement models. It appears to be a reference for an organization to track which printers are still being serviced and supported versus discontinued or replaced by newer models. The listing contains over 150 printer models in total and spans from 1990s models to more recent ones from 2013-2018.Call Option

Call OptionProf. Simply Simple

╠²

The document provides an example to explain a call option contract between a farmer and bread manufacturer. In a call option:

1) The farmer agrees to sell wheat to the manufacturer at a fixed price of Rs. 110 in 3 months.

2) The manufacturer pays the farmer a premium for the option to either execute the contract or exit without obligation.

3) If wheat prices fall to Rs. 90, the manufacturer can exit while the farmer receives the premium as compensation for participating.

The call option gives the manufacturer flexibility while still protecting both parties' interests through the option premium paid.Call option

Call optionTata Mutual Fund

╠²

The document explains the concept of a call option using an example of a farmer and bread manufacturer. In a call option contract, the bread manufacturer has the option to either execute the contract to buy wheat from the farmer at a pre-agreed price of Rs. 110 or exit the contract and buy wheat from the open market. If the bread manufacturer exits the contract, they must pay the farmer a premium of Rs. 5. This compensates the farmer while still allowing the bread manufacturer flexibility. The key distinction of a call option is that it gives flexibility to the purchaser of the commodity rather than the seller.Option Basics

Option BasicsHSBC InvestDirect (India) Limited

╠²

This document provides an overview of options contracts, including calls and puts. It defines key terms like strike price, expiration date, premium price, and describes the rights of buyers and sellers. The document also explains the components of an option's price, including intrinsic value and time value. Overall, the document serves as an introduction to basic option concepts.Unit principles of option pricing call

Unit principles of option pricing callSudarshan Kadariya

╠²

The document discusses key concepts related to options pricing including: the minimum and maximum value of a call option; factors that affect call prices such as exercise price, time to maturity, interest rates, and stock volatility; the difference between American and European style options; and the potential early exercise of American call options on dividend and non-dividend paying stocks.Factors affecting call and put option prices

Factors affecting call and put option priceskingsly nelson

╠²

The document outlines 6 primary factors that affect call and put option prices: 1) the underlying price, 2) expected volatility, 3) strike price, 4) time until expiration, 5) interest rates, and 6) dividends. Option prices increase or decrease based on whether the underlying price, expected volatility, time until expiration, and interest rates increase or decrease. Option prices also increase if the strike price is further in or out of the money and if dividends rise or fall.Derivatives

DerivativesSajna Fathima

╠²

The document explains call and put options, which are derivative financial instruments allowing the buyer to buy or sell an underlying asset at a specified price. It details the rights and obligations of both buyers and sellers, as well as key terminologies like option premium, strike price, and expiration date. Additionally, the document discusses the strategic use of options to limit losses and manage risk.Call option

Call optionStrides Shasun

╠²

The document discusses call options. A call option gives the buyer the right, but not the obligation, to buy an underlying asset at a specified price within a specific time period. There are different types of underlying assets for call options, including stocks, indexes, currencies, and commodities. Call options provide leverage for investors and limit their risk to the premium paid, while allowing profits from rising asset prices. However, calls also have disadvantages like time expiration, complexity, and unlimited losses for writers of naked calls. The document provides examples of how call options are exercised based on the direction of the underlying asset price.DERIVATIVES LESSONS

DERIVATIVES LESSONSAugustin Bangalore

╠²

Derivatives derive their value from underlying assets such as stocks, commodities, currencies, and bonds. The main types of derivatives are forwards, futures, and options. Forwards involve an obligation for both parties to fulfill the contract terms at a future date. Futures are standardized contracts traded on an exchange with high liquidity. Options confer the right but not obligation to buy or sell the underlying asset at a strike price by an expiry date. Key participants in derivatives markets include speculators, hedgers, and arbitrageurs. Common derivatives strategies involve futures arbitrage, hedging, and using options spreads. Greeks like delta and gamma help analyze how option prices change with movements in the underlying asset.Derivatives Binomial Option Pricing Model Examples

Derivatives Binomial Option Pricing Model Examplesuichong

╠²

The document provides examples of using the binomial option pricing model to value various types of options, including call options, put options, and options on currencies and futures contracts. It shows the step-by-step calculations for single-period and multi-period options using the binomial tree approach.Options Trading Strategies

Options Trading StrategiesMayank Bhatia

╠²

The document covers various options investment strategies, detailing the fundamental concepts of call and put options, as well as various trading strategies, including spreads, straddles, and protective puts. It explains how these strategies can be used based on the investor's expectations of stock price movements, outlining potential profits and risks associated with each. Additionally, it provides practical examples to illustrate the application of these strategies in real-world scenarios.Derivatives- CALL AND PUT OPTIONS

Derivatives- CALL AND PUT OPTIONSDinesh Kumar

╠²

This document provides an introduction to options, including the different types (calls and puts), how they work, key terminology, and factors that influence pricing. An option gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before expiration. The buyer pays a premium to the seller for this right. Key terms discussed include strike price, expiration date, and long/short positions. Factors like time to expiration, volatility, and interest rates impact an option's price. The Black-Scholes model is commonly used to price options based on these variables.Options strategies

Options strategiesPavan Makhija

╠²

The document discusses various options trading strategies, including:

1) Buying call options to profit from an expected rise in the market. This strategy has unlimited upside potential but limited downside risk of the premium paid.

2) Buying put options to profit from an expected fall in the market. This also has unlimited upside potential and limited downside risk of the premium.

3) Holding stock and selling covered calls to generate income from the stock holding when a neutral market is expected. This caps upside potential in exchange for the option premium received.

The document explains the mechanics and risk-reward profiles of these and other options strategies through the use of diagrams and payoff tables.Derivatives - Option strategies.

Derivatives - Option strategies.Ameya Ranadive

╠²

The document discusses various option strategies including long call, long put, short call, synthetic long call, and short put.

A long call strategy involves buying call options and profits if the underlying stock or index price rises above the strike price plus premium paid. A long put strategy involves buying put options and profits if the price falls below the strike price minus premium paid.

A short call strategy involves selling call options and profits if the price remains below or at the strike price, collecting premium as maximum profit. A synthetic long call strategy involves buying stock and buying protective put options to limit downside risk while retaining upside potential.

A short put strategy involves selling put options and profits as long as the underlying price remains aboveIT Companies in Magarpatta: A Thriving Hub of Technology and Innovation

IT Companies in Magarpatta: A Thriving Hub of Technology and Innovationprernarathi90

╠²

IT Firms in Magarpatta have transformed the region into one of PuneŌĆÖs most vibrant and sought-after technology destinations. Located in Hadapsar, Magarpatta City is a privately managed, self-sustained township that blends residential, commercial, and IT infrastructure with green and eco-friendly planning. The presence of leading software companies, excellent connectivity, and world-class amenities make it a hotspot for IT professionals and businesses alike.

Marketing Assignment presentation of good marketing techniques how to impleme...

Marketing Assignment presentation of good marketing techniques how to impleme...Priya Raj

╠²

Marketing presentationChapter 1 Introduction to Accountin1.6 plusone class first chapter (1) (1).pptx

Chapter 1 Introduction to Accountin1.6 plusone class first chapter (1) (1).pptxdilshap23

╠²

introduction to accountingRushi Manche | Blockchain Tech Company Co-Founder

Rushi Manche | Blockchain Tech Company Co-FounderRushi Manche

╠²

Rushi Manche has received recognition for his academic, entrepreneurial, and public service achievements at the state, national, and international levels. His contributions span a variety of disciplines, including finance, technology, and education.Vaden Consultancy: Transforming Businesses with Integrated HR, IT, and Cloud ...

Vaden Consultancy: Transforming Businesses with Integrated HR, IT, and Cloud ...Vaden Consultancy

╠²

At Vaden Consultancy, we specialize in aligning talent, technology, and infrastructure to power business transformation. Our integrated service model brings together end-to-end HR consultancy, custom software development, and cloud infrastructure management ŌĆö enabling organizations to scale efficiently, adapt faster, and stay future-ready.

From sourcing top-tier talent and streamlining recruitment through RPO, to building enterprise-grade applications and deploying Microsoft 365, Azure, and Power Platform solutions ŌĆö we deliver a seamless experience under one roof. With expert support and strategic insight, we help businesses enhance productivity, reduce operational costs, and drive innovation at every level.

Vaden Consultancy is not just a service provider ŌĆö we are your strategic partner for growth in todayŌĆÖs digital-first economy. BMGI India Addressing Strategic, Innovative, and Operational Problems at Core...

BMGI India Addressing Strategic, Innovative, and Operational Problems at Core...Naresh Raisinghani

╠²

Discover how BMGI India empowers businesses to solve core challenges, drive sustainable growth, and achieve real transformation through proven frameworks and deep industry expertise.

https://www.bmgindia.comInternational Business, 4th Edition- Alan M. Rugman.pdf

International Business, 4th Edition- Alan M. Rugman.pdfGamingwithUBAID

╠²

nternational Business, 4th Edition- Alan M. Rugman.pdBenefits of virtual events For the Business

Benefits of virtual events For the BusinessTrevento media Private Limited

╠²

Virtual events are successful and efficient for all audiences because they reduce expenses, increase global reach, increase engagement, provide real-time data, and promote sustainability.Enhancing Customer Engagement in Direct Selling Through AI Segmentation

Enhancing Customer Engagement in Direct Selling Through AI SegmentationEpixel MLM Software

╠²

Direct selling is a successful business model where they always incorporate and upgrade themselves with latest strategies and trends. Customers preferences and needs always change. So, it is essential for the companies to understand the changes from the beginning itself and provide them the personalized services.

Employing AI segmentation in direct selling ensures the companies increased customer satisfaction and customer engagement. With AI, companies can get their customers individual preferences, interactions, and even emotional cues. By integrating AI with direct sales, companies can benefit such as analyzing individual behaviors, preferences, and emotional cues, providing deeper insights of each customer, enabling personalized engagement with the audience, anticipating future customer behavior based on historical data, and providing more precise customer targeting by identifying pattern.

Direct selling is all about micro moments small, often fleeting, opportunities to engage with customers. Companies using AI can pinpoint these moments and understand customer preferences on their purchase patterns and provide them the response in the most relevant and timely way. BOURNS POTENTIOMETER Provide You Precision

BOURNS POTENTIOMETER Provide You Precisionsmidmart

╠²

Bourns potentiometers are high-quality variable resistors designed for precision control in a wide range of electronic applications. Known for their durability, accuracy, and reliability, Bourns potentiometers are ideal for adjusting signal levels, tuning circuits, or setting reference voltages in industrial, automotive, and consumer electronics.

Available in rotary and slide variants, these components offer excellent repeatability, smooth operation, and long mechanical life, making them a trusted choice for engineers and designers worldwide.

The APCO Geopolitical Radar Q3 2025 Edition

The APCO Geopolitical Radar Q3 2025 EditionAPCO

╠²

Welcome to the APCO Geopolitical Radar (AGR), an overview of geopolitical risks posed to corporations operating globally. AGR reflects our understanding of the regional risks facing businesses and how these risks come together at a global level. It is intended as a baseline from which to develop strategies that navigate and mitigate these risks. This report looks at emerging issues for Q3 2025 and was published in April 2025. Our regional insights represent the best thinking of APCO corporate advisory practitioners. With more than 1,300 people across more than 30 global locations, our analysis draws on decades of experience and insights serving corporations that operate globally.

The APCO Geopolitical Radar Q3 2025 EditionStone Hill Ready Mix Concrete Bagalur

Stone Hill Ready Mix Concrete Bagalurstonehillrealtyblr

╠²

Stone Hill Ready Mix Concrete is a trusted provider of high-quality ready-mix concrete solutions, serving construction and infrastructure projects across Bagalur. With a commitment to precision, durability, and customer satisfaction, we specialize in supplying concrete tailored to meet the unique requirements of residential, commercial, and industrial projects.

What Drives Collectors in Sports and Beyond, and How Mantel is Bringing Them ...

What Drives Collectors in Sports and Beyond, and How Mantel is Bringing Them ...Neil Horowitz

╠²

On episode 2947of the Digital and Social Media Sports Podcast, Neil chatted with Evan Parker, CEO of Mantel.

What follows is a collection of snippets from the podcast. To hear the full interview and more, check out the podcast on all podcast platforms and at www.dsmsports.net.Shivsrushti - A Living Chronicle of MaharashtraŌĆÖs History

Shivsrushti - A Living Chronicle of MaharashtraŌĆÖs HistoryRaj Kumble

╠²

Shivsrushti, a heritage park in Pune envisioned by Babasaheb Purandare, offers a powerful blend of immersive storytelling, historical accuracy, and civic education centered around the life and values of Chhatrapati Shivaji Maharaj. Through lifelike exhibits and recreated experiences, it brings history to life for people of all ages, encouraging reflection on leadership, inclusivity, and ethical governance. The Abhay Bhutada Foundation has played a pivotal role in expanding access to Shivsrushti by supporting educational visits for underprivileged students, ensuring that this cultural treasure is shared widely and meaningfully. More than a tribute to the past, Shivsrushti serves as a public model for how history can inspire civic pride and social unity in contemporary India.

smidmart industrial Automation Ones Stop Solution

smidmart industrial Automation Ones Stop Solutionsmidmart

╠²

Smidmart is an industrial automation products one stop solutions where you got all materials you want from control panel cutomization to checkweigher parts your one stop solution is smidart . we are avialble on https://www.smidmart.com/AX to Dynamics 365 Finance and Operations in USA.pdf

AX to Dynamics 365 Finance and Operations in USA.pdfTrident information system

╠²

Upgrading from Microsoft Dynamics AX to Dynamics 365 Finance & Supply Chain Management (D365 F&O) is not just a technology upgradeŌĆöitŌĆÖs a strategic move to transform your business. At Trident Information Systems, a trusted Microsoft Gold Partner, we specialize in Upgrade AX to D365 F&O implementations. With decades of ERP expertise, we ensure your migration journey is smooth, efficient, and delivers maximum ROI. Whether youŌĆÖre transitioning from AX to D365 F&O, we are here to make your digital transformation seamless and impactful.

More Related Content

Viewers also liked (6)

DERIVATIVES LESSONS

DERIVATIVES LESSONSAugustin Bangalore

╠²

Derivatives derive their value from underlying assets such as stocks, commodities, currencies, and bonds. The main types of derivatives are forwards, futures, and options. Forwards involve an obligation for both parties to fulfill the contract terms at a future date. Futures are standardized contracts traded on an exchange with high liquidity. Options confer the right but not obligation to buy or sell the underlying asset at a strike price by an expiry date. Key participants in derivatives markets include speculators, hedgers, and arbitrageurs. Common derivatives strategies involve futures arbitrage, hedging, and using options spreads. Greeks like delta and gamma help analyze how option prices change with movements in the underlying asset.Derivatives Binomial Option Pricing Model Examples

Derivatives Binomial Option Pricing Model Examplesuichong

╠²

The document provides examples of using the binomial option pricing model to value various types of options, including call options, put options, and options on currencies and futures contracts. It shows the step-by-step calculations for single-period and multi-period options using the binomial tree approach.Options Trading Strategies

Options Trading StrategiesMayank Bhatia

╠²

The document covers various options investment strategies, detailing the fundamental concepts of call and put options, as well as various trading strategies, including spreads, straddles, and protective puts. It explains how these strategies can be used based on the investor's expectations of stock price movements, outlining potential profits and risks associated with each. Additionally, it provides practical examples to illustrate the application of these strategies in real-world scenarios.Derivatives- CALL AND PUT OPTIONS

Derivatives- CALL AND PUT OPTIONSDinesh Kumar

╠²

This document provides an introduction to options, including the different types (calls and puts), how they work, key terminology, and factors that influence pricing. An option gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before expiration. The buyer pays a premium to the seller for this right. Key terms discussed include strike price, expiration date, and long/short positions. Factors like time to expiration, volatility, and interest rates impact an option's price. The Black-Scholes model is commonly used to price options based on these variables.Options strategies

Options strategiesPavan Makhija

╠²

The document discusses various options trading strategies, including:

1) Buying call options to profit from an expected rise in the market. This strategy has unlimited upside potential but limited downside risk of the premium paid.

2) Buying put options to profit from an expected fall in the market. This also has unlimited upside potential and limited downside risk of the premium.

3) Holding stock and selling covered calls to generate income from the stock holding when a neutral market is expected. This caps upside potential in exchange for the option premium received.

The document explains the mechanics and risk-reward profiles of these and other options strategies through the use of diagrams and payoff tables.Derivatives - Option strategies.

Derivatives - Option strategies.Ameya Ranadive

╠²

The document discusses various option strategies including long call, long put, short call, synthetic long call, and short put.

A long call strategy involves buying call options and profits if the underlying stock or index price rises above the strike price plus premium paid. A long put strategy involves buying put options and profits if the price falls below the strike price minus premium paid.

A short call strategy involves selling call options and profits if the price remains below or at the strike price, collecting premium as maximum profit. A synthetic long call strategy involves buying stock and buying protective put options to limit downside risk while retaining upside potential.

A short put strategy involves selling put options and profits as long as the underlying price remains aboveRecently uploaded (20)

IT Companies in Magarpatta: A Thriving Hub of Technology and Innovation

IT Companies in Magarpatta: A Thriving Hub of Technology and Innovationprernarathi90

╠²

IT Firms in Magarpatta have transformed the region into one of PuneŌĆÖs most vibrant and sought-after technology destinations. Located in Hadapsar, Magarpatta City is a privately managed, self-sustained township that blends residential, commercial, and IT infrastructure with green and eco-friendly planning. The presence of leading software companies, excellent connectivity, and world-class amenities make it a hotspot for IT professionals and businesses alike.

Marketing Assignment presentation of good marketing techniques how to impleme...

Marketing Assignment presentation of good marketing techniques how to impleme...Priya Raj

╠²

Marketing presentationChapter 1 Introduction to Accountin1.6 plusone class first chapter (1) (1).pptx

Chapter 1 Introduction to Accountin1.6 plusone class first chapter (1) (1).pptxdilshap23

╠²

introduction to accountingRushi Manche | Blockchain Tech Company Co-Founder

Rushi Manche | Blockchain Tech Company Co-FounderRushi Manche

╠²

Rushi Manche has received recognition for his academic, entrepreneurial, and public service achievements at the state, national, and international levels. His contributions span a variety of disciplines, including finance, technology, and education.Vaden Consultancy: Transforming Businesses with Integrated HR, IT, and Cloud ...

Vaden Consultancy: Transforming Businesses with Integrated HR, IT, and Cloud ...Vaden Consultancy

╠²

At Vaden Consultancy, we specialize in aligning talent, technology, and infrastructure to power business transformation. Our integrated service model brings together end-to-end HR consultancy, custom software development, and cloud infrastructure management ŌĆö enabling organizations to scale efficiently, adapt faster, and stay future-ready.

From sourcing top-tier talent and streamlining recruitment through RPO, to building enterprise-grade applications and deploying Microsoft 365, Azure, and Power Platform solutions ŌĆö we deliver a seamless experience under one roof. With expert support and strategic insight, we help businesses enhance productivity, reduce operational costs, and drive innovation at every level.

Vaden Consultancy is not just a service provider ŌĆö we are your strategic partner for growth in todayŌĆÖs digital-first economy. BMGI India Addressing Strategic, Innovative, and Operational Problems at Core...

BMGI India Addressing Strategic, Innovative, and Operational Problems at Core...Naresh Raisinghani

╠²

Discover how BMGI India empowers businesses to solve core challenges, drive sustainable growth, and achieve real transformation through proven frameworks and deep industry expertise.

https://www.bmgindia.comInternational Business, 4th Edition- Alan M. Rugman.pdf

International Business, 4th Edition- Alan M. Rugman.pdfGamingwithUBAID

╠²

nternational Business, 4th Edition- Alan M. Rugman.pdBenefits of virtual events For the Business

Benefits of virtual events For the BusinessTrevento media Private Limited

╠²

Virtual events are successful and efficient for all audiences because they reduce expenses, increase global reach, increase engagement, provide real-time data, and promote sustainability.Enhancing Customer Engagement in Direct Selling Through AI Segmentation

Enhancing Customer Engagement in Direct Selling Through AI SegmentationEpixel MLM Software

╠²

Direct selling is a successful business model where they always incorporate and upgrade themselves with latest strategies and trends. Customers preferences and needs always change. So, it is essential for the companies to understand the changes from the beginning itself and provide them the personalized services.

Employing AI segmentation in direct selling ensures the companies increased customer satisfaction and customer engagement. With AI, companies can get their customers individual preferences, interactions, and even emotional cues. By integrating AI with direct sales, companies can benefit such as analyzing individual behaviors, preferences, and emotional cues, providing deeper insights of each customer, enabling personalized engagement with the audience, anticipating future customer behavior based on historical data, and providing more precise customer targeting by identifying pattern.

Direct selling is all about micro moments small, often fleeting, opportunities to engage with customers. Companies using AI can pinpoint these moments and understand customer preferences on their purchase patterns and provide them the response in the most relevant and timely way. BOURNS POTENTIOMETER Provide You Precision

BOURNS POTENTIOMETER Provide You Precisionsmidmart

╠²

Bourns potentiometers are high-quality variable resistors designed for precision control in a wide range of electronic applications. Known for their durability, accuracy, and reliability, Bourns potentiometers are ideal for adjusting signal levels, tuning circuits, or setting reference voltages in industrial, automotive, and consumer electronics.

Available in rotary and slide variants, these components offer excellent repeatability, smooth operation, and long mechanical life, making them a trusted choice for engineers and designers worldwide.

The APCO Geopolitical Radar Q3 2025 Edition

The APCO Geopolitical Radar Q3 2025 EditionAPCO

╠²

Welcome to the APCO Geopolitical Radar (AGR), an overview of geopolitical risks posed to corporations operating globally. AGR reflects our understanding of the regional risks facing businesses and how these risks come together at a global level. It is intended as a baseline from which to develop strategies that navigate and mitigate these risks. This report looks at emerging issues for Q3 2025 and was published in April 2025. Our regional insights represent the best thinking of APCO corporate advisory practitioners. With more than 1,300 people across more than 30 global locations, our analysis draws on decades of experience and insights serving corporations that operate globally.

The APCO Geopolitical Radar Q3 2025 EditionStone Hill Ready Mix Concrete Bagalur

Stone Hill Ready Mix Concrete Bagalurstonehillrealtyblr

╠²

Stone Hill Ready Mix Concrete is a trusted provider of high-quality ready-mix concrete solutions, serving construction and infrastructure projects across Bagalur. With a commitment to precision, durability, and customer satisfaction, we specialize in supplying concrete tailored to meet the unique requirements of residential, commercial, and industrial projects.

What Drives Collectors in Sports and Beyond, and How Mantel is Bringing Them ...

What Drives Collectors in Sports and Beyond, and How Mantel is Bringing Them ...Neil Horowitz

╠²

On episode 2947of the Digital and Social Media Sports Podcast, Neil chatted with Evan Parker, CEO of Mantel.

What follows is a collection of snippets from the podcast. To hear the full interview and more, check out the podcast on all podcast platforms and at www.dsmsports.net.Shivsrushti - A Living Chronicle of MaharashtraŌĆÖs History

Shivsrushti - A Living Chronicle of MaharashtraŌĆÖs HistoryRaj Kumble

╠²

Shivsrushti, a heritage park in Pune envisioned by Babasaheb Purandare, offers a powerful blend of immersive storytelling, historical accuracy, and civic education centered around the life and values of Chhatrapati Shivaji Maharaj. Through lifelike exhibits and recreated experiences, it brings history to life for people of all ages, encouraging reflection on leadership, inclusivity, and ethical governance. The Abhay Bhutada Foundation has played a pivotal role in expanding access to Shivsrushti by supporting educational visits for underprivileged students, ensuring that this cultural treasure is shared widely and meaningfully. More than a tribute to the past, Shivsrushti serves as a public model for how history can inspire civic pride and social unity in contemporary India.

smidmart industrial Automation Ones Stop Solution

smidmart industrial Automation Ones Stop Solutionsmidmart

╠²

Smidmart is an industrial automation products one stop solutions where you got all materials you want from control panel cutomization to checkweigher parts your one stop solution is smidart . we are avialble on https://www.smidmart.com/AX to Dynamics 365 Finance and Operations in USA.pdf

AX to Dynamics 365 Finance and Operations in USA.pdfTrident information system

╠²

Upgrading from Microsoft Dynamics AX to Dynamics 365 Finance & Supply Chain Management (D365 F&O) is not just a technology upgradeŌĆöitŌĆÖs a strategic move to transform your business. At Trident Information Systems, a trusted Microsoft Gold Partner, we specialize in Upgrade AX to D365 F&O implementations. With decades of ERP expertise, we ensure your migration journey is smooth, efficient, and delivers maximum ROI. Whether youŌĆÖre transitioning from AX to D365 F&O, we are here to make your digital transformation seamless and impactful.

Miriam Cho: Transforming Healthcare through Visionary Leadership

Miriam Cho: Transforming Healthcare through Visionary Leadershipjessicashaw101998

╠²

Miriam Cho, President and Chief Pharmacy Officer (CPO) of MAC Rx, LLC, has extensive experience in the LTC and healthcare sectors. Miriam is skilled in various areas, including healthcare management, pharmacy operations, cost management, Medicare Part D, cardiopulmonary resuscitation (CPR), pharmacy consulting, and clinical pharmacology. She holds a Doctor of Pharmacy (Pharm.D.) degree from Midwestern University in Illinois, showcasing her strong background in healthcare services.From Visibility to Action: How Modern Cloud Teams Regain Control

From Visibility to Action: How Modern Cloud Teams Regain ControlAmnic

╠²

As cloud environments become increasingly sophisticated, visibility into usage and cost is no longer sufficient. Today's teams must transition from being reactive observers to having confident, knowledgeable action. This presentation delves into how companies can turn dispersed insights into decisions that avoid surprises and foster accountability.

From Visibility to Action: How Modern Cloud Teams Regain Control takes you through the changing requirements of cloud-native organizations: from creating a single pane of costs to eliminating alert fatigue, applying guardrails, and folding cost visibility directly into DevOps pipelines.

You will learn here how to:

- Get past visibility into actionable control in multi-cloud and K8s

- Solve visibility fatigue using prioritized contextual information

- Move the cost responsibility left into the engineering process

Regain clarity in a fragmented cloud landscape

Whether youŌĆÖre a startup scaling fast or an enterprise navigating complexity, this will help your team turn cloud data into decisions and bills into predictable outcomes. Ak─Źn├Ł pl├Īn pro chemick├Į pr┼»mysl - Ivan Sou─Źek

Ak─Źn├Ł pl├Īn pro chemick├Į pr┼»mysl - Ivan Sou─Źekpavelborek

╠²

Kulat├Į st┼»l: CLEAN INDUSTRIAL DEAL ŌĆō BUDOUCNOST ─īESK├ē CHEMIE A OCEL├ü┼śSTV├Ź se uskute─Źnil 18.6.2025 v s├Łdle HK ─īRBMGI India Addressing Strategic, Innovative, and Operational Problems at Core...

BMGI India Addressing Strategic, Innovative, and Operational Problems at Core...Naresh Raisinghani

╠²

Ad

Call option data 2010

- 1. INSTRUMENT SYMBOL EXPIRY_DT STRIKE_PR OPTION_TYP PEN O HIGH LOW SAIL 30-Dec-10 0 XX 178 183.3 177.9 SAIL 27-Jan-11 0 XX 180.9 183.95 180.6 SAIL 24-Feb-11 0 XX 0 0 0 FUTSTK SAIL 25-Nov-10 0 XX 198.2 199.25 194.3 FUTSTK SAIL 30-Dec-10 0 XX 200 200 195.75 FUTSTK SAIL 27-Jan-11 0 XX 0 0 0 SAIL 30-Sep-10 0 XX 188.1 190.4 187 SAIL 28-Oct-10 0 XX 189.1 190.8 187.8 SAIL 25-Nov-10 0 XX 0 0 0 FUTSTK SAIL 28-Oct-10 0 XX 208.25 226.8 208.2 FUTSTK SAIL 25-Nov-10 0 XX 209.25 227.05 209.25 FUTSTK SAIL 30-Dec-10 0 XX 0 0 0 FUTSTK SAIL 29-Jul-10 0 XX 191.6 191.8 189.25 FUTSTK SAIL 26-Aug-10 0 XX 190.45 191.2 188.9 FUTSTK SAIL 30-Sep-10 0 XX 0 0 0 FUTSTK SAIL 24-Jun-10 0 XX 204.7 207.1 196.95 FUTSTK SAIL 29-Jul-10 0 XX 204 205.2 195.45 FUTSTK SAIL 26-Aug-10 0 XX 0 0 0 FUTSTK SAIL 29-Apr-10 0 XX 254.4 254.8 250.15 FUTSTK SAIL ######## 0 XX 254.2 254.45 250.6 FUTSTK SAIL 24-Jun-10 0 XX 0 0 0 FUTSTK SAIL 25-Feb-10 0 XX 211.65 215.75 207.8 FUTSTK SAIL 25-Mar-10 0 XX 210.4 215 210 FUTSTK SAIL 29-Apr-10 0 XX 0 0 0

- 2. CLOSE SETTLE_PR CONTRACTSVAL_INLAKHOPEN_INT CHG_IN_OITIMESTAMP 182.35 182.35 3984 7227.99 6278000 443000 1-Dec-10 183.4 183.4 148 269.73 269000 29000 1-Dec-10 172.1 184.8 0 0 0 0 1-Dec-10 195.05 195.05 3927 7715.87 8807000 569000 1-Nov-10 196.05 196.05 41 81.17 119000 15000 1-Nov-10 206.6 197 0 0 0 0 1-Nov-10 189.55 189.55 4484 8479.03 7817000 762000 1-Sep-10 190.3 190.3 197 373.45 342000 165000 1-Sep-10 188.55 191.1 0 0 0 0 1-Sep-10 225.35 225.35 22405 49188.23 8881000 3055000 1-Oct-10 226.05 226.05 142 313.67 78000 69000 1-Oct-10 209 227.7 0 0 0 0 1-Oct-10 190.05 190.05 3091 5883.88 8349000 316000 1-Jul-10 189.25 189.25 93 176.22 345000 50000 1-Jul-10 196 192.35 0 0 1000 0 1-Jul-10 198.1 198.1 5906 16119.29 7155000 486000 1-Jun-10 196.7 196.7 40 80.24 71000 21000 1-Jun-10 202.65 201.25 0 0 1000 0 1-Jun-10 253.15 253.15 5103 17433.43 5663250 234900 1-Apr-10 253.15 253.15 78 266.62 276750 47250 1-Apr-10 250 255.45 0 0 6750 0 1-Apr-10 213.95 213.95 9636 27606.43 8878950 1372950 1-Feb-10 214.4 214.4 18 51.66 48600 2700 1-Feb-10 221.45 215.9 0 0 0 0 1-Feb-10