Canopus web bank

- 1. Innovative software platform for modern banking CANOPUS WEBbank 2.0

- 2. Who we are ? âĒ Canopus Software is a software development company founded in 1992. We offer turnkey IT solutions for such customers as banks, financial companies, payment service providers, payment institutions and corporate treasuries âĒ For more than 20 years of work we successfully implemented more than 150 projects for clients all over the world (Russia, CIS, Europe, Asia) âĒ Our mission is to create a comfort IT infrastructure for our customers

- 3. What we do ? Based on the problems that our clients face, we offer a range of services : IT solutions: Software implementation Integration with 3rd party providers Related services (hosting, administration) Assistance in registration of companies in different jurisdictions Assistance in obtaining the necessary licenses, opening bank accounts Consulting, assistance in development of business model Professional services (accounting, hr) Assistance in building relations with partners (internet acquiring, payment cards providers, professional associations)

- 4. Our clients: âĒ Offshore banks âĒ Payment systems âĒ Corporate treasuries(in-house banking) âĒ Payment Institutions âĒ FX providers

- 5. CANOPUS FS â universal platform for financial institution automation CANOPUS FS CANOPUS Treasury CANOPUS WEBbank CANOPUS EpaySuite âĒ All our solutions based on universal platform CANOPUS FS. âĒ Platform Canopus FSâĒ is designed to fully automate the business processes of the modern financial institution in the STP mode (Straight Through Processing) âĒ CANOPUS WEBbank 2.0 â solution for modern international banks, which provides services to its customers using the latest technology.

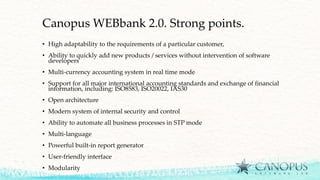

- 6. Canopus WEBbank 2.0. Strong points. âĒ High adaptability to the requirements of a particular customer, âĒ Ability to quickly add new products / services without intervention of software developers âĒ Multi-currency accounting system in real time mode âĒ Support for all major international accounting standards and exchange of financial information, including: ISO8583, ISO20022, IAS30 âĒ Open architecture âĒ Modern system of internal security and control âĒ Ability to automate all business processes in STP mode âĒ Multi-language âĒ Powerful built-in report generator âĒ User-friendly interface âĒ Modularity

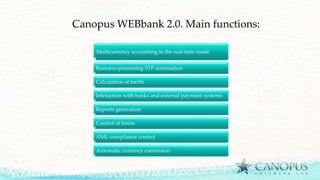

- 7. Canopus WEBbank 2.0. Main functions: Multicurrency accounting in the real-time mode Business-processing STP automation Calculation of tariffs Interaction with banks and external payment systems Reports generation Control of limits AML-compliance control Automatic currency conversion

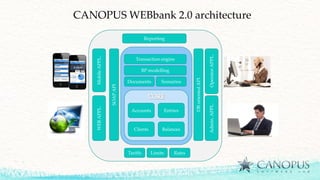

- 8. CANOPUS WEBbank 2.0 architecture Accounts Entries Clients Balances Transaction engine BP modelling Documents Scenarios SOAPAPI WEBAPPL.MobileAPPL. DBorientedAPI OperatorAPPL.Admin.APPL. Tariffs Limits Rates Reporting

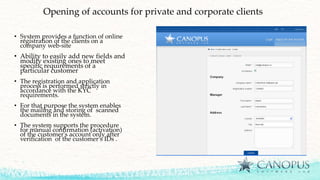

- 9. Opening of accounts for private and corporate clients âĒ System provides a function of online registration of the clients on a company web-site âĒ Ability to easily add new fields and modify existing ones to meet specific requirements of a particular customer âĒ The registration and application process is performed strictly in accordance with the KYC requirements. âĒ For that purpose the system enables the mailing and storing of scanned documents in the system. âĒ The system supports the procedure for manual confirmation (activation) of the customer's account only after verification of the customerâs IDs .

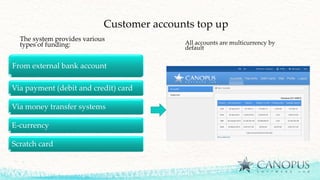

- 10. Customer accounts top up From external bank account Via payment (debit and credit) card Via money transfer systems E-currency Scratch card The system provides various types of funding: All accounts are multicurrency by default

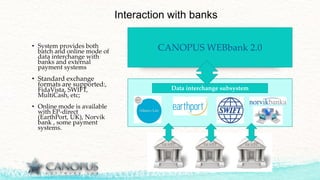

- 11. CANOPUS WEBbank 2.0 Interaction with banks âĒ System provides both batch and online mode of data interchange with banks and external payment systems âĒ Standard exchange formats are supported:, FidaVista, SWIFT, MultiCash, etc; âĒ Online mode is available with EP-direct (EarthPort, UK), Norvik bank , some payment systems. Data interchange subsystem

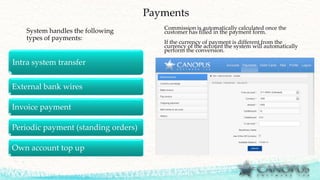

- 12. Payments Intra system transfer External bank wires Invoice payment Periodic payment (standing orders) Own account top up Commission is automatically calculated once the customer has filled in the payment form. If the currency of payment is different from the currency of the account the system will automatically perform the conversion. System handles the following types of payments:

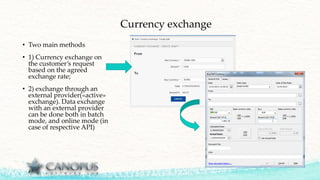

- 13. Currency exchange âĒ Two main methods âĒ 1) Currency exchange on the customerâs request based on the agreed exchange rate; âĒ 2) exchange through an external provider(ÂŦactiveÂŧ exchange). Data exchange with an external provider can be done both in batch mode, and online mode (in case of respective API)

- 14. Brokerage accounts âĒ CANOPUS together with its partners have years of experience providing services for brokerage companies âĒ We can provide additional technical consultation and services in this field

- 15. What we suggest âĒ We can integrate our solution CANOPUS WEBbank with your existing brokarage system (SaxoBank) âĒ In addition to your existing solution we can assist in setting up and maintaining such trading platforms as âĒ UniTrader, http://unitrader.com/, developed by our partners âĒ MetaTrader, http://www.metaquotes.net/

- 16. Mobile payments. âĒ Simplified WEB. âĒ Solution adapted for smartphone based on web application: â Statements â Balances â Internal and external transfers â Currency conversion âĒ Native and cross-platform applications for IOS/Android: â Account balances; â Statements; â Intra system transfers; â Own accounts top-up; â Conversion; â Transfers based on predefined templates; â Bill payments etc âĒ SMS banking: â Transaction notifications; â Balance enquiry; â Intra accounts transfer; â Intra system transfers;

- 17. Mobile application (OS Android version) Login Home page Statement period Account balance Internal transfer

- 18. Money transfers. âĒ Intra-system transfers âĒ Transfers through external money transfer system CANOPUS WEBbank 2.0

- 19. Cards issue âĒ Co-branded cards issue; âĒ Virtual cards issue; âĒ Own cards issue.

- 20. Cards handling module âĒ Order and activation of cards; âĒ Cards top up; âĒ Card to card transfer; âĒ Return of funds to the current account; âĒ Card blocking.

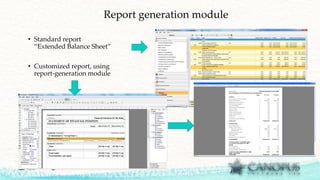

- 21. Report generation module âĒ Standard report âExtended Balance Sheetâ âĒ Customized report, using report-generation module

- 22. Security âĒ CANOPUS WEBbank complies with modern security requirements of financial information systems. âĒ The system incorporates a number of functions to prevent unauthorized access to data from the client interface, as well as protects the system from insider threats : â Storage of the most critical pieces of information in encrypted form; â Logging all the activity for both the client and the operator; â Multi-factor authentication; â Access control differentiation; â A special monitoring system for abnormal activity of both the client and the operator; â The use of secure protocols and encryption of traffic

- 23. Client authentication and authorization of transactions âĒ System supports several methods of transaction authorization and client authentication: âĒ Payment password; âĒ One-time password card (scratch card); âĒ Pin code generator (digipass); âĒ One-time sms password. âĒ End customer can choose the authentication method by himself.

- 24. Internal mail. Chat âĒ CANOPUS WEBbank has a system of internal mail and online chat, through which customers can communicate directly with the staff within the system: â Send and receive text messages; â Send and receive attached files â Communicate in real time

- 25. Internal AML control system âĒ Checks against various black lists (OFAC, UK, EU etc); âĒ Limit control, automatic generation and processing of declarations of origin of funds in the event of exceeding the specified limit; âĒ Control of abnormal activity that does not match the profile of the client âĒ Built-in notification system; âĒ Support of KYC-control and identification (verification) of the client; âĒ Setting of limits and available products based on client profile and level of verification.

- 26. Our advantages: âĒ Flexible pricing policy and payment methods âĒ The optimum combination of functionality, reliability and cost; âĒ The scalability of the system. The possibility of a rapid launch of the new financial products / services; âĒ Customization and configuration of the system in accordance with the requirements of the customer âĒ High performance and reliability (up to 1000 transactions per second.) âĒ Low cost of ownership; âĒ Ready gateways with a number of providers of payment and financial services, the possibility of rapid integration of new service providers.

- 27. How we work: âĒ 1) Project study: business process description, data structure description, tariffâs structure description, limits description, etc. âĒ 2) Meta-data and handbooks creation; âĒ 3) Business process definition; âĒ 4) Handbooks definition; âĒ 5) Tariffs and limits adjustment; âĒ 6) Customization of gateways for Interaction with correspondent banks and external payment systems; âĒ 7) User profiles and access rights definition; âĒ 8) Customer interface layout and menu structure adjustment âĒ 9) Integration testing, all business process emulation; âĒ 10) Dry run âĒ 11) System go live

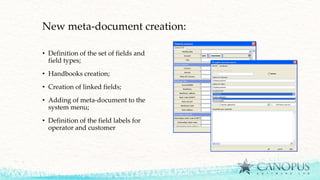

- 28. New meta-document creation: âĒ Definition of the set of fields and field types; âĒ Handbooks creation; âĒ Creation of linked fields; âĒ Adding of meta-document to the system menu; âĒ Definition of the field labels for operator and customer

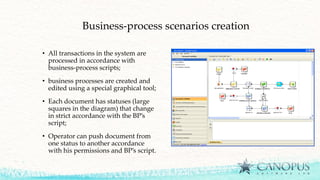

- 29. Business-process scenarios creation âĒ All transactions in the system are processed in accordance with business-process scripts; âĒ business processes are created and edited using a special graphical tool; âĒ Each document has statuses (large squares in the diagram) that change in strict accordance with the BPâs script; âĒ Operator can push document from one status to another accordance with his permissions and BPâs script.

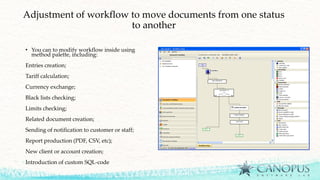

- 30. Adjustment of workflow to move documents from one status to another âĒ You can to modify workflow inside using method palette, including: Entries creation; Tariff calculation; Currency exchange; Black lists checking; Limits checking; Related document creation; Sending of notification to customer or staff; Report production (PDF, CSV, etc); New client or account creation; Introduction of custom SQL-code

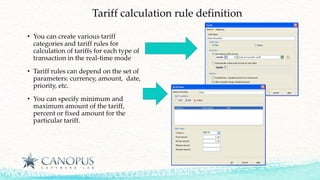

- 31. Tariff calculation rule definition âĒ You can create various tariff categories and tariff rules for calculation of tariffs for each type of transaction in the real-time mode âĒ Tariff rules can depend on the set of parameters: currency, amount, date, priority, etc. âĒ You can specify minimum and maximum amount of the tariff, percent or fixed amount for the particular tariff.

- 32. Handbook adjustment âĒ Correspondent accounts handbook; âĒ Chart of accounts âĒ Currencies and currency rates handbooks, etc.

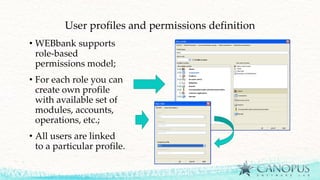

- 33. User profiles and permissions definition âĒ WEBbank supports role-based permissions model; âĒ For each role you can create own profile with available set of modules, accounts, operations, etc.; âĒ All users are linked to a particular profile.

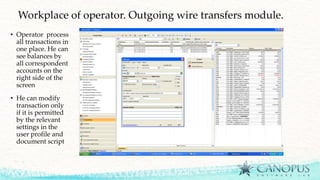

- 34. Workplace of operator. Outgoing wire transfers module. âĒ Operator process all transactions in one place. He can see balances by all correspondent accounts on the right side of the screen âĒ He can modify transaction only if it is permitted by the relevant settings in the user profile and document script

- 36. Thank you for your attention ! Russia, Moscow 6 Serebrykova proezd +7 495 984-96-82 www.canopuslab.ru CANOPUS Innovative Technologies Andrey Chukhlantsev Managing Partner ÂŦInnovative Business Solutions" 10613, Estonia, Tallinn, Madara 33 GSM.Moskow: +7 903 977 24 21 andrey@naumobile.ru Skype: andrey.naumobile