Capital budgeting

- 2. Overview ï Meaning of capital budgeting ï Definition of capital budgeting ï Importance of capital budgeting ï Types of capital budgeting.

- 3. Meaning of capital budgeting

- 4. Definition

- 5. Importance ïValue maximization: Maximizes the market value of the firm(share value of the firm). ïCost minimization: it minimizes the cost of capital and cost of financing. ïIncrease in share price: capital structure maximizes the companyâs market share by increasing the earnings per share of the ordinary shareholders. ïInvesting opportunity: Capital structure increases the ability of the copany to fund new wealth âincreases the investing opportunities.

- 6. Complex capital structure pattern ï Equity shares and debentures (i.e. long term debt including bonds etc.) ïEquity shares and preference shares. ïEquity shares, preference shares and debentures (i.e. long term debt including bonds, etc).

- 7. Techniques used ïMany formal methods are used in capital budgeting , including the techniques such as: ï Net present value. ï Profitability index. ï Internal rate of return. ï Payback period. ï Accounting rate of return.

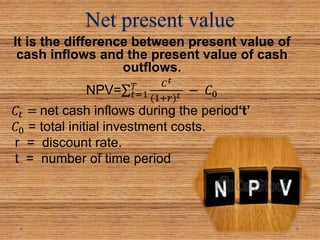

- 8. Net present value It is the difference between present value of cash inflows and the present value of cash outflows. NPV= ðĄ=1 ð ðķ ðĄ (1+ð) ðĄ â ðķ0 ðķðĄ = net cash inflows during the periodâtâ ðķ0 = total initial investment costs. r = discount rate. t = number of time period

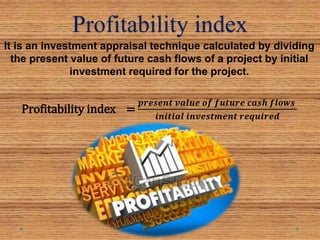

- 9. Profitability index It is an investment appraisal technique calculated by dividing the present value of future cash flows of a project by initial investment required for the project. Profitability index = ððððððð ððððð ðð ðððððð ðððð ððððð ððððððð ðððððððððð ðððððððð

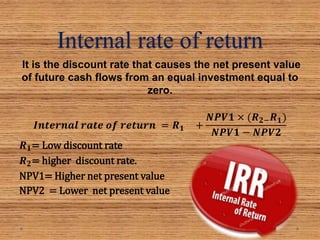

- 10. Internal rate of return It is the discount rate that causes the net present value of future cash flows from an equal investment equal to zero. ð°ððððððð ðððð ðð ðððððð = ðđ ð + ðĩð·ð―ð Ã (ðđ ðâ ðđ ð) ðĩð·ð―ð â ðĩð·ð―ð ðđ ð= Low discount rate ðđ ð= higher discount rate. NPV1= Higher net present value NPV2 = Lower net present value

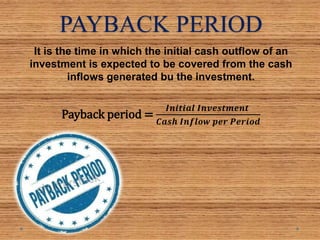

- 11. PAYBACK PERIOD It is the time in which the initial cash outflow of an investment is expected to be covered from the cash inflows generated bu the investment. Payback period = ð°ðððððð ð°ððððððððð ðŠððð ð°ððððð ððð ð·ððððð

- 12. Accounting rate of return It is ratio of estimated accounting profit of a project to the average investment made in the project. Accounting rate of return = ðĻðððððð ðĻððððððððð ð·ððððð ðĻðððððð ð°ððððððððð