Care fees planning

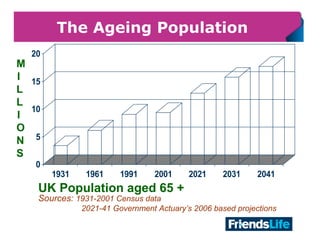

- 3. 3 The Ageing Population 0 5 10 15 20 1931 1961 1991 2001 2021 2031 2041 UK Population aged 65 + Sources: 1931-2001 Census data 2021-41 Government Actuaryâs 2006 based projections M I L L I O N S

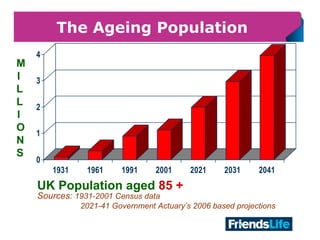

- 4. 4 The Ageing Population UK Population aged 85 + Sources: 1931-2001 Census data 2021-41 Government Actuaryâs 2006 based projections 0 1 2 3 4 1931 1961 1991 2001 2021 2031 2041 M I L L I O N S

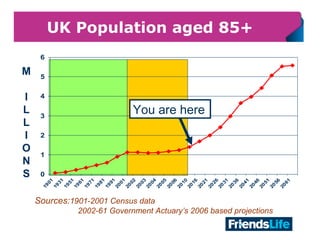

- 5. 5 0 1 2 3 4 5 6 1901 1931 1951 1961 1971 1981 1991 2001 2002 2003 2004 2005 2006 2010 2016 2021 2026 2031 2036 2041 2046 2051 2056 2061 UK Population aged 85+ M I L L I O N S You are here Sources:1901-2001 Census data 2002-61 Government Actuaryâs 2006 based projections

- 6. 6 The Legal System âĒ Wills and Estate Planning âĒ Transfer of Assets...... âĒ Solutions for those who are unable to look after their own financial affairs. âPower of Attorney âEnduring Power of Attorney âLasting Power of Attorney (England and Wales only)

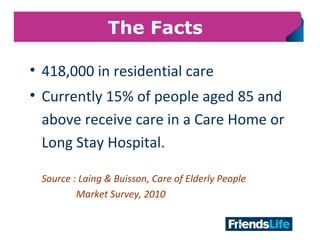

- 7. 7 The Facts âĒ 418,000 in residential care âĒ Currently 15% of people aged 85 and above receive care in a Care Home or Long Stay Hospital. Source : Laing & Buisson, Care of Elderly People Market Survey, 2010

- 8. 8 The Cost of Care Care homes with nursing: The average cost of a private care home with nursing in the Northern Ireland is ÂĢ563 per week Source : Laing & Buisson, Care of Elderly People Market Survey, 2010 âĶ.but can cost considerably more.

- 9. 9 Relevant Legislation âĒ National Assistance (Assessment of Resources) 1992 âĒ HASSASSA 1982 & Adjudications Act 1983 âĒ Income Support (General) Regs. 1987 âĒ National Assistance Act 1948 âĒ Insolvency Act 1986 âĒ Health and Social Care Act 2001

- 10. 10 Legislation NHS & Community Care Act 1990 âĒ Law in April 1993 âĒ Encourages care at home and in the community Source : NHS & CCA 1990 Policy Document âĒ Reduces State financial burden

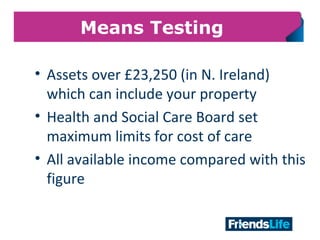

- 11. 11 Means Testing âĒ Assets over ÂĢ23,250 (in N. Ireland) which can include your property âĒ Health and Social Care Board set maximum limits for cost of care âĒ All available income compared with this figure

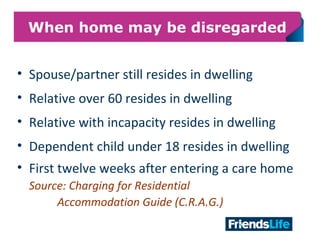

- 12. 12 When home may be disregarded âĒ Spouse/partner still resides in dwelling âĒ Relative over 60 resides in dwelling âĒ Relative with incapacity resides in dwelling âĒ Dependent child under 18 resides in dwelling âĒ First twelve weeks after entering a care home Source: Charging for Residential Accommodation Guide (C.R.A.G.)

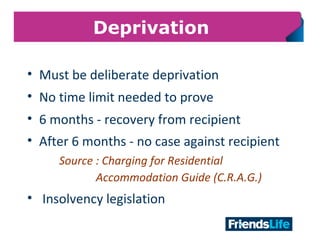

- 13. 13 Deprivation âĒ Must be deliberate deprivation âĒ No time limit needed to prove âĒ 6 months - recovery from recipient âĒ After 6 months - no case against recipient Source : Charging for Residential Accommodation Guide (C.R.A.G.) âĒ Insolvency legislation

- 14. 14 The Health & Social Care Act 2001 âĒ Introduced âfreeâ nursing care In N. Ireland single rate of ÂĢ100.00 per week Payable by the Health and Social Care Board directly to the care home âĒ Property disregarded for the first 12 weeks âĒ Deferred Payment Scheme

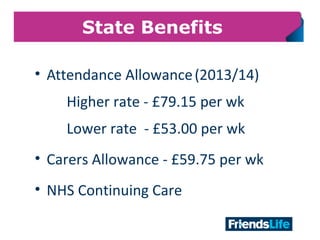

- 15. 15 State Benefits âĒ Attendance Allowance(2013/14) Higher rate - ÂĢ79.15 per wk Lower rate - ÂĢ53.00 per wk âĒ Carers Allowance - ÂĢ59.75 per wk âĒ NHS Continuing Care

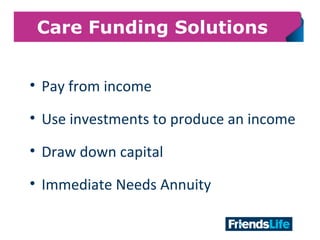

- 16. 16 Care Funding Solutions âĒ Pay from income âĒ Use investments to produce an income âĒ Draw down capital âĒ Immediate Needs Annuity

- 18. 18 Immediate Needs Annuities For those already requiring care. âĒ Regular monthly benefit âĒ Single premium âĒ Care at home or in a Care Home âĒ Paid for life âĒ Benefits can be indexed âĒ Premium Protection Option âĒ Tax free - paid to registered care provider âĒ Taxable - when paid to policyholder

- 19. 19 Options: âĒ Indexation Level RPI RPI+2% Choice of 3% to 10% âĒ Premium Protection Protects : 25%, 50%, 75% of total premium âĒ Long Term âĒ Short Term (first 3 or 6 months) Immediate Needs Annuities

- 20. 20 Meet Harry

- 21. 21 Care at Home âĒ Harry is aged 79 âĒ Currently in a wheel chair âĒ Suffered a stroke last year âĒ Paralysed down one side âĒ Determined to stay at home âĒ Doesnât want to sell his house

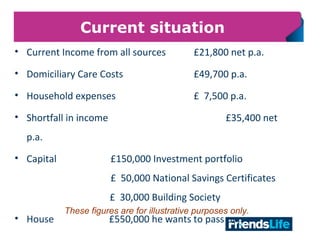

- 22. 22 Current situation âĒ Current Income from all sources ÂĢ21,800 net p.a. âĒ Domiciliary Care Costs ÂĢ49,700 p.a. âĒ Household expenses ÂĢ 7,500 p.a. âĒ Shortfall in income ÂĢ35,400 net p.a. âĒ Capital ÂĢ150,000 Investment portfolio ÂĢ 50,000 National Savings Certificates ÂĢ 30,000 Building Society âĒ House ÂĢ550,000 he wants to pass on These figures are for illustrative purposes only.

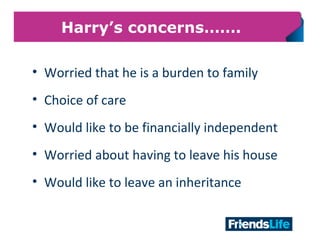

- 23. 23 Harryâs concernsâĶâĶ. âĒ Worried that he is a burden to family âĒ Choice of care âĒ Would like to be financially independent âĒ Worried about having to leave his house âĒ Would like to leave an inheritance

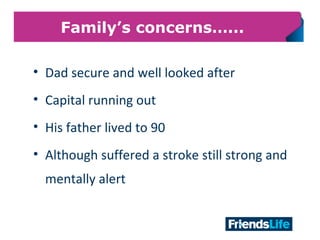

- 24. 24 Familyâs concernsâĶ... âĒ Dad secure and well looked after âĒ Capital running out âĒ His father lived to 90 âĒ Although suffered a stroke still strong and mentally alert

- 25. 25 Options available âĒ Invest the capital to produce income âĒ Achieve a typical 3.5% net return on ÂĢ230,000 = ÂĢ8,050 p.a. âĒ Current Income ÂĢ21,800 + ÂĢ8,050 = ÂĢ29,850 p.a. âĒ May have to move into a care home âĒ Meet the care costs from capital âĒ Risk the capital being used up and having to sell the house These figures are for illustrative purposes only

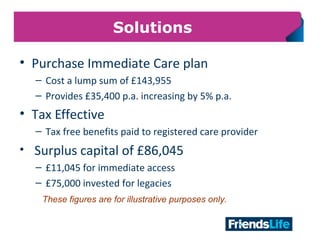

- 26. 26 Solutions âĒ Purchase Immediate Care plan â Cost a lump sum of ÂĢ143,955 â Provides ÂĢ35,400 p.a. increasing by 5% p.a. âĒ Tax Effective â Tax free benefits paid to registered care provider âĒ Surplus capital of ÂĢ86,045 â ÂĢ11,045 for immediate access â ÂĢ75,000 invested for legacies These figures are for illustrative purposes only.

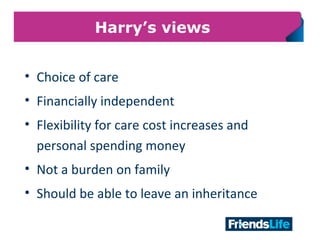

- 27. 27 Harryâs views âĒ Choice of care âĒ Financially independent âĒ Flexibility for care cost increases and personal spending money âĒ Not a burden on family âĒ Should be able to leave an inheritance

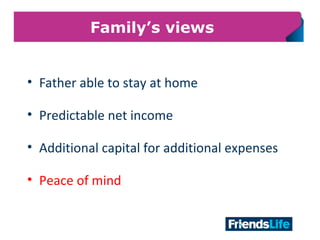

- 28. 28 Familyâs views âĒ Father able to stay at home âĒ Predictable net income âĒ Additional capital for additional expenses âĒ Peace of mind

- 29. 29 Government proposals... 2017?...2016?... 2015?..... The Care and Support Funding Reform Proposals: âĒ ONLY APPLY TO ENGLAND! âĒ Introduce Longevity Cap of c.ÂĢ72,000 âĒ Increase means test threshold to ÂĢ118,000 âĒ Introduce accommodation charge of c.ÂĢ12,000 pa âĒ A Universal Deferred Payment Scheme

- 30. 30 Friends Life Company Ltd , the provider of the Lifetime Care range of plans, is authorised and regulated by the Financial Services Authority, register No 185063 (www.fsa.gov.uk/register/home.do) A company limited by shares, registered in England No 3291349. Registered office: Pixham End, Dorking, Surrey. RH4 1QA As part of our commitment to quality service, telephone calls may be recorded. The address for written communications is The Friends Life Centre, PO Box 1810, Bristol, BS99 5SN. Telephone 0845 30 30 430 Further InformationFurther Information âĒFull details of our range of products & services are available from your Financial Adviser âĒThis presentation is based on our understanding of current Law and HM Revenue and Customs practice which could change.

- 31. 31 Navigator Financial Planning Ltd 3b Milltown Hill Warrenpoint Co Down BT34 3QY T: 028 3085 1199 E: david@navigatorFP.com Navigator Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. FCA registration no 587701. Further InformationFurther Information

Editor's Notes

- #10: Nat Ass (A of R) 1992 deals with Means Testing and the Income Support Regulations HASSASSA = Health and Social Services and Social Security Act : Section 21 deals with the guidelines on the 6 month rule. Section 22 deals with charges on property Inc Supp Regs covers the treatment of assets given away prior to 6 months before requiring care. Nat Ass Act covers the requirement to maintain a person for whom one has responsibility. Insolvency Act - legislation used by LAs to take take action on a debt over ÂĢ750 (ÂĢ1,500) in Scotland