Case econ08 ppt_34

- 1. Chapter 34 Open-Economy Macroeconomics: The Balance of Payments and Exchange Rates Prepared by: Fernando & Yvonn Quijano ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

- 2. CHAPTER 34: Open-Economy Macroeconomics: The Balance Open-Economy 34 of Payments and Exchange Rates Macroeconomics: The Balance of Payments Chapter Outline The Balance of Payments and Exchange Rates The Current Account The Capital Account The United States as a Debtor Nation Equilibrium Output (Income) in an Open Economy The International Sector and Planned Aggregate Expenditure Imports and Exports and the Trade Feedback Effect Import and Export Prices and the Price Feedback Effect The Open Economy with Flexible Exchange Rates The Market for Foreign Exchange Factors That Affect Exchange Rates The Effects of Exchange Rates on the Economy An Interdependent World Economy Appendix: World Monetary Systems Since 1900 ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 2 of 26

- 3. CHAPTER 34: Open-Economy Macroeconomics: The Balance Open-Economy Macroeconomics: The Balance of Payments and Exchange Rates of Payments and Exchange Rates When people in different countries buy from and sell to each other, an exchange of currencies must also take place. exchange rate The price of one countryâs currency in terms of another countryâs currency; the ratio at which two currencies are traded for each other. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 3 of 26

- 4. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE BALANCE OF PAYMENTS of Payments and Exchange Rates foreign exchange All currencies other than the domestic currency of a given country. balance of payments The record of a countryâs transactions in goods, services, and assets with the rest of the world; also the record of a countryâs sources (supply) and uses (demand) of foreign exchange. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 4 of 26

- 5. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE BALANCE OF PAYMENTS THE CURRENT ACCOUNT of Payments and Exchange Rates balance of trade A countryâs exports of goods and services minus its imports of goods and services. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 5 of 26

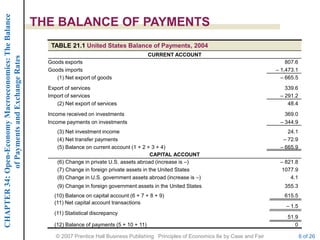

- 6. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE BALANCE OF PAYMENTS TABLE 21.1 United States Balance of Payments, 2004 CURRENT ACCOUNT of Payments and Exchange Rates Goods exports 807.6 Goods imports â 1,473.1 (1) Net export of goods â 665.5 Export of services 339.6 Import of services â 291.2 (2) Net export of services 48.4 Income received on investments 369.0 Income payments on investments â 344.9 (3) Net investment income 24.1 (4) Net transfer payments â 72.9 (5) Balance on current account (1 + 2 + 3 + 4) â 665.9 CAPITAL ACCOUNT (6) Change in private U.S. assets abroad (increase is â) â 821.8 (7) Change in foreign private assets in the United States 1077.9 (8) Change in U.S. government assets abroad (increase is â) 4.1 (9) Change in foreign government assets in the United States 355.3 (10) Balance on capital account (6 + 7 + 8 + 9) 615.5 (11) Net capital account transactions â 1.5 (11) Statistical discrepancy 51.9 (12) Balance of payments (5 + 10 + 11) 0 ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 6 of 26

- 7. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE BALANCE OF PAYMENTS THE CURRENT ACCOUNT of Payments and Exchange Rates trade deficit Occurs when a countryâs exports of goods and services are less than its imports of goods and services in a given period. balance on current account Net exports of goods, plus net exports of services, plus net investment income, plus net transfer payments. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 7 of 26

- 8. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE BALANCE OF PAYMENTS THE CAPITAL ACCOUNT of Payments and Exchange Rates balance on capital account In the United States, the sum of the following (measured in a given period): the change in private U.S. assets abroad, the change in foreign private assets in the United States, the change in U.S. government assets abroad, and the change in foreign government assets in the United States. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 8 of 26

- 9. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE BALANCE OF PAYMENTS THE UNITED STATES AS A DEBTOR NATION of Payments and Exchange Rates Prior to the mid-1970s, the United States had generally run current account surpluses. This began to turn around in the mid-1970s, and by the mid-1980s, the United States was running large current account deficits. In other words, the United States changed from a creditor nation to a debtor nation. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 9 of 26

- 10. CHAPTER 34: Open-Economy Macroeconomics: The Balance EQUILIBRIUM OUTPUT (INCOME) IN AN OPEN ECONOMY THE INTERNATIONAL SECTOR AND PLANNED AGGREGATE EXPENDITURE of Payments and Exchange Rates Planned aggregate expenditure in an open economy: AE C + I + G + EX - IM net exports of goods and services (EX - IM) The difference between a countryâs total exports and total imports. Determining the Level of Imports marginal propensity to import (MPM) The change in imports caused by a $1 change in income. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 10 of 26

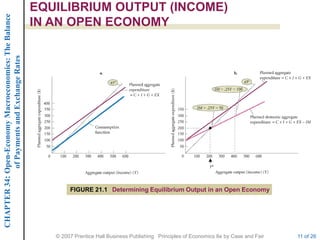

- 11. CHAPTER 34: Open-Economy Macroeconomics: The Balance EQUILIBRIUM OUTPUT (INCOME) IN AN OPEN ECONOMY of Payments and Exchange Rates FIGURE 21.1 Determining Equilibrium Output in an Open Economy ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 11 of 26

- 12. CHAPTER 34: Open-Economy Macroeconomics: The Balance EQUILIBRIUM OUTPUT (INCOME) IN AN OPEN ECONOMY of Payments and Exchange Rates The Open-Economy Multiplier 1 open-economy multiplier 1 ( MPC MPM ) The effect of a sustained increase in government spending (or investment) on incomeâ that is, the multiplierâis smaller in an open economy than in a closed economy. The reason: When government spending (or investment) increases and income and consumption rise, some of the extra consumption spending that results is on foreign products and not on domestically produced goods and services. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 12 of 26

- 13. CHAPTER 34: Open-Economy Macroeconomics: The Balance EQUILIBRIUM OUTPUT (INCOME) IN AN OPEN ECONOMY IMPORTS AND EXPORTS AND THE TRADE of Payments and Exchange Rates FEEDBACK EFFECT The Determinants of Imports The same factors that affect householdsâ consumption behavior and firmsâ investment behavior are likely to affect the demand for imports. The Determinants of Exports The demand for U.S. exports depends on economic activity in the rest of the worldârest-of-the-world real wages, wealth, nonlabor income, interest rates, and so onâas well as on the prices of U.S. goods relative to the price of rest-of-the-world goods. If foreign output increases, ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 13 of 26

- 14. CHAPTER 34: Open-Economy Macroeconomics: The Balance EQUILIBRIUM OUTPUT (INCOME) IN AN OPEN ECONOMY The Trade Feedback Effect of Payments and Exchange Rates trade feedback effect The tendency for an increase in the economic activity of one country to lead to a worldwide increase in economic activity, which then feeds back to that country. An increase in U.S. imports increases other countriesâ exports, which stimulates those countriesâ economies and increases their imports, which increases U.S. exports, which stimulates the U.S. economy and increases its imports, and so on. This is the trade feedback effect. In other words, an increase in U.S. economic activity leads to a worldwide increase in economic activity, which then âfeeds backâ to the United States. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 14 of 26

- 15. CHAPTER 34: Open-Economy Macroeconomics: The Balance EQUILIBRIUM OUTPUT (INCOME) IN AN OPEN ECONOMY Export prices of other countries affect U.S. import prices. of Payments and Exchange Rates The general rate of inflation abroad is likely to affect U.S. import prices. If the inflation rate abroad is high, U.S. import prices are likely to rise. The Price Feedback Effect price feedback effect The process by which a domestic price increase in one country can âfeed backâ on itself through export and import prices. An increase in the price level in one country can drive up prices in other countries. This in turn further increases the price level in the first country. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 15 of 26

- 16. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE OPEN ECONOMY WITH FLEXIBLE EXCHANGE RATES THE MARKET FOR FOREIGN EXCHANGE of Payments and Exchange Rates TABLE 21.2 Some Private Buyers and Sellers in International Exchange Markets: United States and Great Britain THE DEMAND FOR POUNDS (SUPPLY OF DOLLARS) 1.Firms, households, or governments that import British goods into the United States or wish to buy British-made goods and services 2.U.S. citizens traveling in Great Britain 3.Holders of dollars who want to buy British stocks, bonds, or other financial instruments 4.U.S. companies that want to invest in Great Britain 5.Speculators who anticipate a decline in the value of the dollar relative to the pound THE SUPPLY OF POUNDS (DEMAND FOR DOLLARS) 1. Firms, households, or governments that import U.S. goods into Great Britain or wish to buy U.S.- made goods and services 2. British citizens traveling in the United States 3. Holders of pounds who want to buy stocks, bonds, or other financial instruments in the United States 4. British companies that want to invest in the United States 5. Speculators who anticipate a rise in the value of the dollar relative to the pound ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 16 of 26

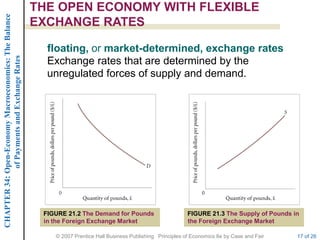

- 17. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE OPEN ECONOMY WITH FLEXIBLE EXCHANGE RATES floating, or market-determined, exchange rates of Payments and Exchange Rates Exchange rates that are determined by the unregulated forces of supply and demand. FIGURE 21.2 The Demand for Pounds FIGURE 21.3 The Supply of Pounds in in the Foreign Exchange Market the Foreign Exchange Market ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 17 of 26

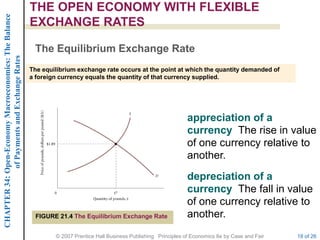

- 18. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE OPEN ECONOMY WITH FLEXIBLE EXCHANGE RATES The Equilibrium Exchange Rate of Payments and Exchange Rates The equilibrium exchange rate occurs at the point at which the quantity demanded of a foreign currency equals the quantity of that currency supplied. appreciation of a currency The rise in value of one currency relative to another. depreciation of a currency The fall in value of one currency relative to FIGURE 21.4 The Equilibrium Exchange Rate another. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 18 of 26

- 19. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE OPEN ECONOMY WITH FLEXIBLE EXCHANGE RATES FACTORS THAT AFFECT EXCHANGE RATES of Payments and Exchange Rates Purchasing Power Parity: The Law of One Price law of one price If the costs of transportation are small, the price of the same good in different countries should be roughly the same. purchasing-power-parity theory A theory of international exchange holding that exchange rates are set so that the price of similar goods in different countries is the same. A high rate of inflation in one country relative to another puts pressure on the exchange rate between the two countries, and there is a general tendency for the currencies of relatively high-inflation countries to depreciate. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 19 of 26

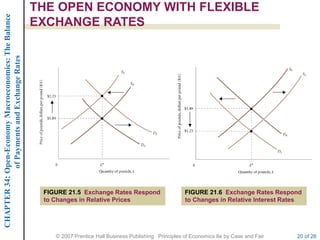

- 20. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE OPEN ECONOMY WITH FLEXIBLE EXCHANGE RATES of Payments and Exchange Rates FIGURE 21.5 Exchange Rates Respond FIGURE 21.6 Exchange Rates Respond to Changes in Relative Prices to Changes in Relative Interest Rates ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 20 of 26

- 21. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE OPEN ECONOMY WITH FLEXIBLE EXCHANGE RATES THE EFFECTS OF EXCHANGE RATES ON THE ECONOMY of Payments and Exchange Rates The level of imports and exports depends on exchange rates as well as on income and other factors. When events cause exchange rates to adjust, the levels of imports and exports will change. Changes in exports and imports can in turn affect the level of real GDP and the price level. Further, exchange rates themselves also adjust to changes in the economy. Exchange Rate Effects on Imports, Exports, and Real GDP A depreciation of a countryâs currency is likely to increase its GDP. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 21 of 26

- 22. CHAPTER 34: Open-Economy Macroeconomics: The Balance THE OPEN ECONOMY WITH FLEXIBLE EXCHANGE RATES Exchange Rates and Prices The depreciation of a of Payments and Exchange Rates countryâs currency tends to increase its price level. Monetary Policy with Flexible Exchange Rates A cheaper dollar is a good thing if the goal of the monetary expansion is to stimulate the domestic economy. Fiscal Policy with Flexible Exchange Rates The openness of the economy and flexible exchange rates do not always work to the advantage of policy makers. Monetary Policy with Fixed Exchange Rates There is no role monetary policy can play if a country has a fixed exchange rate. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 22 of 26

- 23. CHAPTER 34: Open-Economy Macroeconomics: The Balance AN INTERDEPENDENT WORLD ECONOMY The increasing interdependence of countries in the of Payments and Exchange Rates world economy has made the problems facing policy makers more difficult. We used to be able to think of the United States as a relatively self-sufficient region. Forty years ago, economic events outside U.S. borders had relatively little effect on its economy. This situation is no longer true. The events of the past four decades have taught us that the performance of the U.S. economy is heavily dependent on events outside U.S. borders. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 23 of 26

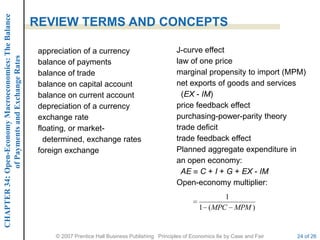

- 24. CHAPTER 34: Open-Economy Macroeconomics: The Balance REVIEW TERMS AND CONCEPTS appreciation of a currency J-curve effect of Payments and Exchange Rates balance of payments law of one price balance of trade marginal propensity to import (MPM) balance on capital account net exports of goods and services balance on current account (EX - IM) depreciation of a currency price feedback effect exchange rate purchasing-power-parity theory floating, or market- trade deficit determined, exchange rates trade feedback effect foreign exchange Planned aggregate expenditure in an open economy: AE C + I + G + EX - IM Open-economy multiplier: 1 1 ( MPC MPM ) ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 24 of 26

- 25. CHAPTER 34: Open-Economy Macroeconomics: The Balance Appendix WORLD MONETARY SYSTEMS SINCE 1900 of Payments and Exchange Rates THE GOLD STANDARD PROBLEMS WITH THE GOLD STANDARD FIXED EXCHANGE RATES AND THE BRETTON WOODS SYSTEM âPUREâ FIXED EXCHANGE RATES PROBLEMS WITH THE BRETTON WOODS SYSTEM ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 25 of 26

- 26. CHAPTER 34: Open-Economy Macroeconomics: The Balance of Payments and Exchange Rates Appendix Bretton Woods The site in New Hampshire where a group of experts from 44 countries met in 1944 and agreed to an international monetary system of fixed exchange rates. ÂĐ 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair 26 of 26