Cash flow (for your practice)

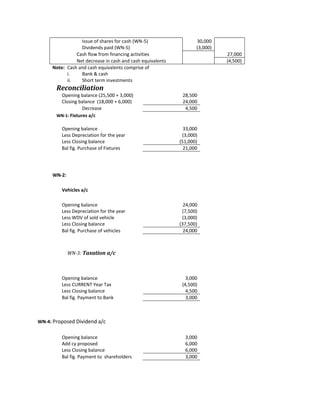

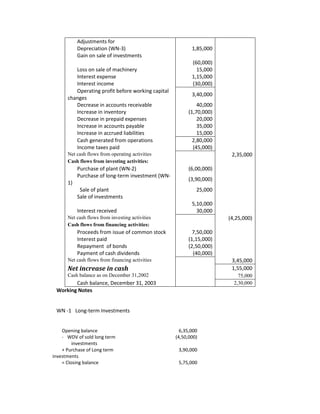

- 1. CASH FLOW STATEMENTS(With SOLUTION)<br />Impact of Adjustment for changes in Working Capital <br />Rs.Net Profit for the year 200810,000Expenses outstanding on January 01, 20082,000Expenses outstanding as on December 31,20083,000Interest received in advance on 1 January, 20081,000Interest received in advance on December 31,20082,000<br />Compute Cash from Operations using the above data<br />INDIRECT METHOD<br />From the following information prepare cash flow statement for the year ended 31.12.2004 by Indirect Method:<br />Balance Sheet as at 31st December<br />2008 Rs.2009 Rs.2008 Rs.2009 Rs.Share capital3,00,0003,50,000Land & Buildings2,20,0003,00,000Bank overdraft3,20,0002,00,000Machinery4,00,0002,80,000Bills payable1,00,00080,000Stock1,00,00090,000Creditors1,80,0002,50,000Debtors1,40,0001,60000Cash40,00050,0009,00,0008,80,0009,00,0008,80,000Additional Informationa.Net profit for the year 2009 amounted to Rs.1,20,000.b.During the year, a machinery costing Rs.50,000 (accumulated depreciation Rs.20,000) was sold for Rs.26,000. The provision for depreciation against Machinery as on 31.12.2008 was Rs.1,00,000 and on 31.12.2009 Rs.1,70,000.<br />The Balance sheet of Reliance Ltd., for the years ended 31st March, 2008 and 2009 were summarized as under:<br />Liabilities2009Rs.2008Rs.Assets2009Rs.2008Rs.Equity share capital1,80,0001,50,000Fixed assets (at WDV)Building30,00030,000ReservesFixtures51,00033,000Profit & Loss a/c15,00012,000Vehicles37,50024,000Short-term investments6,0003,000Current liabilities:Current assets: Creditors12,0007,500Stock51,00042,000Taxation4,5003,000Debtors24,00018,000Proposed dividends6,0003,000Bank & cash18,00025,5002,17,5001,75,5002,17,5001,75,500<br />Profit & Loss a/c for the year ended 31.3.2009 is<br />ParticularsRs.Profit before tax13,500Taxation(4,500)Profit after tax 9,000Proposed dividends6,000Retained profits 3,000<br />Further information is available<br />Rs.<br />ParticularsFixturesVehiclesDepreciation for year3,0007,500Disposals:Proceeds on disposal5,100Written down value(3,000)Profit on disposal2,100<br />Prepare a cash flow statement for the year ended 31-3-2009.<br />4. Following are comparative balance sheets of AB Ltd. For the year ended December 31,2009. Prepare a Cash flow statement as per AS -3.<br />2008 Rs.2009 Rs.2008 Rs.2009 Rs.Share capital205000265000Land & Buildings148500144250Reserves 5000050000Machinery112950116200P& L a/c3969041220Goodwill-20000Bank Loan 59510-Current Assets 198530170730Current liabilities 7328052660Cash75007700Prov for taxation 4000050000467480458880467480458880Additional InformationDuring the year 2009, the company paid tax of Rs.25,000A dividend of Rs.26,000 was paid during the year 2009.Profit before tax for the year is Rs.62,530DURING the year the company purchased machinery for Rs.5,650. It also acquired Another company (stock Rs.21,640, and machinery Rs.18,360) and paid Rs.60,000 in Share Capital for the acquisition)<br />5. You are the Senior Accounts Officer of Little Flower Ltd. The Comparative Balance sheets as on March 31,2002 and March 31,2003 and the Income Statement for the financial year 2002-03 are given below.<br />Little Flower Ltd.<br />Comparative Balance Sheets <br />As on March 31, 2003 and March 31, 2002<br />2003(Rs.)2002(Rs.)Assets:Cash2,30,00075,000Accounts receivable2,35,0002,75,000Long -term investments5,75,0006,35,000Inventory7,20,0005,50,000Prepaid insurance5,00025,000Land45,00,00045,00,000Plant and equipment35,75,00025,25,000╠²╠²╠²Less: Accumulated depreciation(5,15,000)(3,40,000)93,25,00082,45,000Liabilities:Accounts payable2,50,0002,15,000Accrued liabilities60,00045,000Income tax payable15,00025,000Bonds payable 14,75,00012,25,000Shareholders' Equity:Common stock43,25,00035,75,000Retained earnings32,00,00031,60,00093,25,00082,45,000<br />Income Statement for the Financial year 2002-03<br />Rs.Rs.Sales 34,90,000Cost of goods sold (26,00,000)Gross margin8,90,000Operating expenses (7,35,000)1,55,000Other Income (Expenses)Interest paid (1,15,000)Interest income received 30,000Gain on sale of Investments 60,000Loss on sale of Plant(15,000)(40,000)Profit before Tax1,15,000Income tax(35,000)Profit after Tax80,000<br />Additional information:<br />i.During the period 2002-03, Little Flower Ltd. purchased investments amounting to Rs.3,90,000<br />ii.The book value of the investments sold was Rs.4,50,000<br />iii.During the period a plant amounting to Rs.6,00,000 was purchased<br />iv.A machinery costing Rs.50,000 with accumulated depreciation of Rs.10,000 was sold for Rs.25,000<br />v.On March 31, 2003 Little Flower Ltd. issued bonds of Rs.5,00,000 at face value in exchange for a Plant<br />vi.During the period the company repaid Rs.2,50,000 bonds at face value on maturity<br />vii.During the period the company issued 75,000 common stock of Rs.10 each<br />viii.Cash dividends paid during 2002-03 amount to Rs.40,000<br />You are required to prepare a Statement of Cash Flows (using indirect method) for the period ended March 31, 2003.<br />DIRECT METHOD<br />5. Following information pertaining to Lehra Ltd. was extracted from the accounting records for the year ended March 31, 2008:<br />Particulars Amount (Rs.)Cash received from customers8,70,000Rent received10,000Cash paid to suppliers and employees5,10,000Taxes paid 1,10,000Cash dividend paid30,000<br />Compute the Net cash flow provided by operations for 2007-08, if the company reports as per AS-3.<br />6. The following is the data pertaining to Mc. Dowellson Ltd. for the calendar year 2009.<br />Cash Receipts:Rs.Customers66,00,000Interest on notes receivable1,20,000Sale of investments2,00,000Proceeds from issue of debentures10,00,000Sale of equipment 4,00,000Issuance of common stock20,00,000Cash Payments:Purchase of investments10,00,000Interest on notes payable1,80,000Purchase of equipment12,00,000Operating expenses44,00,000Repayment of Debentures15,00,000Payment of dividends to shareholders3,00,000<br />The balance of cash and cash equivalents is Rs.13,00,000 at the beginning of 2009 and Rs.30,40,000 at the end of 2009<br />Required:<br />Prepare a statement of cash flows for 2002 for Mc. Dowellson Ltd. Use the direct method for reporting operating activities.<br />Solutions<br />Rs.Net Profit for the year 200810,000Expenses outstanding on January 01, 20082,000Expenses outstanding as on December 31,20083,000Interest received in advance on 1 January, 20081,000Interest received in advance on December 31,20082,000<br />Cash flow Statement (CFS) for the year ended 31.12.2009<br />ParticularsRs.Rs.a.Cash flow from operating activities (Indirect approach)Profit before tax and extra ordinary items1,20,000Add: Depreciation [WNŌĆō1 ]90,000Add: Loss on sale of asset (WN-2)4,000Operating profit before working capital changes2,14,000Adjustments for WC changesDecrease in stock10,000Increase in debtors(20,000)Decrease in Bills payable(20,000)Increase in creditors70,000Decrease in Bank overdraft(1,20,000)Cash from operating activities 1,34,000b.Cash flows from investing activitiesSale of machinery26,000Purchase of Land & Buildings (3,00,000ŌĆō2,20,000)(80,000)(54,000)c.Cash flow from financing activities Drawings(70,000)Increase in cash & cash equivalents10,000<br />WN-1:<br />WDV of Machinery = Rs.4,00,000<br />Less WDV of machinery sold= (30,000)<br />Less closing WDV of machinery = (2,80,000)<br />Balance Current depreciation = 90,000<br />WN-2: Profit or loss on sale of Machinery<br />WDV of the machine sold = Rs.30,000<br />Cash proceeds from sale = Rs.26,000<br />Loss on sale of machinery = Rs.4,000<br />WN-2:<br />Rs.Opening capital3,00,000Add:Profit during the year1,20,0004,20,000Less:Closing capital3,50,000Drawings70,000Reconciliation:Opening cash balance40,000Closing cash balance50,000Increase in cash10,000<br />Reliance LtdCash Flow Statement for the year ended 31.3.2009<br />ParticularsRs.Rs.A.Cash flow from operating activitiesNet profit before taxation13,500Add: DepreciationFixtures3,000Vehicles7,500Less:Profit on sale of vehicles(2,100)Operating profit before WC changes21,900Adjustment for WC changesIncrease in debtors(6,000)Increase in inventories(9,000)Increase in sundry creditors4,500Cash generated from operations11,400Income taxes paid (WN-3)(3,000)Cash from operating activities8,400B.Cash flow from investing activitiesSale proceeds on vehicles5,100Purchase of vehicles (WN-2)(24,000)Purchase of fixtures (WN-1)(21,000)Cash flow from investing activities(39,900)C.Cash flow from financing activitiesIssue of shares for cash (WN-5)30,000Dividends paid (WN-5)(3,000)Cash flow from financing activities27,000Net decrease in cash and cash equivalents(4,500)<br />Note: Cash and cash equivalents comprise of<br />i.Bank & cash<br />ii.Short term investments<br />Reconciliation<br />Opening balance (25,500 + 3,000)=28,500Closing balance (18,000 + 6,000)=24,000Decrease=4,500<br />WN-1: Fixtures a/c<br />Opening balance =33,000Less Depreciation for the year(3,000)Less Closing balance =(51,000)Bal fig. Purchase of Fixtures=21,000<br />WN-2:<br />Vehicles a/c <br />Opening balance =24,000Less Depreciation for the year(7,500)Less WDV of sold vehicle(3,000)Less Closing balance =(37,500)Bal fig. Purchase of vehicles=24,000<br />WN-3: Taxation a/c<br />Opening balance =3,000Less CURRENT Year Tax(4,500)Less Closing balance =4,500Bal fig. Payment to Bank =3,000<br />WN-4: Proposed Dividend a/c<br />Opening balance =3,000Add cy proposed 6,000Less Closing balance =6,000Bal fig. Payment to shareholders =3,000<br />ParticularsRs.Rs.A.Cash flow from operating activitiesNet profit before taxation62530Add: DepreciationOn Land & Building4250On Machinery20,76025,010Add stock obtained on acquisition 21640+ DECREASE in current Assets 27800Decrease in current Liabilities (20620)Tax Paid (25,000)Cash flows from Operating Activities 91360B.Cash flow from investing activitiesPurchase of Machinery (5650)Cash flow from investing activities(5650)C.Cash flow from financing activitiesRepayment of bank loan (59510)Dividends paid (26,000)Cash flow from financing activities(85,510)Net decrease in cash and cash equivalents200Opening cash balance 7500Closing Cash Balance 7700(The company issued share capital of Rs.60,000 for acquiring assets of other company)<br />Working Notes:<br />Depreciation on Machinery is ascertained as follows:<br />Opening balance Rs.112950<br />+ Acquired from other company 18,360<br />+ Purchased during the year 5650<br />Closing balance 116200Depreciation for the year 20,760<br />ii) Issue of share capital for acquisition of assets is a non-cash item and hence not shown in the cash flow statement. <br />Little Flower Ltd.<br />Statement of Cash Flows<br />For Year Ended December 31, 2003<br />Cash flows from operating activities:Net profit before taxation 1,15,000Adjustments for Depreciation (WN-3)1,85,000Gain on sale of investments (60,000)Loss on sale of machinery15,000Interest expense1,15,000Interest income (30,000)Operating profit before working capital changes 3,40,000Decrease in accounts receivable40,000Increase in inventory(1,70,000)Decrease in prepaid expenses20,000Increase in accounts payable35,000Increase in accrued liabilities15,000Cash generated from operations 2,80,000Income taxes paid(45,000)Net cash flows from operating activities2,35,000Cash flows from investing activities:Purchase of plant (WN-2)(6,00,000)Purchase of long-term investment (WN-1)(3,90,000) Sale of plant 25,000Sale of investments 5,10,000Interest received 30,000Net cash flows from investing activities(4,25,000)Cash flows from financing activities:Proceeds from issue of common stock7,50,000Interest paid(1,15,000)Repayment of bonds(2,50,000)Payment of cash dividends(40,000)Net cash flows from financing activities3,45,000Net increase in cash1,55,000Cash balance as on December 31,200275,000Cash balance, December 31, 20032,30,000<br />Working Notes<br />WN -1Long-term Investments<br />Opening balance =6,35,000WDV of sold long term investments(4,50,000)+ Purchase of Long term investments 3,90,000= Closing balance 5,75,000WN-2Plants & Equipment<br />Opening balance =21,85,000+ purchase of equip6,00,000+ Exchange for bonds 5,00,000Less WDV of Sold equip (40,000)Less current year dep(1,85,000)30,60,000WN-4Bonds Payable account<br />Opening balance =12,25,000+ Exchange for Plant & Equip5,00,000Less repaid (2,50,000)= Closing balance 14,75,000DIRECT METHOD <br />Payment of dividends is a financing activity. All other transactions listed are cash flows from operating activities. Accordingly, the net cash flows from operating is Rs.2,60,000 (Rs.8,70,000 + Rs.10,000 ŌĆō Rs.5,10,000 ŌĆō Rs.1,10,000).

- 3. Cash flow statement for the year 2009Cash flows from operating activities:Collections from customersInterest on note receivableInterest on note payablePayment of operating expenses66,00,0001,20,000(1,80,000)(44,00,000)Net cash inflows from operating activities21,40,000Cash flows from investing activities:Purchase of investmentsSale of investmentsPurchase of equipmentSale of equipmentNet cash outflows from investing activities(10,00,000)2,00,000(12,00,000)4,00,000(16,00,000)Cash flows from financing activitiesProceeds from issue of DebenturesRepayment of DebenturesIssuance of common stockPayment of dividends10,00,000(15,00,000)20,00,000(3,00,000)Net cash inflows from financing activities12,00,000Net increase in cashCash and cash equivalents, January 1Cash and cash equivalents, December 3117,40,00013,00,00030,40,000<br />

![CASH FLOW STATEMENTS(With SOLUTION)<br />Impact of Adjustment for changes in Working Capital <br />Rs.Net Profit for the year 200810,000Expenses outstanding on January 01, 20082,000Expenses outstanding as on December 31,20083,000Interest received in advance on 1 January, 20081,000Interest received in advance on December 31,20082,000<br />Compute Cash from Operations using the above data<br />INDIRECT METHOD<br />From the following information prepare cash flow statement for the year ended 31.12.2004 by Indirect Method:<br />Balance Sheet as at 31st December<br />2008 Rs.2009 Rs.2008 Rs.2009 Rs.Share capital3,00,0003,50,000Land & Buildings2,20,0003,00,000Bank overdraft3,20,0002,00,000Machinery4,00,0002,80,000Bills payable1,00,00080,000Stock1,00,00090,000Creditors1,80,0002,50,000Debtors1,40,0001,60000Cash40,00050,0009,00,0008,80,0009,00,0008,80,000Additional Informationa.Net profit for the year 2009 amounted to Rs.1,20,000.b.During the year, a machinery costing Rs.50,000 (accumulated depreciation Rs.20,000) was sold for Rs.26,000. The provision for depreciation against Machinery as on 31.12.2008 was Rs.1,00,000 and on 31.12.2009 Rs.1,70,000.<br />The Balance sheet of Reliance Ltd., for the years ended 31st March, 2008 and 2009 were summarized as under:<br />Liabilities2009Rs.2008Rs.Assets2009Rs.2008Rs.Equity share capital1,80,0001,50,000Fixed assets (at WDV)Building30,00030,000ReservesFixtures51,00033,000Profit & Loss a/c15,00012,000Vehicles37,50024,000Short-term investments6,0003,000Current liabilities:Current assets: Creditors12,0007,500Stock51,00042,000Taxation4,5003,000Debtors24,00018,000Proposed dividends6,0003,000Bank & cash18,00025,5002,17,5001,75,5002,17,5001,75,500<br />Profit & Loss a/c for the year ended 31.3.2009 is<br />ParticularsRs.Profit before tax13,500Taxation(4,500)Profit after tax 9,000Proposed dividends6,000Retained profits 3,000<br />Further information is available<br />Rs.<br />ParticularsFixturesVehiclesDepreciation for year3,0007,500Disposals:Proceeds on disposal5,100Written down value(3,000)Profit on disposal2,100<br />Prepare a cash flow statement for the year ended 31-3-2009.<br />4. Following are comparative balance sheets of AB Ltd. For the year ended December 31,2009. Prepare a Cash flow statement as per AS -3.<br />2008 Rs.2009 Rs.2008 Rs.2009 Rs.Share capital205000265000Land & Buildings148500144250Reserves 5000050000Machinery112950116200P& L a/c3969041220Goodwill-20000Bank Loan 59510-Current Assets 198530170730Current liabilities 7328052660Cash75007700Prov for taxation 4000050000467480458880467480458880Additional InformationDuring the year 2009, the company paid tax of Rs.25,000A dividend of Rs.26,000 was paid during the year 2009.Profit before tax for the year is Rs.62,530DURING the year the company purchased machinery for Rs.5,650. It also acquired Another company (stock Rs.21,640, and machinery Rs.18,360) and paid Rs.60,000 in Share Capital for the acquisition)<br />5. You are the Senior Accounts Officer of Little Flower Ltd. The Comparative Balance sheets as on March 31,2002 and March 31,2003 and the Income Statement for the financial year 2002-03 are given below.<br />Little Flower Ltd.<br />Comparative Balance Sheets <br />As on March 31, 2003 and March 31, 2002<br />2003(Rs.)2002(Rs.)Assets:Cash2,30,00075,000Accounts receivable2,35,0002,75,000Long -term investments5,75,0006,35,000Inventory7,20,0005,50,000Prepaid insurance5,00025,000Land45,00,00045,00,000Plant and equipment35,75,00025,25,000╠²╠²╠²Less: Accumulated depreciation(5,15,000)(3,40,000)93,25,00082,45,000Liabilities:Accounts payable2,50,0002,15,000Accrued liabilities60,00045,000Income tax payable15,00025,000Bonds payable 14,75,00012,25,000Shareholders' Equity:Common stock43,25,00035,75,000Retained earnings32,00,00031,60,00093,25,00082,45,000<br />Income Statement for the Financial year 2002-03<br />Rs.Rs.Sales 34,90,000Cost of goods sold (26,00,000)Gross margin8,90,000Operating expenses (7,35,000)1,55,000Other Income (Expenses)Interest paid (1,15,000)Interest income received 30,000Gain on sale of Investments 60,000Loss on sale of Plant(15,000)(40,000)Profit before Tax1,15,000Income tax(35,000)Profit after Tax80,000<br />Additional information:<br />i.During the period 2002-03, Little Flower Ltd. purchased investments amounting to Rs.3,90,000<br />ii.The book value of the investments sold was Rs.4,50,000<br />iii.During the period a plant amounting to Rs.6,00,000 was purchased<br />iv.A machinery costing Rs.50,000 with accumulated depreciation of Rs.10,000 was sold for Rs.25,000<br />v.On March 31, 2003 Little Flower Ltd. issued bonds of Rs.5,00,000 at face value in exchange for a Plant<br />vi.During the period the company repaid Rs.2,50,000 bonds at face value on maturity<br />vii.During the period the company issued 75,000 common stock of Rs.10 each<br />viii.Cash dividends paid during 2002-03 amount to Rs.40,000<br />You are required to prepare a Statement of Cash Flows (using indirect method) for the period ended March 31, 2003.<br />DIRECT METHOD<br />5. Following information pertaining to Lehra Ltd. was extracted from the accounting records for the year ended March 31, 2008:<br />Particulars Amount (Rs.)Cash received from customers8,70,000Rent received10,000Cash paid to suppliers and employees5,10,000Taxes paid 1,10,000Cash dividend paid30,000<br />Compute the Net cash flow provided by operations for 2007-08, if the company reports as per AS-3.<br />6. The following is the data pertaining to Mc. Dowellson Ltd. for the calendar year 2009.<br />Cash Receipts:Rs.Customers66,00,000Interest on notes receivable1,20,000Sale of investments2,00,000Proceeds from issue of debentures10,00,000Sale of equipment 4,00,000Issuance of common stock20,00,000Cash Payments:Purchase of investments10,00,000Interest on notes payable1,80,000Purchase of equipment12,00,000Operating expenses44,00,000Repayment of Debentures15,00,000Payment of dividends to shareholders3,00,000<br />The balance of cash and cash equivalents is Rs.13,00,000 at the beginning of 2009 and Rs.30,40,000 at the end of 2009<br />Required:<br />Prepare a statement of cash flows for 2002 for Mc. Dowellson Ltd. Use the direct method for reporting operating activities.<br />Solutions<br />Rs.Net Profit for the year 200810,000Expenses outstanding on January 01, 20082,000Expenses outstanding as on December 31,20083,000Interest received in advance on 1 January, 20081,000Interest received in advance on December 31,20082,000<br />Cash flow Statement (CFS) for the year ended 31.12.2009<br />ParticularsRs.Rs.a.Cash flow from operating activities (Indirect approach)Profit before tax and extra ordinary items1,20,000Add: Depreciation [WNŌĆō1 ]90,000Add: Loss on sale of asset (WN-2)4,000Operating profit before working capital changes2,14,000Adjustments for WC changesDecrease in stock10,000Increase in debtors(20,000)Decrease in Bills payable(20,000)Increase in creditors70,000Decrease in Bank overdraft(1,20,000)Cash from operating activities 1,34,000b.Cash flows from investing activitiesSale of machinery26,000Purchase of Land & Buildings (3,00,000ŌĆō2,20,000)(80,000)(54,000)c.Cash flow from financing activities Drawings(70,000)Increase in cash & cash equivalents10,000<br />WN-1:<br />WDV of Machinery = Rs.4,00,000<br />Less WDV of machinery sold= (30,000)<br />Less closing WDV of machinery = (2,80,000)<br />Balance Current depreciation = 90,000<br />WN-2: Profit or loss on sale of Machinery<br />WDV of the machine sold = Rs.30,000<br />Cash proceeds from sale = Rs.26,000<br />Loss on sale of machinery = Rs.4,000<br />WN-2:<br />Rs.Opening capital3,00,000Add:Profit during the year1,20,0004,20,000Less:Closing capital3,50,000Drawings70,000Reconciliation:Opening cash balance40,000Closing cash balance50,000Increase in cash10,000<br />Reliance LtdCash Flow Statement for the year ended 31.3.2009<br />ParticularsRs.Rs.A.Cash flow from operating activitiesNet profit before taxation13,500Add: DepreciationFixtures3,000Vehicles7,500Less:Profit on sale of vehicles(2,100)Operating profit before WC changes21,900Adjustment for WC changesIncrease in debtors(6,000)Increase in inventories(9,000)Increase in sundry creditors4,500Cash generated from operations11,400Income taxes paid (WN-3)(3,000)Cash from operating activities8,400B.Cash flow from investing activitiesSale proceeds on vehicles5,100Purchase of vehicles (WN-2)(24,000)Purchase of fixtures (WN-1)(21,000)Cash flow from investing activities(39,900)C.Cash flow from financing activitiesIssue of shares for cash (WN-5)30,000Dividends paid (WN-5)(3,000)Cash flow from financing activities27,000Net decrease in cash and cash equivalents(4,500)<br />Note: Cash and cash equivalents comprise of<br />i.Bank & cash<br />ii.Short term investments<br />Reconciliation<br />Opening balance (25,500 + 3,000)=28,500Closing balance (18,000 + 6,000)=24,000Decrease=4,500<br />WN-1: Fixtures a/c<br />Opening balance =33,000Less Depreciation for the year(3,000)Less Closing balance =(51,000)Bal fig. Purchase of Fixtures=21,000<br />WN-2:<br />Vehicles a/c <br />Opening balance =24,000Less Depreciation for the year(7,500)Less WDV of sold vehicle(3,000)Less Closing balance =(37,500)Bal fig. Purchase of vehicles=24,000<br />WN-3: Taxation a/c<br />Opening balance =3,000Less CURRENT Year Tax(4,500)Less Closing balance =4,500Bal fig. Payment to Bank =3,000<br />WN-4: Proposed Dividend a/c<br />Opening balance =3,000Add cy proposed 6,000Less Closing balance =6,000Bal fig. Payment to shareholders =3,000<br />ParticularsRs.Rs.A.Cash flow from operating activitiesNet profit before taxation62530Add: DepreciationOn Land & Building4250On Machinery20,76025,010Add stock obtained on acquisition 21640+ DECREASE in current Assets 27800Decrease in current Liabilities (20620)Tax Paid (25,000)Cash flows from Operating Activities 91360B.Cash flow from investing activitiesPurchase of Machinery (5650)Cash flow from investing activities(5650)C.Cash flow from financing activitiesRepayment of bank loan (59510)Dividends paid (26,000)Cash flow from financing activities(85,510)Net decrease in cash and cash equivalents200Opening cash balance 7500Closing Cash Balance 7700(The company issued share capital of Rs.60,000 for acquiring assets of other company)<br />Working Notes:<br />Depreciation on Machinery is ascertained as follows:<br />Opening balance Rs.112950<br />+ Acquired from other company 18,360<br />+ Purchased during the year 5650<br />Closing balance 116200Depreciation for the year 20,760<br />ii) Issue of share capital for acquisition of assets is a non-cash item and hence not shown in the cash flow statement. <br />Little Flower Ltd.<br />Statement of Cash Flows<br />For Year Ended December 31, 2003<br />Cash flows from operating activities:Net profit before taxation 1,15,000Adjustments for Depreciation (WN-3)1,85,000Gain on sale of investments (60,000)Loss on sale of machinery15,000Interest expense1,15,000Interest income (30,000)Operating profit before working capital changes 3,40,000Decrease in accounts receivable40,000Increase in inventory(1,70,000)Decrease in prepaid expenses20,000Increase in accounts payable35,000Increase in accrued liabilities15,000Cash generated from operations 2,80,000Income taxes paid(45,000)Net cash flows from operating activities2,35,000Cash flows from investing activities:Purchase of plant (WN-2)(6,00,000)Purchase of long-term investment (WN-1)(3,90,000) Sale of plant 25,000Sale of investments 5,10,000Interest received 30,000Net cash flows from investing activities(4,25,000)Cash flows from financing activities:Proceeds from issue of common stock7,50,000Interest paid(1,15,000)Repayment of bonds(2,50,000)Payment of cash dividends(40,000)Net cash flows from financing activities3,45,000Net increase in cash1,55,000Cash balance as on December 31,200275,000Cash balance, December 31, 20032,30,000<br />Working Notes<br />WN -1Long-term Investments<br />Opening balance =6,35,000WDV of sold long term investments(4,50,000)+ Purchase of Long term investments 3,90,000= Closing balance 5,75,000WN-2Plants & Equipment<br />Opening balance =21,85,000+ purchase of equip6,00,000+ Exchange for bonds 5,00,000Less WDV of Sold equip (40,000)Less current year dep(1,85,000)30,60,000WN-4Bonds Payable account<br />Opening balance =12,25,000+ Exchange for Plant & Equip5,00,000Less repaid (2,50,000)= Closing balance 14,75,000DIRECT METHOD <br />Payment of dividends is a financing activity. All other transactions listed are cash flows from operating activities. Accordingly, the net cash flows from operating is Rs.2,60,000 (Rs.8,70,000 + Rs.10,000 ŌĆō Rs.5,10,000 ŌĆō Rs.1,10,000).](https://image.slidesharecdn.com/cashflowforyourpractice-110414010729-phpapp01/85/Cash-flow-for-your-practice-1-320.jpg)