CB_IR__Jul_15_Itau_CorpBanca_Transaction_updated

- 1. The Merger of Banco Ita├║ Chile and CorpBanca July 2015

- 2. 2 CONFIDENTIAL DRAFT On January 29, 2014 Ita├║ Unibanco, Banco Ita├║ Chile, CorpBanca and CorpGroup entered into a agreement, involving: ’é¦ The merger of Banco Ita├║ Chile and CorpBanca, creating Ita├║ CorpBanca ’é¦ Ita├║ Unibanco will control Ita├║ CorpBanca ’é¦ Ita├║ Unibanco and CorpGroup will sign a ShareholdersŌĆÖ Agreement ’é¦ Ita├║ CorpBanca will control CorpBancaŌĆÖs and Ita├║ UnibancoŌĆÖs Colombian entities ’é¦ CorpBanca to be the surviving legal entity On June 26 and 30, 2015, CorpBanca and Banco Ita├║ Chile Extraordinary Shareholders Meetings approved the proposed merger and agreed to modify the afore mentioned agreement, involving: ’é¦ Additional dividend for current CorpBancaŌĆÖs shareholders ’é¦ Reduction of Ita├║ Chile dividend ’é¦ New dividend policy for 2015 fiscal year ’é¦ Extension of the deadline for the purchase of CorpGroupŌĆÖs stake in CorpBanca Colombia ’é¦ Closing date between January 1, 2016 and May 2, 2016 Introduction

- 3. 3 CONFIDENTIAL DRAFTFairness Opinions to the Board ’é¦ In January 2014 the Board of Directors of CorpBanca received separate opinions of Merrill Lynch, Pierce, Fenner & Smith Incorporated and Goldman Sachs & Co. ŌĆĢ Each to the effect that and based upon and subject to the matters set forth therein, the Chilean Exchange Ratio is fair, from a financial point of view, to CorpBanca ’é¦ On August 2014 the Board of Directors of CorpBanca received a third opinion from the University of Chile regarding the proposed merger between Ita├║ Chile and CorpBanca ŌĆĢ The study highlights that the operation is equally favorable to all CorpBancaŌĆÖs shareholders and affirms CorpBancaŌĆÖs Board of Directors recommendations

- 4. 4 CONFIDENTIAL DRAFTExpert Report and other report to the Board ’é¦ In April 2015 the Board of Directors of CorpBanca received from KPMG the expert report required by the Chilean law to perform the Extraordinary General Shareholders Meeting ’é¦ In May 2015 the Board of Directors of CorpBanca received an additional report from Citi to complement their analysis and deliver their opinion regarding the pending merger between Ita├║ and CorpBanca

- 5. 5 CONFIDENTIAL DRAFT ’é¦ Consolidates the 4th largest private bank in Chile by total loans, with a true potential of becoming the 3rd largest1 ’é¦ Complementary segments, products and lines of business ’é¦ Solid capital base and improved funding profile ’é¦ Potential to generate relevant synergies ’é¦ Strong framework to reach a stronger position in the Colombian market Source: Company financials, Superintendencia de Bancos e Instituciones Financieras (ŌĆ£SBIFŌĆØ) and Superintendencia Financiera de Colombia (ŌĆ£SFCŌĆØ). 1 Pro-forma rankings based on gross loans as reported to the SBIF, excluding loans from CorpBanca Colombia and, SFC. Transaction Rationale

- 6. 6 CONFIDENTIAL DRAFT ’é¦ Operation will constitute a merger between CorpBanca and Banco Ita├║ Chile ŌĆĢ Consequently, CorpBanca will issue new shares in exchange for all the assets and liabilities of Banco Ita├║ Chile which will be delivered to Ita├║ Unibanco ’é¦ Prior to this, Ita├║ will inject US$652MM of capital into Banco Ita├║ Chile ŌĆĢ ~Ch$54 Bn (US$99 MM*) had already been injected in 2014 ’é¦ The exchange ratio for net assets of Banco Ita├║ Chile will imply the following ownership structure post-merger: ŌĆĢ Ita├║ Unibanco: 33.58% (controlling shareholder) ŌĆĢ CorpGroup: 33.13% ŌĆĢ Minorities: 33.29% Transaction Terms *Note: Figures converted to US dollars at a rate of 544.10 CLP/USD.

- 7. 7 CONFIDENTIAL DRAFTA CorpBanca ShareholdersŌĆÖ Point of View BeforeŌĆ” ŌĆ”After Situation as of January 31, 2014 (CorpBanca Chile shareholder) 100% equity ownership in an entity that has: ’é¦ A 7.3% market share in Chile ’é¦ 66.3% of a Colombian bank with a 6.6% market share in Colombia ’é¦ Equity of US$2.2BN2,5 ’é¦ Annual net income of US$256MM1,2,3,5 Post-Merger Situation (based on December 2014) (Ita├║ CorpBanca shareholder) 66.42% equity ownership in an entity that has: ’é¦ A 12.6% market share in Chile ’é¦ At least 78.64% of a Colombian bank with a 6.3% market share in Colombia ’é¦ Equity of ~US$5.3BN2,4,5 ’é¦ Annual net income of ~US$516MM 2,3,5 1 Net income includes Helm BankŌĆÖs results since August 2013. 2 Excludes minority interest, reflecting a 66.3% ownership in CorpBanca Colombia. 3 Does not include fully phased-in after-tax synergies of US$80MM. Includes the dilution for the issuance of 172,048MM shares to Ita├║ Unibanco. 4 Excludes special dividends 45Figures converted to US dollars at a rate of 605.5 CLP/USD Situation as of December 31, 2014 (CorpBanca Chile shareholder) 100% equity ownership in an entity that has: ’é¦ A 7.4% market share in Chile ’é¦ 66.3% of a Colombian bank with a 6.3% market share in Colombia ’é¦ Equity of US$2.4BN2,5 ’é¦ Annual net income of US$374MM 2,5 Current

- 8. 8 CONFIDENTIAL DRAFT Pro-Forma Financials as of December 31, 2014 (US$MM) CorpBanca Chile 1 Banco Ita├║ Chile 1 Pro Forma Combined 2 (a) Committed Dividends (b) Pro Forma Combined (a) + (b) Assets Cash and Equivalents 1,931 1,256 3,187 -369 2,818 Loans Portfolio, net 22,945 10,035 32,980 32,980 Total Assets 33,616 13,463 48,839 -369 48,470 Liabilities Deposits 19,872 7,961 27,833 27,833 Demand Deposits 6,532 1,461 7,993 7,993 Time Deposits 13,340 6,500 19,840 19,840 Total Liabilities 30,705 11,693 42,597 42,597 Total ShareholdersŌĆÖ Equity 2,381 1,771 5,629 -369 5,260 Total Liabilities and ShareholdersŌĆÖ Equity 33,616 13,463 48,839 -369 48,470 Results Operating Income, net of Loan Losses 1,430 426 1,856 Operating Expenses -862 -272 -1,135 Net Income 438 142 579 Net Income attributable to Shareholders 374 142 516 Main Financial Indicators Net Interest Margin 3.3% 2.6% 3,1% Return on Total Assets 1.11% 1.05% 1.06% Return on Shareholders' Equity 12.9% 8.0% 8.8% Efficiency Ratio (Consolidated) 47.5% 47.7% 47.6% 1 Company filings with local regulatory authorities a as of 12.31.2014. 2 KPMG Expert Report as of 12.31.2014. Note: Figures converted to US dollars at a rate of 605.5 CLP/USD.

- 9. 9 CONFIDENTIAL DRAFT Source: Management projections. ’é¦ We estimate these synergies to be fully achieved in 3 years post-merger ’é¦ We also expect further funding cost improvements and substantial revenue synergies, which are not included in the cost synergies below ’é¦ We estimate total one-time integration costs of approximately US$85MM to occur during the first 3 years ┬╣ Denotes low-end and high-end fully phased-in pre-tax synergies from year 3 onward. Significant Opportunity to Generate Synergies Human Resources ’ü« Relevant synergies related to optimization of organizational structures US$67MM 1 Administration ’ü« Savings derived from a reduction in administrative expenses ’ü« Reduction of costs from services rendered by mutual service providers US$18MM 2 Information Technology ’ü« Relevant savings from scalable IT systems US$19MM 3 Others ’ü« Savings derived from enhanced branch network US$10MM 4 Indicative Total Fully Phased-in Pre-Tax Synergies Range Description Low-End Pre-Tax Synergies1 High-End Pre-Tax Synergies1 US$55MM US$15MM US$16MM US$8MM US$114MMUS$93MM

- 10. 10 CONFIDENTIAL DRAFTSignificant Expected Improvement in Capital Position ’é¦ The pro-forma entity will have a much larger capital base to support further growth ŌłÆ CorpBanca will combine its current Tier I Capital of US$2.0BN (net of special dividend) with Banco Ita├║ ChileŌĆÖs current capital of US$1.2BN and US$552MM additional common equity injection prior to closing of the transaction Capital Levels Combination estimated by CorpBanca management, based on figures in December 2014. Includes: - US$552MM of capital increase in Ita├║ Chile(620 CLP / USD) - Purchase of 12.36% stake in CorpBanca Colombia - Corresponding adjustments to derivatives accounting effects of the business combination based on the expert report Excludes: - Special dividend paid by CorpBanca on July 1, 2015 - Dividends that Ita├║ Chile approved not to distribute It entails maximum utilization of subordinated bonds. Note: Figures converted to US dollars at a rate of 605.5 CLP/USD Tier I Capital Tier I Ratio BIS Ratio US$2.0 BN US$1.2 BN US$5.2 BN CorpBanca Ita├║ Chile Ita├║ CorpBanca 8.6% 10.5% 12.9% 12.4% 11.6% 16.1% CorpBanca Ita├║ Chile Ita├║ CorpBanca CorpBanca Ita├║ Chile Ita├║ CorpBanca

- 11. 11 CONFIDENTIAL DRAFT Banking Platform with Larger Scale 2 Positive Impact to Ita├║ CorpBanca 3 Unique Partnership 1 Source: Company financials and SBIF. 1 Pro-forma rankings based on gross loans as reported to the SBIF and SFC, excluding loans from CorpBanca Colombia . Unique opportunity to partner with a leading institution ’é¦ Ita├║ Unibanco is the largest private financial institution in Brazil and a premier LatAm franchise ’é¦ The new entity will benefit from the strength of a ~US$57BN market cap partner in its existing markets while enhancing opportunities for growth abroad ’é¦ Opportunity to leverage Ita├║ UnibancoŌĆÖs strong global client relationships ’é¦ The merged entity will be able to expand its banking productsŌĆÖ offering Emergence of a leading banking platform in Chile and Colombia ’é¦ Greater scale and resources to grow and compete more effectively in Chile and Colombia ’é¦ Enhanced footprint in Chile and Colombia create a platform to expand in the region, particularly into Peru and Central America ’é¦ 4th largest private bank in Chile and 5th largest private bank in Colombia by total loans1 Merged bank will have a stronger financial profile and greater earnings power ’é¦ Estimated after-tax cost synergies of approximately US$80MM per year on a fully phased-in basis and total one-time integration costs of approximately US$85MM to occur during the first 3 years ’é¦ Improved funding profile and substantial revenue synergies ’é¦ Additional cross-selling opportunities ’é¦ Accretive transaction for both CorpBancaŌĆÖs and Ita├║ UnibancoŌĆÖs shareholders ’é¦ Improved pro-forma capital position opens room for further loan growth Creating a Regional Leader

- 12. 12 CONFIDENTIAL DRAFT 27.4% 23.0% 13.5% 10.3% 6.3% 5.3% 3.2% 2.8% 2.3% 2.1% GrupoAval Bancolombia Davivienda BBVAColombia CorpBancaColombia Colpatria Banagrario BCSC GNBSudameris Citi US$BN CorpBanca1 Ita├║ 1 Pro-Forma2 Assets 33.6 13.5 48.5 Loans 22.9 10.0 33.0 Headcount 7,456 2,607 10,063 Branches 298 100 398 ATMs 594 70 664 19.0% 18.1% 13.1% 12.6% 7.4% 6.9% 5.2% 5.1% 3.1% 3.1% Santander BancodeChile BCI Ita├║CorpBanca Corpbanca BBVAChile ScotiabankChile BancoIta├║Chile BancoBice BancoSecurity Leading Regional Banking Platform Highlights ’é¦ Accretive transaction to all shareholders after synergies ’é¦ Significant improvement to capital position to support further growth Commercial 70% Mortgage 18% Consumer 12% 1 Company management and filings with local regulatory authorities a as of 12.31.2014. 2 KPMG Expert Report as of 12.31.2014. 3 Pro-forma rankings based on gross loans as reported to the SBIF and SFC, excluding loans from CorpBanca Colombia. Including loans from Colombia, CorpBanca would have a loan market share of 11.3% in Chile. 4 Based on gross loans as reported to the SFC. Grupo Aval represents aggregate gross loans for Banco de Bogota, Banco Popular, Banco de Occidente and Banco AV Villas. Note: Figures converted to US dollars at a rate of 605.5 CLP/USD. Market Share by Loans (Chile)3 #4 Market Share by Loans (Colombia)4 #5 Pro-Forma Loan Mix Pro-Forma Funding Mix US$33BN US$38BN Time Deposits 52% Bonds 18% Interbank Loans 9% Demand Deposits 21%

- 13. 13 CONFIDENTIAL DRAFTTransaction Conditions ’é¦ ShareholdersŌĆÖ Agreement to be executed between Ita├║ Unibanco and CorpGroup ’é¦ Ita├║ CorpBanca to offer to purchase 33.18% percent from minority shareholders in CorpBanca Colombia ’é¦ Obligation for CorpGroup to sell its 12.36% stake in CorpBanca Colombia to Ita├║ CorpBanca ’é¦ The merged bank may take advantage of the global relationship that Ita├║ Unibanco keeps with its clients and expands its offer of banking products

- 14. 14 CONFIDENTIAL DRAFTShareholdersŌĆÖ Agreement Key Terms ’é¦ CorpGroup to hold minimum share ownership that would allow the two parties to collectively have a majority ownership ’é¦ Liquidity option for CorpGroup to sell to Ita├║ Unibanco shares representing a stake of up to 6.6% in Ita├║ CorpBanca at market price and through the Santiago Stock Exchange ’é¦ Corporate Governance - Board of Directors of 11 members (2 alternates) - CEO to be Boris Buvinic - Key committees would include Credit, Asset & Liability Management and Talent committees ’é¦ Dividend Policy - Subject to optimum minimum capital requirements - Target of US$370MM in dividends to all shareholders of CorpBanca

- 15. 15 CONFIDENTIAL DRAFT Regulatory Approvals ’é¦ Chilean regulatorŌĆÖs (SBIF) approval pending Next Steps Extraordinary ShareholdersŌĆÖ Meeting ’é¦ On June 26 and June 30, 2015 both banks EGM approved the merger Final Approval ’é¦ SBIF final operational approval to materialize the merger Expected Legal Merger ’é¦ Between January 1st, 2016 and May 2nd, 2016

- 16. APPENDIX

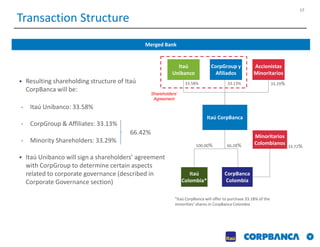

- 17. 17 CONFIDENTIAL DRAFT Ita├║ Colombia* Transaction Structure Merged Bank Accionistas Minoritarios CorpBanca Colombia Minoritarios Colombianos 33.13%33.58% 33.29% 66.28% 33.72%100.00% Ita├║ Unibanco CorpGroup y Afiliados ’é¦ Resulting shareholding structure of Ita├║ CorpBanca will be: - Ita├║ Unibanco: 33.58% - CorpGroup & Affiliates: 33.13% - Minority Shareholders: 33.29% ’é¦ Ita├║ Unibanco will sign a shareholdersŌĆÖ agreement with CorpGroup to determine certain aspects related to corporate governance (described in Corporate Governance section) 66.42% *Ita├║ CorpBanca will offer to purchase 33.18% of the minoritiesŌĆś shares in CorpBanca Colombia Ita├║ CorpBanca ShareholdersŌĆÖ Agreement

- 18. 18 CONFIDENTIAL DRAFTTransaction Structure (ContŌĆÖd) Offer to Acquire Minority Stakes in CorpBanca Colombia Contemplated Structure in Colombia Ita├║ CorpBanca 100% CorpBanca Colombia ’é¦ Ita├║ CorpBanca will offer to acquire the 33.18% aggregate minority stakes in CorpBanca Colombia: - ~US$894MM aggregate cash offer* - Includes CorpGroupŌĆÖs 12.36% indirect ownership (has agreed to sell shares in proposed transaction) ’é¦ Ita├║ CorpBanca will acquire Ita├║ Colombia at a price equivalent to its book value of ~US$170MM CorpGroup Helm Corporation Other Minorities Ita├║ Colombia 66.28% 12.36% 20.82% 0.54% ’é¦ Through the acquisition of minority stakes in CorpBanca Colombia, CorpBancaŌĆÖs shareholders could benefit further from synergies to be achieved from the merger with Helm Bank ’é¦ The purchase will not require additional capital, yielding additional income to Ita├║ CorpBancaŌĆÖs shareholders without the need for dilution * Of which US$330 MM correspond to the payment to CorpGroup and that amount will accrue interest of Libor + 2.7% per year from August 2015 until the closing date

- 19. 19 CONFIDENTIAL DRAFTDisclaimer This Presentation contains forward-looking statements, including statements related to the planned acquisition of Helm Bank and the timing thereof. Forward-looking information is often, but not always, identified by the use of words such as ŌĆ£anticipateŌĆØ, ŌĆ£believeŌĆØ, ŌĆ£expectŌĆØ, ŌĆ£planŌĆØ, ŌĆ£intendŌĆØ, ŌĆ£forecastŌĆØ, ŌĆ£targetŌĆØ, ŌĆ£projectŌĆØ, ŌĆ£mayŌĆØ, ŌĆ£willŌĆØ, ŌĆ£shouldŌĆØ, ŌĆ£couldŌĆØ, ŌĆ£estimateŌĆØ, ŌĆ£predictŌĆØ or similar words suggesting future outcomes or language suggesting an outlook. Forward-looking statements and information are based on current beliefs as well as assumptions made by and information currently available to CorpBanca concerning anticipated financial performance, business prospects, strategies and regulatory developments. Although management considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks that predictions, forecasts, projections and other forward-looking statements will not be achieved. We caution readers not to place undue reliance on these statements as a number of important factors could cause the actual results to differ materially from the beliefs, plans, objectives, expectations and anticipations, estimates and intentions expressed in such forward-looking statements. Furthermore, the forward-looking statements contained in this press release are made as of the date of this press release and CorpBanca does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

- 20. The Merger of Banco Ita├║ Chile and CorpBanca July 2015