Cfs vs.ffs

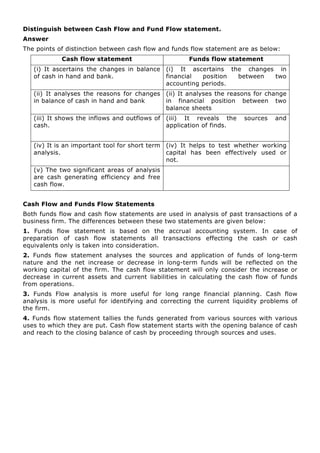

- 1. Distinguish between Cash Flow and Fund Flow statement. Answer The points of distinction between cash flow and funds flow statement are as below: Cash flow statement Funds flow statement (i) It ascertains the changes in balance of cash in hand and bank. (i) It ascertains the changes in financial position between two accounting periods. (ii) It analyses the reasons for changes in balance of cash in hand and bank (ii) It analyses the reasons for change in financial position between two balance sheets (iii) It shows the inflows and outflows of cash. (iii) It reveals the sources and application of finds. (iv) It is an important tool for short term analysis. (iv) It helps to test whether working capital has been effectively used or not. (v) The two significant areas of analysis are cash generating efficiency and free cash flow. Cash Flow and Funds Flow Statements Both funds flow and cash flow statements are used in analysis of past transactions of a business firm. The differences between these two statements are given below: 1. Funds flow statement is based on the accrual accounting system. In case of preparation of cash flow statements all transactions effecting the cash or cash equivalents only is taken into consideration. 2. Funds flow statement analyses the sources and application of funds of long-term nature and the net increase or decrease in long-term funds will be reflected on the working capital of the firm. The cash flow statement will only consider the increase or decrease in current assets and current liabilities in calculating the cash flow of funds from operations. 3. Funds Flow analysis is more useful for long range financial planning. Cash flow analysis is more useful for identifying and correcting the current liquidity problems of the firm. 4. Funds flow statement tallies the funds generated from various sources with various uses to which they are put. Cash flow statement starts with the opening balance of cash and reach to the closing balance of cash by proceeding through sources and uses.