Ch 07

- 1. The Front-Office, Back-Office Interface Chapter 7

- 2. Front-Office/Back-Office Interface Main concern: aligning functional and corporate service strategies Organization: Introduction to misaligned strategies Academics Practitioners/Consultants Prescriptive model - aligning de-coupling and strategy Analysis of the retail bank lending market

- 3. Strategic Service Vision Service Concept definition: results provided for customers General service concepts Cost Speed Flexibility Quality Service Delivery System

- 4. Strategic Service Vision Does a Service Delivery System support the intended Service Concept? Equipment, training, policies, procedures… Low Costs Fee Reversal Policy High Service Staffing Levels Flexibility Systems Technology

- 5. Academic Literature Productivity Levitt (1972) “Production-line Approach to Service,” HBR Levitt (1976) “The Industrialization of Service,” HBR De-coupling of Front- and Back-office Chase (1978, 1981) Customer Contact Model, HBR, Ops. Research

- 6. Basic Principles of De-coupling Customer contact model – Richard Chase, USC Services categorized by level of customer contact High Contact Low Contact Pure Services Mixed Services Quasi-Manufacturing (medical) (branch banks) (distribution centers) Efficiency: f(1 – contact time/service creation time) Potential for efficiency increases as customer contact time/service creation time decreases

- 7. Decoupling Method Decouple high contact and low contact “service factory” operations Buffer low contact operations from customers Employ contact reduction strategies in the low-contact areas customer contact for exceptions only reservations/appointment systems drop-off points (ATMs) task standardization

- 8. Decoupling Employ contact enhancement strategies in the high-contact areas customer-oriented layout people-oriented contact workers partition back office from public view

- 9. Managerial Differences High Contact: Low Contact: Support Center Branch Facility Location near the customer near supply, transportation, labor Facility Layout customer-oriented production efficiency Production orders cannot be smooth production planning stored with backorders Worker Skills public interaction technical Quality Control variable standards numerical measurement Capacity set to peak set to average work load work load

- 10. Two Models of Human Resource Practice Coupled De-coupled Selection criteria Trainability College for platform H.S. for tellers, back-office Training emphasis Broad Immediate task customer focus focus Compensation At or above market Above market for some, below for others Group incentives Individual incentives Returns for longevity  Job Design Cross-training Narrow, specialized Enhanced discretion High control for most Part-timers For retention For cost-control

- 11. Practitioner Literature – “De-coupling is good.” Banking Burger (1988) Bank Systems and Equipment Cronander (1990) Texas Banking Gilmore (1997) Real Estate Finance Journal Pirrie, et al. (1990) Banking World Reed (1971) “Sure It’s a Bank but I think of it as a Factory,” Innovation

- 12. Practitioner Literature Other Services Government: Connors (1986) Office Hospitals: Greene (1990) Modern Healthcare Newspapers: Sharp (1996) Editor & Publisher, 129(29)

- 13. Service Blueprint for Fast Food Restaurants Make Patties Grill Assemble Counter Line of Visibility

- 14. De-coupling and cost Does de-coupling always lower costs? Why does de-coupling often lead to lower costs? De-coupling and task focus Frederick Taylor and Henry Ford

- 15. De-coupling and Rounding of Small Numbers 20 individual units – Each needs 0.75 of a person Staffing level: 1 person each, 20 total 1 central unit: 1 1 1 1 … 15

- 16. De-coupling and Variance Reduction 20 individual units: average day -1 person, good day -2 people Staffing level: 2 people each, 40 total 1 central unit 25 2 2 2 2 …

- 17. Cost Problems Back office: (Queuing math) centralization is good. Bigger means less idle time, higher utilization Front office staffing: Bigger is also better Convenience strategy Large minimum break-even points Break-even based on labor reduction

- 18. De-coupling and Flexibility Bank employee moved from coupled to de-coupled job: “The computer system is suppose to know all the limitations, which is great because I no longer know them.”

- 19. De-coupling and Flexibility Bank manager “As we have more and more processing in the black box, few people know what a bank is really like. Some guys are walking encyclopedias of banking information, but they are a dying breed. Do we need people who really know all the processes? Is there a risk?”

- 20. De-coupling and Service Quality Service Gaps – de-centralized service Management Policy Customer Service Provider

- 21. De-coupling and Service Quality Management Policy Customer Service Gaps – centralized service Management Policy High contact worker Low contact worker

- 22. De-coupling and… Service Quality Quality of conformance – decision consistency improved Task quality and the “Renaissance man” Speed Speed of Task versus speed of Process Task speed improved due to focus Process speed can be worse due to hand-offs

- 23. De-coupling Benefits Cost (task focus, variance reduction, technology) Service quality – conformance quality Speed of Delivery – task speed

- 24. De-coupling Disadvantages Cost (increased idle time in front-office, duty overlap) Service quality – personal service, empathy Speed of delivery – process speed Flexibility

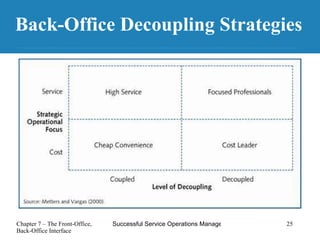

- 26. Consistent Functional Choices for Decoupling Strategies Centralize only when it is cost prohibitive not to Quality control; disaggregation of high-and low-contact Maintain cost competitiveness Scale economies Reason to De-couple Activities requiring expensive capital goods Back-office activities “regionalized,” not centralized Centralize back-office work in excess of front-office idle time All back-office work Activities to De-couple Premium level of personalized service Personalized service at moderate cost Locational convenience/low cost Low costs Competitive Advantage Low High Low High Level of De-coupling High Service Focused Professionals Cheap Convenience Cost Leader Management Practice

- 27. Consistent Functional Choices for Decoupling Strategies Maximize flexibility, response time, or service quality Maintain sufficient flexibility, response time, or service quality at lower cost than High Service Cost minimization; conformance quality Cost minimization; Conformance quality Operational Strategic Focus Broad, but with specialization across functions Narrow, but focused on an entire process Broad. All employees should be able to perform each function. Narrow, focused on task within process, low cross-training Training Very broad Broad Very narrow Narrow High-Contact Product Line High Service Focused Professionals Cheap Convenience Cost Leader Management Practice

- 28. Consistent Functional Choices for Decoupling Strategies Increasing customer relationship depth; High off-site responsibilities Increasing number of customers largely through off-site activity Service customer requests; Low off-site responsibilities Service customer requests; Low off-site responsibilities High-contact Worker Responsibility Salary with commission on unit performance Commission on sales Salary/hourly Salary/hourly High-contact Worker Compensation Enhance service Enhance marketing Reduce job complexity Standardize activity; Labor replacement Purpose of Automation High Service Focused Professionals Cheap Convenience Cost Leader Management Practice

- 29. Activities in Processing a Retail Loan Line of Customer Visibility Solicit Application Application Processing Credit Decision Payment Processing Bad Debt Collection Document Signing

- 30. Modeling Services De-coupling High Service Focused Professionals Cheap Convenience Cost Leader Low High Level of De-coupling Service Cost Strategic Operational Focus Bank of Green Hills Union Planters Nashville Bank of Comm. First Union

- 31. Industry Analysis: Retail Lending in Nashville, TN Cost Leader: AmSouth First American First Union (changing to focused professional) NationsBank Cheap Convenience Nashville Bank of Commerce High Service Sun Trust South Trust Bank of Green Hills Focused Professional Union Planters

- 32. Practitioner/Academic view of De-coupling De-coupling as part of a coherent strategy De-coupling Strategic Focus Classification High de-coupling Service Focused Professional Cost Cost Leader Low de-coupling Service High Service Cost Cheap Convenience Chapter Summary