Ch.2 Overview of the Financial System - mishkin -part 1 of 2.ppt

- 1. ┬® 2013 Pearson Education, Inc. All rights reserved. 2-1 Topics include: 1. Meaning of Financial System. 2. Function of financial Markets. 3. Structure of Financial Markets Chapter Preview

- 2. ┬® 2013 Pearson Education, Inc. All rights reserved. 2-2 Why Study Financial Markets? ŌĆó Financial System: is a set of Financial Markets, Financial institutions, and Regulatory and supervisory bodies. ŌĆó Financial markets: are markets in which funds are transferred from people and Firms who have an excess of available funds to people and Firms who have a need of funds.

- 3. ┬® 2013 Pearson Education, Inc. All rights reserved. 2-3 2. Function of Financial Markets ŌĆó Perform the essential function of channeling funds from economic players that have saved surplus funds to those that have a shortage of funds. ŌĆó Promotes economic efficiency by producing an efficient allocation of capital, which increases production. ŌĆó Directly improve the well-being of consumers by allowing them to time purchases better.

- 4. ┬® 2013 Pearson Education, Inc. All rights reserved. 2-4 Figure 1 Flows of Funds Through the Financial System

- 5. ┬® 2013 Pearson Education, Inc. All rights reserved. 2-5 Segments of Financial Markets Direct Finance ŌĆó Borrowers borrow directly from lenders in financial markets by selling financial instruments which are claims on the borrowerŌĆÖs future income or assets. Indirect Finance ŌĆó Borrowers borrow indirectly from lenders via financial intermediaries (established to source both loanable funds and loan opportunities) by issuing financial instruments which are claims on the borrowerŌĆÖs future income or assets.

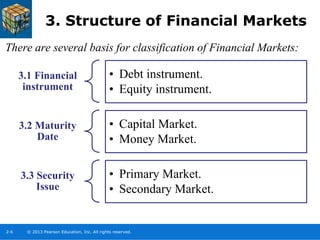

- 6. ┬® 2013 Pearson Education, Inc. All rights reserved. 2-6 3. Structure of Financial Markets There are several basis for classification of Financial Markets: 3.1 Financial instrument ŌĆó Debt instrument. ŌĆó Equity instrument. 3.2 Maturity Date ŌĆó Capital Market. ŌĆó Money Market. 3.3 Security Issue ŌĆó Primary Market. ŌĆó Secondary Market.