chap011.ppt

- 1. Chapter 11 Fundamentals of Corporate Finance Fifth Edition šÝšÝßĢs by Matthew Will McGraw-Hill/Irwin Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved Risk, Return and Capital Budgeting

- 2. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 2 Topics Covered ïMeasuring Market Risk ïĻBeta ïRisk and Return ïĻCAPM ïCapital Budgeting and Project Risk

- 3. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 3 Measuring Market Risk Market Portfolio - Portfolio of all assets in the economy. In practice a broad stock market index is used to represent the market. Beta - Sensitivity of a stockâs return to the return on the market portfolio.

- 4. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 4 Measuring Market Risk Example - Turbo Charged Seafood has the following % returns on its stock, relative to the listed changes in the % return on the market portfolio. The beta of Turbo Charged Seafood can be derived from this information.

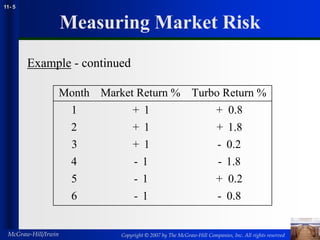

- 5. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 5 Measuring Market Risk Month Market Return % Turbo Return % 1 + 1 + 0.8 2 + 1 + 1.8 3 + 1 - 0.2 4 - 1 - 1.8 5 - 1 + 0.2 6 - 1 - 0.8 Example - continued

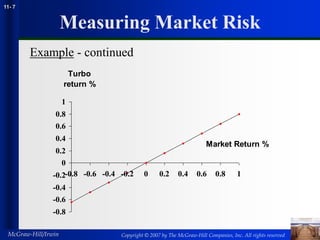

- 6. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 6 Measuring Market Risk B = = 0.8 1.6 2 ïWhen the market was up 1%, Turbo average % change was +0.8% ïWhen the market was down 1%, Turbo average % change was -0.8% ïThe average change of 1.6 % (-0.8 to 0.8) divided by the 2% (-1.0 to 1.0) change in the market produces a beta of 0.8. Example - continued

- 7. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 7 Measuring Market Risk Example - continued -0.8 -0.6 -0.4 -0.2 0 0.2 0.4 0.6 0.8 1 -0.8 -0.6 -0.4 -0.2 0 0.2 0.4 0.6 0.8 1 Market Return % Turbo return %

- 8. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 8 Portfolio Betas ïDiversification decreases variability from unique risk, but not from market risk. ïThe beta of your portfolio will be an average of the betas of the securities in the portfolio. ïIf you owned all of the S&P Composite Index stocks, you would have an average beta of 1.0

- 9. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 9 Stock Betas .30 Heinz . H.J .41 ExxonMobil .46 Pfizer .51 Mart - Wal .76 Boeing .90 s McDonald' .97 GE 1.34 Ford 1.64 er DellComput 2.49 Amazon Beta Stock B Betas calculated with price data from January 2001 thru December 2004

- 10. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 10 Risk and Return

- 11. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 11 Risk and Return

- 12. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 12 Measuring Market Risk Market Risk Premium - Risk premium of market portfolio. Difference between market return and return on risk-free Treasury bills. 0 2 4 6 8 10 12 14 0 0.2 0.4 0.6 0.8 1 Beta Expected Return (%) . Market Portfolio

- 13. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 13 Measuring Market Risk CAPM - Theory of the relationship between risk and return which states that the expected risk premium on any security equals its beta times the market risk premium. Market risk premium = r - r Risk premium on any asset = r - r Expected Return = r + B(r - r ) m f f f m f

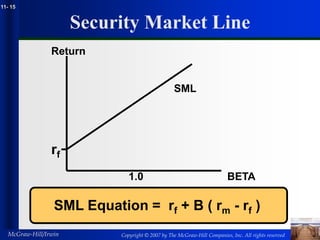

- 14. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 14 Measuring Market Risk Security Market Line - The graphic representation of the CAPM. Beta Expected Return (%) . Rf Rm Security Market Line 1.0

- 15. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 15 Security Market Line Return BETA rf 1.0 SML SML Equation = rf + B ( rm - rf )

- 16. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 16 Capital Asset Pricing Model R = rf + B ( rm - rf ) CAPM

- 17. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 17 Testing the CAPM Avg Risk Premium 1931-2002 Portfolio Beta 1.0 SML 30 20 10 0 Investors Market Portfolio Beta vs. Average Risk Premium

- 18. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 18 Testing the CAPM 0.1 1 10 100 1926 1936 1946 1956 1966 1976 1986 1996 High-minus low book-to-market Return vs. Book-to-Market Dollars (log scale) Small minus big http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html 2004

- 19. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 19 Stock Expected Returns 5.1 Heinz . H.J 5.9 ExxonMobil 6.2 Pfizer 6.6 Mart - Wal 8.3 Boeing 9.3 s McDonald' 9.8 GE 12.4 Ford 14.5 er DellComput 20.4 Amazon Beta Stock ) (r E

- 20. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 20 Capital Budgeting & Project Risk ïThe project cost of capital depends on the use to which the capital is being put. Therefore, it depends on the risk of the project and not the risk of the company.

- 21. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 21 Capital Budgeting & Project Risk Example - Based on the CAPM, ABC Company has a cost of capital of 17%. [4 + 1.3(10)]. A breakdown of the companyâs investment projects is listed below. When evaluating a new dog food production investment, which cost of capital should be used? 1/3 Nuclear Parts Mfr. B=2.0 1/3 Computer Hard Drive Mfr. B=1.3 1/3 Dog Food Production B=0.6 AVG. B of assets = 1.3

- 22. Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin 11- 22 Capital Budgeting & Project Risk Example - Based on the CAPM, ABC Company has a cost of capital of 17%. (4 + 1.3(10)). A breakdown of the companyâs investment projects is listed below. When evaluating a new dog food production investment, which cost of capital should be used? R = 4 + 0.6 (14 - 4 ) = 10% 10% reflects the opportunity cost of capital on an investment given the unique risk of the project.

![Copyright ÂĐ 2007 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

11- 21

Capital Budgeting & Project Risk

Example - Based on the CAPM, ABC Company has a cost

of capital of 17%. [4 + 1.3(10)]. A breakdown of the

companyâs investment projects is listed below. When

evaluating a new dog food production investment, which

cost of capital should be used?

1/3 Nuclear Parts Mfr. B=2.0

1/3 Computer Hard Drive Mfr. B=1.3

1/3 Dog Food Production B=0.6

AVG. B of assets = 1.3](https://image.slidesharecdn.com/chap011-221123151242-18475272/85/chap011-ppt-21-320.jpg)