Modern Auditing

- 1. MMOODDEERRNN AAUUDDIITTIINNGG 77tthh EEddiittiioonn WWiilllliiaamm CC.. BBooyynnttoonn CCaalliiffoorrnniiaa PPoollyytteecchhnniicc SSttaattee UUnniivveerrssiittyy aatt SSaann LLuuiiss OObbiissppoo RRaayymmoonndd NN.. JJoohhnnssoonn PPoorrttllaanndd SSttaattee UUnniivveerrssiittyy WWaalltteerr GG.. KKeellll UUnniivveerrssiittyy ooff MMiicchhiiggaann Developed by: Dr. Raymond N. Johnson, CPA Gregory K. Lowry, MBA, CPA John Wiley & Sons, Inc.

- 2. CCHHAAPPTTEERR 77 CCHHAAPPTTEERR 77 AACCCCEEPPTTIINNGG TTHHEE EENNGGAAGGEEMMEENNTT AANNDD AACCCCEEPPTTIINNGG TTHHEE EENNGGAAGGEEMMEENNTT AANNDD PPLLAANNNNIINNGG TTHHEE AAUUDDIITT PPLLAANNNNIINNGG TTHHEE AAUUDDIITT Overview of a Financial Statement Audit Client Acceptance and Retention Planning the Audit Obtaining an Understanding of the Client’s Business and Industry Performing Analytical Procedures

- 3. OOvveerrvviieeww ooff aa FFiinnaanncciiaall SSttaatteemmeenntt AAuuddiitt 4 Phases of an Audit 1. Client Acceptance and Retention 2. Planning the Audit 3. Performing Audit Tests 4. Reporting the Findings

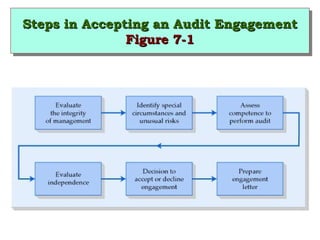

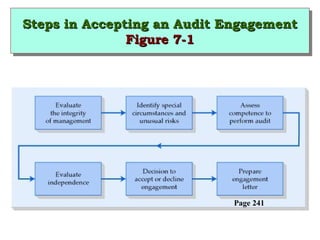

- 4. SStteeppss iinn AAcccceeppttiinngg aann AAuuddiitt EEnnggaaggeemmeenntt Steps in AAcccceeppttiinngg aann AAuuddiitt EEnnggaaggeemmeenntt FFiigguurree 77--11 FFiigguurree 77--11

- 5. Management IInntteeggrriittyy • Communication with the Predecessor Auditor • Make inquiries of other third parties • Review previous experience with existing clients – Knowledge of critical success factors competition • Client background checks – Previous bankruptcy – Previous convictions – Suspected ties to organized crime • Industry experience

- 6. Identify Special Circumstances and Unusual Risks Focus on the auditor’s business risks • Identify intended users of audited statements – Purchase and sale of business • Assess prospective client’s legal and financial stability – Client’s need for capital • Identify scope limitations • Evaluate the entity’s financial reporting systems and auditability – Inadequate internal controls

- 7. Assess Competence to Perform the Audit • Services desired • Identify the audit team • Need for consultation and use of specialists • Trend in industry specialization

- 8. Evaluating IInnddeeppeennddeennccee • Evaluate whether there are any circumstance that would impair independence

- 9. DDeecciissiioonn ttoo AAcccceepptt • 80’s: Accept clients as route to partnership, but not as cognizant of risks • 90’s: Clean up client list during good times with a focus on growth oriented clients

- 10. SStteeppss iinn AAcccceeppttiinngg aann AAuuddiitt EEnnggaaggeemmeenntt Steps in AAcccceeppttiinngg aann AAuuddiitt EEnnggaaggeemmeenntt FFiigguurree 77--11 FFiigguurree 77--11 Page 241

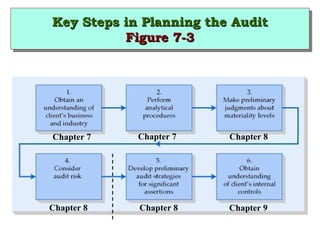

- 11. KKeeyy SStteeppss iinn PPllaannnniinngg tthhee AAuuddiitt Key Steps iinn PPllaannnniinngg tthhee AAuuddiitt FFiigguurree 77--33 FFiigguurree 77--33 Chapter 7 Chapter 7 Chapter 8 Chapter 8 Chapter 8 Chapter 9

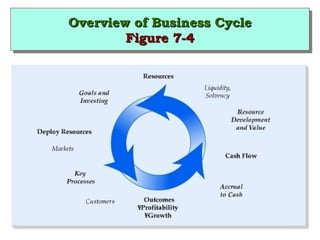

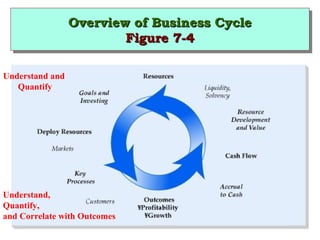

- 12. OOvveerrvviieeww ooff BBuussiinneessss CCyyccllee OOvveerrvviieeww ooff BBuussiinneessss CCyyccllee FFiigguurree 77--44 FFiigguurree 77--44

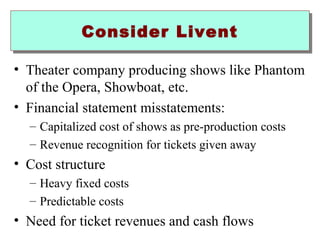

- 13. CCoonnssiiddeerr LLiivveenntt • Theater company producing shows like Phantom of the Opera, Showboat, etc. • Financial statement misstatements: – Capitalized cost of shows as pre-production costs – Revenue recognition for tickets given away • Cost structure – Heavy fixed costs – Predictable costs • Need for ticket revenues and cash flows

- 14. OOvveerrvviieeww ooff BBuussiinneessss CCyyccllee OOvveerrvviieeww ooff BBuussiinneessss CCyyccllee FFiigguurree 77--44 FFiigguurree 77--44 Understand and Quantify Understand, Quantify, and Correlate with Outcomes

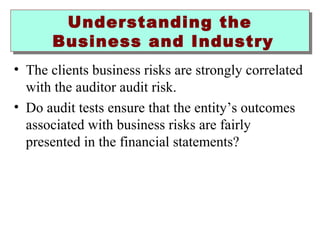

- 15. Understanding the Business and Industry • The clients business risks are strongly correlated with the auditor audit risk. • Do audit tests ensure that the entity’s outcomes associated with business risks are fairly presented in the financial statements?

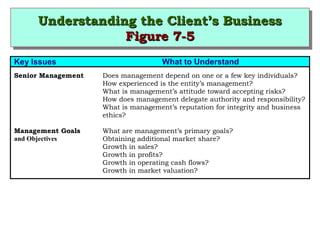

- 16. UUnnddeerrssttaannddiinngg tthhee CClliieenntt’’ss BBuussiinneessss Understanding tthhee CClliieenntt’’ss BBuussiinneessss FFiigguurree 77--55 FFiigguurree 77--55 Key Issues What to Understand Senior Management Does management depend on one or a few key individuals? How experienced is the entity’s management? What is management’s attitude toward accepting risks? How does management delegate authority and responsibility? What is management’s reputation for integrity and business ethics? Management Goals What are management’s primary goals? and Objectives Obtaining additional market share? Growth in sales? Growth in profits? Growth in operating cash flows? Growth in market valuation?

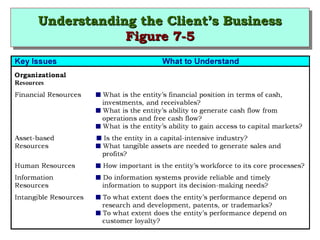

- 17. UUnnddeerrssttaannddiinngg tthhee CClliieenntt’’ss BBuussiinneessss Understanding tthhee CClliieenntt’’ss BBuussiinneessss FFiigguurree 77--55 FFiigguurree 77--55

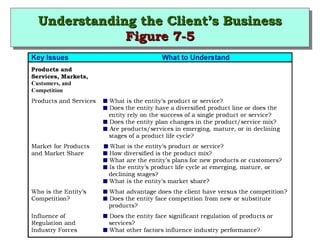

- 18. UUnnddeerrssttaannddiinngg tthhee CClliieenntt’’ss BBuussiinneessss Understanding tthhee CClliieenntt’’ss BBuussiinneessss FFiigguurree 77--55 FFiigguurree 77--55

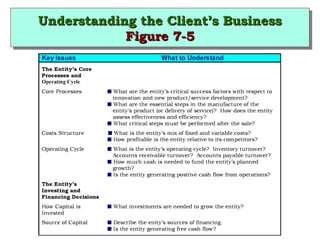

- 19. UUnnddeerrssttaannddiinngg tthhee CClliieenntt’’ss BBuussiinneessss Understanding tthhee CClliieenntt’’ss BBuussiinneessss FFiigguurree 77--55 FFiigguurree 77--55

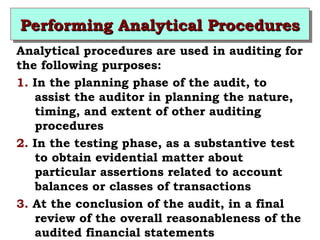

- 20. PPPPeeeerrrrffffoooorrrrmmmmiiiinnnngggg AAAAnnnnaaaallllyyyyttttiiiiccccaaaallll PPPPrrrroooocccceeeedddduuuurrrreeeessss Analytical procedures are used in auditing for the following purposes: 1. In the planning phase of the audit, to assist the auditor in planning the nature, timing, and extent of other auditing procedures 2. In the testing phase, as a substantive test to obtain evidential matter about particular assertions related to account balances or classes of transactions 3. At the conclusion of the audit, in a final review of the overall reasonableness of the audited financial statements

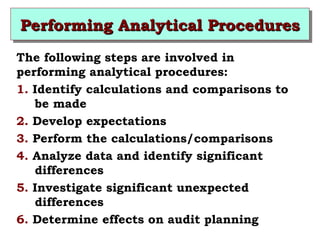

- 21. PPPPeeeerrrrffffoooorrrrmmmmiiiinnnngggg AAAAnnnnaaaallllyyyyttttiiiiccccaaaallll PPPPrrrroooocccceeeedddduuuurrrreeeessss The following steps are involved in performing analytical procedures: 1. Identify calculations and comparisons to be made 2. Develop expectations 3. Perform the calculations/comparisons 4. Analyze data and identify significant differences 5. Investigate significant unexpected differences 6. Determine effects on audit planning

- 22. NNeeww TTeecchhnnoollooggyy,, IInncc.. • Evaluate the data presented on pp 260-261. • Develop your own expectations • Compare company data with expectations • Identify issues that need audit attention.

- 23. CCHHAAPPTTEERR 77 CCHHAAPPTTEERR 77 AACCCCEEPPTTIINNGG AANNDD PPLLAANNNNIINNGG TTHHEE AAUUDDIITT EENNGGAAGGEEMMEENNTT AACCCCEEPPTTIINNGG AANNDD PPLLAANNNNIINNGG TTHHEE AAUUDDIITT EENNGGAAGGEEMMEENNTT

- 24. CCCCooooppppyyyyrrrriiiigggghhhhtttt Copyright 2001 John Wiley Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley Sons, Inc. The purchaser may make backup copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.