Chapter 13 solutions

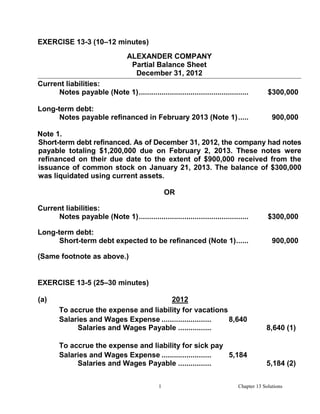

- 1. EXERCISE 13-3 (10–12 minutes) ALEXANDER COMPANY Partial Balance Sheet December 31, 2012 Current liabilities: Notes payable (Note 1) ..................................................... $300,000 Long-term debt: Notes payable refinanced in February 2013 (Note 1) ..... 900,000 Note 1. Short-term debt refinanced. As of December 31, 2012, the company had notes payable totaling $1,200,000 due on February 2, 2013. These notes were refinanced on their due date to the extent of $900,000 received from the issuance of common stock on January 21, 2013. The balance of $300,000 was liquidated using current assets. OR Current liabilities: Notes payable (Note 1) ..................................................... $300,000 Long-term debt: Short-term debt expected to be refinanced (Note 1) ...... 900,000 (Same footnote as above.) EXERCISE 13-5 (25–30 minutes) (a) 2012 To accrue the expense and liability for vacations Salaries and Wages Expense .......................... 8,640 Salaries and Wages Payable .................. 8,640 (1) To accrue the expense and liability for sick pay Salaries and Wages Expense .......................... 5,184 Salaries and Wages Payable .................. 5,184 (2) 1 Chapter 13 Solutions

- 2. To record sick leave paid Salaries and Wages Payable ........................... 3,456 (3) Cash ......................................................... 3,456 2013 To accrue the expense and liability for vacations Salaries and Wages Expense .......................... 9,360 Salaries and Wages Payable .................. 9,360 (4) To accrue the expense and liability for sick pay Salaries and Wages Expense .......................... 5,616 Salaries and Wages Payable .................. 5,616 (5) To record vacation time paid Salaries and Wages Expense .......................... 648 Salaries and Wages Payable ........................... 7,776 (6) Cash ......................................................... 8,424 (7) To record sick leave paid Salaries and Wages Expense .......................... 144 Salaries and Wages Payable ........................... 4,536 (8) Cash ......................................................... 4,680 (9) (1) 9 employees X $12.00/hr. X 8 hrs./day X 10 days = $8,640 (2) 9 employees X $12.00/hr. X 8 hrs./day X 6 days = $5,184 (3) 9 employees X $12.00/hr. X 8 hrs./day X 4 days = $3,456 (4) 9 employees X $13.00/hr. X 8 hrs./day X 10 days = $9,360 (5) 9 employees X $13.00/hr. X 8 hrs./day X 6 days = $5,616 (6) 9 employees X $12.00/hr. X 8 hrs./day X 9 days = $7,776 (7) 9 employees X $13.00/hr. X 8 hrs./day X 9 days = $8,424 (8) 9 employees X $12.00/hr. X 8 hrs./day X (6–4) days = $1,728 9 employees X $13.00/hr. X 8 hrs./day X (5–2) days = +2,808 = $4,536 (9) 9 employees X $13.00/hr. X 8 hrs./day X 5 days = $4,680 Note: Vacation days and sick days are paid at the employee’s current wage. Also, if employees earn vacation pay at different pay rates, a 2 Chapter 13 Solutions

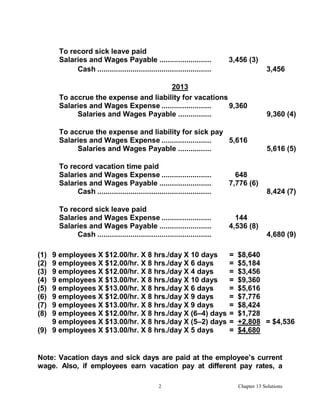

- 3. consistent pattern of recognition (e.g., first-in, first-out) could be employed which liabilities have been paid. (b) Accrued liability at year-end: 2012 2013 Vacation Sick Pay Vacation Sick Pay Wages Wages Wages Wages Payable Payable Payable Payable Jan. 1 balance $ 0 $ 0 $ 8,640 $1,728 + accrued 8,640 5,184 9,360 5,616 – paid ( 0) (3,456) (7,776) (4,536) Dec. 31 balance $8,640(1) $1,728(2) $10,224(3) $2,808(4) (1) 9 employees X $12.00/hr. X 8 hrs./day X 10 days = $ 8,640 (2) 9 employees X $12.00/hr. X 8 hrs./day X (6–4) days = $ 1,728 (3) 9 employees X $12.00/hr. X 8 hrs./day X (10–9) days = $ 864 9 employees X $13.00/hr. X 8 hrs./day X 10 days = +9,360 $10,224 (4) 9 employees X $13.00/hr. X 8 hrs./day X (2 + 6 – 5) days = $ 2,808 EXERCISE 13-10 (10–15 minutes) (a) Cash (150 X $4,000) ......................................................... 600,000 Sales Revenue ........................................................ 600,000 Warranty Expense ........................................................... 17,000 Inventory ................................................................. 17,000 Warranty Expense ($45,000* – $17,000) ......................... 28,000 Warranty Liability ................................................... 28,000 *(150 X $300) 3 Chapter 13 Solutions

- 4. (b) Cash.................................................................................. 600,000 Sales Revenue ........................................................ 600,000 Warranty Expense ........................................................... 17,000 Inventory ................................................................. 17,000 EXERCISE 13-12 (15–20 minutes) Inventory of Premiums (8,800 X $.90) ............................. 7,920 Cash......................................................................... 7,920 Cash (120,000 X $3.30) .................................................... 396,000 Sales Revenue ........................................................ 396,000 Premium Expense ............................................................ 3,960 Inventory of Premiums [(44,000 ÷ 10) X $.90] ....... 3,960 Premium Expense ............................................................ 2,520* Premium Liability .................................................... 2,520 *[(120,000 X 60%) – 44,000] ÷ 10 X $.90 = 2,520 EXERCISE 13-13 (20–30 minutes) (1) The FASB requires that, when some amount within the range of expected loss appears at the time to be a better estimate than any other amount within the range, that amount is accrued. When no amount within the range is a better estimate than any other amount, the dollar amount at the low end of the range is accrued and the dollar amount at the high end of the range is disclosed. In this case, therefore, Maverick Inc. would report a liability of $800,000 at December 31, 2012. (2) The loss should be accrued for $6,000,000. The potential insurance recovery is a gain contingency—it is not recorded until received. According to FASB ASC 410-30-35-8, claims for recoveries may be recorded if the recovery is deemed probable. 4 Chapter 13 Solutions

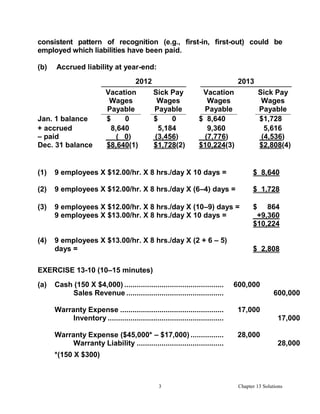

- 5. (3) This is a gain contingency because the amount to be received will be in excess of the book value of the plant. Gain contingencies are not recorded and are disclosed only when the probabilities are high that a gain contingency will become reality. PROBLEM 13-2 1. Dec. 5 Cash ................................................................................. 500 Due to Customer .................................................... 500 2. Dec. 1-31 Cash ................................................................................. 798,000 Sales Revenue ($798,000 ÷ 1.05) .................................................. 760,000 Sales Taxes Payable ($760,000 X .05)....................................................38,000 3. Dec. 10 Trucks ($120,000 X 1.05) ................................................. 126,000 Cash ........................................................................ 126,000 4. Dec. 31 Land Improvements ........................................................ 84,000 Asset Retirement Obligation .................................84,000 PROBLEM 13-7 (a) (1) Cash ................................................................................. 4,440,000 Sales Revenue (600 X $7,400).................................. 4,440,000 (2) Warranty Expense ([$600 X $390] / 2) ............................ 117,000 Inventory ($170 X 600 X 1/2) .................................... 51,000 Salaries and Wages Payable ($220 X 600 X 1/2) ................................................... 66,000 (3) Warranty Expense ........................................................... 117,000 Warranty Liability (600 machines X $390) – $117,000...................... 117,000 (4) Warranty Liability ............................................................ 117,000 5 Chapter 13 Solutions

- 6. Inventory ................................................................... 51,000 Salaries and Wages Payable ................................... 66,000 (b) (1) Cash 4,440,000 Sales Revenue .......................................................... 4,440,000 (2) Warranty Expense ........................................................... 117,000 Inventory ................................................................... 51,000 Salaries and Wages Payable ................................... 66,000 (3) Under the cash-basis method, the total warranty expense is recorded through entries 2 and 4 which recognize warranty costs as incurred. Warranty expense for 2013 is $117,000 under the cash basis. (4) Warranty Expense ........................................................... 117,000 Inventory ................................................................... 51,000 Salaries and Wages Payable ................................... 66,000 (c) Cash-basis method: No liability for future costs to be incurred under outstanding warranties is recorded or normally disclosed under the cash basis method. Expense warranty accrual method: As of 12/31/12 the balance sheet would disclose a current liability in the amount of $117,000 for Warranty Liability. (d) In the case of Alvarado Company, the expense warranty accrual method reflects properly the income resulting from operations in 2012 and 2013 because the warranty costs are matched with the revenues resulting from the sale, which required such costs to be incurred. Under the cash-basis method, the warranty costs appearing on the 2013 income statement are charged against unrelated revenues; 2012 net income is overstated and 2013 net income is understated. 6 Chapter 13 Solutions

- 7. PROBLEM 13-8 Inventory of Premiums .................................................... 60,000 Cash......................................................................... 60,000 (To record purchase of 40,000 puppets at $1.50 each) Cash .................................................................................. 1,800,000 Sales Revenue ........................................................ 1,800,000 (To record sales of 480,000 boxes at $3.75 each) Premium Expense ............................................................ 34,500 Inventory of Premiums ........................................... 34,500 [To record redemption of 115,000 coupons. Computation: (115,000 Ă· 5) X $1.50 = $34,500] Premium Expense ............................................................ 23,100 Premium Liability .................................................... 23,100 [To record estimated liability for premium claims outstanding at December 31, 2013.] Computation: Total coupons issued in 2013 ................. 480,000 Total estimated redemptions (40%) ................................ 192,000 Coupons redeemed in 2013 ............................................ 115,000 Estimated future redemptions ........................................ 77,000 Cost of estimated claims outstanding (77,000 Ă· 5) X $1.50 = $23,100 7 Chapter 13 Solutions

- 8. PROBLEM 13-10 (a) Because the cause for litigation occurred before the date of the financial statements and because an unfavorable outcome is probable and reasonably estimable, Windsor Airlines should report a loss and a liability in the December 31, 2012, financial statements. The loss and liability might be recorded as follows: Lawsuit Loss ($9,000,000 X 60%) ........................................................ 5,400,000 Lawsuit Liability...................................................... 5,400,000 Note to the Financial Statements Due to an accident which occurred during 2012, the Company is a defendant in personal injury suits totaling $9,000,000. The Company is charging the year of the casualty with $5,400,000 in estimated losses, which represents the amount that the company legal counsel estimates will finally be awarded. (b) Windsor Airlines need not establish a liability for risk of loss from lack of insurance coverage itself. GAAP does not require or allow the establishment of a liability for expected future injury to others or damage to the property of others even if the amount of the losses is reasonably estimable. The cause for a loss must occur on or before the balance sheet date for a loss contingency to be recorded. However, the fact that Windsor is self-insured should be disclosed in a note. 8 Chapter 13 Solutions

![(b) Cash..................................................................................

600,000

Sales Revenue ........................................................ 600,000

Warranty Expense ........................................................... 17,000

Inventory ................................................................. 17,000

EXERCISE 13-12 (15–20 minutes)

Inventory of Premiums (8,800 X $.90) ............................. 7,920

Cash......................................................................... 7,920

Cash (120,000 X $3.30) .................................................... 396,000

Sales Revenue ........................................................ 396,000

Premium Expense ............................................................ 3,960

Inventory of Premiums [(44,000 Ă· 10) X $.90] ....... 3,960

Premium Expense ............................................................ 2,520*

Premium Liability .................................................... 2,520

*[(120,000 X 60%) – 44,000] ÷ 10 X $.90 = 2,520

EXERCISE 13-13 (20–30 minutes)

(1) The FASB requires that, when some amount within the range of

expected loss appears at the time to be a better estimate than

any other amount within the range, that amount is accrued.

When no amount within the range is a better estimate than any

other amount, the dollar amount at the low end of the range is

accrued and the dollar amount at the high end of the range is

disclosed. In this case, therefore, Maverick Inc. would report a

liability of $800,000 at December 31, 2012.

(2) The loss should be accrued for $6,000,000. The potential

insurance recovery is a gain contingency—it is not recorded

until received. According to FASB ASC 410-30-35-8, claims for

recoveries may be recorded if the recovery is deemed probable.

4 Chapter 13 Solutions](https://image.slidesharecdn.com/chapter13solutions-130126164356-phpapp02/85/Chapter-13-solutions-4-320.jpg)

![(3) This is a gain contingency because the amount to be received

will be in excess of the book value of the plant. Gain

contingencies are not recorded and are disclosed only when the

probabilities are high that a gain contingency will become reality.

PROBLEM 13-2

1. Dec. 5 Cash .................................................................................

500

Due to Customer .................................................... 500

2. Dec. 1-31 Cash .................................................................................

798,000

Sales Revenue

($798,000 Ă· 1.05) .................................................. 760,000

Sales Taxes Payable

($760,000 X .05)....................................................38,000

3. Dec. 10 Trucks ($120,000 X 1.05) .................................................

126,000

Cash ........................................................................

126,000

4. Dec. 31 Land Improvements ........................................................

84,000

Asset Retirement Obligation .................................84,000

PROBLEM 13-7

(a) (1) Cash .................................................................................

4,440,000

Sales Revenue (600 X $7,400).................................. 4,440,000

(2) Warranty Expense ([$600 X $390] / 2) ............................

117,000

Inventory ($170 X 600 X 1/2) .................................... 51,000

Salaries and Wages Payable

($220 X 600 X 1/2) ................................................... 66,000

(3) Warranty Expense ...........................................................

117,000

Warranty Liability

(600 machines X $390) – $117,000...................... 117,000

(4) Warranty Liability ............................................................

117,000

5 Chapter 13 Solutions](https://image.slidesharecdn.com/chapter13solutions-130126164356-phpapp02/85/Chapter-13-solutions-5-320.jpg)

![PROBLEM 13-8

Inventory of Premiums .................................................... 60,000

Cash......................................................................... 60,000

(To record purchase of 40,000 puppets at

$1.50 each)

Cash .................................................................................. 1,800,000

Sales Revenue ........................................................ 1,800,000

(To record sales of 480,000 boxes at

$3.75 each)

Premium Expense ............................................................ 34,500

Inventory of Premiums ........................................... 34,500

[To record redemption of 115,000 coupons.

Computation: (115,000 Ă· 5) X $1.50 = $34,500]

Premium Expense ............................................................ 23,100

Premium Liability .................................................... 23,100

[To record estimated liability for premium

claims outstanding at December 31, 2013.]

Computation: Total coupons issued in 2013 ................. 480,000

Total estimated redemptions (40%) ................................ 192,000

Coupons redeemed in 2013 ............................................ 115,000

Estimated future redemptions ........................................ 77,000

Cost of estimated claims outstanding (77,000 Ă· 5) X $1.50 = $23,100

7 Chapter 13 Solutions](https://image.slidesharecdn.com/chapter13solutions-130126164356-phpapp02/85/Chapter-13-solutions-7-320.jpg)