Gursale Sir Chapter 3 Source Documents

- 1. BOOK KEEPING & ACCOUNTANCY CHAPTER NO. 3 SOURCE DOCUMENTS REQUIRED FOR ACCOUNTING 8/26/2013 AJAY JANARDAN GURSALE. M.Com. B.Ed. MAHARASHTRA STATE BOARD OF SECONDARY & HIGHER SECONDARY EDUCATION, PUNE ŌĆō 411004.

- 2. VOUCHER Meaning : Voucher is documentary evidence in support of business transaction. Voucher is prepared when a transaction takes place. The vouchers may vary for different transactions like cash expenses, purchases or sales etc. For exa. 1.Cash vouchers 2. Petty Cash Vouchers 3.Bank Vouchers 4. Purchase Vouchers 5. Sales Vouchers etc. Internal Voucher : 1. When the business is very big and spread over a number of branches a voucher is prepared for the transfer of cash or goods from one branch to another branch or head office to branch or vice versa it is called internal voucher. 2. In another situation when things are purchased from hawkers, grocers or while travelling by auto, taxi, we can not get receipt as proof for such transaction, it is necessary to create documentary record by preparing a voucher in the organisation, it is also known as internal voucher. External Voucher : An external voucher is a document received from an outside agency regarding the business tansaction. For exa. Cash memo received from the seller for the purchase of stationary of goods, receipt of electricity bill paid etc. Importance of Voucher : 1. A voucher is documentary evidence of the transaction. 2. Used to ascertainment of profit in tax matter like income tax, sales tax. 3. Help the auditor to perform his duties efficiently & independently. 4. A voucher confirms the date, amount and concerned party of transaction. 5. A voucher describes the nature of transactions.

- 4. 1.CASH VOUCHER Meaning : For the amount spent in cash, one should prepare a cash voucher. Voucher supports the entry for cash payment in the cash book. Contents of Cash Voucher 1.Name & address of the business organisation. 2.Voucher Number. 3.Date of Voucher. 4.Name of the Payee. 5.Details of Payment (i.e. Payment on which a/c) 6.A/c head this indicates the group of expenditure. 7.Amount in Figures & Words. 8.Signature of the person preparing the voucher. 9.Signature of the payee. 10. Signature of the person authorizing the payment.

- 5. CASH VOUCHER Shriram Trading Co. 9, Sudama Towers, Rajaji Path, Kalyan. Voucher No.______ Date : ____________ Pay to______________________________________________________________ On account of _______________________________________________________ Debit Account________________________________________________________ Total Rupees (In Words)___________________________________________only. Amount Rs. Prepared by__________ Passed by_________ ReceiverŌĆÖs Sign.________

- 6. 2.PETTY CASH VOUCHER Meaning : A small amount of expenditure which is issued by the petty cashier and must get documentary proof in support of the expenditure, it is called as Petty Cash voucher. Basically it is as good as cash voucher because other than the amount and frequency of transaction the expenditure is similar to that of the cash transaction. Contents of Petty Cash Voucher 1. Name & Address of the business organisation. 2. Voucher Number. 3. Date of Voucher. 4. Name of the Payee. 5. Details of payment. 6. Account Head. 7. Amount in Words & Figures. 8. Signature of the person preparing the voucher. 9. Signature of the Payee. Generally for petty expenses the petty cashier himself is authorized to sanction the payment, there is no need of any other sanctioning authority.

- 7. PETTY CASH VOUCHER SHRUTI TRADERS. 6, A.R.STREET, DADAR. MUMBAI ŌĆō 400 016. Voucher No.______ Date : ____________ Pay to______________________________________________________________ On account of _______________________________________________________ Debit Account________________________________________________________ Total Rupees (In Words)___________________________________________only. Amount Rs. Petty CashierŌĆÖs sign __________ ReceiverŌĆÖs Sign.________

- 8. 3.CASH MEMO Meaning : The seller issues the cash memo, when goods are sold for cash. ŌĆó It is reliable record of cash basis. ŌĆó On the basis of cash memos, cash sales are recorded in the Cash Book. ŌĆó As the cash memos are generally numbered even if one cash memo is missed, fraud can be found out immediately. Contents of Cash Memo. 1.Name & address of the seller. 2.Cash memo/ Invoice No.(Printed) 3. Date of Invoice. 4. Name & Address of the Purchaser / Customer. 5. Details of the goods supplied (Description, Quantity, Rate) 6. Amount of each item in description. 7. Other charges ŌĆō Sales Tax/ VAT / Excise Tax (Applicable) 8. Details of MVAT No. Declaration under MVAT Act,2002. 9. Signature of the seller / Proprietor.

- 9. CASH MEMO IdEAl BOOK dEPOT 472, Mahatma Gandhi Road, Thane - 422 202. All Subjects text books & self study material available. INVOICE No.________ Stationary & Zerox paper available. Date : _____________ Name of the Customer : ________________________________ Address : ________________________________ Sr. No Particulars 1 2 3 4 5 6 7 Qty Rate Amount Rs. Ps. - VAT (Incl.) - Disc. Total Rs. Amount in words Rupees ______________________________________only. Reg.No.Under MVAT Act, 2002. MVAT No.-12354/MH/2012. Reg.No.Under CST Act, 1956. CST No.- 2354/CST/2013 XXX Subject to realization of cheque. E.&O.E. ProprietorŌĆÖs Signature Ideal Book Depot.

- 10. 4.CREDIT MEMO MEANING : When the goods are sold on credit, the supplier issues a credit memo. It is also called as bill or invoice. Importance : ŌĆó It is a statement sent by a seller to buyer whose signature is obtained on the carbon copies. ŌĆó On the basis of credit memo, credit sales are recorded in Sales Book by the seller. ŌĆó It is only proof of verification of credit sale of the organisation. Contents of Credit Memo. 1.Name & address of the seller. 2.Credit memo/ Invoice No.(Printed) 3. Date of Invoice. 4. Name & Address of the Purchaser / Customer. 5. Details of the goods supplied (Description, Quantity, Rate) 6.Delivery Challan no. 7. Terms of payment. 8. Amount of each item in description. 9. Other charges ŌĆō Sales Tax/ VAT / Excise Tax (Applicable) 10. Details of MVAT No. Declaration under MVAT Act,2002. 11.ReceiverŌĆÖs signature. 11. Signature of the seller / Proprietor.

- 11. Credit MeMo ideal BooK dePot 472, Mahatma Gandhi Road, Thane - 422 202. Credit Memo No.________ All Subjects text books & self study material available. Date : _____________ Stationary & Zerox paper available. Name of the Customer : ________________________________ Address : ________________________________ Sr. No Particulars Qty 1 2 3 4 5 6 7 Rate Amount Rs. Ps. - VAT (Incl.) - Disc. Total Rs. Amount in words Rupees ______________________________________only. Reg.No.Under MVAT Act, 2002. MVAT No.-12354/MH/2012. Reg.No.Under CST Act, 1956. CST No.- 2354/CST/2013 XXX ReceiverŌĆÖs Signature XXX Subject to realization of cheque. E.&O.E. ProprietorŌĆÖs Signature Ideal Book Depot.

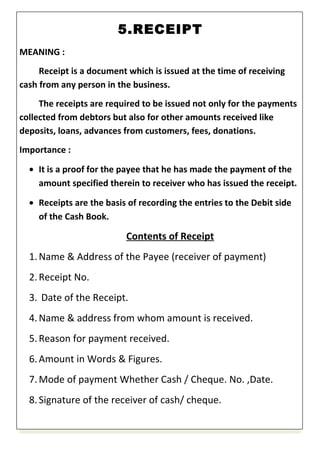

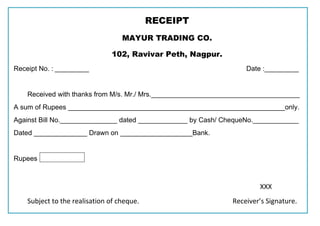

- 12. 5.RECEIPT MEANING : Receipt is a document which is issued at the time of receiving cash from any person in the business. The receipts are required to be issued not only for the payments collected from debtors but also for other amounts received like deposits, loans, advances from customers, fees, donations. Importance : ŌĆó It is a proof for the payee that he has made the payment of the amount specified therein to receiver who has issued the receipt. ŌĆó Receipts are the basis of recording the entries to the Debit side of the Cash Book. Contents of Receipt 1. Name & Address of the Payee (receiver of payment) 2. Receipt No. 3. Date of the Receipt. 4. Name & address from whom amount is received. 5. Reason for payment received. 6. Amount in Words & Figures. 7. Mode of payment Whether Cash / Cheque. No. ,Date. 8. Signature of the receiver of cash/ cheque.

- 13. RECEIPT MAYUR TRADING CO. 102, Ravivar Peth, Nagpur. Receipt No. : _________ Date :_________ Received with thanks from M/s. Mr./ Mrs._______________________________________ A sum of Rupees _________________________________________________________only. Against Bill No._______________ dated _____________ by Cash/ ChequeNo.____________ Dated ______________ Drawn on ___________________Bank. Rupees XXX Subject to the realisation of cheque. ReceiverŌĆÖs Signature.

- 14. 6.DEBIT NOTE Meaning : Debit note is prepared for debiting the account of the counter part with the amount and for the reason specified therein. This is issued when i) Less debit was formerly given. ii) Additional debit is now to be given. iii) To cancel the wrong credit or extra credit given. Importance of Debit Note : 1. On the basis of debit notes, journal entries can be passed in the journal proper. 2. When the goods are return to the seller or when the price in the outward invoice is over charged, the buyer sends a debit note to the seller. 3. On the basis of credit note the seller records the ŌĆśSales Return BookŌĆÖ. Contents of deBit note ŌĆō 1.Name & address of organization. 2. Debit note No. 3. Date 4. Name of debit a/c. 5.Amount in words & in figures. 6. Reason for debit. 7. Signature of authority.

- 15. DEBIT NOTE MANISH TRADING CO. 11, MIDC ŌĆō KUDAL , SINDHUDURG. Debit Note No.______ Date : ____________ To, _______________________________ _______________________________ Your account has been debited in our books by Rupees _______________________ On account of ____________________________________________________________ ________________________________________________________________________ Total Rupees_________ /Please acknowledge. Prepared by____________ Checked by _________

- 16. 6.CREDIT NOTE Meaning : A credit note is a document prepared for crediting the account of the counterpart. The amount and the reason are specified in the credit note. This is issued when i)Crediting the account of counterpart. ii) Cancelling the extra debit or wrong debit. iii) Less credit already given. Importance of Debit Note : 4. On the basis of debit notes, journal entries can be passed in the journal proper. 5. When the goods are return to the seller or when the price in the outward invoice is over charged, the buyer sends a debit note to the seller. 6. On the basis of credit note the seller records the ŌĆśSales Return BookŌĆÖ. Contents of Debit note ŌĆō 1.Name & address of organization. 2. Debit note No. 3. Date 4. Name of debit a/c. 5.Amount in words & in figures.

- 17. 6. Reason for debit. 7. Signature of authority.