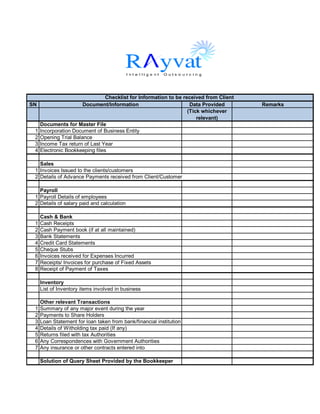

BOOKKEEPING CHECKLIST

- 1. SN 1 2 3 4 Checklist for Information to be received from Client Document/Information Data Provided (Tick whichever relevant) Documents for Master File Incorporation Document of Business Entity Opening Trial Balance Income Tax return of Last Year Electronic Bookkeeping files Sales 1 Invoices Issued to the clients/customers 2 Details of Advance Payments received from Client/Customer Payroll 1 Payroll Details of employees 2 Details of salary paid and calculation 1 2 3 4 5 6 7 8 Cash & Bank Cash Receipts Cash Payment book (if at all maintained) Bank Statements Credit Card Statements Cheque Stubs Invoices received for Expenses Incurred Receipts/ Invoices for purchase of Fixed Assets Receipt of Payment of Taxes Inventory List of Inventory items involved in business 1 2 3 4 5 6 7 Other relevant Transactions Summary of any major event during the year Payments to Share Holders Loan Statement for loan taken from bank/financial institution Details of Witholding tax paid (If any) Returns filed with tax Authorities Any Correspondences with Government Authorities Any insurance or other contracts entered into Solution of Query Sheet Provided by the Bookkeeper Remarks