[CIPM][CFA] cipm-webinar.pdf

- 1. CIPM PROGRAM 21 March 2017 Thomas Porter – Head, CIPM Program, CFA Institute Bobby Lamy, Ph.D., CFA – Head, Practice Analysis, CFA Institute Steve Horan, Ph.D., CFA, CIPM – Managing Director, Credentialing, CFA Institute

- 3. 3 To lead the investment profession globally by promoting the highest standards of ethics, education, and professional excellence for the ultimate benefit of society. CFA Institute Mission To advance the CFA Institute mission by promoting ethical standards and best practices in investment portfolio evaluation. CIPM Program Vision

- 4. Learn more about the CIPM program at www.cfainstitute.org/cipm Optimize investor results Drive smarter, more informed decision-making CIPM PROGRAM 4 Ethical and Professional Standards 15% Ethics 15% Reporting Standards 70% Performance Evaluation 10% Manager Selection 20% Appraisal 20% Attribution 20% Measurement INVESTMENT PERFORMANCE AND RISK EVALUATION 30%

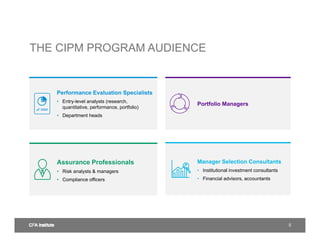

- 5. THE CIPM PROGRAM AUDIENCE 5 Portfolio Managers Performance Evaluation Specialists • Entry-level analysts (research, quantitative, performance, portfolio) • Department heads Assurance Professionals • Risk analysts & managers • Compliance officers Manager Selection Consultants • Institutional investment consultants • Financial advisors, accountants

- 6. TOP CIPM PROGRAM CANDIDATE ROLES 6 APRIL 2016 EXAM ADMINISTRATION 25% 11% 6% 6% 6% 10% 5% 4% Top 8 Roles Comprise 73% of CIPM Candidates Manager of Managers Research Analyst Investment Analyst Quantitative Analyst Performance Analyst Consultant Accountant/ Auditor Financial Advisor/ Planner Portfolio Manager Risk Analyst/ Manager

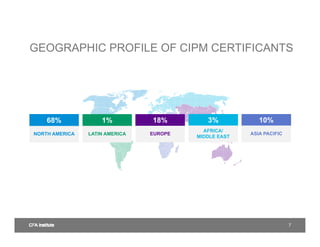

- 7. GEOGRAPHIC PROFILE OF CIPM CERTIFICANTS 7 NORTH AMERICA 68% LATIN AMERICA 1% EUROPE 18% AFRICA/ MIDDLE EAST 3% ASIA PACIFIC 10%

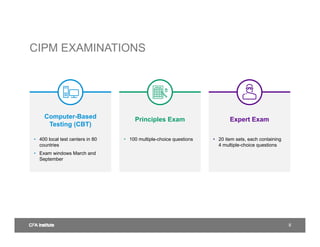

- 8. Computer-Based Testing (CBT) Expert Exam Principles Exam 8 • 400 local test centers in 80 countries • Exam windows March and September • 100 multiple-choice questions • 20 item sets, each containing 4 multiple-choice questions CIPM EXAMINATIONS

- 9. 9 Program Overview 2016-2017 CIPM® PROGRAM Professional/ graduate level Pricing (US$) December 2016 Timeline or Registration period Early registration deadline Schedule for the exam Sit for the exam Exam results Sept 2017 1 Apr–31 Jul 2017 31 May 2017 1 Apr–23 Sept 2017 16–30 Sept 2017 Early Nov 2017 March 2017 1 Oct 2016– 31 Jan 2017 30 Nov 2016 1 Oct 2016– 23 Mar 2017 16–31 Mar 2017 Early May 2017 enrollment fee $0 early registration $575 first-time candidate $975 returning candidate $500 or EXAM SCHEDULE AND PRICING OVERVIEW Professor / Regulator Scholarships available

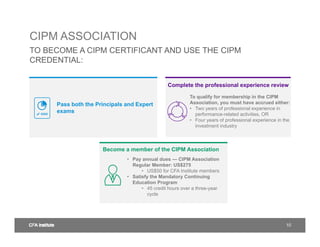

- 10. Pass both the Principals and Expert exams CIPM ASSOCIATION 10 • Pay annual dues — CIPM Association Regular Member: US$275 • US$50 for CFA Institute members • Satisfy the Mandatory Continuing Education Program • 45 credit hours over a three-year cycle TO BECOME A CIPM CERTIFICANT AND USE THE CIPM CREDENTIAL: Become a member of the CIPM Association Complete the professional experience review To qualify for membership in the CIPM Association, you must have accrued either: • Two years of professional experience in performance-related activities, OR • Four years of professional experience in the investment industry

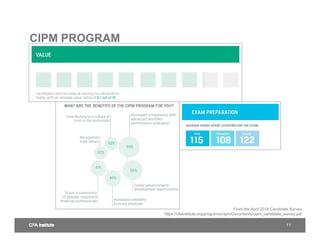

- 11. CIPM PROGRAM 11 From the April 2016 Candidate Survey https://cfainstitute.org/programs/cipm/Documents/cipm_candidate_survey.pdf

- 12. CIPM PROGRAM CURRICULUM 12 Bobby Lamy, Ph.D., CFA Head, Practice Analysis, CFA Institute CFA Institute

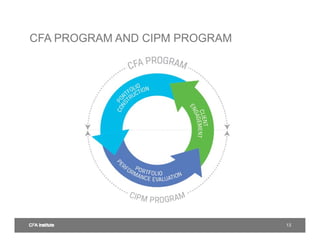

- 13. CFA PROGRAM AND CIPM PROGRAM 13

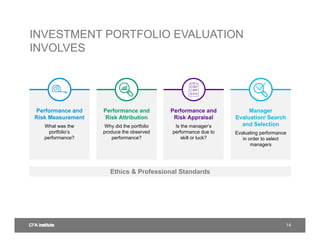

- 14. 14 Performance and Risk Appraisal Is the manager’s performance due to skill or luck? Performance and Risk Attribution Why did the portfolio produce the observed performance? Performance and Risk Measurement What was the portfolio’s performance? Manager Evaluation/ Search and Selection Evaluating performance in order to select managers Ethics & Professional Standards INVESTMENT PORTFOLIO EVALUATION INVOLVES

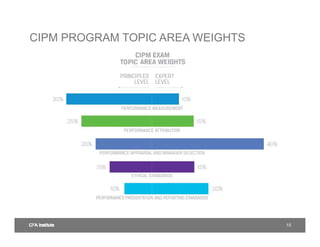

- 15. CIPM PROGRAM TOPIC AREA WEIGHTS 15

- 16. Performance Attribution Performance Measurement Performance Presentation and GIPS Standards Performance Appraisal and Manager Selection 16 Ethical Standards Knowledge/Comprehension Application/Analysis Synthesis/Evaluation PRINCIPLES EXPERT Ethics Ethics INVESTMENT PERFORMANCE EVALUATION PROCESS

- 17. HEAR FROM A CIPM CERTIFICANT 17 Steve Horan, Ph.D., CFA , CIPM Managing Director, Credentialing CFA Institute BENEFITS OF EARNING THE CIPM DESIGNATION

- 18. - Acquire technical expertise in a key area of the investment profession - Provide insight/guidance into the management of investment strategies - Become part of a global community of investment professionals who strive for integrity and excellence - Develop your career – stand out with expert knowledge and a global professional network -Gain current and on-going knowledge with continuing education - Become a stronger member of your team 18 BENEFITS OF THE CIPM DESIGNATION

- 19. 19 “Lessons learned by obtaining the [CIPM] designation helped me to better understand, shape and improve internal processes in performance analytics as well as in performance and risk client reporting. It also helped me boost my career as a subject matter expert in the area.” Maciej Lagoda, CIPM Performance Analyst, Credit Suisse Switzerland “I was delighted to be one of the first to take the CIPM exam and support the program. The program is the essential cornerstone to developing performance measurement.” Carl Bacon, CIPM Chairman, StatPro Group United Kingdom “The CIPM has distinguished and defined my career. The knowledge is not just for performance practitioners, but for non- practitioners as well. A non-practitioner will never see performance the same way ever again after completing the CIPM. From understanding the fundamental concepts that form the foundation of every return calculated in all the right measures, to looking beyond the numbers and obtaining the skill to effectively evaluate strategies and the managers who execute them. It is my opinion that this niche area of study is one of the most important and impactful in the investment industry.” Ioannis Segounis, CFA, CIPM Managing Director, Phocion Investment Services Inc. Canada WHAT WE’RE HEARING

- 20. Registration for the September 2017 CIPM exam opens on 1 April 2017! Learn more about the CIPM program at: www.cfainstitute.org/cipm 20 QUESTIONS? Contact: CIPM@cfainstitute.org

![19

“Lessons learned by obtaining the [CIPM]

designation helped me to better understand,

shape and improve internal processes in

performance analytics as well as in performance

and risk client reporting. It also helped me boost

my career as a subject matter expert in the area.”

Maciej Lagoda, CIPM

Performance Analyst, Credit Suisse

Switzerland

“I was delighted to be one of the first to take the

CIPM exam and support the program. The

program is the essential cornerstone to

developing performance measurement.”

Carl Bacon, CIPM

Chairman, StatPro Group

United Kingdom

“The CIPM has distinguished and defined my

career. The knowledge is not just for

performance practitioners, but for non-

practitioners as well. A non-practitioner will never

see performance the same way ever again after

completing the CIPM. From understanding the

fundamental concepts that form the foundation of

every return calculated in all the right measures,

to looking beyond the numbers and obtaining the

skill to effectively evaluate strategies and the

managers who execute them. It is my opinion

that this niche area of study is one

of the most important and impactful in the

investment industry.”

Ioannis Segounis, CFA, CIPM

Managing Director, Phocion Investment Services Inc.

Canada

WHAT WE’RE HEARING](https://image.slidesharecdn.com/cipmcfacipm-webinar-221117055134-2bb88d0b/85/CIPM-CFA-cipm-webinar-pdf-19-320.jpg)